Tag Archive: Featured

So berechnest du die Vorabpauschale 🧮 #vorabpauschale #shorts

Nach 2 Jahren fällt 2023 nun wieder die Vorabpauschale auf Fonds und ETFs an. Die Vorabpauschale ist eine Steuer, die auf Investmentfonds anfällt. Sie wurde 2018 eingeführt, um sicherzustellen, dass Anleger ihren fairen Anteil an Steuern zahlen, auch wenn sie ihre Gewinne über Jahrzehnte nicht realisieren.

Kostenloses Depot eröffnen: ►►...

Read More »

Read More »

The race to improve weather forecasting

As global warming makes weather more extreme and deadly, accurate and accessible weather forecasting has never been more needed.

00:00 - Hurricane Otis

00:40 - Extreme weather

01:33 - Democratic Republic of Congo

02:38 - Problems with forecasting

04:25 - Innovative solutions

05:41 - Arrival of AI

07:30 - Smallholder farmers

09:30 - Early warning systems

Read about the high-tech race to improve weather forecasting: https://econ.st/4a1pqpo

Listen...

Read More »

Read More »

Diesen Trick hasst das Finanzamt / Jetzt sofort handeln und Steuern sparen

Das Finanzamt sieht nur realisierte Gewinne/Verluste als besteuerbar an. Wie du dir das zunutze machen kannst, um noch dieses Jahr weniger Steuern zu zahlen, erkläre ich dir im heutigen Video.

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q4Termin23

Tägliche Updates ab sofort auf

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE...

Read More »

Read More »

¿Cuál es el MEJOR DISCO de los Rolling Stones?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

USDCAD volatility continues as traders remain cautious of recent technical break.

The USDCAD is experiencing volatility as oil prices rise following the OPEC decision. Traders are cautious after a recent technical break and are monitoring the 38.2% Fibonacci retracement level.

Read More »

Read More »

The USD moves higher in early US trading as markets reacted data and OPEC. What next?

Some technical breaks in the 3 major currency pairs are tilting the short-term bias in favor of the US dollar

Read More »

Read More »

Unfassbar: “Ich brauche 5.000 neue Mitarbeiter!”

Lisa Paus von den Grünen ist Familienministerin und will 5.000 neue Stellen für eine neue Behörde schaffen! Mehr Staat, weniger Freiheit!

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: Elena Ternovaja, CC BY-SA 3.0 Commonshttps://upload.wikimedia.org/wikipedia/commons/8/89/Ulrike_Hermann_at_Frankfurter_Buchmesse_2022_-1.jpg

👉🏽5 Euro Startbonus bei Bondora ►►...

Read More »

Read More »

From the Invisible Hand to the Invisible Sleight-of-Hand

Advocates of unbacked paper money claim that theirs is the “civilized” choice, as opposed to gold, or what Keynes called “that barbarous relic.” These inflationists, however, are the ones wrecking civilization as we have known it.

Original Article: From the Invisible Hand to the Invisible Sleight-of-Hand

Read More »

Read More »

Doing the Bond Math Amid Fiscal Dysfunction

(11/30/23) Face-off Movie, Bond Math, and Market Preview: How does the Consumer continue to spend? Texas' Christmas spending habits = $817/avg. Budgeting for Christmas w price pressure in mind. Will interest rates be but next year (why wouild the Fed do that)? Michael Lebowitz helps crunch the Bond Math: What price changes mean in the Bond Market. What is the credit risk to consider? How will you be paid? Recession is inevitable; how long do you...

Read More »

Read More »

El PARO REAL en España es ABRUMADOR

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Inflationary Expectations Do Not Cause Inflation

Many economists believe that inflationary expectations cause general increases in prices. For instance, if there is a sharp increase in oil prices, people will form higher inflationary expectations that set in motion general increases in the prices of other goods and services. According to the former Federal Reserve chairman Ben Bernanke, “Undoubtedly, the state of inflation expectations greatly influences actual inflation and thus the central...

Read More »

Read More »

The Dollar is Having One of Its Best Days This Month

Overview: After being bludgeoned, the dollar

is having one of its best days of the month. It is rising against all the major

currencies. The Dollar Index is up about 0.5%, which is the most since the end

of October. The greenback is also firmer against all the emerging market currencies

but the Turkish lira and Russian ruble. Some of the demand for the dollar may

be a function of month end, but also the disappointing Chinese PMI, revisions

that...

Read More »

Read More »

“Ich will Grünes Schrumpfen und staatliche Rationierung”!

Ulrike Herrmann spricht klar und deutlich aus, was viele Grüne wollen, aber versuchen uns anders zu verkaufen. Immerhin ist Frau Herrmann in ihrer Feindlichkeit gegenüber Menschlicher Selbstbestimmung ehrlich.

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: Elena Ternovaja, CC BY-SA 3.0...

Read More »

Read More »

Gold Technical Analysis

Here's a quick technical analysis on Gold with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #220

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM AUF FACEBOOK (Bisher 6500+ Mitglieder): ►Jetzt Beitreten &...

Read More »

Read More »

Is Suze Orman Right About Taking Vacations?

Some financial gurus say the only way out of debt is by cutting up your credit cards, forgoing your daily coffee (or avocado toast), or even putting your credit card in a freezer. Basically, what they’re saying is “Live below your means.”

At Rich Dad, we say you shouldn’t live below your means. Rather we say you should expand your means by purchasing assets so that eventually the income from your assets pays for things like clothes, an iPhone, a...

Read More »

Read More »

Der tiefe Fall des Rene Benko [Was passiert jetzt?] Investmentpunk LIVE!

👉https://kurs.betongoldtraining.com/yt 🏢🤑Wie Du Dir mit Immobilien ein Vermögen aufbaust

Die #Signa Holding vom Tiroler Immobilien Tycoon Rene #Benko meldet Insolvenz an. Insgesamt geht es um Schulden in Milliardenhöhe. Wer aller betroffen ist und welche Kreise der Bankrott nach sich ziehen könnte, analysiert heute der österreichische Selfmade Immobilien Millionär Gerald Hörhan aka. Der Investmentpunk.

Wer ist Gerald Hörhan?

Der österreichische...

Read More »

Read More »

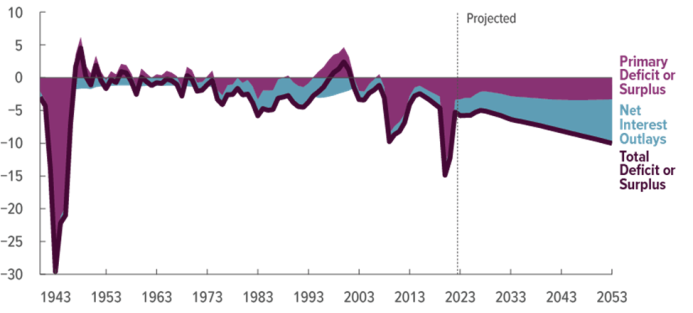

As the US Treasury Runs Out of Creditors, Its Options Dwindle

Are the chickens coming home to roost for the US Treasury? As Ryan McMaken noted in a recent Mises Wire article, the United States is in a debt spiral and there’s no easy way out.

The problem is multifaceted, but the origin is profligate government spending. While it typically spikes during crises, spending is increasing at an alarming rate even outside of crisis periods. And tax revenues are not keeping up, which means ever-deepening deficits....

Read More »

Read More »

Time Preference Is the Key Driver of Interest Rates

Forget the other mainstream explanations for interest. Time preference explains this phenomenon and gives a true picture of why interest exists in the first place.

Original Article: Time Preference Is the Key Driver of Interest Rates

Read More »

Read More »