Tag Archive: Japanese yen

The State of the Bull

(here is a draft of my monthly column for a Chinese paper)

The US dollar has had a rough few months. It has fallen against most major and emerging market currencies this year. A critical issue for global investors and policymakers is whether ...

Read More »

Read More »

FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidati...

Read More »

Read More »

Japanese Capital Flows: Six Observations

The following observations are drawn from the weekly report of Japan’s Ministry of Finance unless noted otherwise. We use the weekly data instead of monthly to identify changes of trend earlier. We use simple convention of the week by the last rather than the first day. That means that the report for the week ending April …

Read More »

Read More »

FX Daily, April 21: ECB Takes Center Stage

The ECB meeting is the session's highlight. In recognition of the risk that ECB President Draghi expresses displeasure with the premature tightening of financial conditions through the exchange rate channel is encouraged a modest bout of euro s...

Read More »

Read More »

FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried …

Read More »

Read More »

FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in N...

Read More »

Read More »

FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political … Continue reading...

Read More »

Read More »

FX Weekly: The Dollar’s Technical Condition Remains Vulnerable

The US dollar turned in a mixed performance last week, which given the softer than expected inflation, retail sales data, and industrial output figures, coupled with the poor technical backdrop, could be a signal that its decline in recent months has run its course. The dollar-bloc continued its advance, led by the Australian dollar’s nearly …

Read More »

Read More »

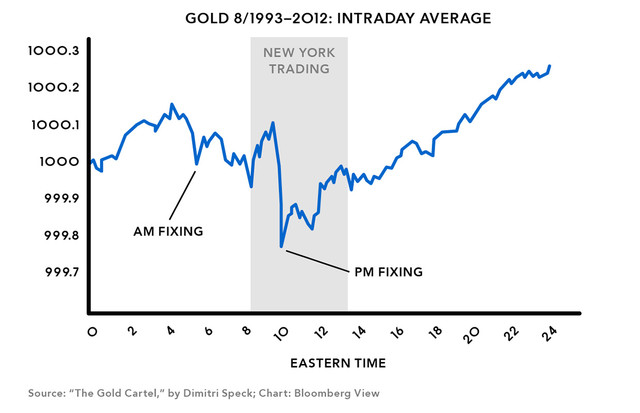

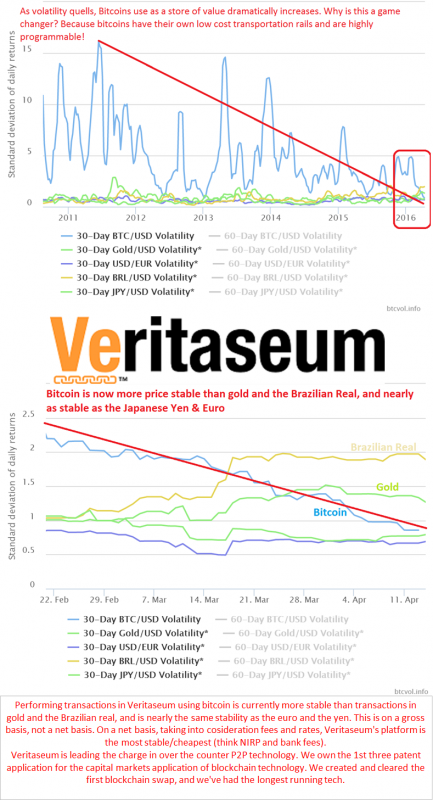

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined … Continue reading »

Read More »

Read More »

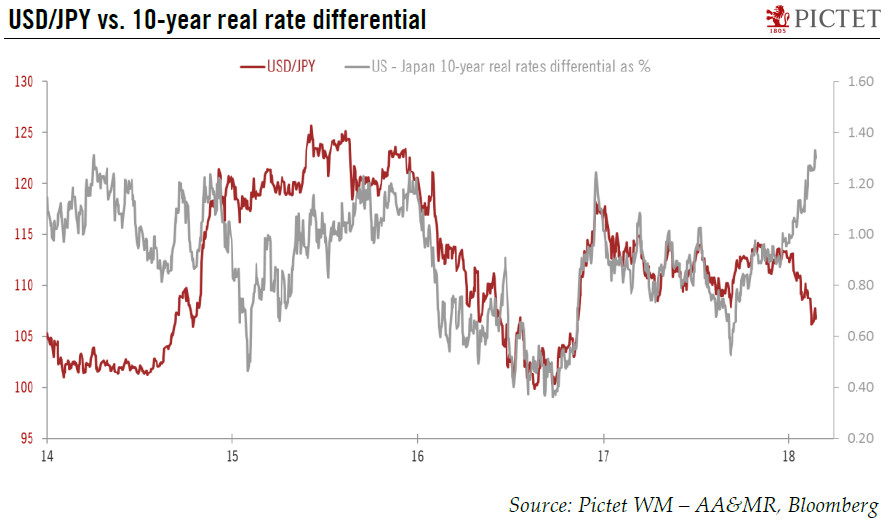

More Thoughts about the Yen

Every so often there is a market move that appears inexplicable. The conundrum now is the yen's strength. Of course, there are numerous attempts to shed light on the yen's rise, but many, like ourselves, are not very satisfied.

Perhaps par...

Read More »

Read More »

Great Graphic: Beware of Sophistry about the Yen and Nikkei

There is a common ploy used by many analysts and reporters that often simply does not stand up to close scrutiny, and would in fact be mocked in the university. The ploy is to take two time series and put them on the same chart but use different scales. Such a ploy often is used … Continue reading »

Read More »

Read More »

FX Daily, April11: Is the Dollar Bottoming against the Yen?

The yen's surge may be easing. It made a new marginal high in Asia, but has not been able to sustain it Technically, a hammer candlestick pattern may be traced out by the greenback's recovery today. Supporting the greenback is the movement in interest rate differentials. The US 10-year premium over Japan has widened by … Continue...

Read More »

Read More »

Weekly Speculative Position: Switch to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record …

Read More »

Read More »

FX Daily: Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the …

Read More »

Read More »

FX Daily, April 7: Yen Continues to Climb

The main feature in the foreign exchange market continues to be the surge of the Japanese yen. A convincing explanation of the yen's strength seems elusive. Until last week, which means through the fiscal year-end last month, Japanese fund managers have been buying foreign bonds at a near-record pace. Foreign investors, for their part, have …

Read More »

Read More »

Great Graphic: Head and Shoulders in Dollar-Yen

The old head and shoulders pattern in the dollar against the yen is back in vogue. We first pointed it out in the first week of January here.

Recall the details. The neckline is drawn around JPY116.30 and measuring objective is near JPY107.00....

Read More »

Read More »

FX Daily, April 6: Greenback Finds A Little Traction

The US dollar is better bid today but remains largely in the ranges seen in recent days. There a few developments to note, which together are lifting European equities after Asian equities softened. First, the API oil inventory estimate showed an unexpected fall of 4.3 mln barrels. An increase of half the magnitude was expected. The …

Read More »

Read More »