Tag Archive: Investing

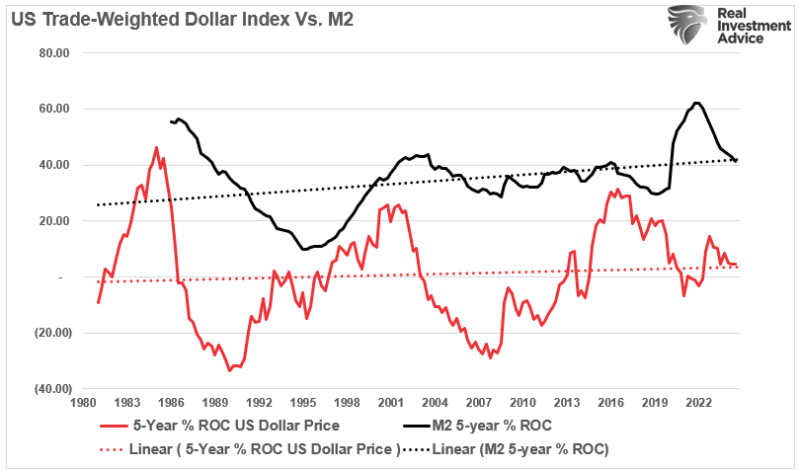

Do Money Supply, Deficit And QE Create Inflation?

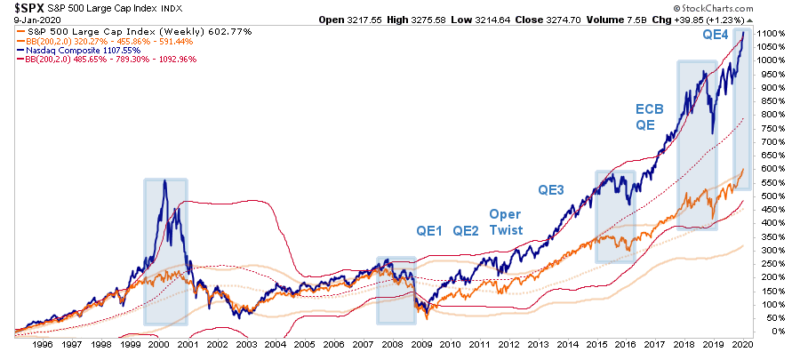

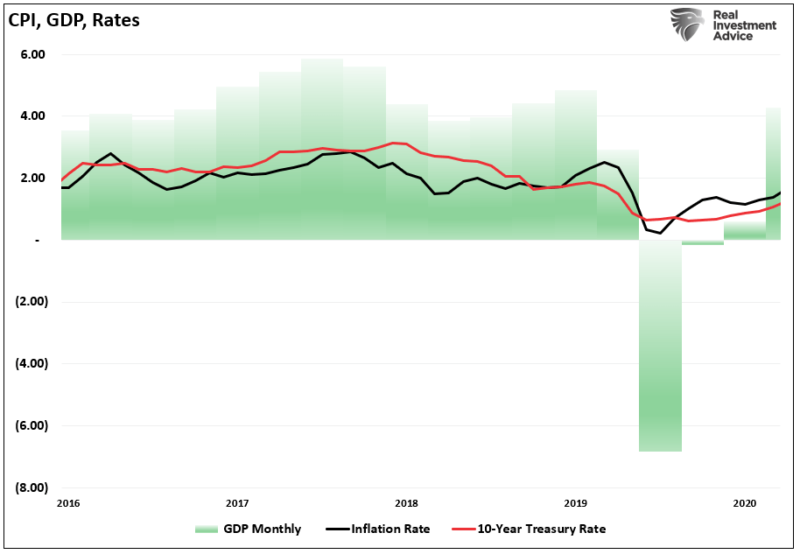

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was …

Read More »

Read More »

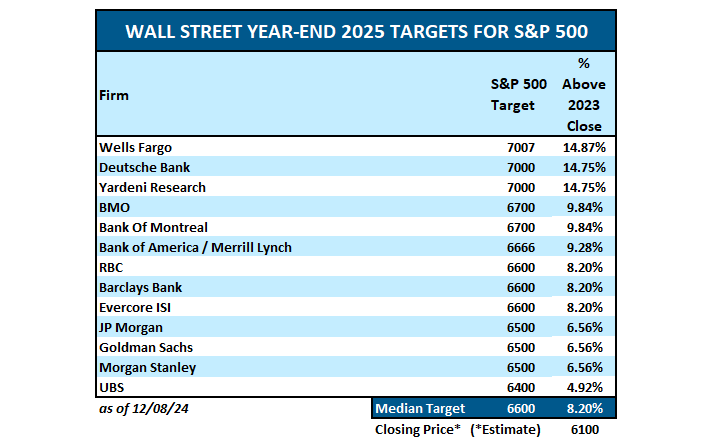

Are Return Expectations For 2025 Too High?

In a recent post, I discussed Wall Street's return estimates for 2025 for the S&P 500 index. To wit: "We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are optimistic for the coming year. The median estimate is for the market to rise … Continue reading »

Read More »

Read More »

Gardening Guide To Better Portfolio Returns In 2025

As we head into 2025, investors are giddy over the market returns of the last two years. As shown, the annual returns, while elevated, have come with only average volatility along the way. However, while most analysts and investors expect 2025 to be another bullish year, there is always a risk of a more disappointing …

Read More »

Read More »

Tactically Bearish As Risks Increase

In last week's discussion with Thoughtful Money, I noted that we are becoming more "tactically bearish" as we progress into 2025. While we have remained primarily bullish in equity positioning over the last two years, several risks are now worth considering. However, it is critical to note that being "tactically bearish" does NOT mean we …

Read More »

Read More »

Investor Resolutions For 2025

I publish an updated version of my New Year “investor” resolutions yearly. The purpose of the process is to take an annual inventory of what I did and did not do over the last year to improve my portfolio management practices. As with all resolutions made at the beginning of a new year, it is not uncommon … Continue reading...

Read More »

Read More »

“Curb Your Enthusiasm” In 2025

"Curb Your Enthusiasm," which ran its series finale last year, starred Larry David as an over-the-top version of himself in a comedy series that showed how seemingly trivial details of day-to-day life can precipitate a catastrophic chain of events. The show never failed to deliver a laugh but also reminded me that unexpected events can …

Read More »

Read More »

The Rules Of Bob Farrell – An Updated Illustrated Guide

In a recent discussion on TheRealInvestmentShow, Bob Farrell and his 10 investment rules were discussed, which elicited several email questions asking, "Who is Bob Farrell, and where are these rules?". I often forget how old I have become, and the investing legends of my youth are no longer there and are lost to the sands of time. …

Read More »

Read More »

A Complete Guide to Investment Strategies for Building Wealth

Building wealth through investing requires a clear understanding of foundational principles and a disciplined approach to asset allocation. Whether you’re new to investing or looking to refine your strategy, this guide explores key investment strategies for wealth creation, offering insights on diversification, risk tolerance, and how to build a portfolio that aligns with your goals. …

Read More »

Read More »

Affordable Care Act & The Inflation Of Healthcare

When the Obama Administration first suggested the Affordable Care Act following the Financial Crisis, we argued that the outcome would be substantially higher, not lower, healthcare costs. It is interesting today that economists and the media complain about surging healthcare costs with each inflation report but fail to identify the root cause of that escalation. …

Read More »

Read More »

Prediction For 2025 Using Valuation Levels

It’s that time of year when Wall Street polishes up its crystal balls and predicts next year's market returns. Since Wall Street never predicts a down year, these forecasts are often wrong and sometimes very wrong. For example, on December 7th, 2021, we wrote an article about the predictions for 2022. “There is one thing …

Read More »

Read More »

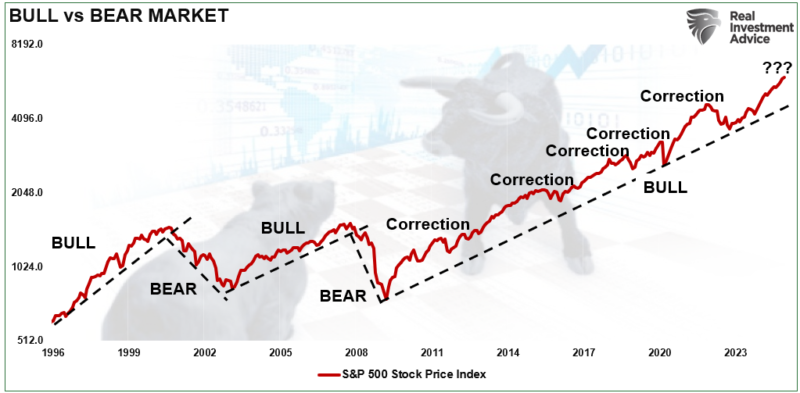

Permabull? Hardly.

I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling …

Read More »

Read More »

Economic Indicators And The Trajectory Of Earnings

Understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide valuable insights into the economic environment that shapes company profitability. …

Read More »

Read More »

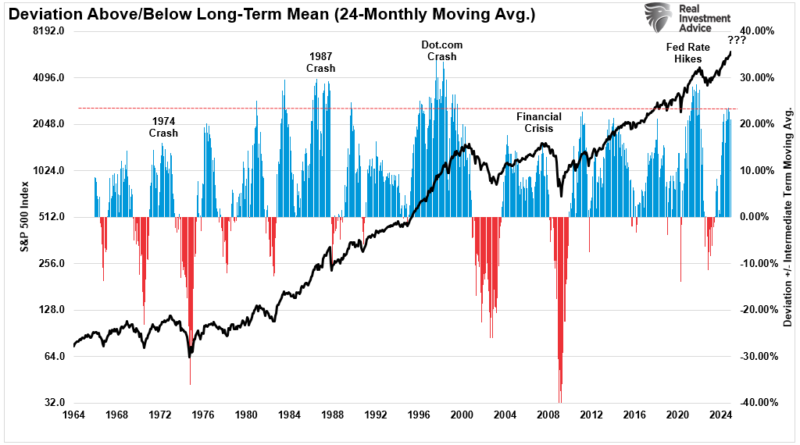

Portfolio Rebalancing And Valuations. Two Risks We Are Watching.

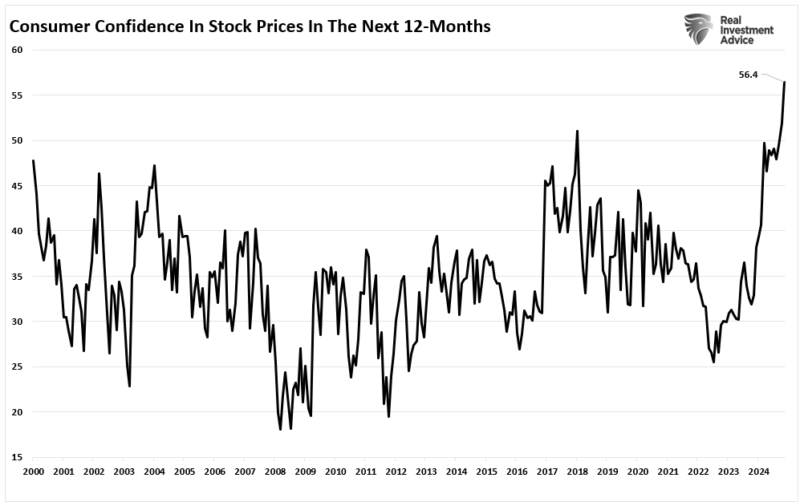

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market.

Read More »

Read More »

How to Build a Diversified Investment Portfolio for Long-Term Growth

Investing for the long term is a journey that requires careful planning, patience, and, most importantly, diversification. Building a diversified investment portfolio is essential for mitigating risk and ensuring steady growth over time. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. In this …

Read More »

Read More »

How to Assess Your Risk Tolerance Before Investing

Investing is an essential part of building wealth, but the key to success lies in aligning your investments with your personal comfort level. Assessing risk tolerance is the foundation of a successful investment strategy. By understanding how much risk you’re willing and able to take, you can make informed decisions about your portfolio and achieve …

Read More »

Read More »

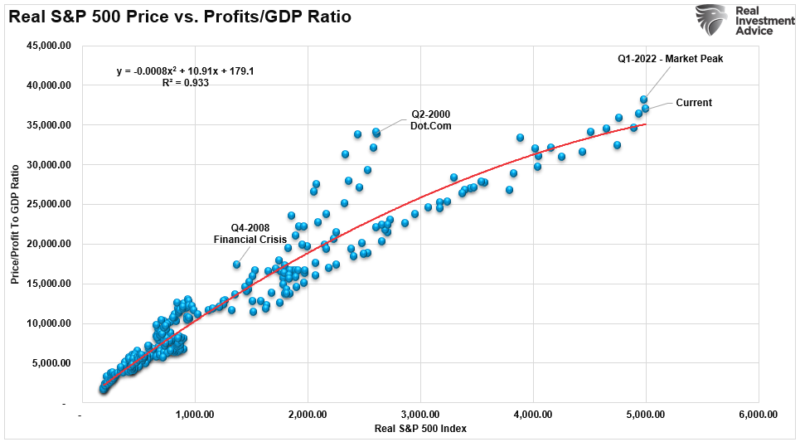

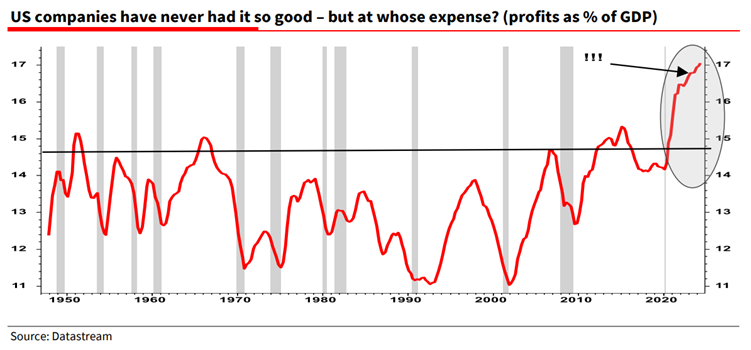

The Kalecki Profit Equation And The Coming Reversion

Corporations are currently producing the highest level of profitability, as a percentage of GDP, in history. However, understanding corporate profitability involves more than glancing at quarterly earnings reports. At its core, the Kalecki Profit Equation provides a valuable framework, especially when exploring the reasons behind today’s elevated profit margins and what could disrupt them. James …

Read More »

Read More »

Leverage And Speculation Are At Extremes

Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week's #BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows …

Read More »

Read More »

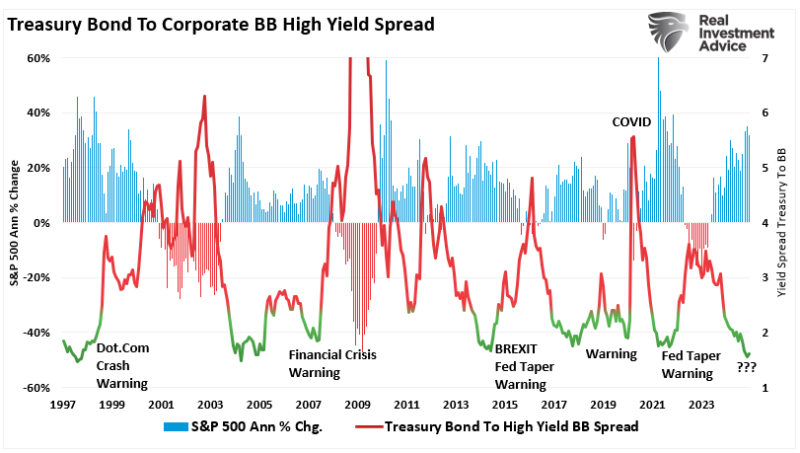

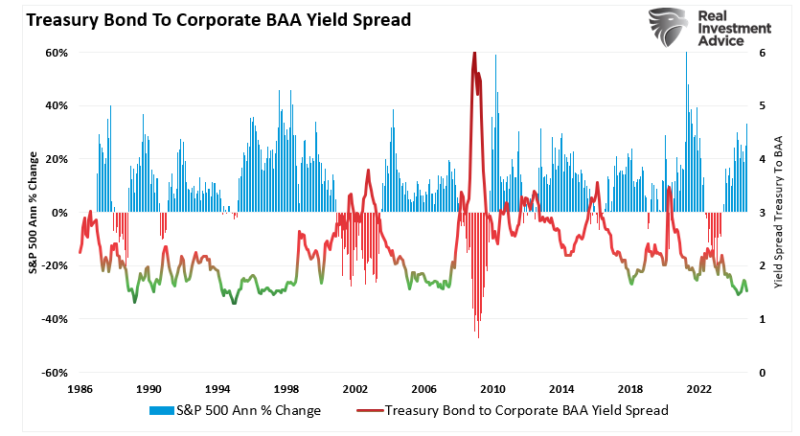

Credit Spreads: The Markets Early Warning Indicators

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge …

Read More »

Read More »

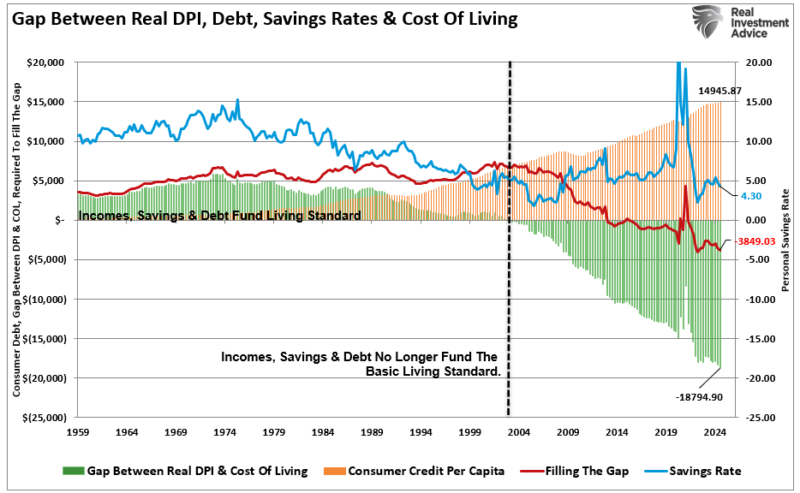

“Trumpflation” Risks Likely Overstated

With the re-election of President Donald Trump, the worries about tariffs and pro-business policies sparked concerns of "Trumpflation." Inflation has been a top concern for policymakers, businesses, and everyday consumers, especially following the sharp price increases experienced over the past few years. However, growing evidence shows inflationary pressures continue to ease significantly, paving the way …

Read More »

Read More »

Yardeni And The Long History Of Prediction Problems

Following President Trump's re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets. Unsurprisingly, the rush by perma-bulls to make long-term predictions is remarkable.

Read More »

Read More »