Tag Archive: Federal Reserve

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell's testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB's move is more debatable, an adjustment at the July 25 meeting appears to have increased.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

Read More »

Read More »

FX Daily, July 03: Yields Extend Decline

Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy's benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy's two-year is breaking more convincingly below zero.

Read More »

Read More »

FX Weekly Preview: Macro Update: Melodrama Subsides but Capriciousness Remains

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected.

Read More »

Read More »

FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery.

Read More »

Read More »

FX Daily, June 05: Dollar Remains on Back Foot

Overview: The Federal Reserve's patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US.

Read More »

Read More »

FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces--trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies.

Read More »

Read More »

THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck. Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of...

Read More »

Read More »

FX Daily, May 02: Dollar Consolidates Fed-Inspired Recovery

Overview: The US dollar is consolidating yesterday's post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe's Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would be the largest decline in three weeks. The S&P 500 posted a potential key reversal yesterday by setting new record highs and then closing below the previous session's low.

Read More »

Read More »

FX Daily, April 15: Redemption Monday

The holiday-shortened week is off to a slow, tentative start. The surge of the S&P 500 before the weekend failed to inspire today. Asia markets were mostly firmer, led by Japan, while China, Hong Kong, and Singapore moved lower.

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

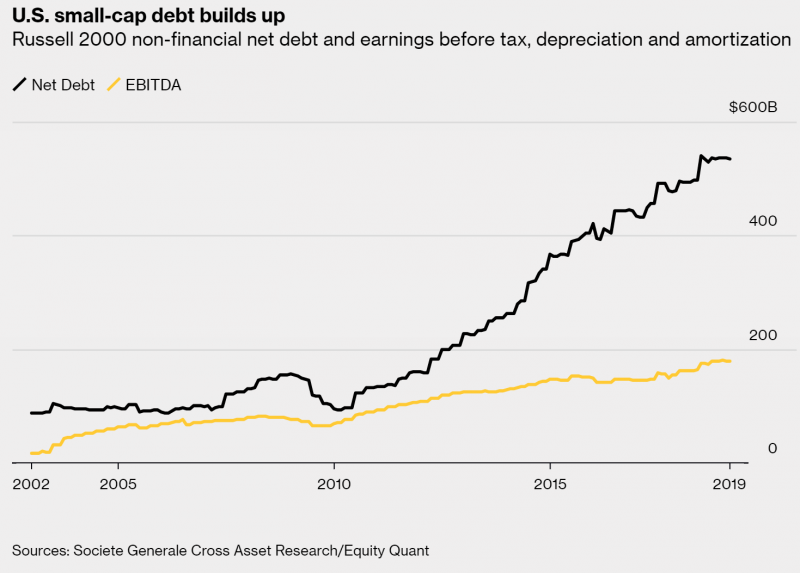

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »

Cool Video: Fed’s Independence Challenged and Defended

I was on the set Fox Business set this afternoon talking with Charles Payne and Quincy Krosby about Fed policy. Payne suggested that both the political left and right are trying to politicize the Federal Reserve to print money for their favorite programs.

Read More »

Read More »

FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low.

Read More »

Read More »

FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident.

Read More »

Read More »

FX Daily, February 13: QT is not the Opposite of QE

The Federal Reserve has long been clear on the sequence of events as it innovated the playbook during the Great Financial Crisis. There would be a considerable period between when the Fed would finish its credit easing operations that involved purchasing Treasuries and mortgage-backed securities (MBS) and its first-rate hike.

Read More »

Read More »

Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December's estimate, which brings it to 222k (from 312k).

Read More »

Read More »

FX Weekly Preview: Divergence Reinvigorated

Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling's gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December.

Read More »

Read More »