Tag Archive: inflation

Weekly Market Pulse: The More Things Change…

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

RBA, BOC, and ECB Meetings and more in the Week Ahead

All

three major central banks that meet in the coming days will hike rates. The question is by how much. The Reserve Bank of Australia makes its

announcement early Tuesday, September 6. One of the challenges for policymakers and investors is

that Australia reports inflation quarterly. The Q2 estimate was released on July

27. It showed prices accelerating to 6.1% year-over-year from 5.1% in Q1. The

trimmed mean rose to 4.9% from 3.7%, and the...

Read More »

Read More »

Goldilocks Calling

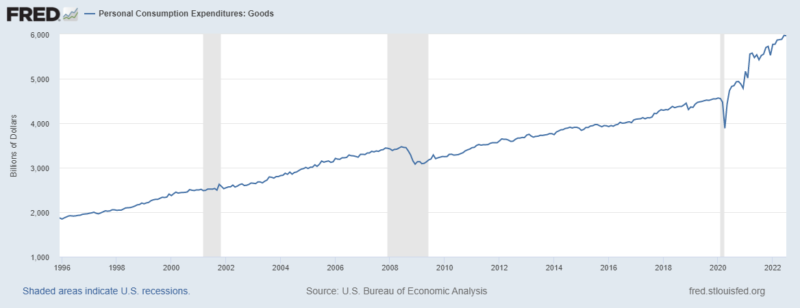

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

Read More »

Read More »

EMU August CPI at 9.1%, while the Core Rate Jumps to 4.3%

Overview: The rise in global interest rates continues. The US 10-year yield is a few basis points near 3.15% and European benchmarks are mostly 5-6 bp higher. Of note, the sharp sell-off in UK Gilts has being extended. Yesterday’s 10 bp rise has been followed by another 14 bp surge today. Italian bonds are also getting hit. The 10-year yield is up a little more than 10 bp.

Read More »

Read More »

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk.

Read More »

Read More »

Rate Hikes Are Working

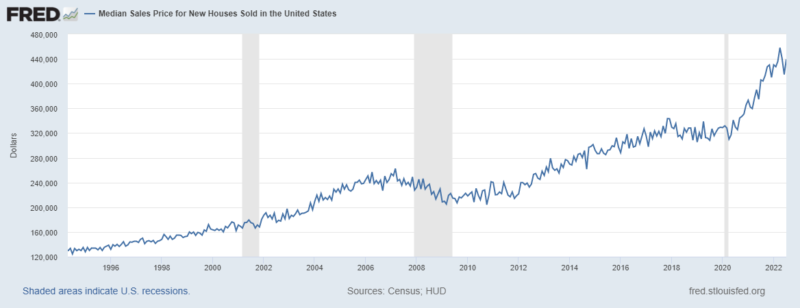

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Flash PMI, Jackson Hole, and the Price Action

For many, this will be the last week of the summer. However, in an unusual twist of the calendar, the US August employment report will be released on September 2, the end of the following week, rather than after the US Labor Day holiday (September 5).

Read More »

Read More »

The Dollar is on Fire

The dollar is on fire. It is rising against all the major currencies and cutting through key technical levels like a hot knife in butter. The Canadian dollar is the strongest of the majors this week, which often outperforms on the crosses in a strong US dollar environment. It is off 1.5% this week.

Read More »

Read More »

Markets Look for Direction

Overview: The biggest development today in the capital markets is the

jump in benchmark interest rates. The US

10-year yield is up five basis points to 2.86%, which is about 10 bp above

Monday’s low. European yields are up 9-10

bp. The 10-year German Bund yield was

near 0.88% on Monday and is now near 1.07%.

Italy’s premium over German is near 2.18%, the most in nearly three

weeks. Although Asia Pacific equities

rallied, led by Japan’s 1.2%...

Read More »

Read More »

China Disappoints and Surprises with Rate Cut

Overview: Equities were mostly higher in the Asia

Pacific region, though Chinese and Hong Kong markets eased, and South Korea and

India were closed for national holidays. Despite new Chinese exercises off the

coast of Taiwan following another US congressional visit, Taiwan’s Taiex gained

almost 0.85%. Europe’s Stoxx 600 is advancing for the fourth consecutive session,

while US futures are paring the pre-weekend rally. Following disappointing data...

Read More »

Read More »

Is it All Really about Today’s US CPI Print?

Overview: The US dollar is trading with a heavier bias ahead of the July CPI report. The intraday momentum indicators are overextended, and this could set the stage for the dollar to recover in North America.

Read More »

Read More »

When markets forget that Central Banks cannot fix the world with interest rates

2022-09-04

by Stephen Flood

2022-09-04

Read More »