I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Tag Archive: House Prices

Rate Hikes Are Working

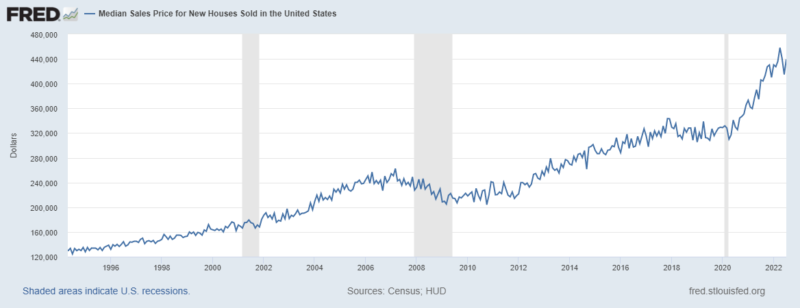

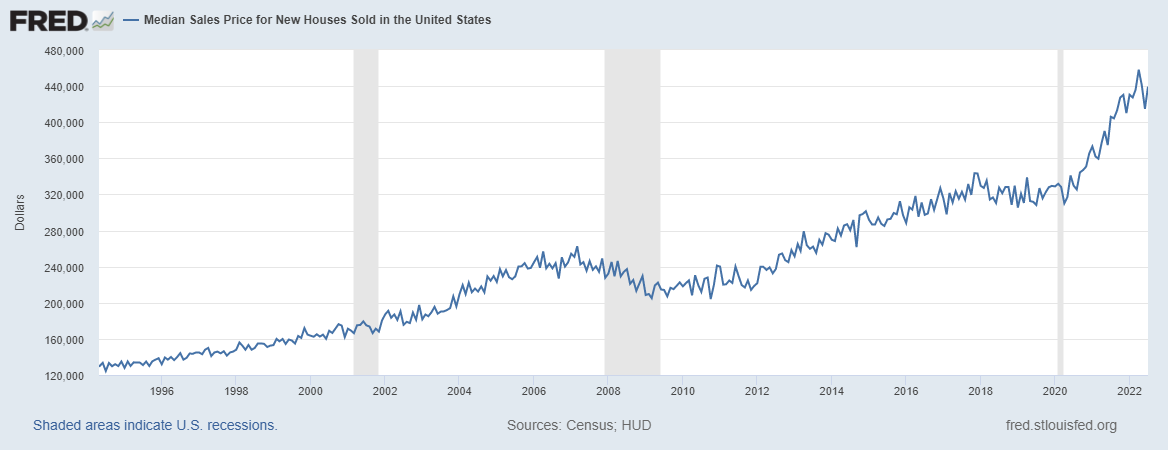

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report.

Read More »

Read More »

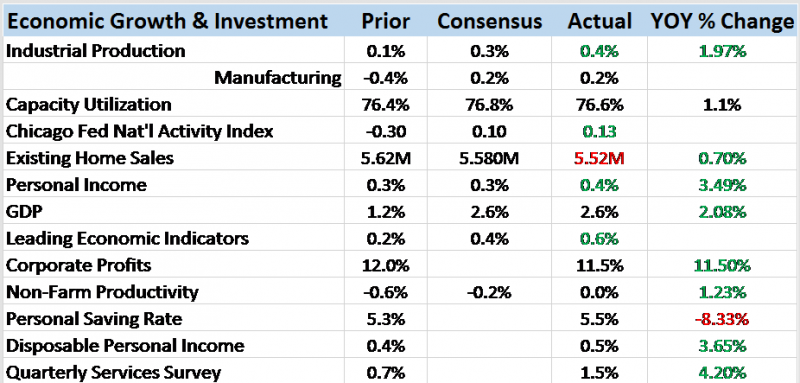

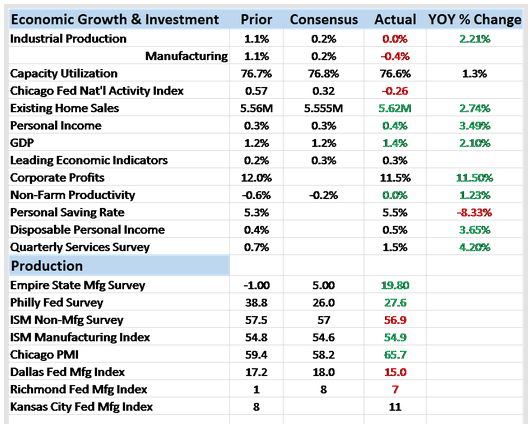

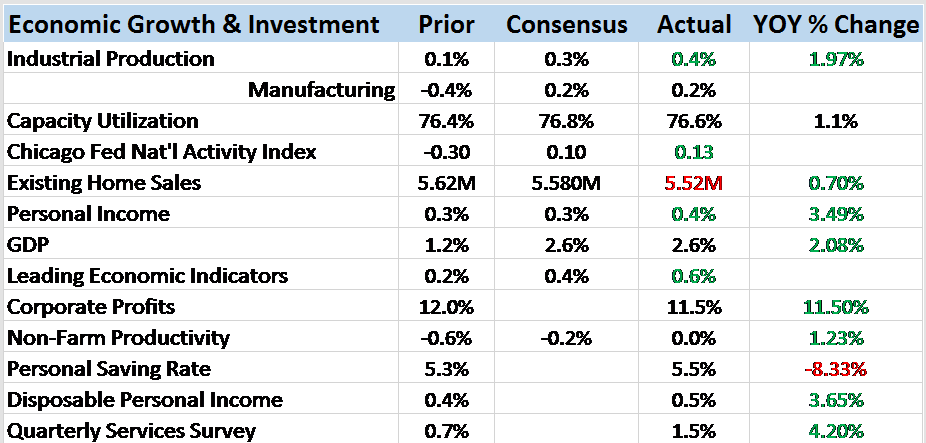

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

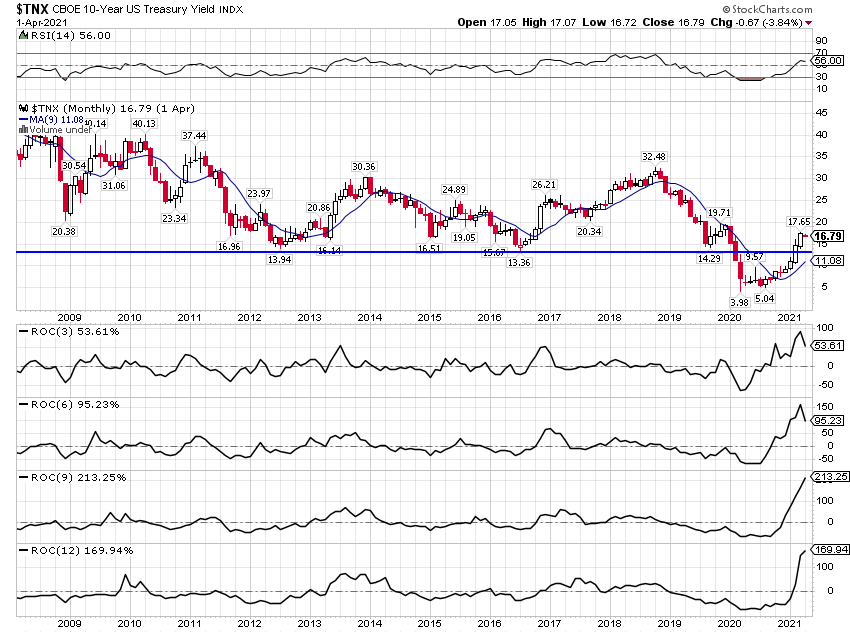

Bi-Weekly Economic Review: Draghi Moves Markets

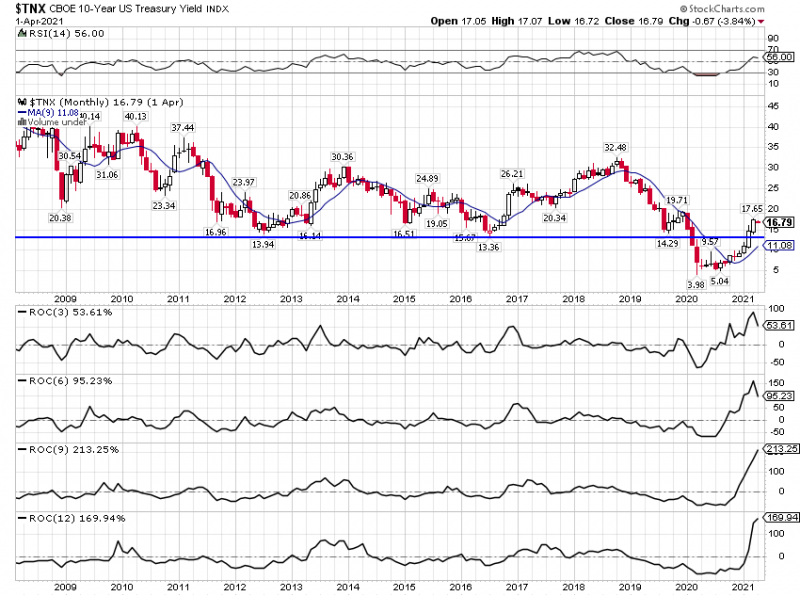

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

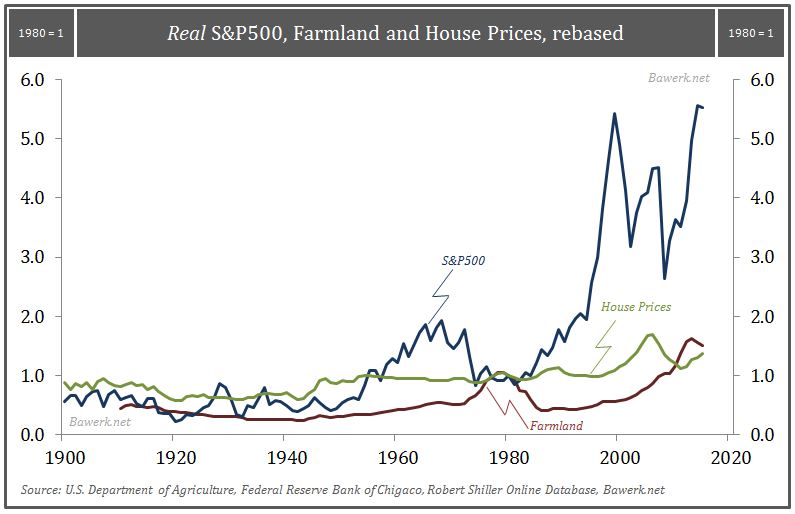

Greenspan, the Sheepherder

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated,...

Read More »

Read More »

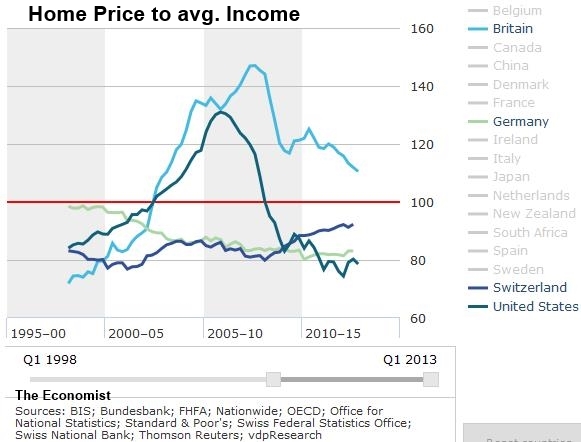

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

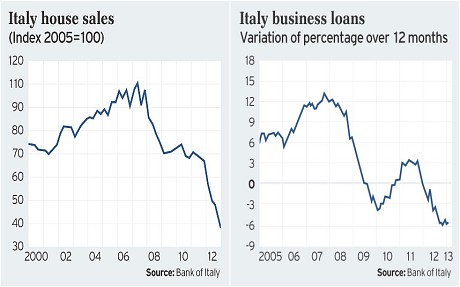

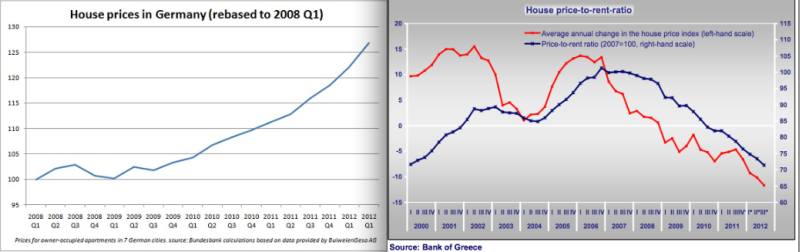

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »