Tag Archive: Featured

Carmen Ibarra:switching career,culinary school,career aspirations, & her mango mama salsa brand

In this full podcast, Carmen Discusses switching careers during the pandemic, culinary school, her career aspirations, and her delicious Mango mama salsa brand.

F.I.Y.E show Instagram:https://www.instagram.com/carmenfibarra/

Carmen instagram: https://www.instagram.com/carmenfibarra/

Mango Mama Salsa Instagram: https://www.instagram.com/mangomamasalsa/

Read More »

Read More »

Meine wichtigste Aktienempfehlung – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Is It Time to Buy Bonds Yet? | 3:00 on Markets & Money

(3/22/22) Maybe not yet, but we're probably getting close: The Fed this week has said it'll need to raise rates faster than previously thought because of rampant inflation. We might get a 50-basis point hike in May because of persistent inflation they didn't see coming (they also didn't see a war between Russia and Ukraine.)

Read More »

Read More »

Sanctions Stink, but Markets Perform Despite Geopolitics

(3/22/22) Markets continue to perform remarkably, despite geopolitical distractions and Fed meddling; there seems to be no demand destruction from high energy prices. Yet. The conundrum is markets' readiness to rally amidst negative sentiment.

Read More »

Read More »

Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that...

Read More »

Read More »

Der Markt erholt sich trotz fortschreitender Ukraine-Krise

Obwohl die Situation in der Ukraine keine Entspannung zeigt, konnte sich der Cryptomarkt wieder fangen. In der vergangenen Woche ging es für die meisten großen Cryptocoins deutlich nach oben – allein Bitcoin legte mehr als 10 Prozent zu.

Read More »

Read More »

Swiss act as early warning system in Bosnia

Swiss information gatherers are keeping a close eye on the situation in Bosnia & Herzegovina, as the country is facing a political crisis that some fear could lead to armed conflict. The Swiss Liaison and Observation Teams (LOT) in Mostar and Trebinje are part of the EUFOR peacekeeping mission.

Read More »

Read More »

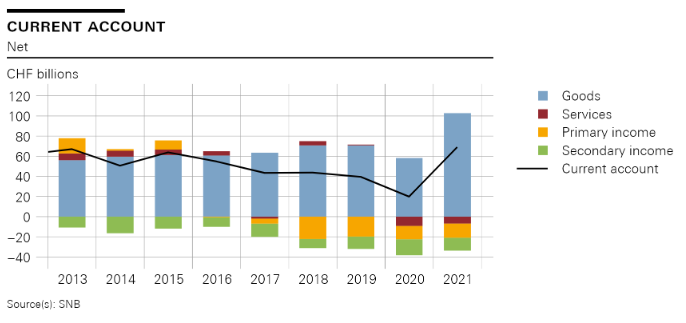

Swiss balance of payments and international investment position: 2021 and Q4 2021

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year....

Read More »

Read More »

Billionaire Investor Charlie Munger Predicts More Inflation | United States May look like Japan!

Welcome to the Epicstone channel, in this channel I will mainly talk about economy. In today’s video I will explain everything you need to know about current inflation, then a billionaire investor Charlie Munger will present his own opinion.

Read More »

Read More »

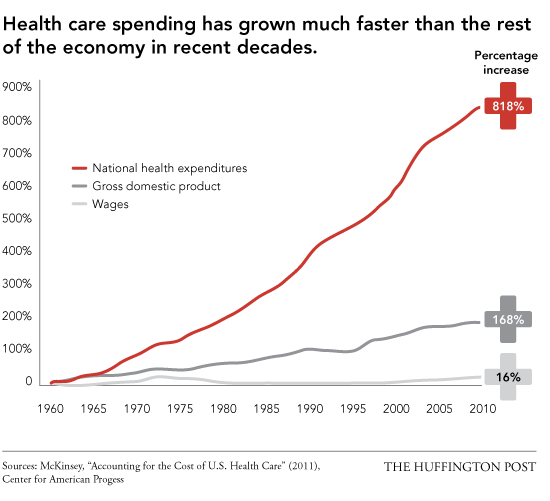

How Healthcare Became Sickcare

The financialization of healthcare started two generations ago and is now in a run-to-fail feedback loop of insolvency. Long-time readers know I have been critical of U.S. healthcare for over a decade. When I use the term sickcare this is not a reflection on the hard work of frontline caregivers--it is a reflection of the financialization incentives that have distorted the system's priorities and put it on a path to insolvency.

Read More »

Read More »

‘Next winter will be difficult in Europe without Russian gas’

The United States wants to cut its dependence on Russian fuels. But Switzerland and Europe cannot completely do without Russian gas, says René Bautz, the CEO of Gaznat, which supplies high-pressure gas to western Switzerland, and president of the Global Gas Centre platform for the natural gas sector.

Read More »

Read More »

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets.

Read More »

Read More »

Biden and Pelosi Want You to Be Economically Ignorant

Jeff Deist and Bob Murphy talk about the state of gross economic ignorance in America today. They explain how Joe Biden and Pelosi in their recent statements on the current economic status take advantage of economic ignorance.

Read More »

Read More »

To Stake or Not to Stake Your Cryptocurrency – [Cryptoverse Ep. 7]

In this episode, host Robb LeCount and expert Jim Lecci explain the viable alternative to putting more crypto assets in your wallet.

They will explain:

1. What is staking?

2. What are the rewards and benefits of staking?

3. What are the different ways you can stake cryptocurrency?

4. What are some risks associated with staking?

Join the #1 crypto community & membership by clicking here: https://bit.ly/34I80k4

#financialeducation...

Read More »

Read More »

Todays Metal Markets. Gold Silver Bitcoin. Alasdair Macleod

Alasdair Macleod, London Metals Analysts – Alasdair has been working in the financial world since 1970 and been a Member of the London Stock Exchange for nearly five decades. His experience encompasses commodities, gold, silver, equity and bond markets, fund management, corporate finance and investment strategy. He’s regularly interviewed at KWN as well as many other premier networks such as CNBC.

Read More »

Read More »

Precious Metals – Gold Silver Bitcoin

Alasdair Macleod, London Metals Analysts – Alasdair has been working in the financial world since 1970 and been a Member of the London Stock Exchange for nearly five decades.

Read More »

Read More »

Gold Price Today – Gareth Soloway

Gold Price Today - Gareth Soloway

Dave Russell of GoldCore TV welcomes back #GarethSoloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on #gold is still on the cards for 2022? What role does the inversion of the yield curve play in signaling a US recession?

The following are some of the highlights from this episode:

Has the bull market for stock returned or is it institutional buying for options...

Read More »

Read More »

When This Happens All Bets Are Off & Silver Could Hit $50 In 2022!! – Alasdair Macleod

When This Happens All Bets Are Off & Silver Could Hit $50 In 2022!! - Alasdair Macleod

In this latest interview, Brian and Darryl Panes from As Good As Gold Australia talk with Alasdair Macleod, Head of Research at GoldMoney.com and Advisor to AGAGA.

#AlasdairMacleod #silver #gold #theincomefinance

--------

? Checkout These Similar Videos?:

What Cathie Wood at Ark Invest JUST Said | Summary.

Ark's Cathie Wood: Confidence growing in...

Read More »

Read More »