Authored by Paul Brodsky via Macro-Allocation.com,

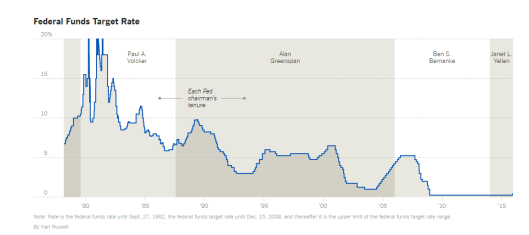

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most political...

Read More »

Tag Archive: hyperinflation

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »

Nigerian Currency Collapses After Central Bank Halts Dollar Sales To Stall “Hyperinflation Monster”

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-...

Read More »

Read More »

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation

There are different discussions ongoing if a central bank may monetize debt and act of a quasi-fiscal agent. One opinion was the Modern Monetary Theory that advocates monetizing debt.

Read More »

Read More »

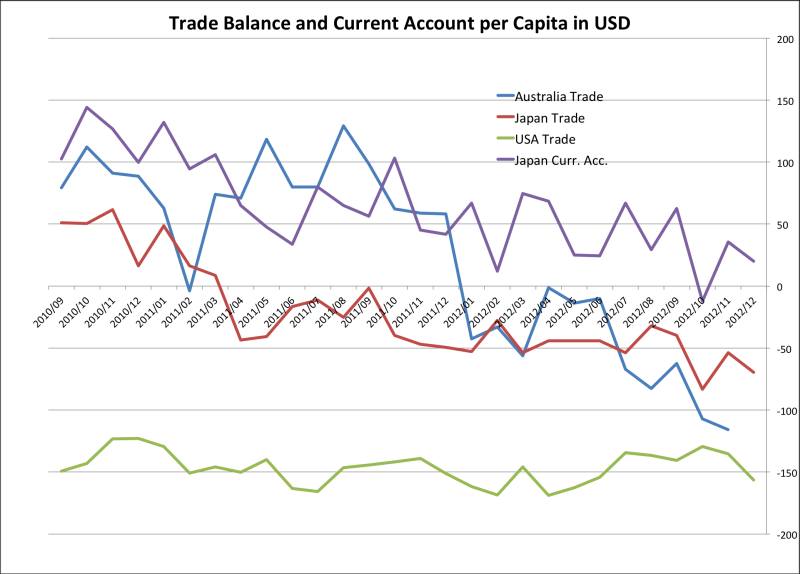

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

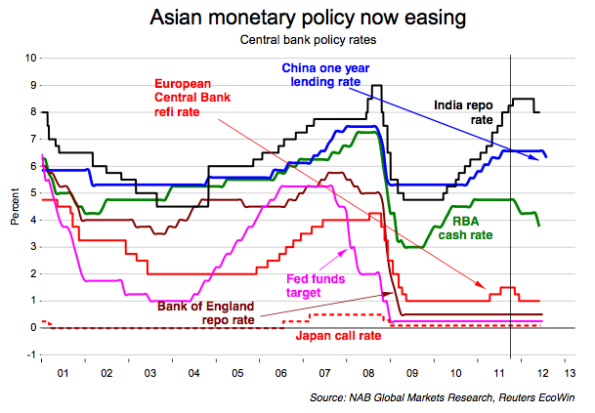

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

Did Austrian Economists Get the Recovery Wrong?

Austrians got the recovery after the financial crisis wrong. Monetary expansion did not lead to hyperinflation and a collapse of central banks. Their mistake was that the Austrian principle of "too cheap money leads to wrong investments", is currently not valid. Due to high risk aversion after the financial crisis, firms do only only best projects. Austrian economists were right before the crisis, but after the crisis Keynesians and Germans with...

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

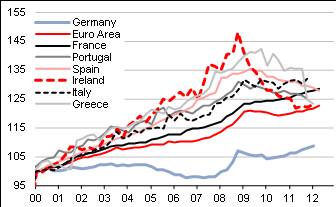

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »

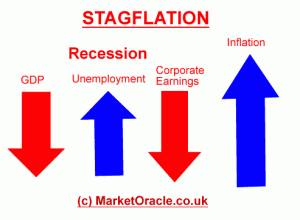

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »