Tag Archive: Featured

Technical Analysis: Unlocking Profitable FX Trading for February 7 with EURUSD, USDJPY, and GBPUSD

Discover the key technical levels shaping the FX market on February 7, 2024, for EURUSD, USDJPY, and GBPUSD. Gain insights into biases, risks, and targets in this informative video.

Read More »

Read More »

Why Bitcoin is the Future of Money – Robert Kiyosaki, Anthony Pompliano

In this episode, Robert Kiyosaki, with guest Anthony Pompliano (Pomp), dives into the world of Bitcoin and its potential as the future of money. They explore a range of topics including the history and principles of Bitcoin, the role of digital assets in safeguarding against inflation, and the impact of technological advancements on financial markets.

Pompliano shares insights on Bitcoin's design to function as digital gold, emphasizing its finite...

Read More »

Read More »

The Smartest Money Move You Can Make Right Now? (2/7/24)

(2/7/24) Early morning coffee snafus: That's no way to start the day. Headline economic data is not comporting with on-the-ground reality: Credit Card and Auto Loan delinquencies are on the rise because borrowers are out of money; there's been a drop in Labor Force participation. Under the surface, things are not that good. Are Valuations really that cheap? A look back at market performance: The S&P is hitting all-time highs, NASDAQ driven by...

Read More »

Read More »

Forget Being the World’s Policeman; the Federal Government Can’t Even Keep DC Safe

As the US federal government works to “bring peace” to the Middle East, Eastern Europe, and East Asia, it faces a rather embarrassing problem. There is currently a historic wave of violent crime battering the residents of Washington, DC.

With 274 homicides, 2023 was the deadliest year for the city since the 1990s. Shootings, carjackings, and armed robberies also jumped in the nation’s capital.

Parts of DC have been unsafe for a long time, but the...

Read More »

Read More »

Sterling Moves Back into Previous Trading Range, but will it Hold?

Overview: The dollar is trading with a

slightly heavier bias as some of its recent gains are pared. Sterling has moved

back into the $1.26-$1.28 trading range that dominated since the middle of last

December until the start of this week. The euro is also trading a little firmer

despite another large drop in German industrial output (-1.6%). The Japanese

yen, Swiss franc, and Norwegian krone are the notable exceptions with a softer profile....

Read More »

Read More »

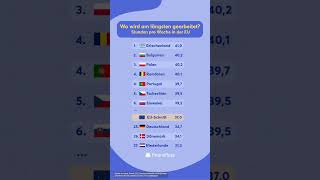

Wo wird am längsten in der EU gearbeitet? #arbeit

Wo wird am längsten in der EU gearbeitet? ?? #arbeit

? Quelle: eurostat, Stand 2022, Durchschnittliche normalerweise geleistete Wochenarbeitsstunden in Haupttätigkeit

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum...

Read More »

Read More »

Rette Dein Vermögen aus den Bankbilanzen!

⭐ Liechtensteintag 2024: Erleben Sie Max Otte, Markus Krall, Stefan Homburg und weitere spannende Redner live am 19. April. Jetzt Ticket sichern: https://liechtensteintag.li/tickets/

Im März 2023 gingen mehrere große Banken in die Knie. Zu einem Kollaps des Finanzsystems kam es zum Glück nicht. Doch die Risiken bleiben weiterhin hoch. In diesem Video zeige ich Dir, wie Du die Situation richtig einschätzt und wie Bankenaktien aktuell performen.

▬...

Read More »

Read More »

Wahnsinn: Tino Chrupalla zerlegt komplette Lanz Sendung!

Tino Chrupalla hält Markus Lanz mal wieder bravourös den Spiegel vor und als ein Autor sogar Chrupalla zustimmt, bricht Lanz schnell die Sendung mit einem desolaten Kommentar ab!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Heinrich-Böll-Stiftung from Berlin, Deutschland -...

Read More »

Read More »

WTI Crude Oil Technical Analysis

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:47 Technical Analysis with Optimal Entries.

2:16 Upcoming Economic Data....

Read More »

Read More »

Pictet Report – The founder of Uizard on how AI is transforming software design

Early on in his career, Tony Beltramelli spotted the potential of machine learning to disrupt and revolutionise software and app design. Since 2017, he has built his Copenhagen-based start-up, Uizard, into one of the world’s leading AI-powered design tools. Here we sit down with the founder to hear what gave him the initial impetus to launch the venture and to listen as he shares his predictions for the future of the design industry....

Read More »

Read More »

Pictet – China expert Zak Dychtwald on the country’s generational divides

Zak Dychtwald is the author of Young China: How the Restless Generation Will Change Their Country and the World and is the founder of the think tank Young China Group, which uses a people-first approach to understand China’s identity and its evolving impact on the world. Here, Zak explains why many in the West continually misunderstand Gen-Zers and millennials in China. He also describes the “cultural gravity” that these young people exert on the...

Read More »

Read More »

Pictet Report – Kyungsun Chung on generating tangible impact with The Sylvan Group

Kyungsun Chung is one of the grandsons of Chung Ju-yung, who started out with a car-repair shop in Seoul in the 1940s and built it into the Hyundai Group, South Korea’s second-largest conglomerate behind Samsung. With that family tree beneath him, the traditional and obvious career path for Kyungsun would have been to join the family business and remain within its folds. However, instead, he has dedicated his professional life to impact investing...

Read More »

Read More »

Pictet Report – How the GoTo Impact Foundation is tackling Indonesia’s toughest challenges

Between 2015 and 2021, Monica Oudang served as the Chief HR Officer for Gojek, a ride-hailing start-up that in 2019 became Indonesia’s first “decacorn” – a private company with a valuation of over $10 billion. During that time, she saw firsthand how company culture, mindset and collaborative problem-solving can together produce transformational change. Today she is the chairperson of The GoTo Impact Foundation, an impact organisation attached to...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #247

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #248

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

Goldback State Bundles

NEVER LET YOUR DOLLAR DEVALUE AGAIN ? with Goldbacks! ? Get one of each goldback denomination from each available state.

Order yours today! ➡️ moneymetals.com/buy/gold

#new #gold #goldback #special #financialfreedom #beyourownbank #goldstacking #preciousmetals #investment #money #metals #moneymetals #goldbug #coincollector #coinpusher #fyp

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

The Bull Run Continues: S&P 5000? (2/6/24)

(2/6/24) Market Behavior in a Presidential Cycle: Markets are positioning for a GOP win in November; Jerome Powell is now more inclined to NOT cut rates any time soon. Markets now need a narrative to support their current thesis, but it's only fundamentals that really matter. The Apple Vision goggle phenom. Markets sell-off, but knocking on the door of 5,000 in the S&P 500: now dealing with gravitational pull. Yields are reversing. NYC giving...

Read More »

Read More »