Tag Archive: Federal Reserve/Monetary Policy

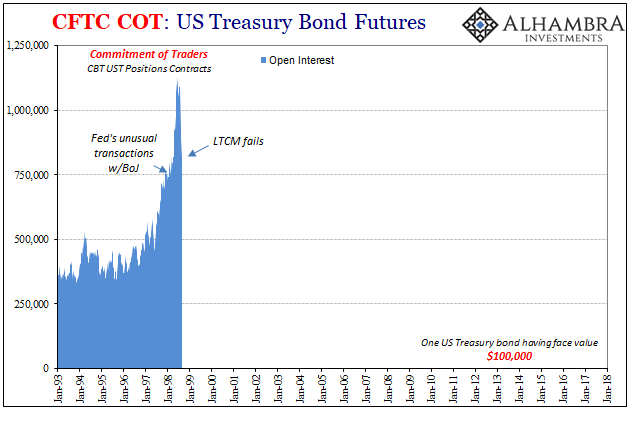

COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders.

Read More »

Read More »

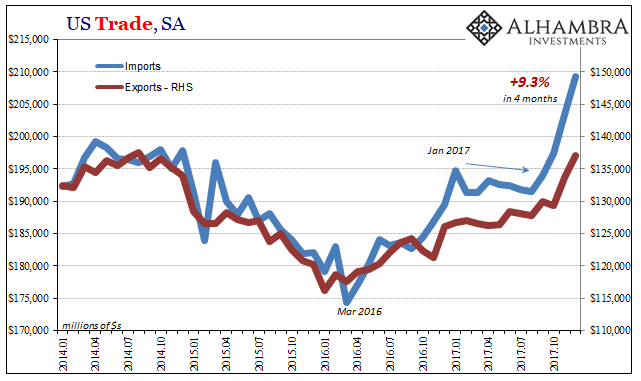

US Imports: A Little Inflation For Yellen, A Little More Bastiat

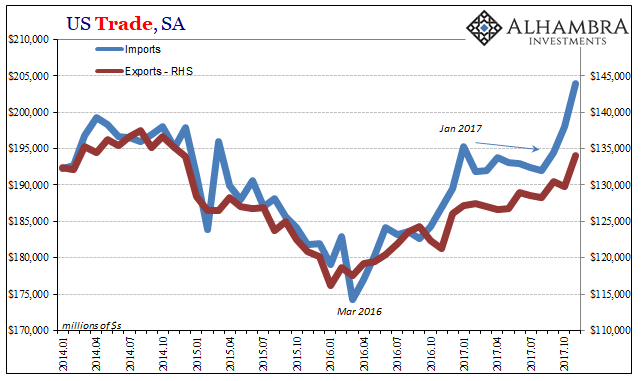

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

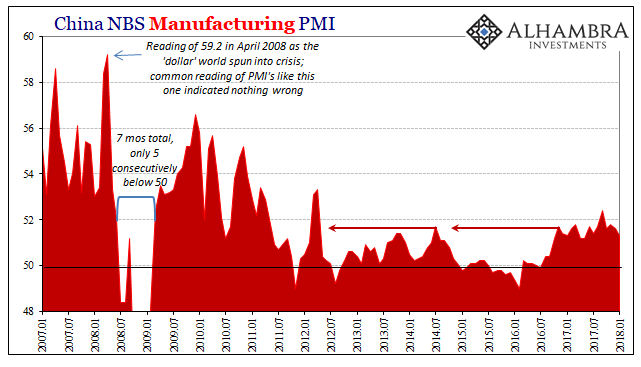

How Global And Synchronized Is A Boom Without China?

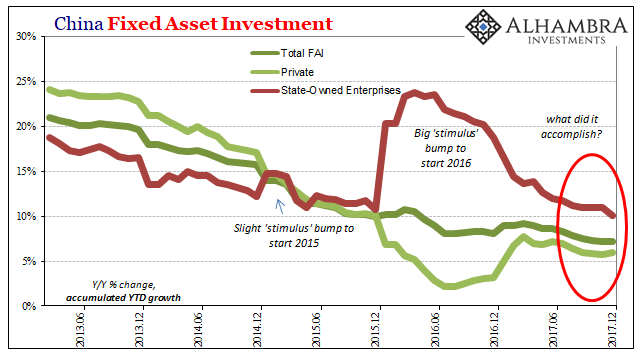

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already.

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »

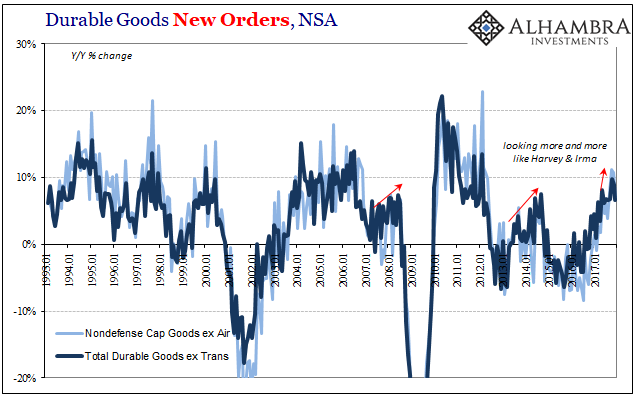

December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes.

Read More »

Read More »

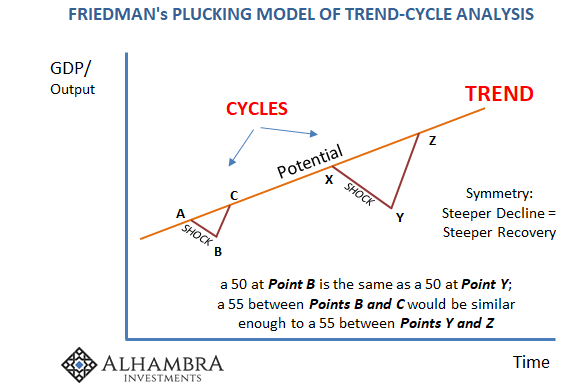

The Dismal Boom

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction.

Read More »

Read More »

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »

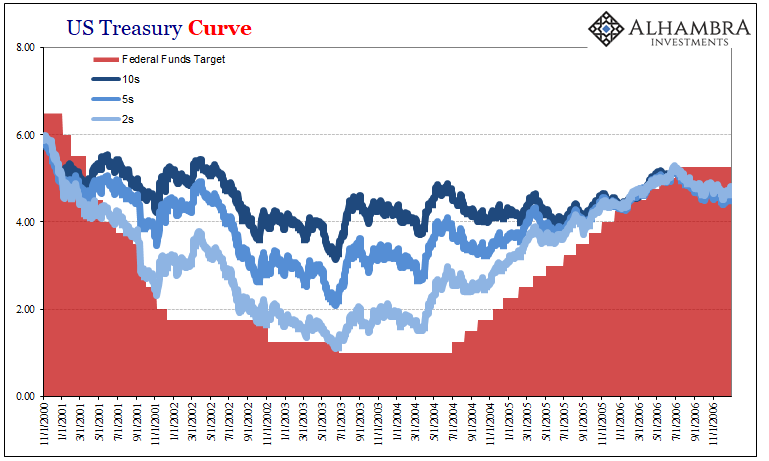

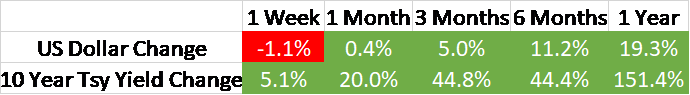

What About 2.62 percent?

There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago.

Read More »

Read More »

The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still.

Read More »

Read More »

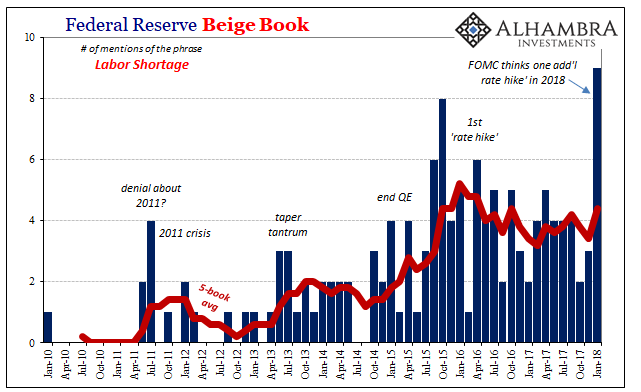

U.S. Unemployment: The Dissonance Book

I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context.

Read More »

Read More »

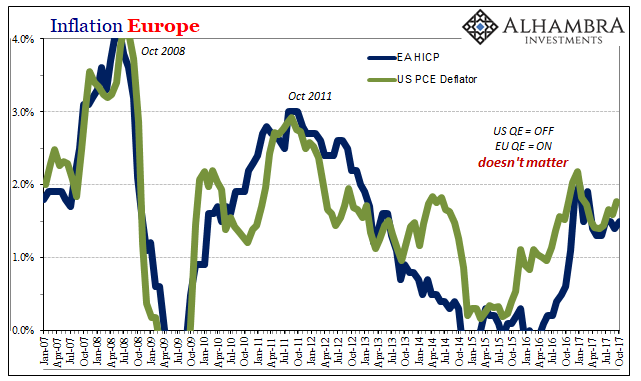

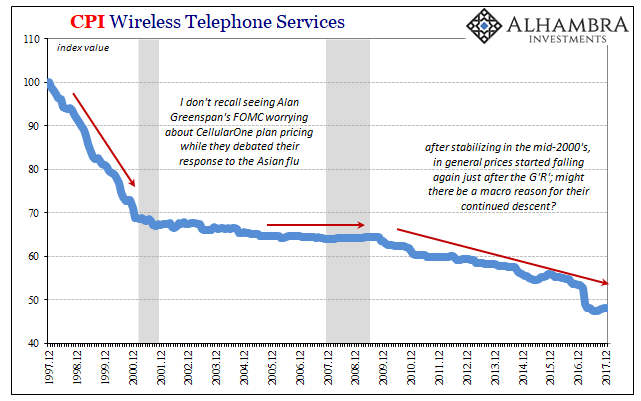

Good or Bad, But Surely Not Transitory

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

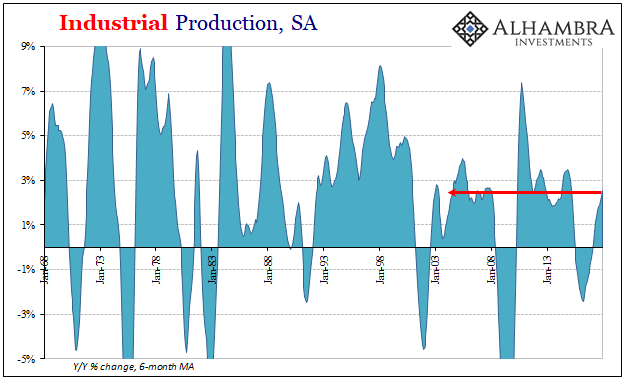

Is Un-Humming A Word? It Might Need To Become One

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best can only manage to reflect...

Read More »

Read More »

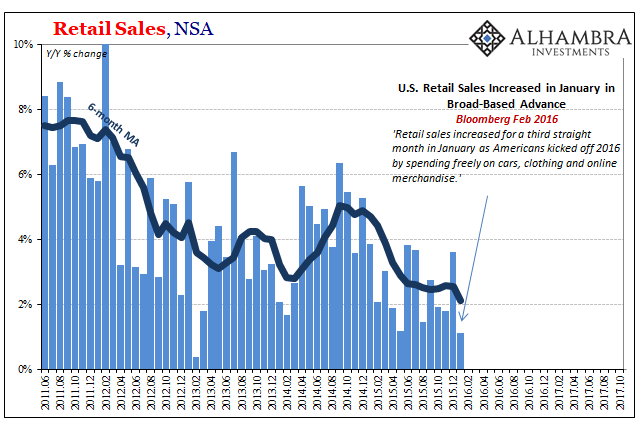

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

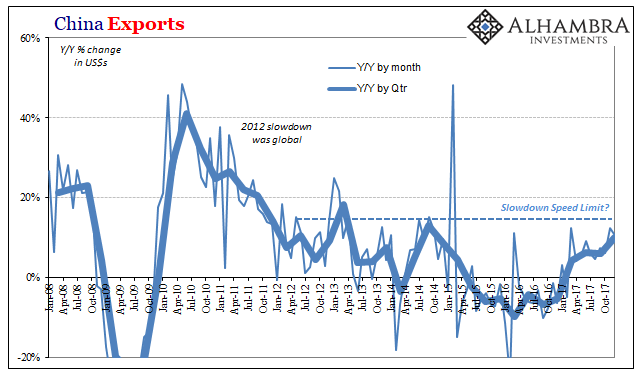

The Dea(r)th of Economic Momentum

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need.

Read More »

Read More »

The Conspicuous Rush To Import

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007.

Read More »

Read More »

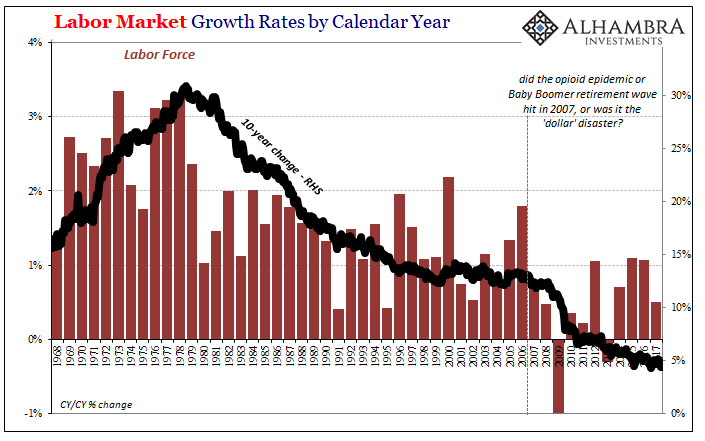

The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016.

Read More »

Read More »

The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few...

Read More »

Read More »

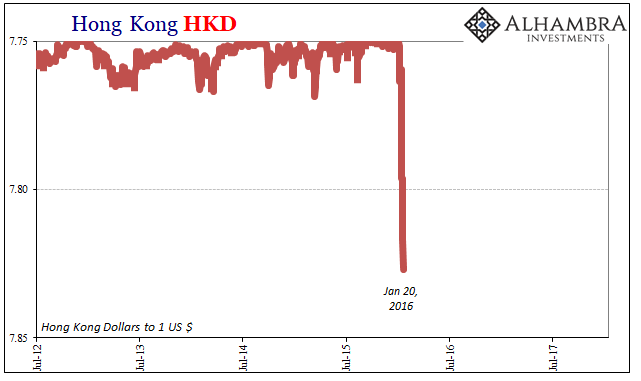

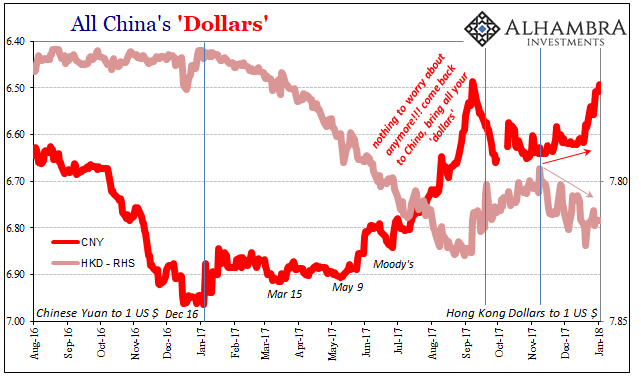

Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously restrained during that...

Read More »

Read More »