Tag Archive: Germany

FX Daily, December 2: PMIs Provide Latest Fuel for Equity Markets

Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss before the weekend. Europe's Dow Jones Stoxx 600 is also shrugging off the pre-weekend loss and to challenge the multiyear high recorded last week.

Read More »

Read More »

FX Daily, November 25: Hong Kong, China, and UK Election Hopes Fan Modest Risk-Taking

Overview: The combination of the victory of the pro-democracy movement in Hong Kong and an apparent concession by China on intellectual property rights is helping bolster risk appetites to start the week. Equities are higher. Hong Kong's Hang Seng led Asia Pacific equities with a 1.5% gain, the second biggest this month. Korea and India's bourses also gained more than 1%.

Read More »

Read More »

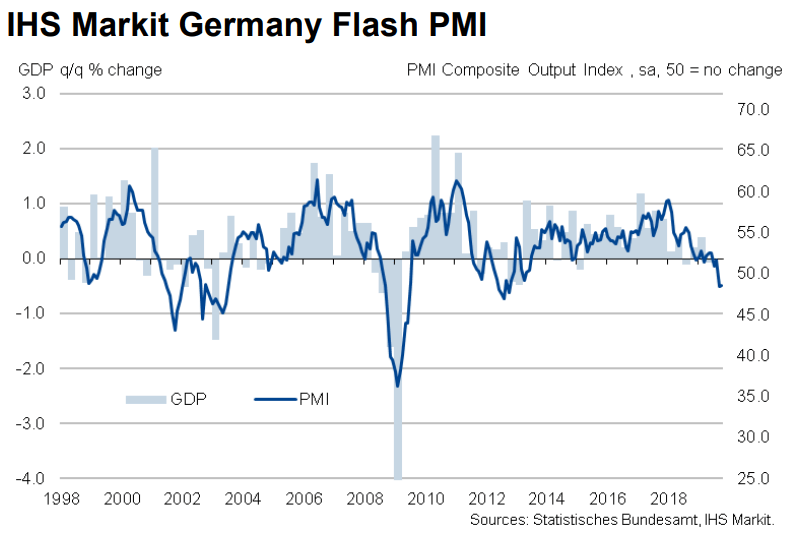

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

FX Weekly Preview: Caution: Prices Diverging from Macro Drivers

Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world's two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce.

Read More »

Read More »

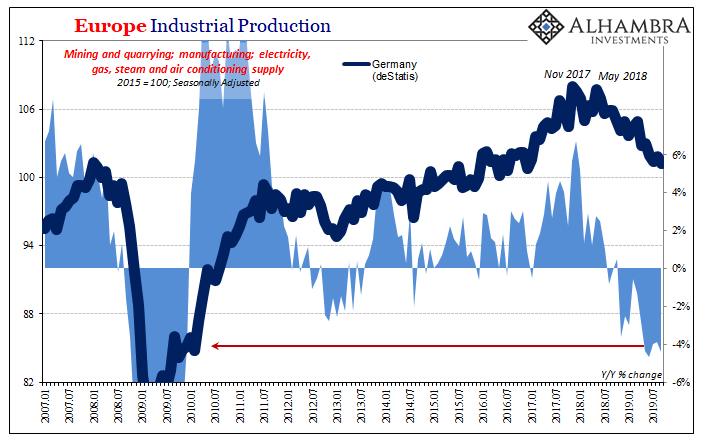

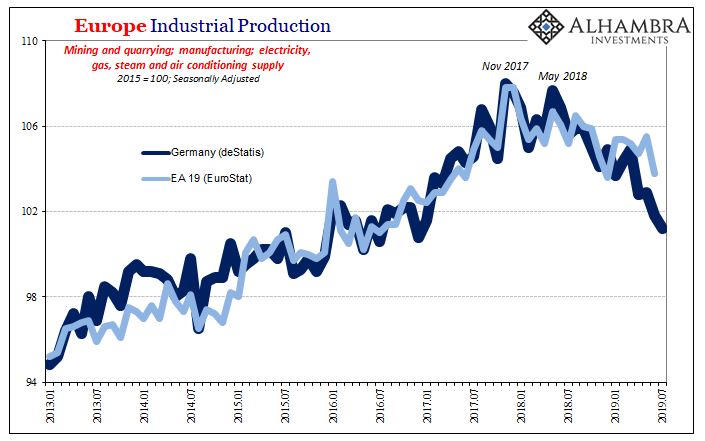

A Perfect Example of the Euro$ Squeeze

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate.

Read More »

Read More »

FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week's gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index rose for the fifth week. Europe's Dow Jones Stoxx 600 is snapping a five-day rally, but it is closing in on the fifth consecutive weekly advance.

Read More »

Read More »

FX Daily, November 7: Trade Optimism Boosts Sentiment but Weighs on the Dollar

Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China's views rather than a new breakthrough. The dollar is paring its recent gains. The MSCI Asia Pacific Index rose for the fifth time in six sessions to reach its best level since August 2018.

Read More »

Read More »

FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe's Dow Jones Stoxx 600 took a five-day advancing streak into this week, but shares are struggling to sustain the upside momentum.

Read More »

Read More »

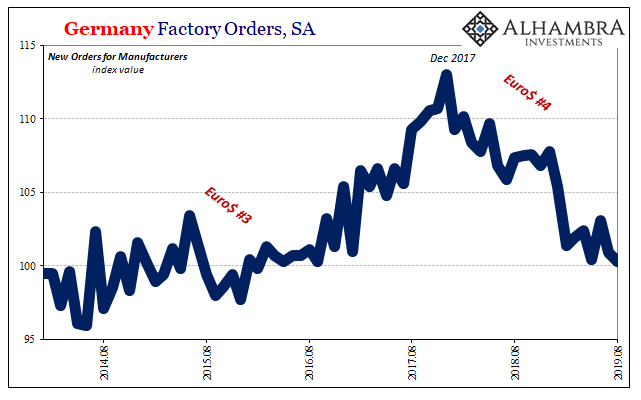

Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year.

Read More »

Read More »

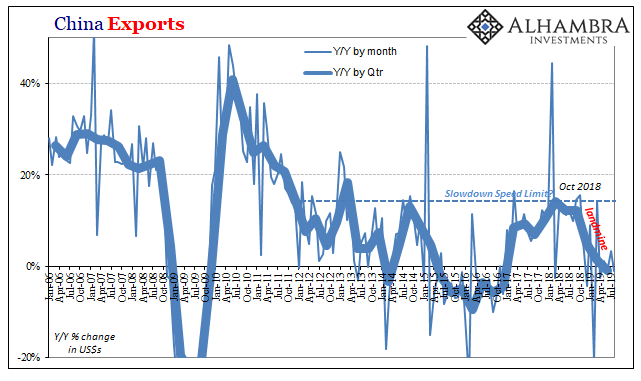

The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much.

Especially not with world’s economy roaring under globally synchronized growth. Even though there were...

Read More »

Read More »

FX Daily, October 8: Not a Good Day for Negotiators

The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe's Dow Jones Stoxx 600 turned down, even though Germany announced an unexpected gain in August industrial output. US shares are trading a bit lower.

Read More »

Read More »

The Consequences Of ‘Transitory’

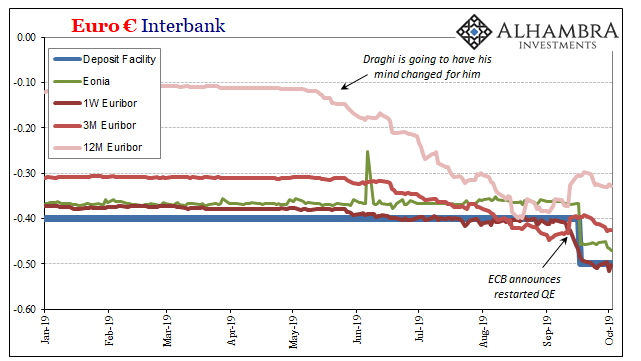

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Read More »

FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment.

Read More »

Read More »

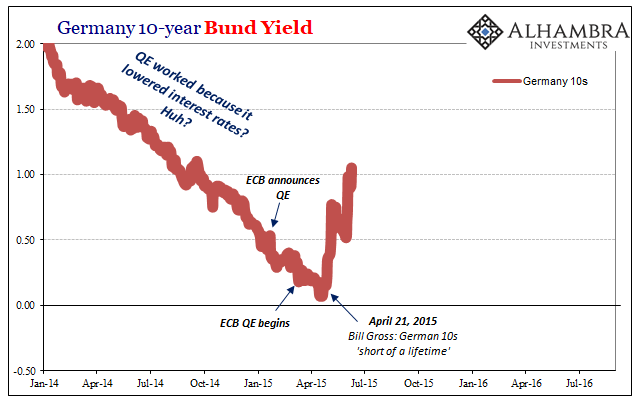

Big Trouble In QE Paradise

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it.

Read More »

Read More »

No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their...

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week on a firm note and extended the rally the third week.

Read More »

Read More »

FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session.

Read More »

Read More »