Tag Archive: Japan

FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today.

Read More »

Read More »

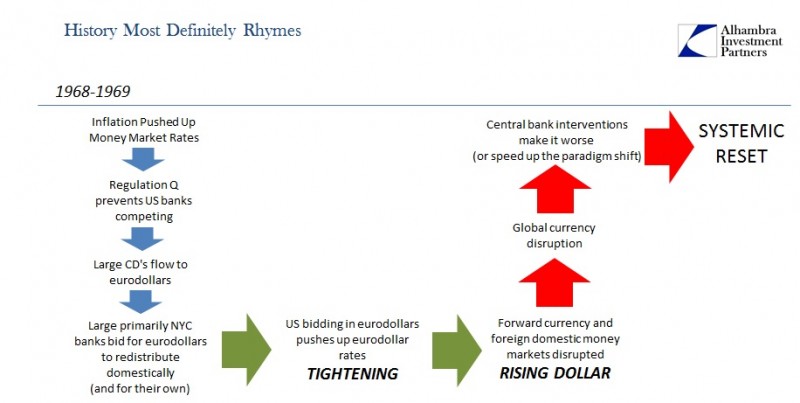

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

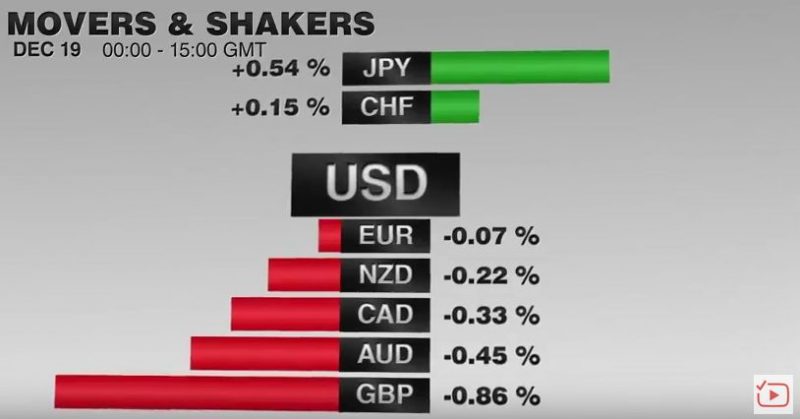

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indictator to GDP growth. It is positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. But today GDP growth is often negatively correlated to the Net Savings Rate. Hence GDP is often a less useful measure.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

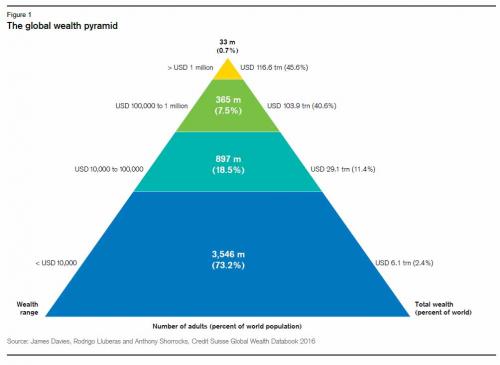

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

Canadian Bank Starts Charging Negative 0.75percent Rate On Most Foreign Cash Balances

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by t...

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

Un-Becoming American – One Man’s Painful Journey To Renouncing Citizenship

In April 2012, I returned to Switzerland – my country of birth – to commence a new phase of my adult life. Naturally, one of the first steps to undertake when establishing oneself in a new country is to open a bank account. I went down to the local Raiffeisen bank branch in the village of Aesch, Luzern, where my relatives and ancestors had lived and worked as farmers for over 10 generations.

Read More »

Read More »