Tag Archive: eurodollar system

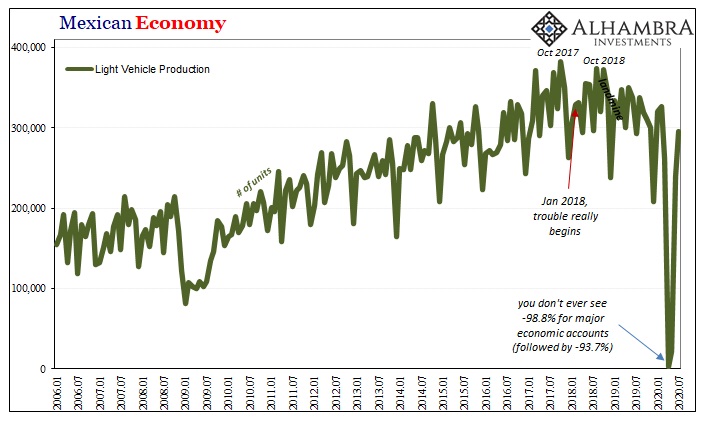

Meaning Mexico

It took some doing, and some time, but Mexico has managed to bring its car production back up to more normal levels. For two months, there had been practically zero automaking in one of the biggest auto-producing nations. Getting back near where things left off, however, isn’t exactly a “V” shaped recovery; it’s only halfway.

Read More »

Read More »

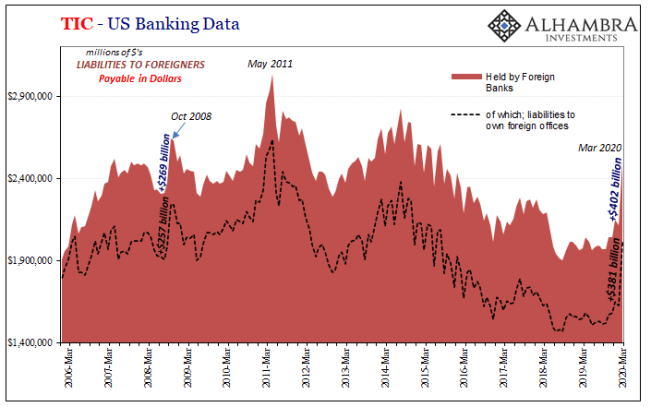

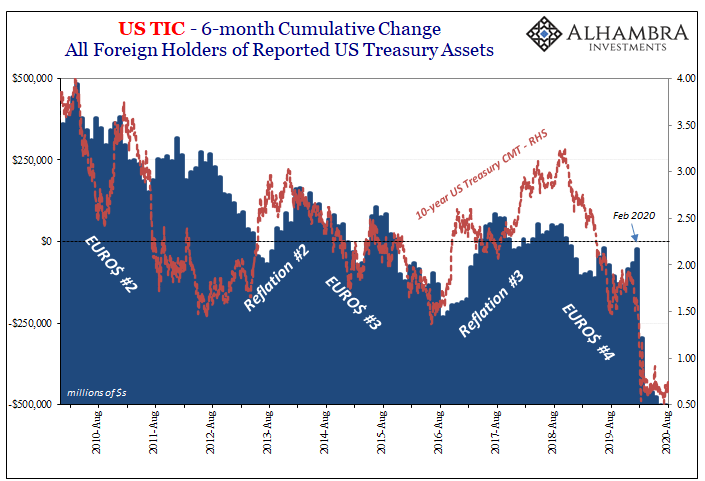

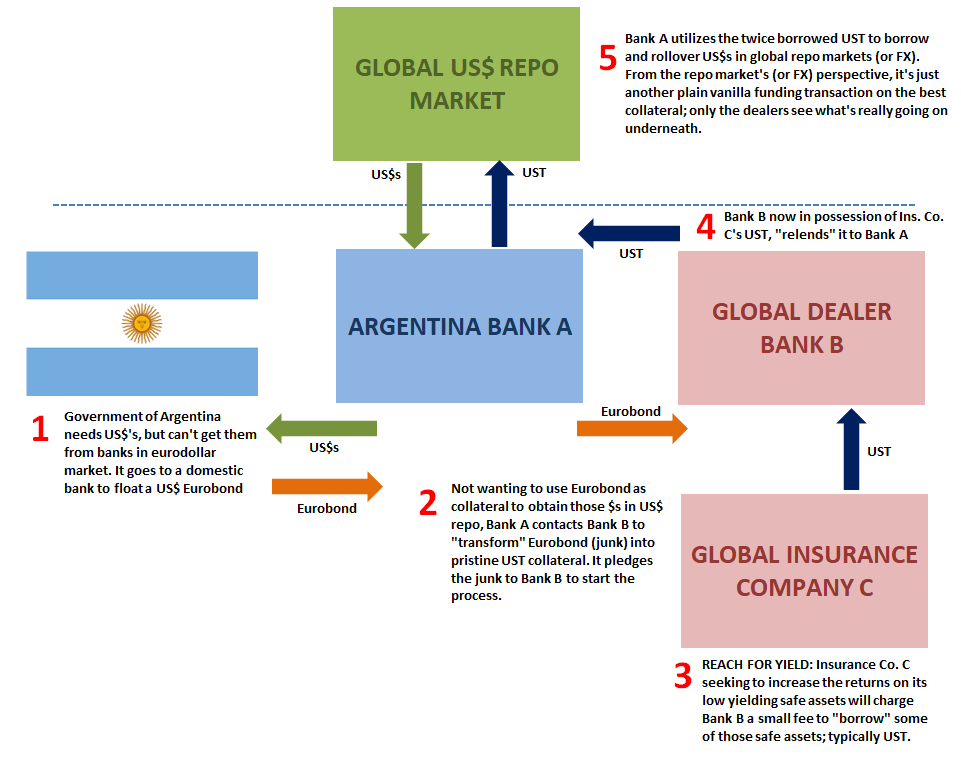

Part 2 of June TIC: The Dollar Why

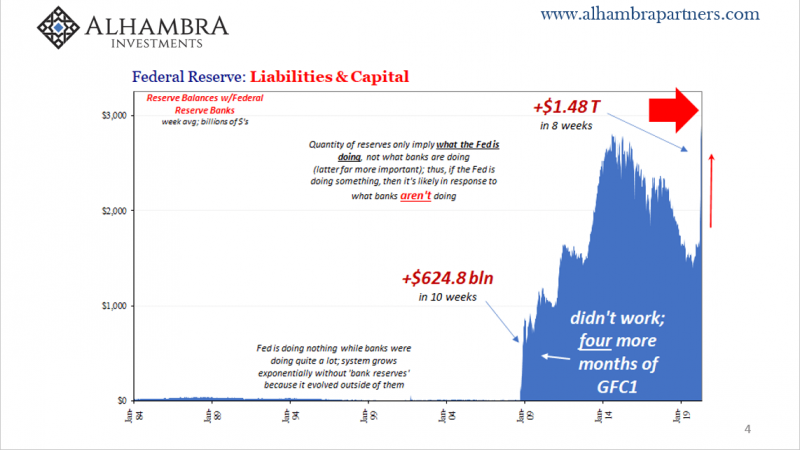

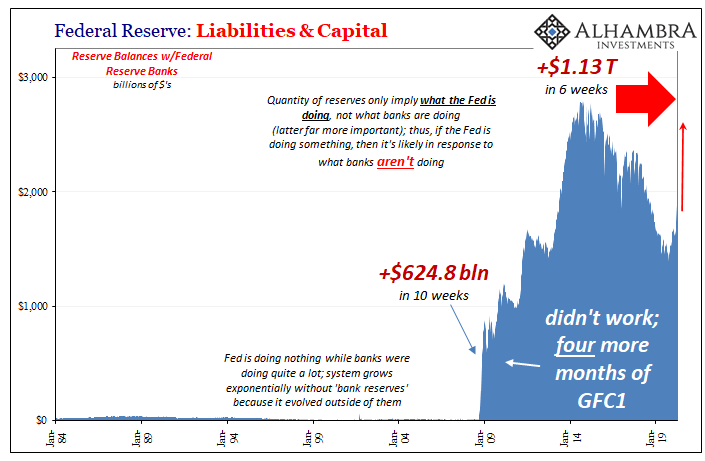

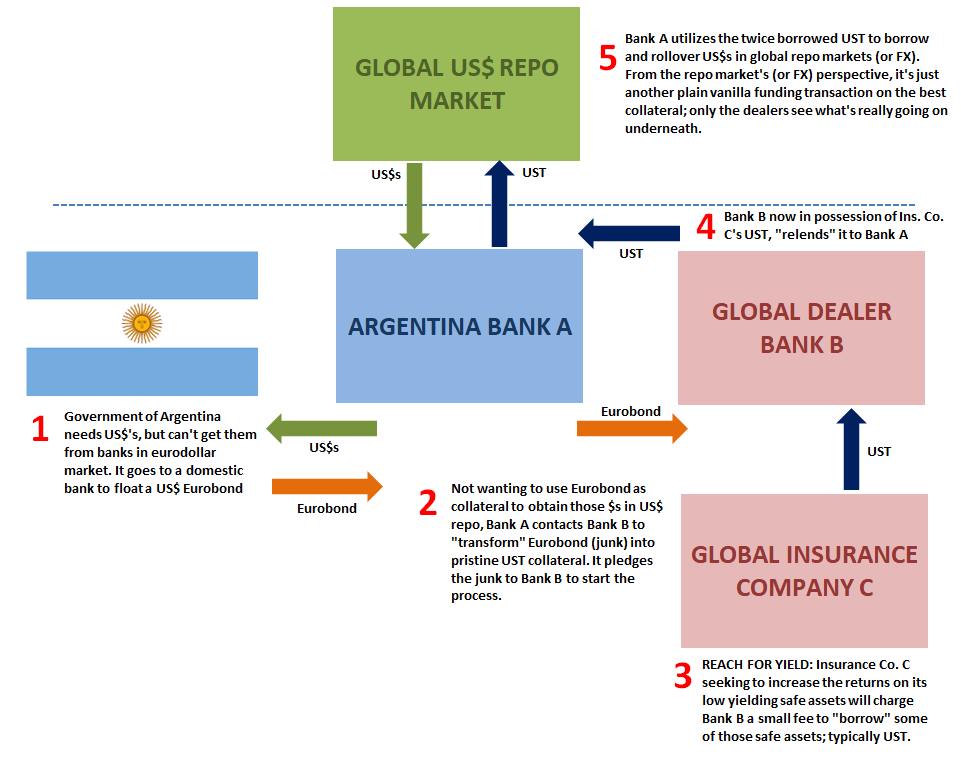

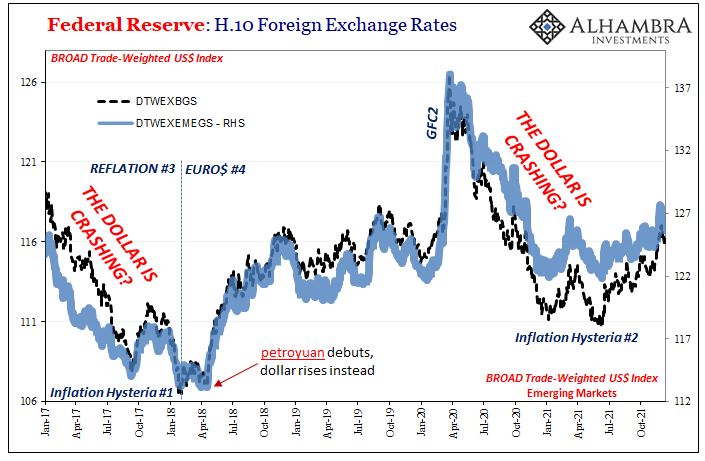

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

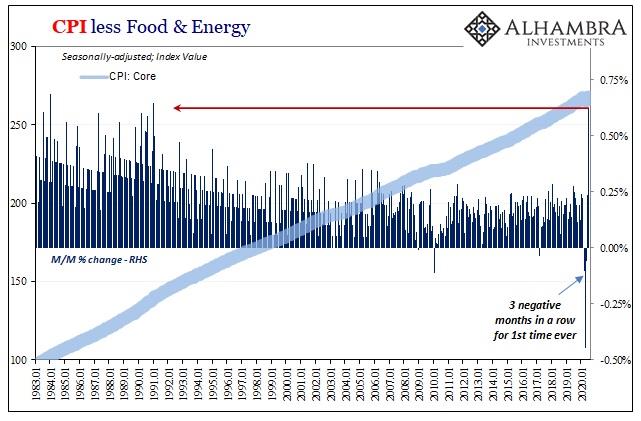

Fama 2: No Inflation For Old Central Banks

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

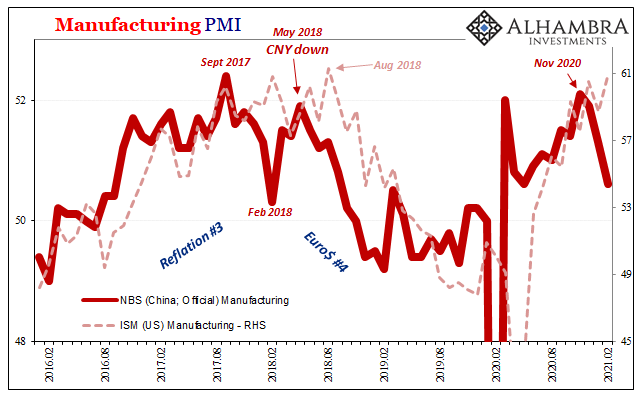

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

Fed Balance Sheet: Swap Me Update

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not.Meaning, there is purpose.

Read More »

Read More »

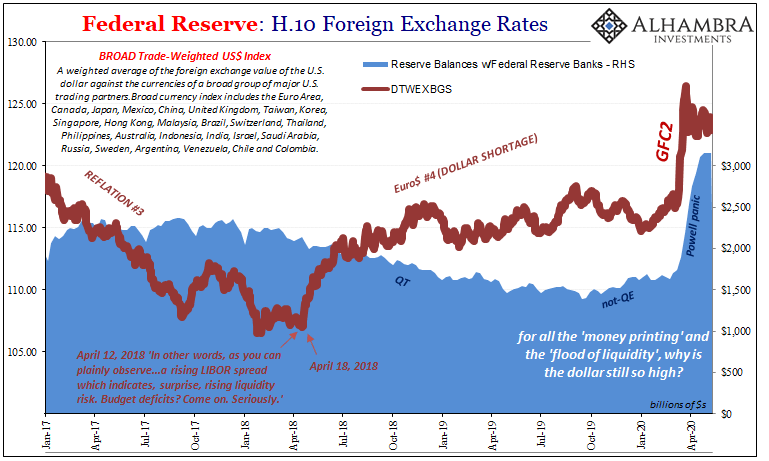

So Much Dollar Bull

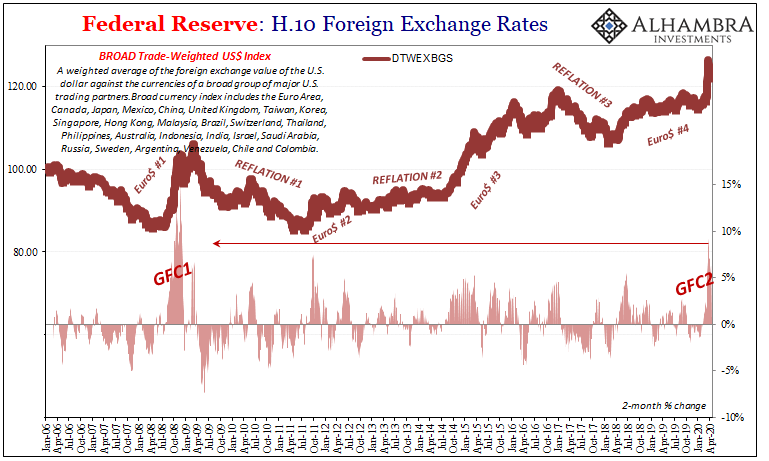

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.In second place (now third)...

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

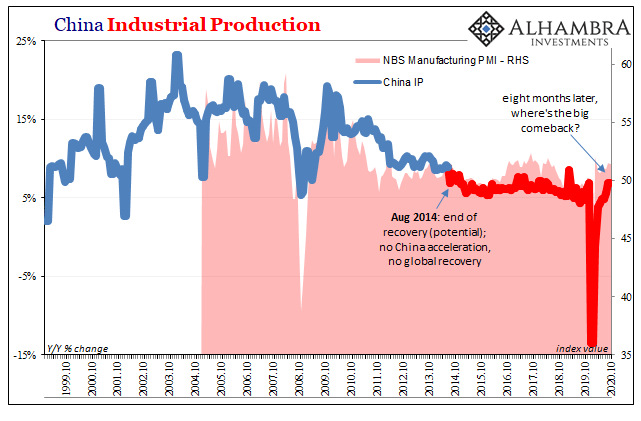

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

Three Short Run Factors Don’t Make A Long Run Difference

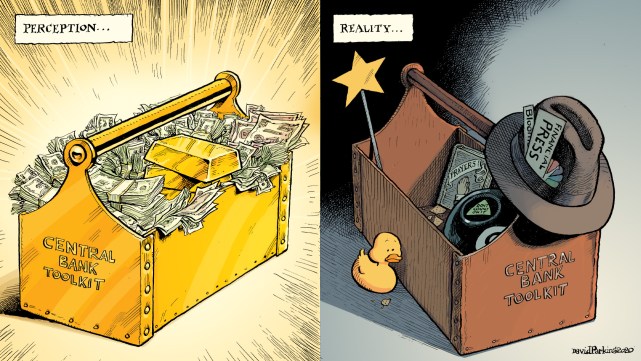

There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed.

Read More »

Read More »

Is GFC2 Over?

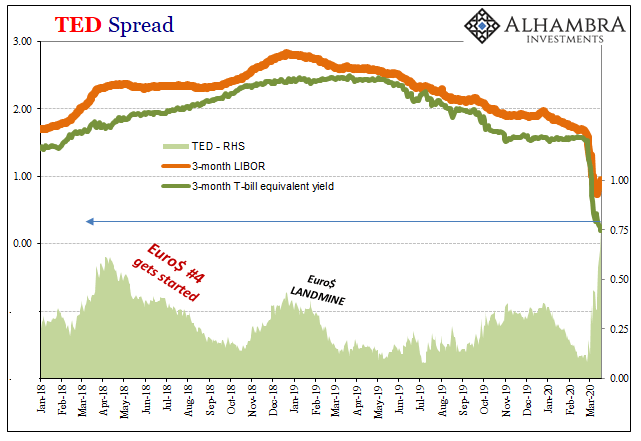

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

A Day For Rate Cuts

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV.

Read More »

Read More »

Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil.

Read More »

Read More »

You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes.

Read More »

Read More »

Don’t Forget (Business) Credit

Rolling over in credit stats, particularly business debt, is never a good thing for an economy. As noted yesterday, in Europe it’s not definite yet but sure is pronounced. The pattern is pretty clear even if we don’t ultimately know how it will play out from here. The process of reversing is at least already happening and so we are left to hope that there is some powerful enough positive force (a real force rather than imaginary, therefore...

Read More »

Read More »

De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part.

Read More »

Read More »

2019: The Year of Repo

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated.

Read More »

Read More »