The yen's surge may be easing. It made a new marginal high in Asia, but has not been able to sustain it Technically, a hammer candlestick pattern may be traced out by the greenback's recovery today.

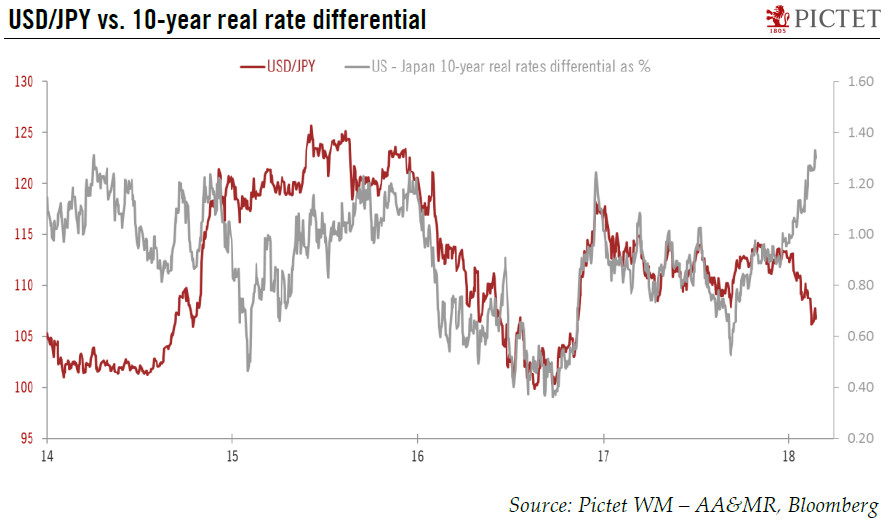

Supporting the greenback is the movement in interest rate differentials. The US 10-year premium over Japan has widened by nearly 10 bp since last Thursday. Near 184 bp, it is the widest this month. The two-year premium has also widened at 96 bp. It is also the widest this month.

The healthier appetite for risk, reflected in the three-day 2% rally in the MSCI emerging market equity index and the rally to new five-day highs in the MSCI World Index (developed equity markets) are not typically associated with an appreciating yen.

There does seem to be a seasonal pattern of yen strength in the month of April. The yen has appreciated against the dollar in four of the past five Aprils and five of the past seven. However, the 3.85% appreciation of the yen so far this month is the largest move since the yen's 6% decline in 2004.

Speculators in the futures market have a record large gross yen position of 98.1k contracts. Each contract is worth JPY12.5 mln. It is also notable that some speculators have begun selling into the yen's advance. Over the past two reporting reports, the yen bears have added to their gross short position, which has risen from the smallest in more than three years (29.5k contracts) to 38.1k contracts. The two-week rise in the gross short position is the largest since last November.

A move above JPY108.50 would help, but a move above the pre-weekend high near JPY109.10 is needed to improve the dollar's technical tone and suggest a low is being carved. The dollar has not closed above its 5-day moving average against the yen since March 28. It is found today just below JPY109.

The fast stochastics appear to be turning, but other technical indicators, like the MACDs, RSI, and slow stochastics give bottom pickers nothing to on which to bank.

We have argued that it is precisely because there is not a currency war that Japanese officials are reluctant to intervene in the foreign exchange market to sell the yen. It is not that the G7/G20 prohibit intervention, it is that the bar is high. The market is not disorderly. In fact, the market move was larger, volatility was greater, and there was a more pronounced skew in the call and put pricing in the first half of February than there is presently.

However, the sharp appreciation of the yen and the tightening of financial conditions in Japan raise the prospect that the BOJ could take fresh action at its policy-making meeting at the end of the month. A former BOJ official argued against, but it seems clear that BOJ Governor Kuroda keeps his own counsel. The April FOMC meeting will take place at the same time. If a June rate hike, which nearly 3/4 of economists expect, according to a recent Wall Street Journal poll, the April FOMC statement could be less dovish than the market is currently pricing.

To be clear, this is not a call to sell yen or to raise currency hedges on yen exposures. It is not a warning that intervention is likely. Rather it is an early heads up that the yen's surge may begin fading soon. Investors should be keeping a watchful eye for a reversal pattern and other signs that the yen's surge is tiring.

Tags: Japanese yen