Tag Archive: Featured

Jerome Powell Speaketh and Gold Records Fall!

Gold hit a new all-time high Tuesday after Jerome Powell gave some indications that the Federal Reserve is getting closer to actually cutting rates.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey analyzes the record-breaking rally, and puts Powell's comments and rate cut mania into context. He also touches on market reaction to the Trump assassination attempt.

Read More »

Read More »

Probier mal diese 7 Steuertricks | Geld ganz einfach

Steuerprogramm & App: Wiso, Taxfix, Smartsteuer

Wiso Steuer 2024* ► https://www.finanztip.de/link/buhlwisosteuer-steuersoftware-yt/yt_Ys6TeZT750w

Steuersparerklärung (Steuerjahr 2023)* ► https://www.finanztip.de/link/wolterssteuersparerklaerung-steuersoftware-yt/yt_Ys6TeZT750w

Tax 2024* ► https://www.finanztip.de/link/buhltax-steuersoftware-yt/yt_Ys6TeZT750w

Steuerbot* ► https://www.finanztip.de/link/steuerbot-steuersoftware-yt/yt_Ys6TeZT750w...

Read More »

Read More »

USDCHF breaks lower below technical levels, increasing the bearish bias. What next?

The USDCHF breaks below its 200 day moving average and 38.2% retracement of the move up from the December 2023 low

Read More »

Read More »

¡INDIGNANTE! La izquierda POLITIZA el Éxito de la Selección

La izquierda politiza el éxito de la selección y ataca a Carvajal por no seguir su propaganda.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Tom DiLorenzo on the Shaun Thompson Show

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #325

► Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

Kickstart the FX trading for July 17 with a technical look at the EURUSD, USDJPY & GBPUSD.

The USD is lower with the EURUSD stretching higher ahead of the ECB decision tomorrow. The GBPUSD is above the 1.3000 level and at a new high for the year.

Read More »

Read More »

Mastering Hurdle Rates: How to Achieve Financial Success

Ever wonder about hurdle rates in your financial plan? It's the key return needed for success. Patience is key in investing. No shortcuts! ? #FinanceTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Politischer Knall! Ehemalige Cum-Ex Staatsanwältin verklagt Ampel!

Ist das das Ende von Faesers politischer Karriere?

Meine Depot-Empfehlung

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By Prime Minister's Office of the United Kingdom -...

Read More »

Read More »

7-17-24 Avoiding the Sexy Stock Plays

With a slowing economy, what's the best play for investors? The market has been sustained essentially by seven large-cap stocks, but that dynamic appears to be shifting, and the appeal of making big money quickly may blind you to the realities in the market.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned...

Read More »

Read More »

Food for thought: raising the world’s IQ

If you don’t have enough food in the first 1,000 days of your life, your brain may never reach its full potential. Our correspondent discusses what better nutrition (https://www.economist.com/leaders/2024/07/11/how-to-raise-the-worlds-iq?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listener) would mean for the world. Undersea...

Read More »

Read More »

Though popular, nationalizations ruin economies

In a world full of hatred for the free market, the people calling for the nationalization of industry aren’t scarce. Despite their political popularity, nationalizations are terrible for economies and represent a stepping stone on the path to destitution and collapse.

Read More »

Read More »

Dollar Crushed, Stocks Slump

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The dollar is broadly lower, and stocks are under pressure. Comments by a Japanese official, which did not appear to break new ground, coupled with Trump's interview in BusinessWeek, where he was critical that Japan was benefiting from a weak yen, despite having apparently spent some $80 bln this year trying to stop it from falling, may have been the trigger....

Read More »

Read More »

EM Einnahmenhistorie ️ #euro

EM Einnahmenhistorie ⚽️? #euro

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »

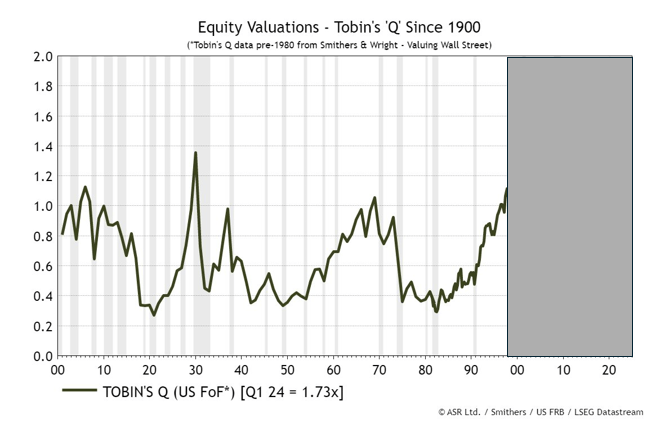

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

“Ich bin schockiert darüber, dass es wieder passiert…”

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist...

Read More »

Read More »

Compact Verbot: Brisante Wendung!

Ist das das Ende von Faesers politischer Karriere?

Meine Depot-Empfehlung

https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

Bildrechte: By © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons), CC...

Read More »

Read More »

Das bringt die Inflation für Investoren: Meine Analyse und vier Strategien

Sicheren Dir hier das Silber-Ticket, um alle Vorträge des Kapitaltags kostenlos online zu sehen: https://investorenausbildung.de/otte

In diesem Video analysiert Florian Günther die globale Inflationssituation. Er bietet einen historischen Überblick, diskutiert aktuelle Trends und gibt einen Ausblick auf mögliche Entwicklungen. Florian präsentiert vier praktische Strategien, wie Anleger von der Inflation profitieren können, darunter Investitionen...

Read More »

Read More »