Tag Archive: Featured

LAS PROPUESTAS QUE LLEVARÁN A ESPAÑA A LA RUINA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Studium finanzieren ohne BAföG ? #studium #bafög #shorts

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=733&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://finanzfluss-campus.de/angebot-youtube/?utm_source=youtube&utm_medium=733&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

? Unsere Empfehlungen:

• Depot:...

Read More »

Read More »

Monetary Chaos

On this week's episode, Mark addresses how we the people can prevent the government and the Federal Reserve from grabbing more power and implementing their own preferred "solutions" to economic issues. This is the third round of monetary chaos the Fed has subjected us to in recent history—a history from which valuable lessons can be learned.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

Thinking outside the State

Modern minds are so oriented toward state power that people often fail to understand there is a better way. Instead of “thinking outside the box,” we should think outside the state.

Original Article: Thinking outside the State

Read More »

Read More »

Swiss potato harvest expected to drop by a third

This year's potato harvest has been disappointing with growers expecting a drop of around a third compared with recent years. Yields are still difficult to estimate at the moment. The final figures will not be known until early December, Ruedi Fischer, President of the Swiss Potato Growers' Association (USPPT), told press agency Keystone-SDA.

Read More »

Read More »

Week Ahead: Have the Markets Turned?

An inflection point may have been reached last week. Despite,

Chair Powell's insistence that the Fed did not adopt an easing bias and

confirmed that there is still no talk of a cut, the market knows better. The

implied yield of December 2024 Fed funds futures contract is about 4.45%, which

is to say, the market is discounting not only the two cuts in the Fed's

September projections, but a third cut, and the risk again (~60%),

of a fourth cut. The...

Read More »

Read More »

Hostage Extraction Needs to be Privatized

Amidst hostage scenarios, like the Hamas situation, it is important to remember why governments should not pay to have their nationals released. Paying for hostages to be released creates a perverse incentive in which more people are taken hostage to receive more payments. This is undoubtedly a subpar outcome.

Furthermore, any effort by governments to reclaim hostages makes their country’s nationals more prone to being taken hostage. Payments and...

Read More »

Read More »

Contra CATO: COVID-19 Vaccinations Are Not a Free Market Victory

In light of Nobel Prizes being given to two researchers of mRNA covid-19 vaccinations, beltway establishments like that of the Cato Institute have lauded praises onto the decision. To Cato, as evidenced by a blog post by Ian Vásquez, the production of these vaccines was a “victory of globalization!” Whilst it certainly required a vast scale of global resources and networking, it was hardly what one could consider a free market victory. The...

Read More »

Read More »

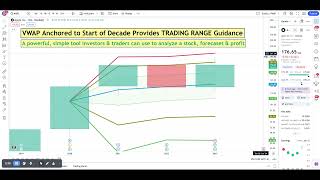

Apple stock long term price analysis, forecast & trading range

Dive into the depths of Apple stock's trading strategy with our latest ? analysis! Anchoring the mighty VWAP from the start of 2020, we're giving you the insider's edge on long-term trading ranges and price forecasting. ?

? In this video, we break down the powerful Volume Weighted Average Price (VWAP) and its role in defining Apple's stock journey. Whether you're a seasoned trader or just starting out, understanding the VWAP's signals is crucial...

Read More »

Read More »

Will a project to reintroduce European bison into Swiss forests work?

The European bison, a species that differs slightly from its north American cousin, died out in Europe. Now it is to be reintroduced in Switzerland. Can a densely populated country tolerate such a large wild animal?

Read More »

Read More »

Großbank verliert 5 Milliarden Kundengelder! @Oli

Die ING Bank verliert über 5,7 Milliarden Euro Kundengelder! Grund dafür ist vor allem die anhaltend hohe Inflationsrate, die dazu führt, dass Bürger immer häufiger ihr Erspartes für Konsumgüter des täglichen Bedarfs aufbrauchen müssen.

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

3 Aktien ab 5.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf5

7 Aktien ab 20.000 € Einzahlung...

Read More »

Read More »

Die 6 wichtigsten Versicherungen

Diese 6 wichtigen Versicherungen solltest Du haben. Welche davon hast Du?

#finanztip

#versicherungen

Read More »

Read More »

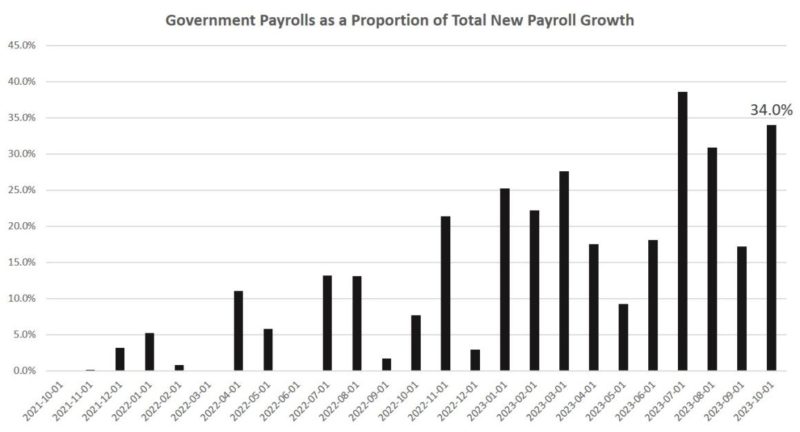

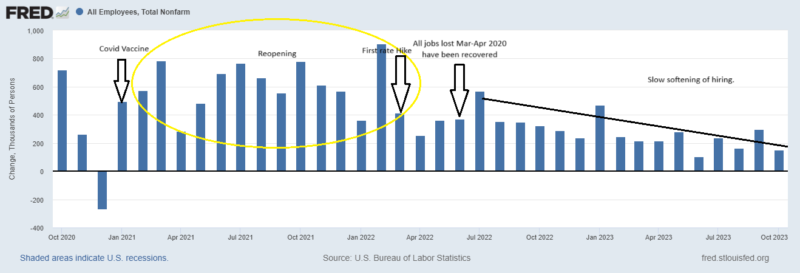

October’s Sobering Jobs Report Adds to Mounting Bad Economic News

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 150,000 jobs in October, month over month. The unemployment rate rose slightly from 3.8 percent to 3.9 percent over the same period.

The headline payroll increase of 150,000, however, was possibly among the best news to be found in today's new jobs data, however. Once we delve more deeply into the numbers, we...

Read More »

Read More »

Price cuts on 350 medicines in Switzerland

With the ever rising cost of of Swiss healthcare, the government has been hunting for savings. This week it announced that it has ordered price cuts on 350 medicines from 1 December 2023, reported RTS.

Read More »

Read More »

Macro: Employment Report

Wall street cheered the fact that we added fewer jobs (150,000) than expected (179,000) in October. This was a welcome relief after the hot September number that was revised down from 336,000 to 279,000.

Read More »

Read More »

Affective Polarization Is Making Us Dumber

Last month, Dr. Ibram X. Kendi’s Center for Antiracist Research at Boston University announced that it was laying off almost all of its staff, in spite of having received almost $55 million in funds in the last three years. Critics have jumped on Kendi’s fall to renew arguments that he’s a grifter or a “midwit,” but there’s another underappreciated aspect to Kendi’s fall. Kendi always struck me as someone who had the raw intellectual horsepower to...

Read More »

Read More »

Making Money While Making Sense of Chaos: Understanding the World of the Traders

Robert Murphy explains how traders make money in a world of uncertainty and diabolical risk.

Original Article: Making Money While Making Sense of Chaos: Understanding the World of the Traders

Read More »

Read More »

Gold Holds Firms as World Braces for Financial Turmoil, War

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As the Federal Reserve puts a hold on interest rates, investors have to ask themselves whether the elevated inflation rate is also on hold.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2023/11/03/gold-holds-firms-as-world-braces-for-financial-turmoil-war-002860

Do you own precious metals you would rather not sell, but need access to cash? Get...

Read More »

Read More »

The Fake China Threat

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop are joined by Joseph Solis-Mullen of the Libertarian Institute to discuss his new book, The Fake China Threat and Its Very Real Danger. Joseph debunks some of the most prominent myths about China, provides historical context for modern tensions, and outlines the real threats the "China myth" poses to Americans.

"So Much Hot Air: The (Fake) China Threat Strikes...

Read More »

Read More »

Eilmeldung: Mercedes droht gigantischer Verlust!

Mercedes Benz Boss spricht von einem Desaster! Es drohen Milliarden von Umsatzeinbußen und Gewinnausfall von mehr als 500 Millionen Euro

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

3 Aktien ab 5.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf5

7 Aktien ab 20.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf20

10 Aktien ab 50.000 € Einzahlung aufs Handelskonto mit...

Read More »

Read More »