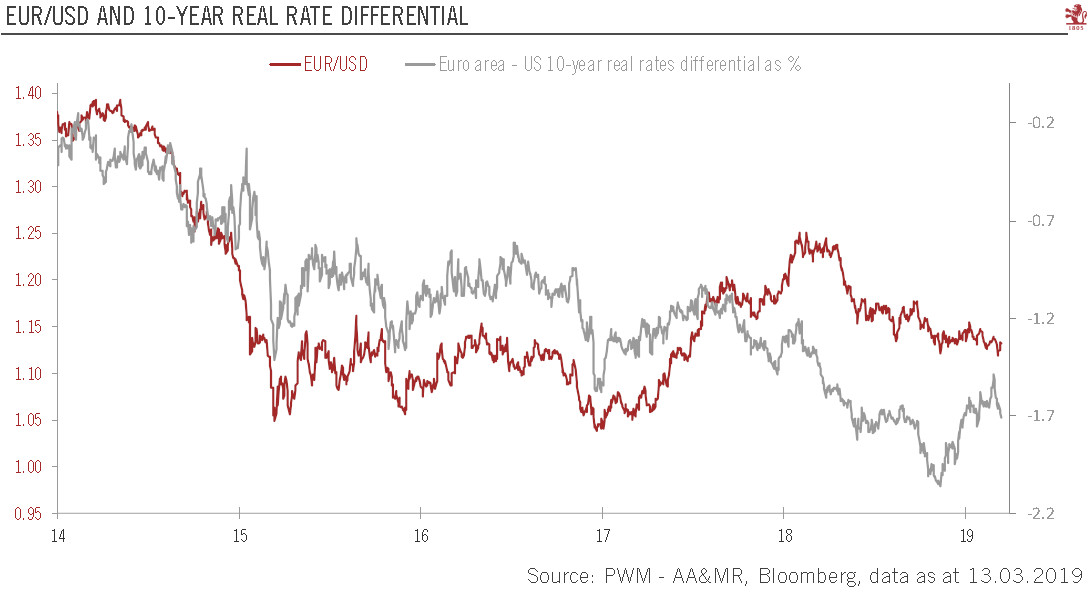

Tag Archive: EUR/USD

Draghi Does not Surprise and Euro Edges Away from $1.10

Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken.

Read More »

Read More »

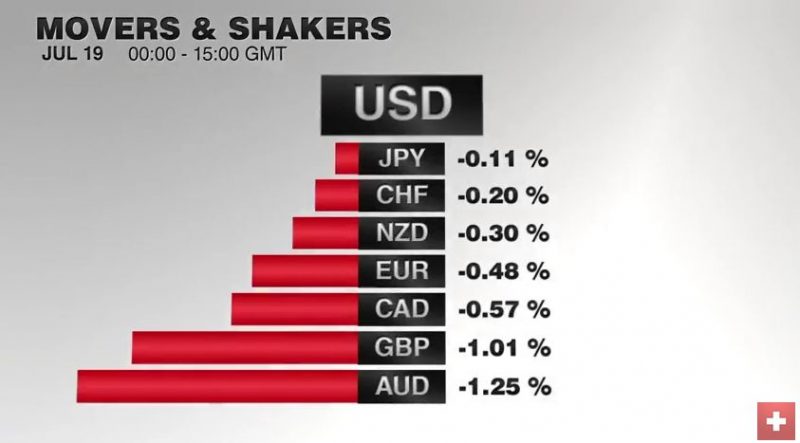

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »

European Court of Justice Ruling Weighs on Italian Banks

ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event.

Read More »

Read More »

Squaring the Circle: Can Article 7 be Used to Force Article 50?

Article 7 would suspend the UK's EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what "is" means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not.

Read More »

Read More »

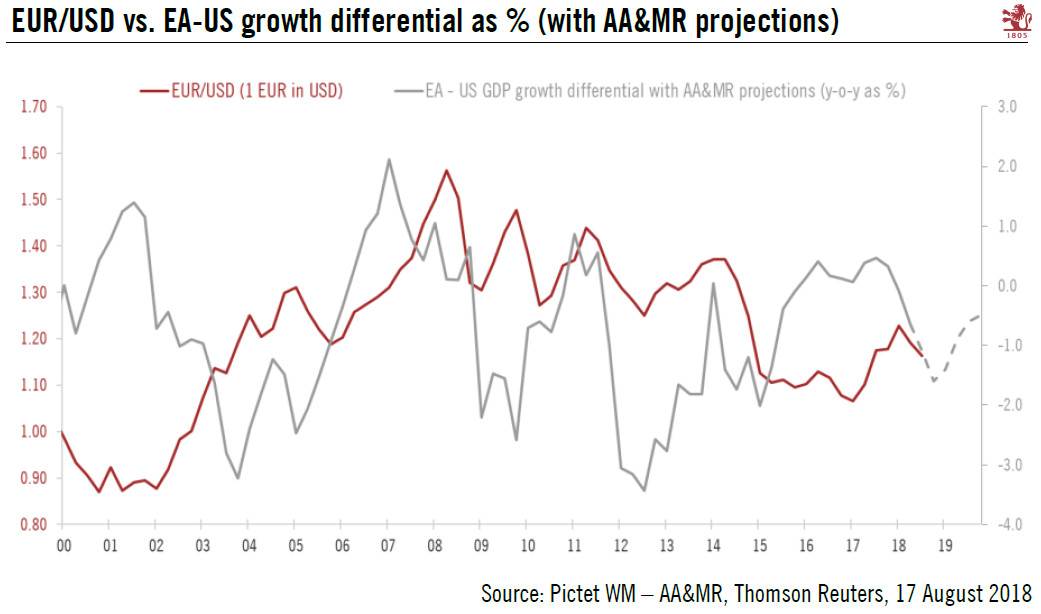

FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Our weekly review of currency movements, with focus on the Swiss franc. This week: The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much driven by the dollar as it is by other currencies.

Read More »

Read More »

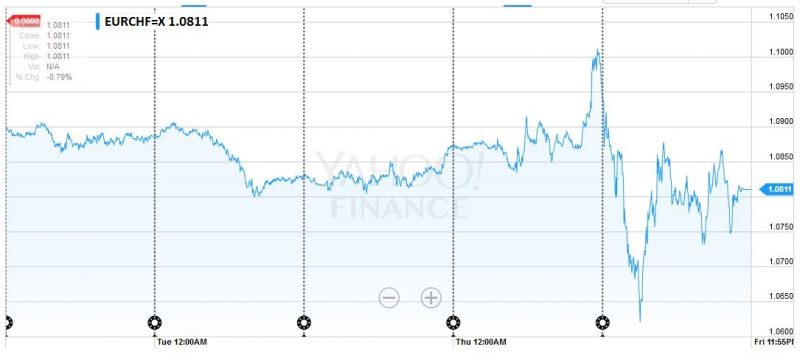

FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls.

Read More »

Read More »

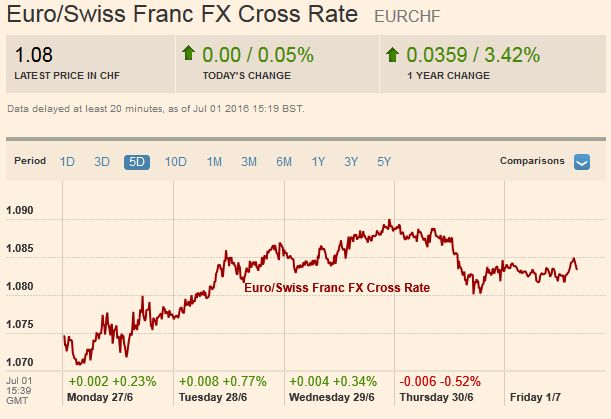

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »