Tag Archive: Featured

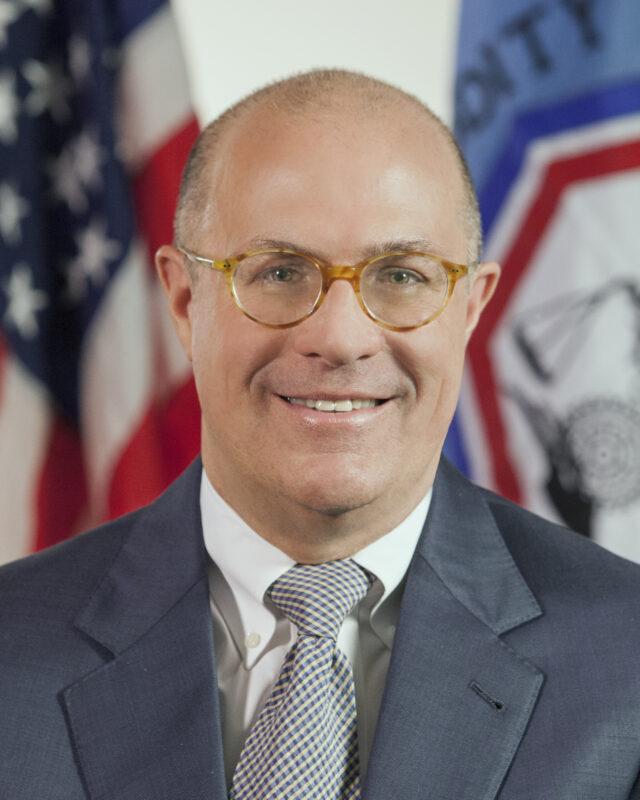

Former US CFTC Chair Chris Giancarlo Joins Sygnum as Senior Policy Adviser

Sygnum, a digital asset banking group, has announced the appointment of J. Christopher Giancarlo, former Chairman of the United States Commodity Futures Trading Commission (CFTC), as its Senior Policy Adviser.

During his time at the CFTC, Giancarlo was known for his support of open markets, innovation, and balanced regulatory approaches.

His advocacy for cryptocurrency before the US Congress earned him the informal title of “crypto dad.”

He remains...

Read More »

Read More »

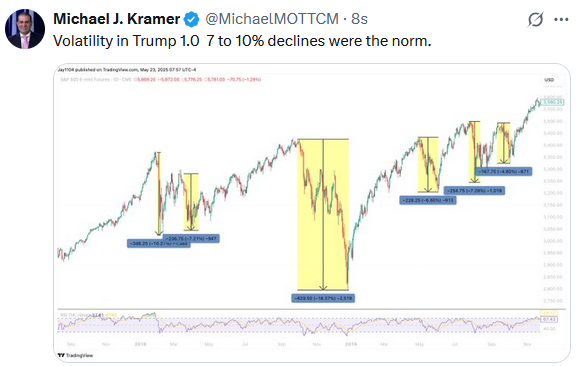

The EU And Apple Hit With Tariffs

After a bout of relative market tranquility, investors were rudely awakened Friday with a barrage of new tariff actions targeting the EU and Apple. Via Truth Social, Trump recommended a 50% tariff on European Union imports starting June 1, 2025, and a 25% tariff on all iPhones made outside the US. Regarding the EU, the … Continue reading...

Read More »

Read More »

Swiss chemical group Clariant faces fresh price fixing probe

The Swiss chemicals group Clariant is facing another claim for damages in connection with alleged price fixing. +Get the most important news from Switzerland in your inbox The Austrian petrochemicals group OMV has filed a lawsuit against a total of four companies, including Clariant. OMV is claiming damages totalling around €1 billion in a court …

Read More »

Read More »

The Political Business Cycle 50 Years Later

William Nordhaus coined the term “Political Business Cycle” a half-century ago. The idea was that government authorities, particularly the central bank, would manipulate the economy to correspond with election cycles, a practice that continues to this day.

Read More »

Read More »

Enslavement of Native Americans in the Caribbean

The transatlantic slave trade from Africa is a well-known chapter in the history of slavery in the Western Hemisphere, but much lesser known is the enslavement of Native Americans. Many of them were shipped to plantations in the Caribbean where they were worked to death.

Read More »

Read More »

Wealth Generation and the Market Economy

A free market economy does not generate jobs or money. Instead, it creates wealth through exchange and production. Government intervention, contrary to what mainstream economists believe, does not enhance wealth, but instead destroys it.

Read More »

Read More »

Why Elon Musk Is Right: The Case Against Subsidizing Amtrak

Amtrak is always on the verge of reviving intercity rail traffic in the US, or at least that is what politicians want us to believe. The truth is that the case for defunding Amtrak has never been stronger.

Read More »

Read More »

Inflation: Looking Beyond Aggregates

Mainstream economists define inflation as the increase in an imaginary “price level” that is relatively neutral in its effects. Austrian economists, however, know better, as they realize that the effects of inflating the money supply are anything but neutral.

Read More »

Read More »

Don’t Be A Panican, But Question Government Shenanigans

Ours in an age when people panic, sometimes for good reasons but often for bad. Governments benefit from panicked citizenry, which is why we always should question those political decisions that can turn our lives upside down.

Read More »

Read More »

Truth or Consequences

The transatlantic slave trade from Africa is a well-known chapter in the history of slavery in the Western Hemisphere, but much lesser known is the enslavement of Native Americans. Many of them were shipped to plantations in the Caribbean where they were worked to death.

Read More »

Read More »

David Hume’s Insights Explain America’s Economic Decline

The Trump White House has enacted tariffs in the belief that other countries are “cheating” by enacting tariffs against US goods and “manipulating” their currencies. However, with the US dollar being the world's reserve currency, the US has engaged in dollar manipulation through inflation.

Read More »

Read More »

Gold Technical Analysis – Consolidation ahead of the next big move

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:01 Technical Analysis with Optimal Entries.

2:06 Upcoming Catalysts...

Read More »

Read More »

Heftig: Grüne schäumen wegen Jette Nietzard!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

SÁNCHEZ SE LANZA AL ANTISEMITISMO PARA TAPAR SU CORRUPCIÓN

Sánchez usa el antisemitismo para tapar la corrupción de su gobierno y blanquear dictaduras mientras oculta la verdad sobre Hamás.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y...

Read More »

Read More »

Why Haters of Free Markets Love the Fruits of Free Markets

There are numerous critics of free markets. However, all of those critics also are consumers and they gladly depend upon free markets to satisfy their needs.

Read More »

Read More »

Why Haters of Free Markets Love the Fruits of Free Markets

There are numerous critics of free markets. However, all of those critics also are consumers and they gladly depend upon free markets to satisfy their needs.

Read More »

Read More »

Mehr Potenzial als Bitcoin? Diese Aktien…

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Sichere Dir jetzt meinen Report (immer mittwochs) – 100% gratis → https://www.lars-erichsen.de/

► Höre Dir jetzt die neuste „BuyTheDip"-Podcast-Folge an → https://buythedip.podigee.io

Auch wenn Bitcoin in den letzten beiden Tagen ein klein wenig zurückgekommen ist, übergeordnet Sie das bullisch aus. Wir haben ein neues Allzeithoch markiert und...

Read More »

Read More »