Tag Archive: international investment position

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

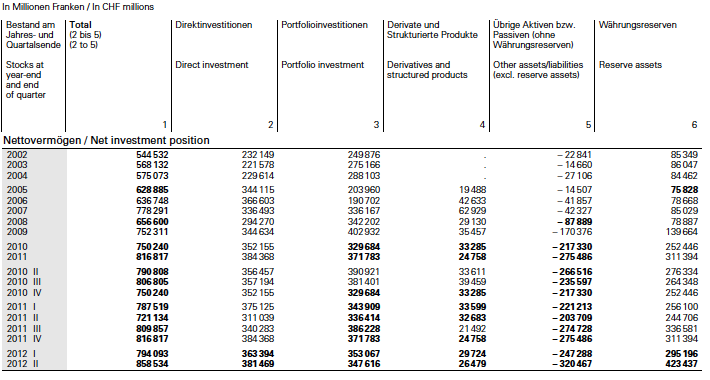

(10.1.2) Net International Investment Position Switzerland and Italy

We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Read More »

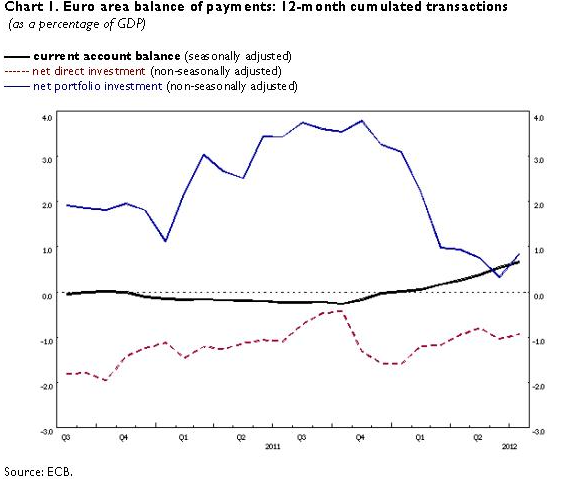

(5) The Balance of Payments Model

The Balance of Payments is the sum of current and capital account. The Balance of Payments model states that a currency appreciate when the Balance of Payments is positive. We give an explanation in around 400 words, that clarifies the relationships.

Read More »

Read More »

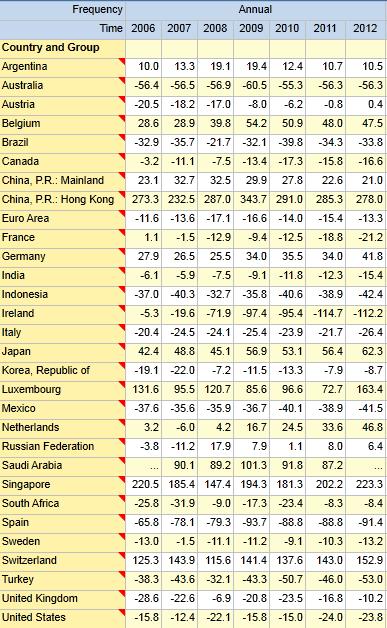

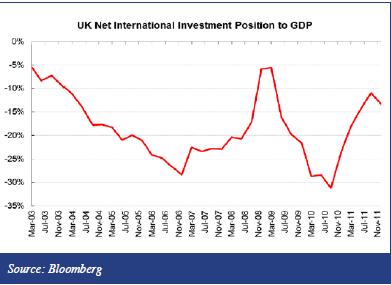

(9.1) Net International Investment Position

A comparison of the net international investment position (NIIP) of several countries. We explain why asset valuation effects this position at the example of the United States.

Read More »

Read More »

(13.1) Is the Swedish Krona a Safe-Haven?

Arguments in favor of and against the Swedish Krona,as safe-haven during the euros crisis. Extracts from tradingfloor.com

Read More »

Read More »

What Drives Government Bond Yields, Part2: Emerging Markets and Recent Discussions

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Read More »

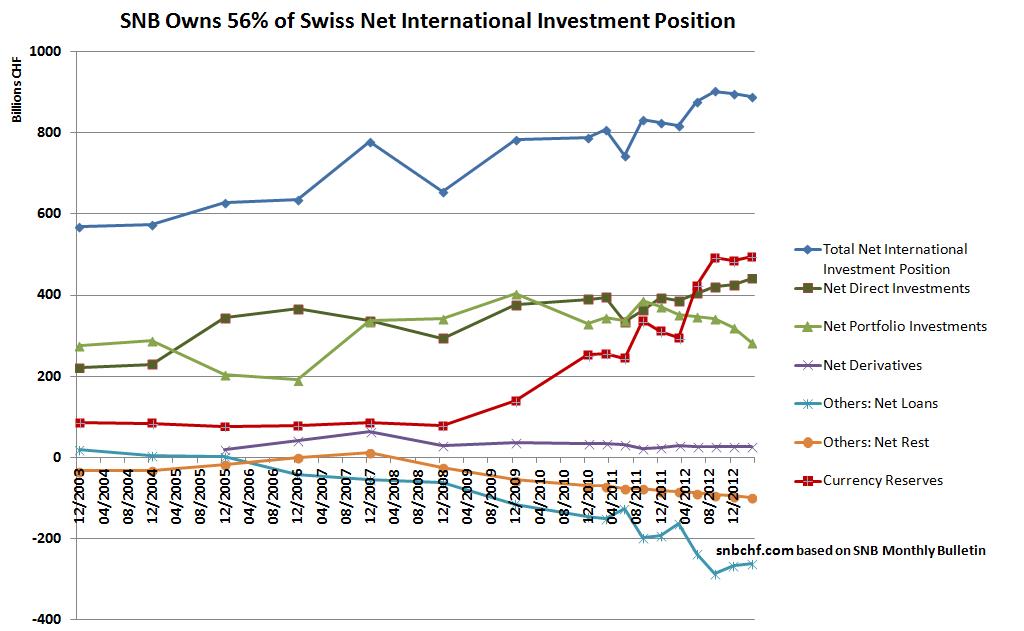

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

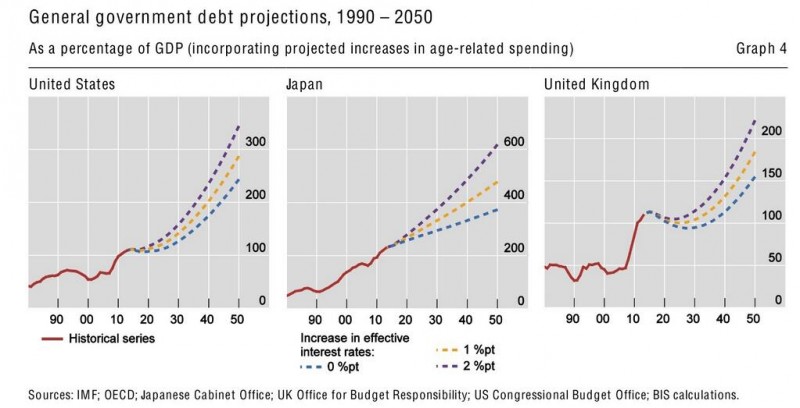

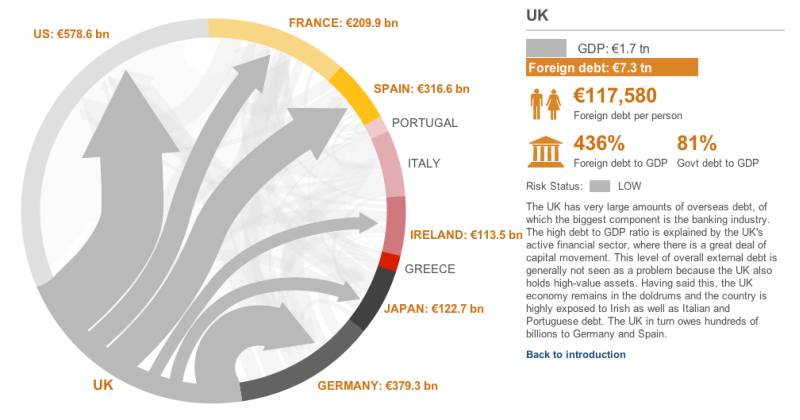

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

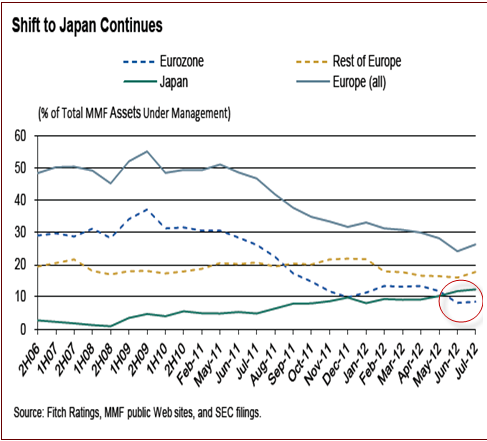

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

Standard and Poor’s critique of the Swiss National Bank, part 1

Part 1: Swiss investments abroad [This paper includes some of the S&P critique, but also aims to clarify some of S&P’s misleading points] Last Thursday Thomas Moser, a member of the Swiss National Bank (SNB) governing council, said that one of the main reasons for the strong franc is the conversion of Swiss foreign incomes …

Read More »

Read More »

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

Read More »

Read More »

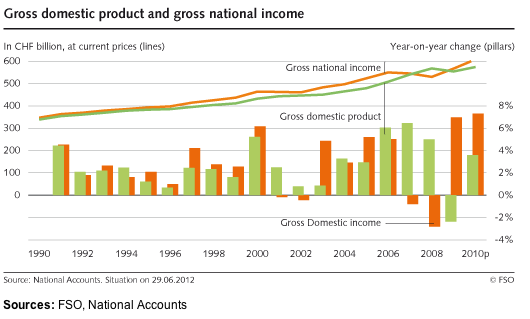

Swiss Net International Investment Position Increases by 64 Billion Francs

Swiss Gross National Income (GNI) rises by 1.8% in Q2, after Q1 +0.5% According to the latest SNB Monthly Bulletin, the Swiss net international investment position (NIIP) has improved by 64.5 billion francs. The Gross National Income (GNI) rises by 1.8% in Q2. The SNB currency reserves rose by 128 Bln. Francs in the …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »