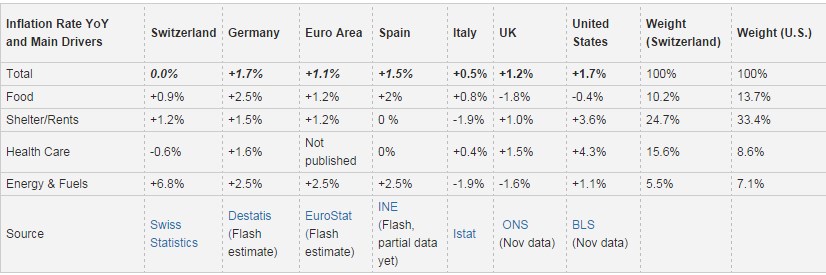

Energy prices in Switzerland turned around from a minus 2.4% in November to a +6.8% in December. Oil prices had seen its trough exactly one year ago.

Especially in Germany and Spain, this translated into inflation rates, that are close to the ECB target rate of 2%.

Read More »

Tag Archive: food inflation

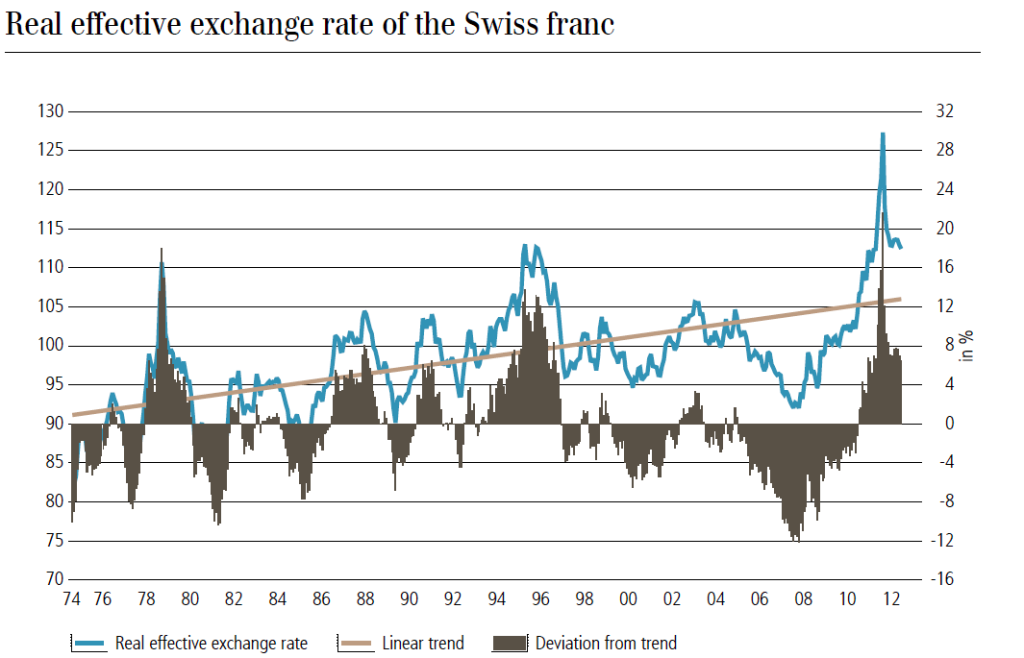

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »

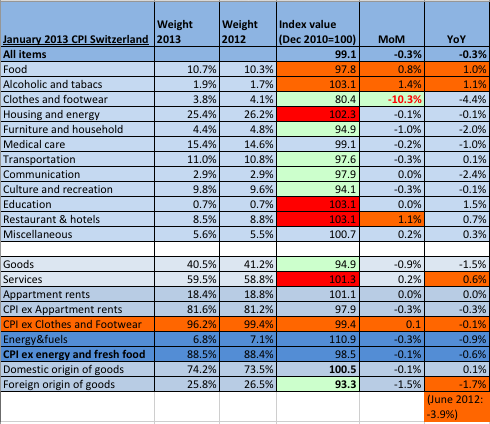

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

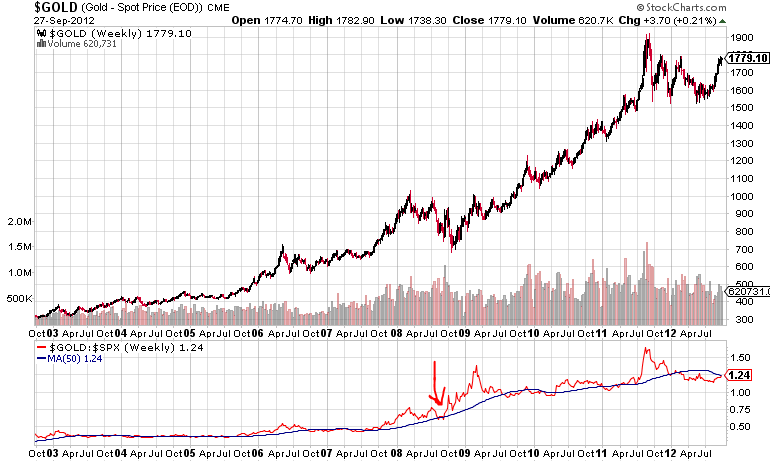

Marc Faber: Assets are overpriced, we short metals and Brent now

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

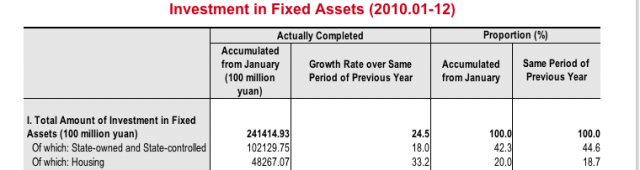

The Chinese Government, a bubble creator or when finally does China consume ?

The years 2009 to 2011 have seen four institutions that created bubbles in commodity, stock and real estate markets. 2008 and 2009 saw the massive Keynesian interventions by the US state and the Chinese government. In 2009 the first Quantitative Easing measures enabled a first flood of hot money into Emerging Markets. Summer 2010 witnessed …

Read More »

Read More »