Tag Archive: EuroDollar

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

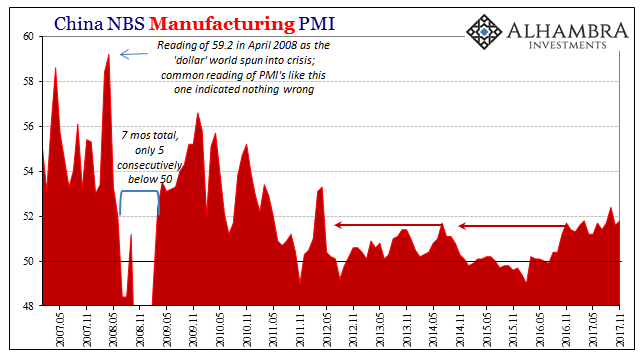

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

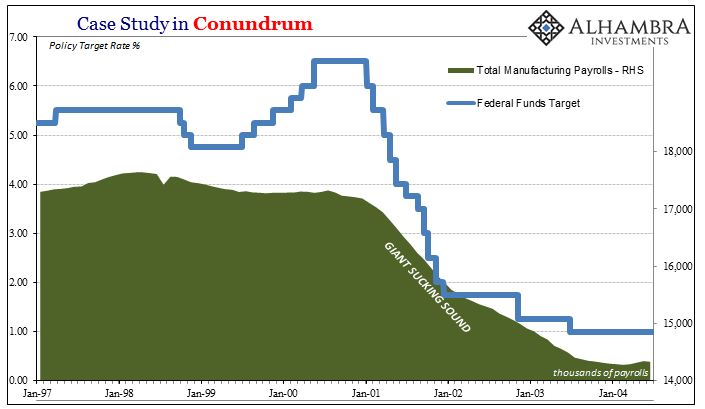

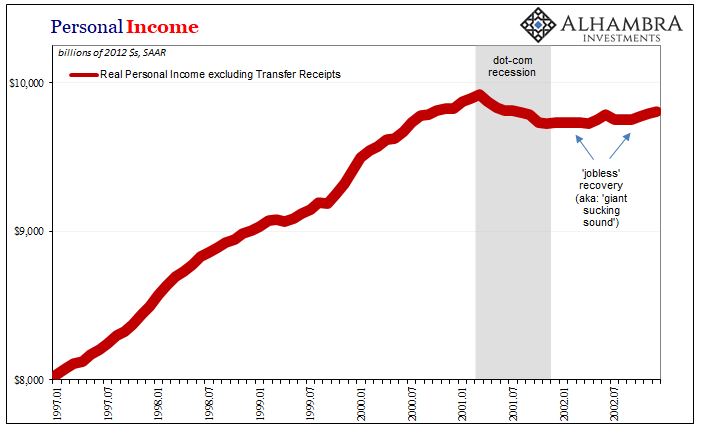

Giant Sucking Sound Sucks (Far) More Than US Industry Now

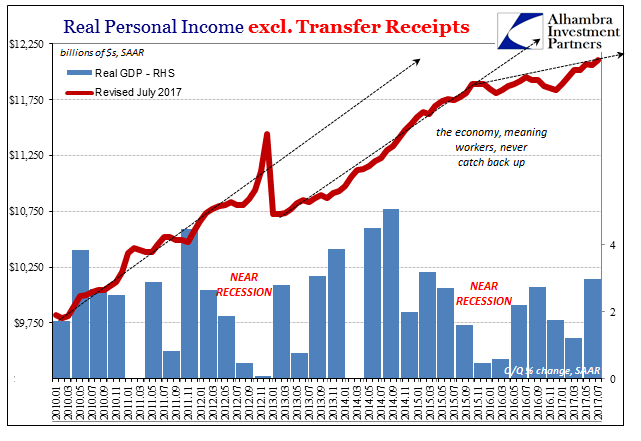

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really are buying at a healthy pace,...

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

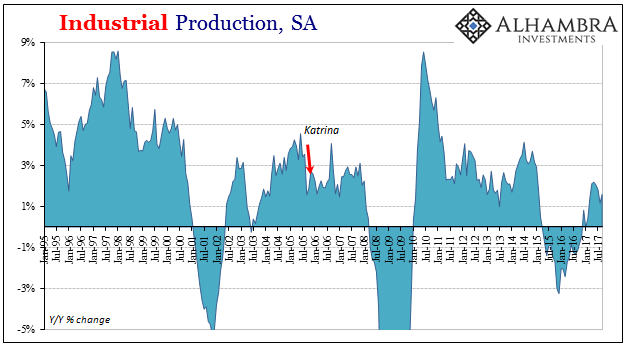

Broader Slowing in Industrial Production

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides (supply as well as demand)...

Read More »

Read More »

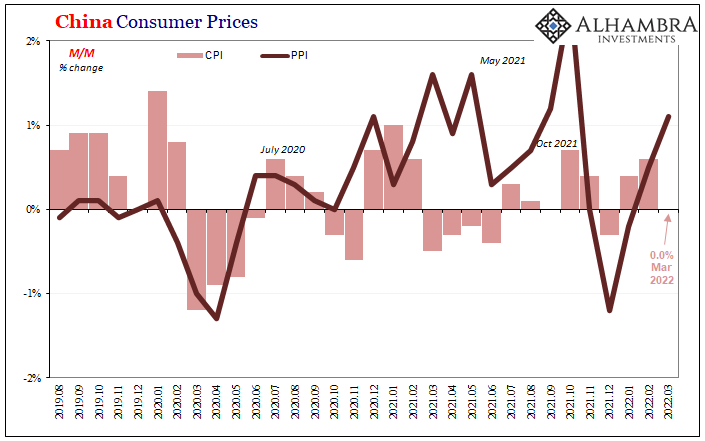

Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

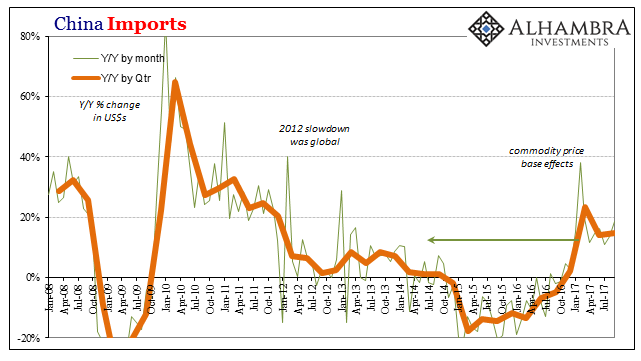

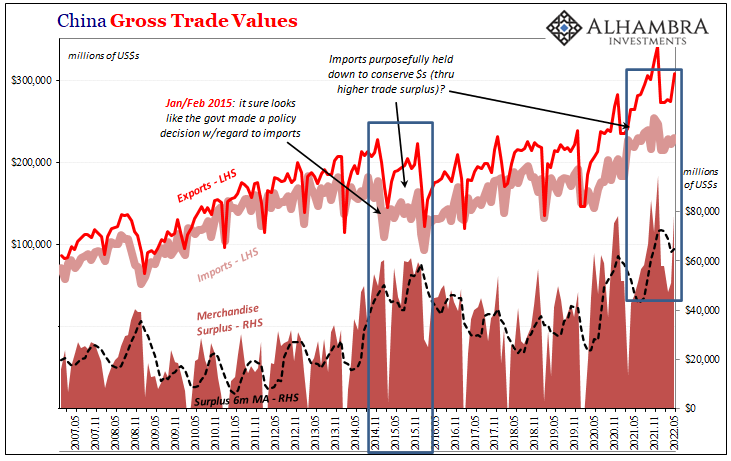

China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday.

Read More »

Read More »

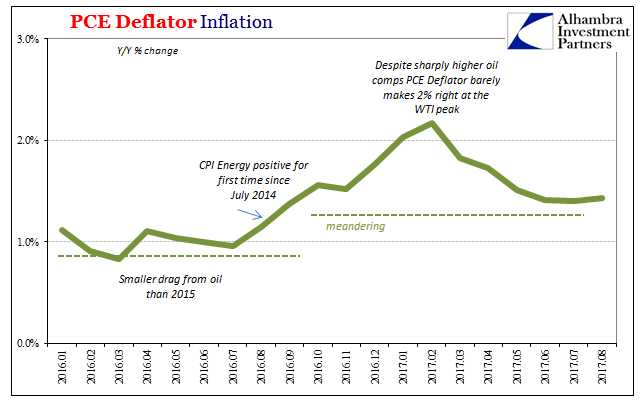

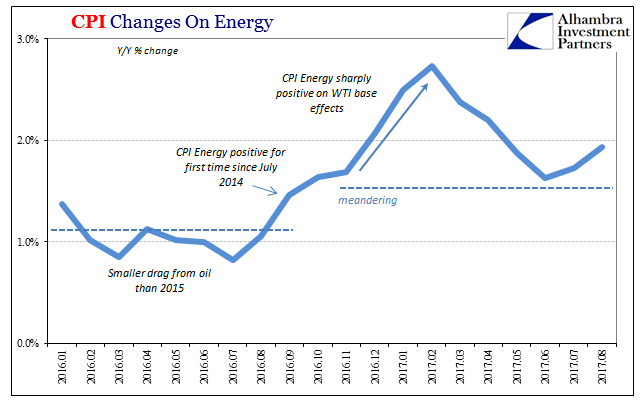

Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses.

Read More »

Read More »

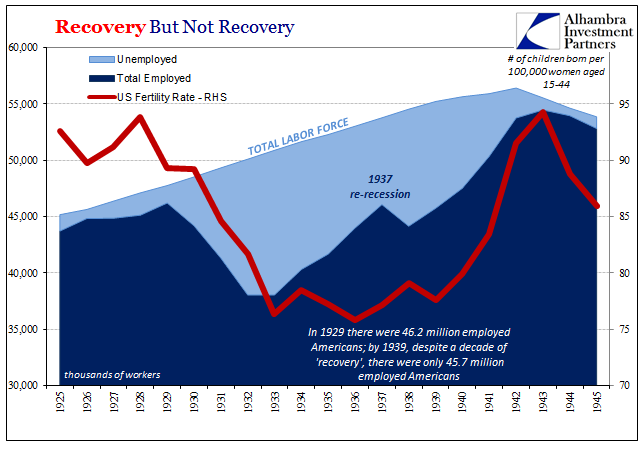

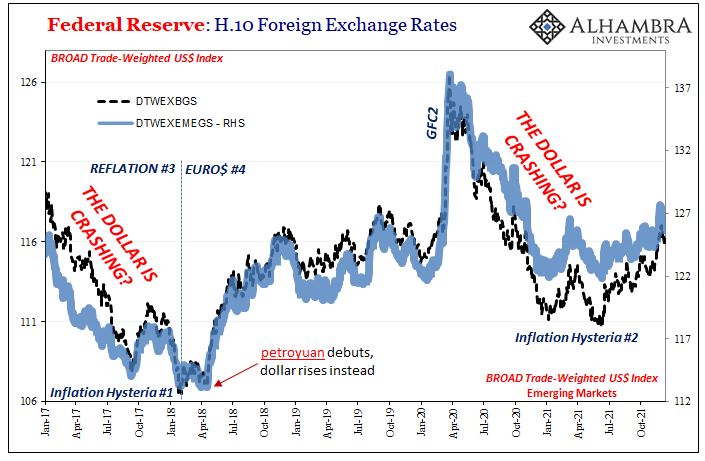

US: Reflation Check

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply.

Read More »

Read More »

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

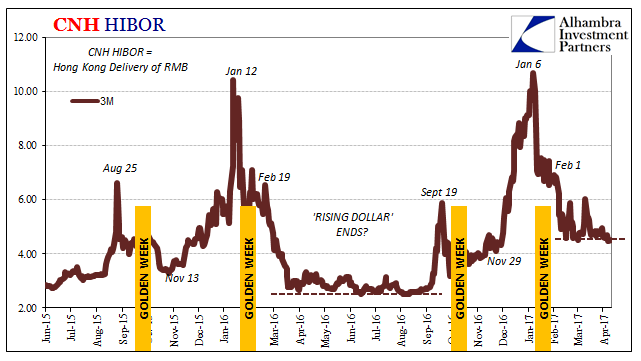

Location Transformation or HIBORMania

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first relates to the Chinese New Year...

Read More »

Read More »

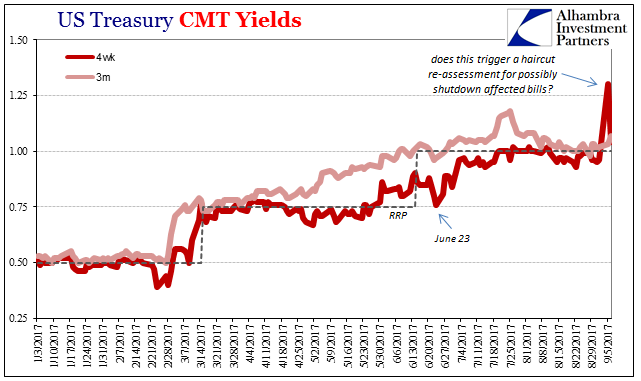

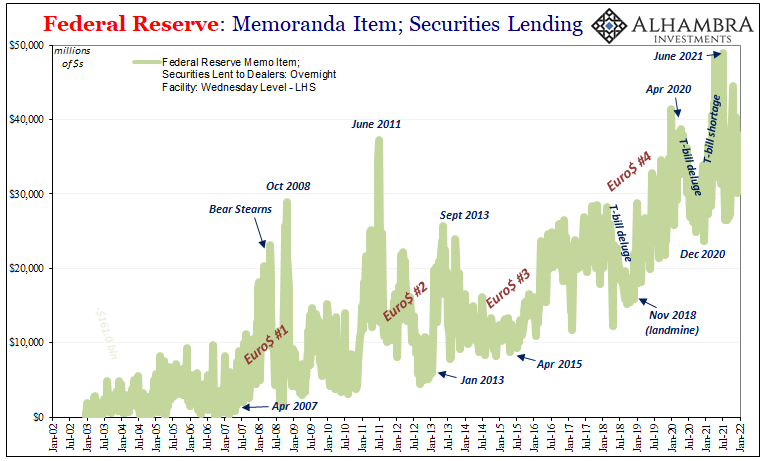

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

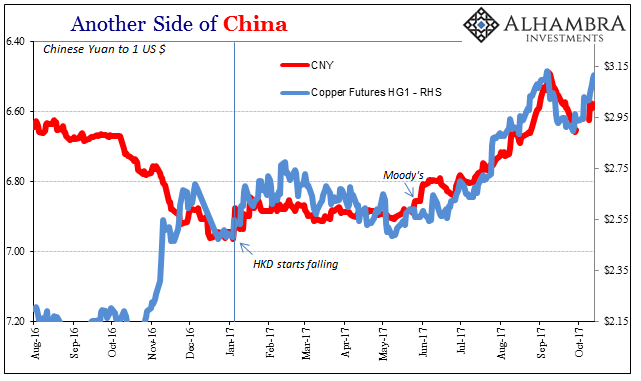

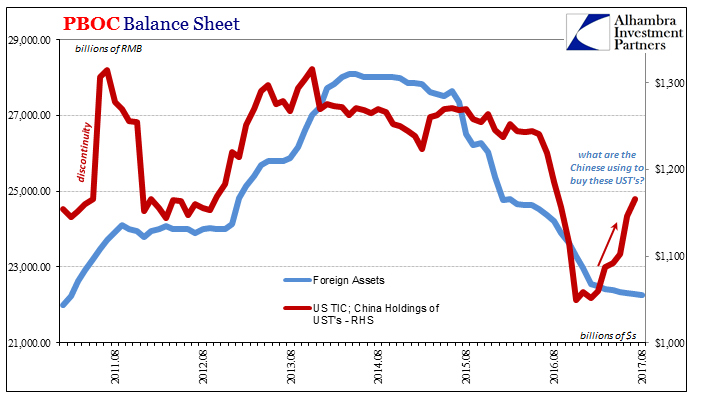

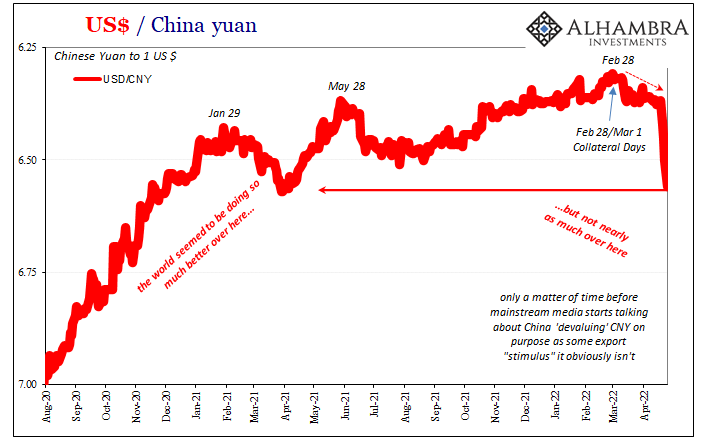

Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely.

Read More »

Read More »

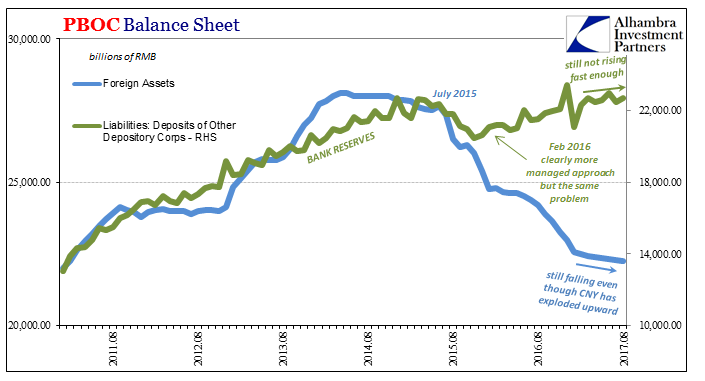

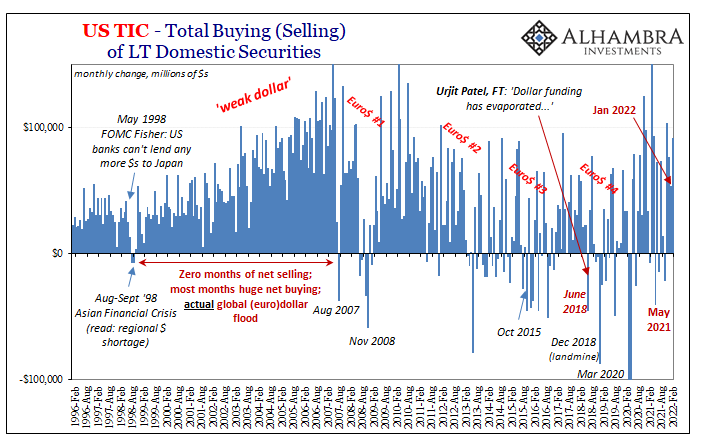

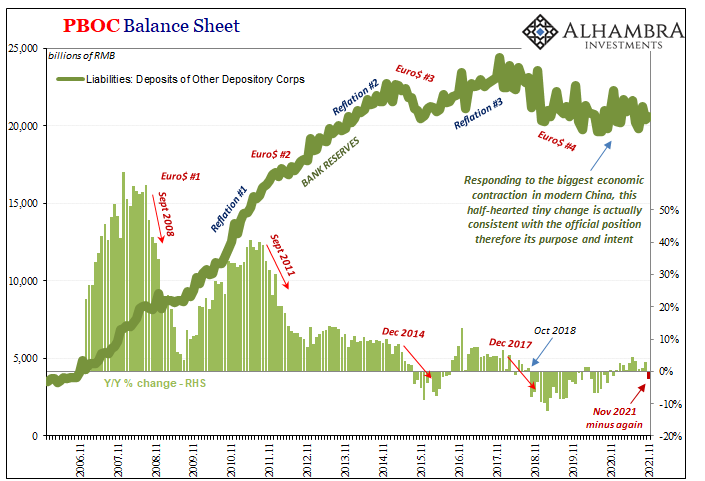

PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

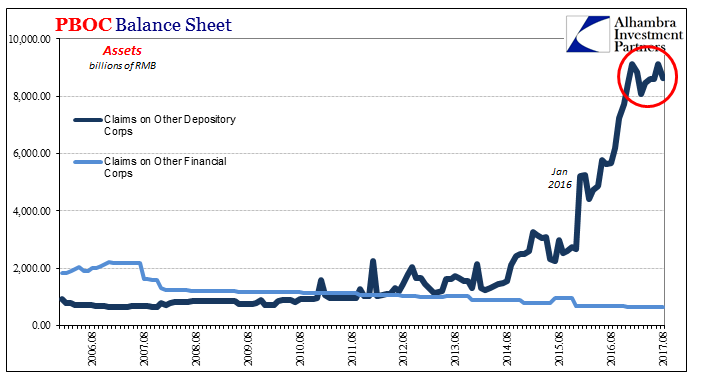

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.

Read More »

Read More »

The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.”

Read More »

Read More »

A Clear Anchor

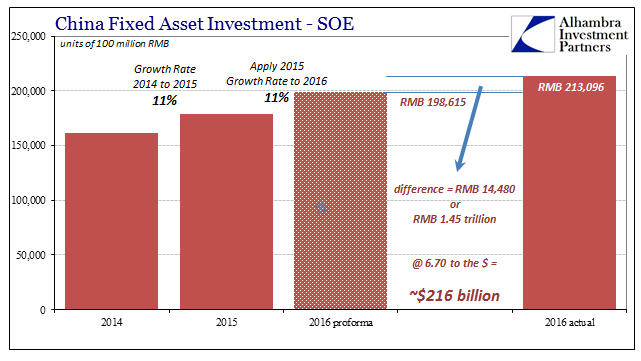

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE). By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP

Read More »

Read More »

When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being different in each and every...

Read More »

Read More »

The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found...

Read More »

Read More »

US Export/Import: ‘Something’ Is Still Out There

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013.

Read More »

Read More »