Tag Archive: federal-reserve

FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week's FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down.

Read More »

Read More »

FX Daily, June 22: Turn Around Tuesday or Dollar Rally Resumes?

Firming long-term US yields have lent the dollar support after trading heavily yesterday. The greenback is around 0.15%-0.50% higher against the major currencies. The Japanese yen and Canadian dollar are among the more resilient, and the Australian dollar and sterling among the heaviest.

Read More »

Read More »

FX Daily, June 21: Dollar Surge Stalls

Pressure on equities seen last week carried over into Asia and Europe today. The MSCI Asia Pacific Index fell for the fourth consecutive session, led by more than a 3% decline in the Nikkei. Australia, Taiwan, and Hong Kong bourses fell by more than 1%. European equities opened lower, but have turned higher.

Read More »

Read More »

FX Daily, June 18: Markets Quiet Ahead of Triple Witching

After some dramatic moves over in the immediate post-Fed period, the markets have quieted. The kind of volatility that is sometimes associated with triple witching expirations in the US may have already taken place. Asia Pacific equities were mixed, but the MSCI benchmark finished with its second consecutive weekly decline.

Read More »

Read More »

FX Daily, June 17: Fed Rocks the World

A more hawkish than expected Federal Reserve sent the US dollar and interest rates higher and spurred an equity sell-off. The knock-on effect sent ripples through the capital markets today. Most equity markets in the Asia Pacific region fell. China, Hong Kong, and Taiwan were notable exceptions.

Read More »

Read More »

FX Daily, June 03: Don’t Believe Sino-American Thaw or Fed’s Corporate Bond Divestment is a Policy Signal

Market participants appear to be biding their time ahead of tomorrow's US jobs report as they digest recent developments. The dollar is firmer, equities are mixed, and benchmark bond yields are a little firmer. China and Hong Kong shares continue their recent underperformance, while most of the large markets in the Asia Pacific region edged higher.

Read More »

Read More »

FX Daily, June 02: The Dollar Snaps Back

The US dollar is enjoying broad, even if not large, gains today following yesterday's recovery from three-year lows against sterling and four-year lows against the Canadian dollar. The greenback is firmer against all the major currencies.

Read More »

Read More »

FX Daily, May 26: RBNZ Joins the Queue, while Yuan’s Advance Continues

The decline in US rates and the doves at the ECB pushing back against the need to reduce bond purchases next month have seen European bond yields unwind most of this month's gain. The inability of US shares to hold on to early gains yesterday did not deter the Asia Pacific and European equities from trading higher.

Read More »

Read More »

FX Daily, May 20: Market Stabilize after Yesterday’s Tumultuous Session

US equity indices finished lower, but the real story was their recovery. Asia Pacific equities were mixed, with Australia's 1.5% rally leading the recovery in some markets, including Tokyo and Singapore. Europe's Dow Jones Stoxx 600 is up a little more than 0.5% near mid-session, led by information technology and industrials, while energy and financials lagged with small gains.

Read More »

Read More »

FX Daily, May 18: Risk Appetites Return Bigly

In Asia, equities markets rallied strongly, led by the more than 5% gain in Taiwan, the most in over a year as Monday's 3% drop was more than overcome. The Nikkei gained more than 2% despite the deeper than expected contraction in Q1 GDP. Hong Kong, South Korea, and India also rose more than a 1% gain as tech came roaring back.

Read More »

Read More »

FX Daily, May 10: The Dollar Remains on the Defensive

Last week's cyberattack on the largest US gasoline pipeline continues to lift oil and gasoline prices. The June gasoline futures gapped higher to extend last week's 2.4% gain but has subsequently moved lower to enter the gap.

Read More »

Read More »

The Dollar and the Fed

One of the stark developments since the initial shock of the pandemic has been the aggressiveness of the US monetary and fiscal response. This was also true in dealing with the Great Financial Crisis. The divergence then and now had shaped the investment climate.

Read More »

Read More »

FX Daily, April 29: US GDP: The V

Overview: The market's initial reaction to the Federal Reserve statement and the press conference was that it was dovish: the 10-year yield slipped, and the dollar was sold to new lows. In fact, the two countries that appear to be ahead of the curve among high-income countries, Canada and Norway, saw their currencies rally to new three-year highs.

Read More »

Read More »

FX Daily, April 28: Biden and Powell are Center Stage

Overview: It appears that the backing up of US yields is giving the dollar a better tone and challenging the Eurosystem, which has stepped up its bond purchases. The US 10-year yield is around 1.65%, roughly a two-week high and back above the 20-day moving average.

Read More »

Read More »

FX Daily, April 12: Capital Markets Look for Direction

Overview: Risk appetites have not returned from the weekend. Equities are heavy, and bond yields softer. The dollar is drifting lower in Europe. China's unusually candid admission of the shortcomings of its vaccine and record new cases in India saw all the equity markets in the region fall. Only South Korea and Taiwan escaped the carnage that saw the Indian market tumble 3.5%.

Read More »

Read More »

Rechecking On Bill And His Newfound Followers

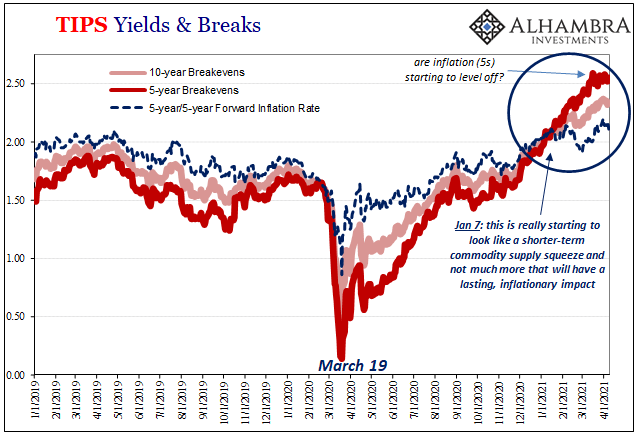

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

FX Daily, March 18: Dovish Fed but Yields Rise, Helping the Greenback Recover from Yesterday’s Slide

Overview: Asia Pacific equities mostly advanced after the US benchmarks recovered following the dovish FOMC. Australia, New Zealand, and India did not participate in today's gains. European bourses edged higher, but US shares are struggling, and the NASDAQ futures are off nearly 1%, threatening to end the three-day rally.

Read More »

Read More »

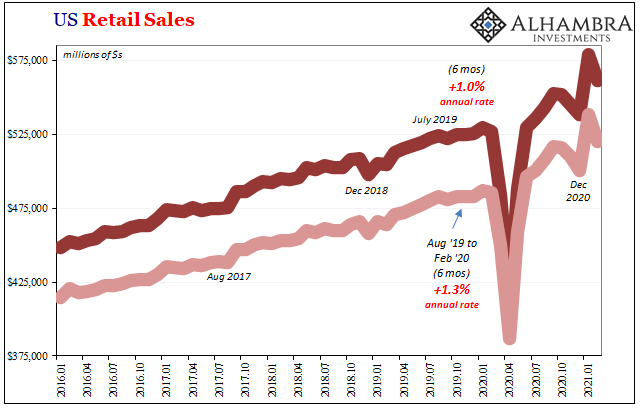

Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »

FX Daily, March 4: OPEC+ and Powell are Awaited

Overview: Equities are under pressure following yesterday's sharp losses in the US. The MSCI Asia Pacific Index suffered its biggest decline of the week today as Japanese, Chinese, and Hong Kong benchmarks slid by more than 2%. The Dow Jones Stoxx 600 Index in Europe is buckling under the pressure and is posting its first decline of the week.

Read More »

Read More »

How High is Too High for Rising Government Bond Yields?

2021-02-27

by Stephen Flood

2021-02-27

Read More »