Tag Archive: Federal Reserve

Presidential Elections and Fed Policy: How Close is Close?

The most important element in next week’s FOMC meeting may come from the dot plot and whether Fed officials back away from the two hikes thought appropriate in March. When looking the schedule of FOMC meetings, and understanding that when the Fed says “gradual” to describe the normalization process, it does not mean hiking at …

Read More »

Read More »

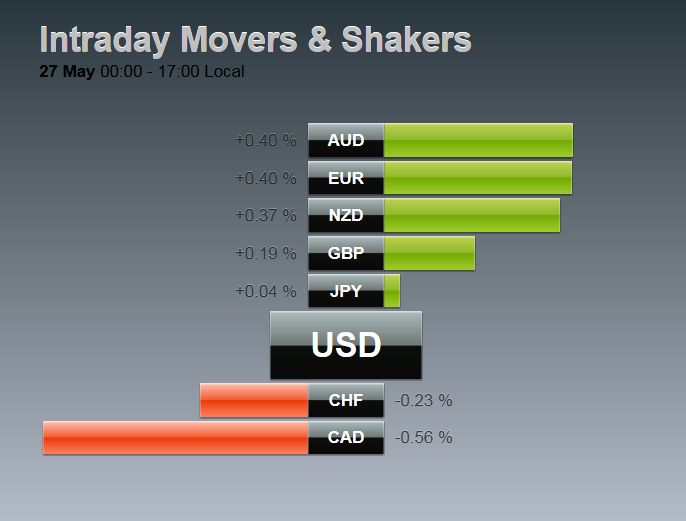

FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday's ranges while sterling and the Canadian dollar pushing through yesterday's lows.

Asian ...

Read More »

Read More »

LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of …

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »

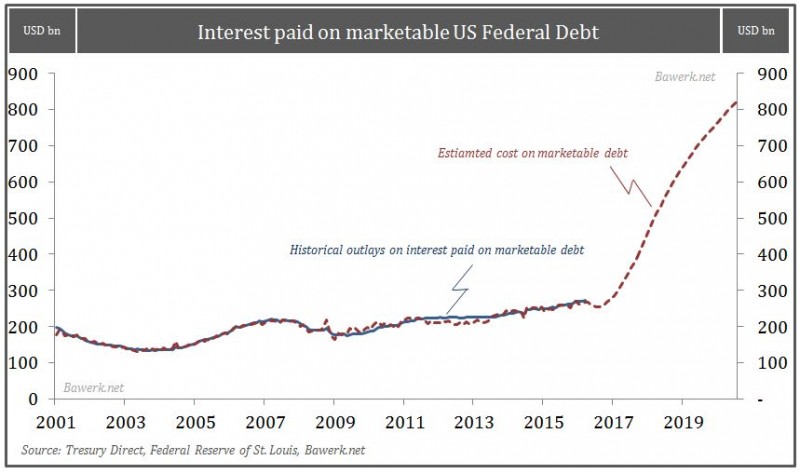

Fed Suppression, Long Term Economic Repression

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulli...

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Mind Control as a method to support the US Dollar

With dollar mind control, the American elites ensure that the dollar remains the global reserve currency. Average Americans should only consume and should not have access to sophisticated financial services.

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show.

There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a Ju...

Read More »

Read More »

FOMC Statement Demonstrates Firm Grasp of the Obvious

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed.

Otherwi...

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

The Shocking Reason For FATCA… And What Comes Next

Submitted by Nick Giambruno via InterntionalMan.com,

If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone.

Few people have, and even fewer fully grasp the terrible things it foreshadows.

FATCA is a U.S. ...

Read More »

Read More »

Great Graphic: WSJ survey of Fed Expectations

This Great Graphic shows the results of the last three Wall Street Journal survey of business and academic economists on the outlook for Fed policy. The key take away is that despite all the talk and ink spilled on the shifting Fed stance and the split within the FOMC, economists views did not change much … Continue...

Read More »

Read More »

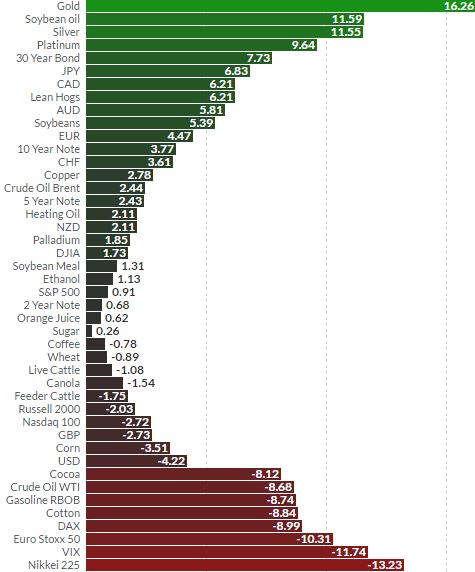

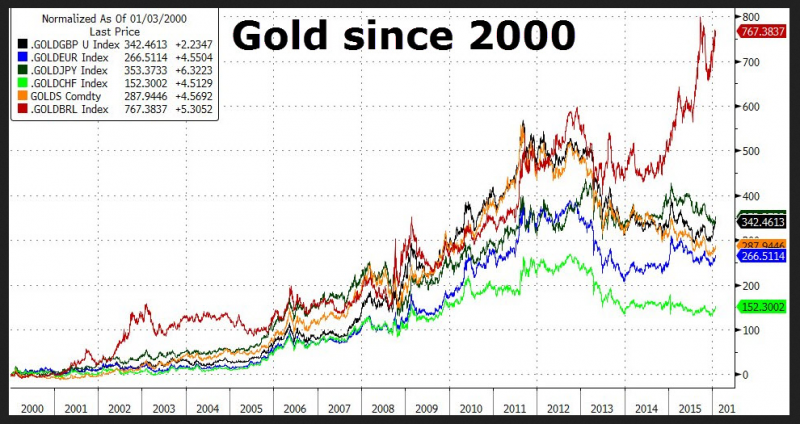

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

Four Keys to The Week Ahead

There are four events that will shape market psychology in the week ahead. They are Yellen's speech to the NY Economic Club, US jobs data, eurozone March CPI and PMI, and Japan's Tankan Survey. The broad backdrop is characterized by the rebuilding of risk appetites since the middle of February, though the MSCI emerging market … Continue reading...

Read More »

Read More »

Dollar Firm Ahead of the FOMC, UK Budget Looms

Since the Federal Reserve hiked rates in December, both the European Central Bank and the Bank of Japan have eased policy further. The idea that because they cut rates means that the Fed cannot raise rates is a not a particularly helpful way to ...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »