Tag Archive: Federal Reserve

US Retail Sales and Industrial Output to Accelerate; China not so Much

At the halfway point of Q4, the markets' focus is on three things: inflation, growth, and central banks' response. With US and Chinese October inflation readings behind us, the focus shifts to the real economy's performance, the world's two largest economies reporting retail sales and industrial production figures. Helped by stronger auto sales, the first increase in six months, US retail sales likely turned in another solid showing of around...

Read More »

Read More »

FX Daily, November 9: Falling Yields Give the Yen a Boost

Overview: Reports that the Fed's Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher against the dollar.

Read More »

Read More »

US Employment Data is Important but for the Millionth Time, Don’t Exaggerate It

Overview: Record high closes yesterday for the S&P 500 and NASDAQ have done little to help global equities today. Most of the Asia Pacific region markets, but Japan and Australia slipped ahead of the weekend while still holding on to gains for the week.

Read More »

Read More »

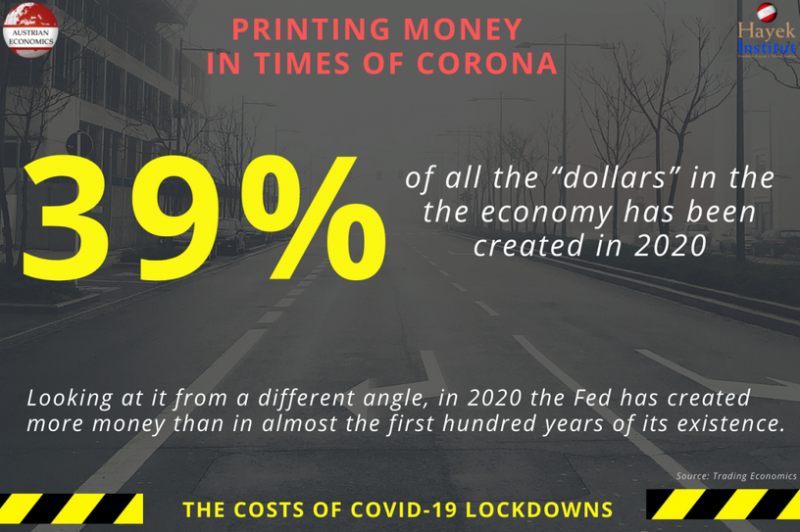

Quantitative Easing: A Boon or Curse?

Central banks’ massive Quantitative Easing (QE) programs have come under scrutiny many times since the central banks fired up the printing press and began quantitative easing programs en masse after the 2008-09 Great Financial Crisis.

However, the increase in central bank assets due to quantitative easing programs during the crisis pale in comparison to the QE programs during the Covid pandemic.

As economies recovered after the...

Read More »

Read More »

Printing Money in Times of Corona

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

FX Daily, February 24: Equities Try to Stabilize and Low Short-Term Rates Help Keep the Dollar on the Defensive

Overview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty (financial transaction tax) since 1993 was announced (0.13% from 0.10%).

Read More »

Read More »

FX Daily, August 28: Optimism about Italy Creeps Back in but Sterling Heads the Opposite Way on Brexit Realities

The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar's reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan, Korea, and Australia rose.

Read More »

Read More »

THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep stock markets afloat and the economic expansion alive.

Read More »

Read More »

FX Weekly Preview: The Week Ahead is not about the Week Ahead

It's the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China's PMI, and the eurozone's preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast.

Read More »

Read More »

FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and the Dow Jones Stoxx 600 is poised to end its three-week air pocket.

Read More »

Read More »

FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday's losses and more. It was led higher by consumer discretionary, energy, and industrials.

Read More »

Read More »

FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends.

Read More »

Read More »

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies).

Read More »

Read More »

FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less dovish terms than the market expected and the reaction function of the market has been clear.

Read More »

Read More »

FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance.

Read More »

Read More »

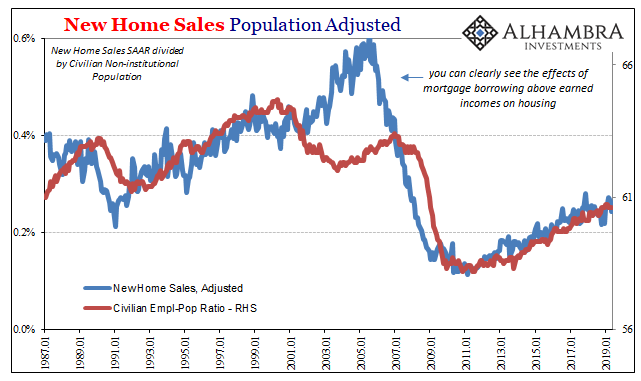

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

The Inflation Tide is Turning!

2021-10-09

by Stephen Flood

2021-10-09

Read More »