Tag Archive: EUR/USD

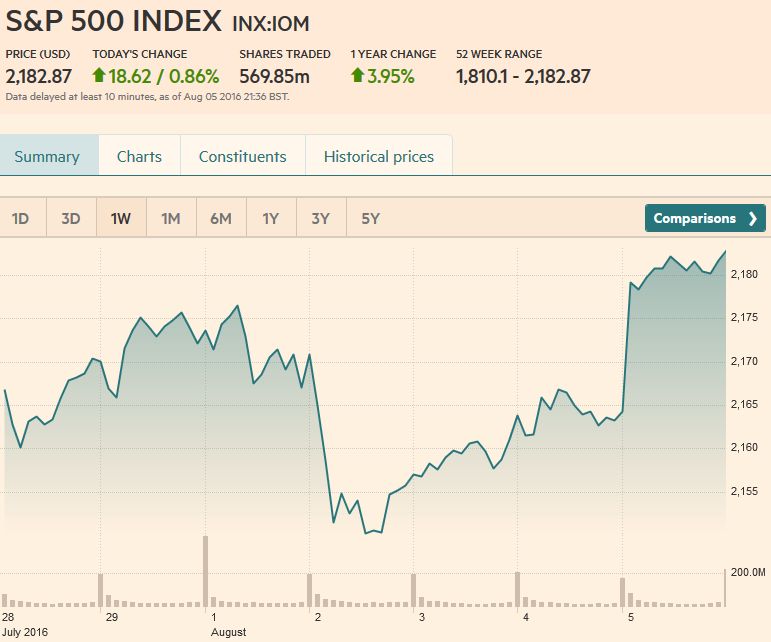

FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the

week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for the

week.

Read More »

Read More »

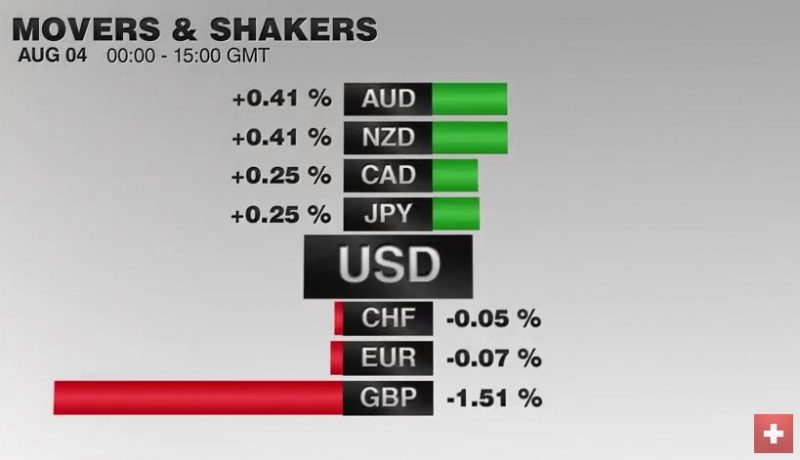

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso.

Read More »

Read More »

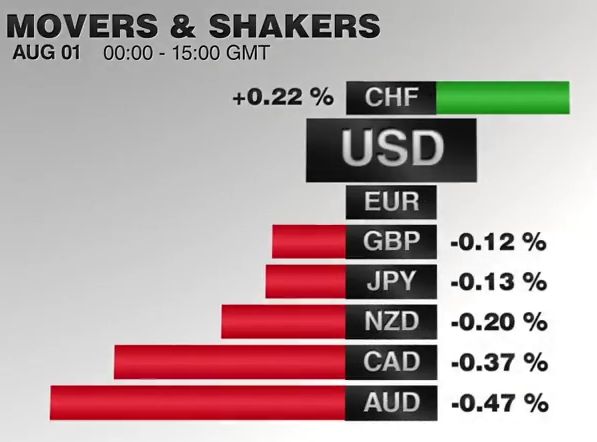

FX Daily, August 01: Dog Days of August Begin

The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week's developments. In particular the BOJ's underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP.

Read More »

Read More »

FX Weekly Preview: After this Week, Does August Matter?

RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan's fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful.

Read More »

Read More »

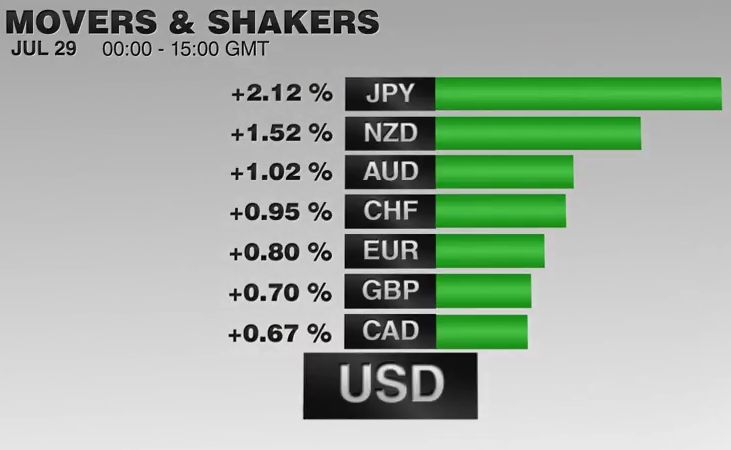

FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

The US dollar advance was stopped in its tracks by the

disappointingly weak Q2 GDP figures. The 1.2% annualized growth rate was

roughly half of the pace expected. The FOMC statement earlier in the week did not leave the impression that a September hike was likely, and with the poor growth numbers, the odds were downgraded

further.

Read More »

Read More »

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »

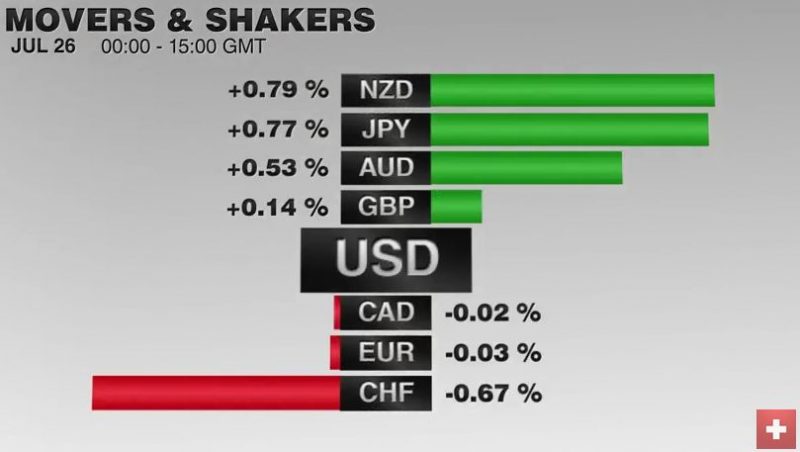

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

European Banks Bad Loans and Coverage

European banks are worrisome. EBA's stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed.

Read More »

Read More »

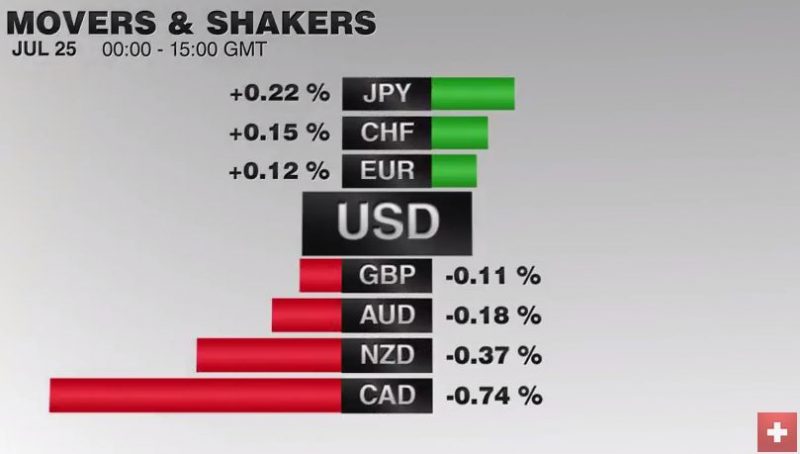

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

European Bank Stress Test: Preview

European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries' banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules.

Read More »

Read More »

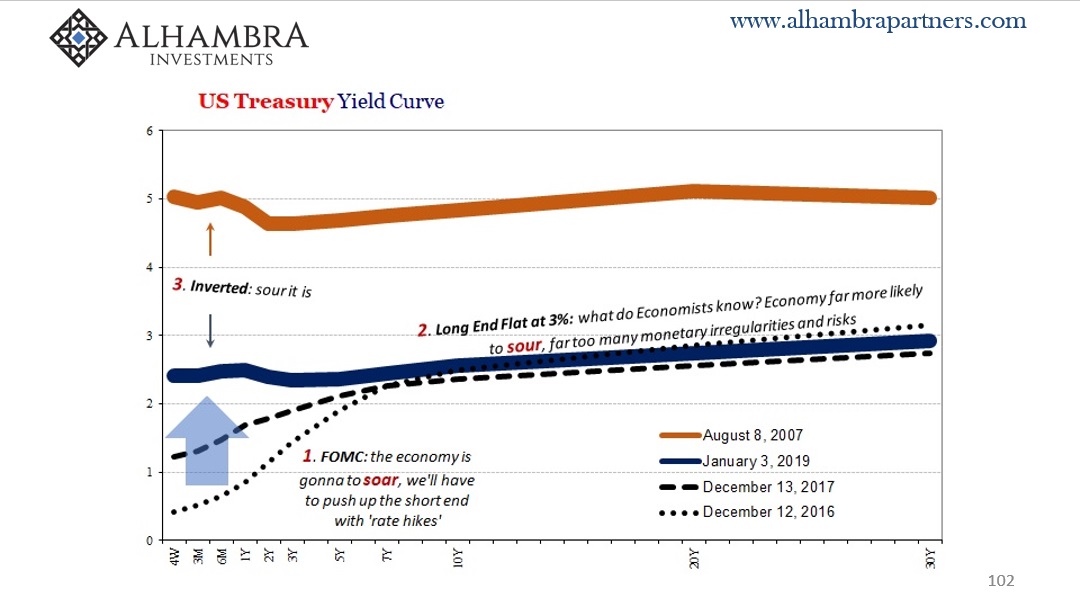

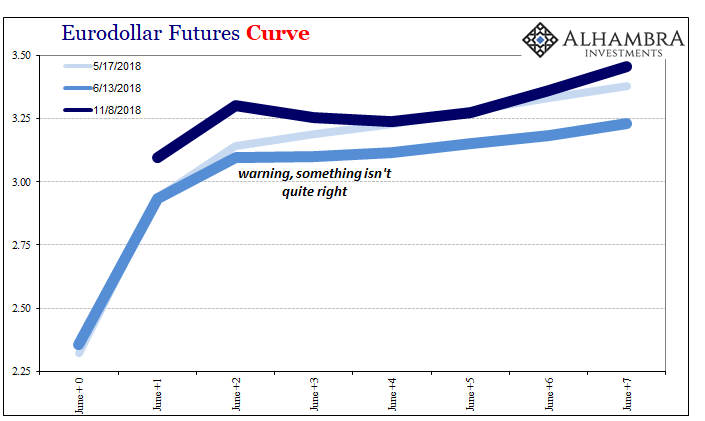

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

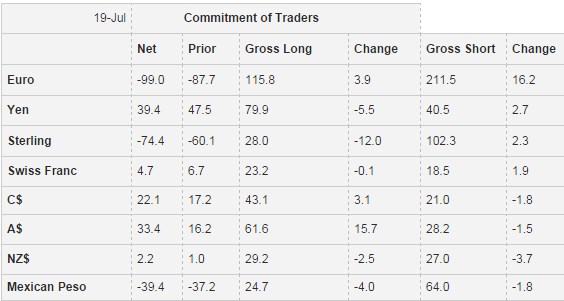

Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. They are more Bullish on Dollar and on the Dollar-Bloc currencies.

Read More »

Read More »

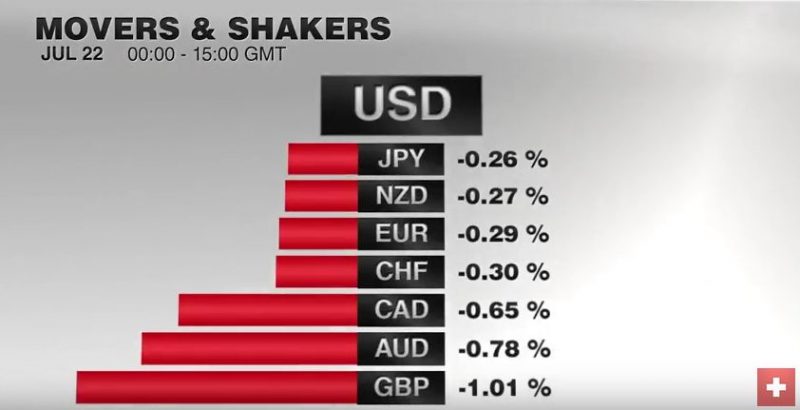

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

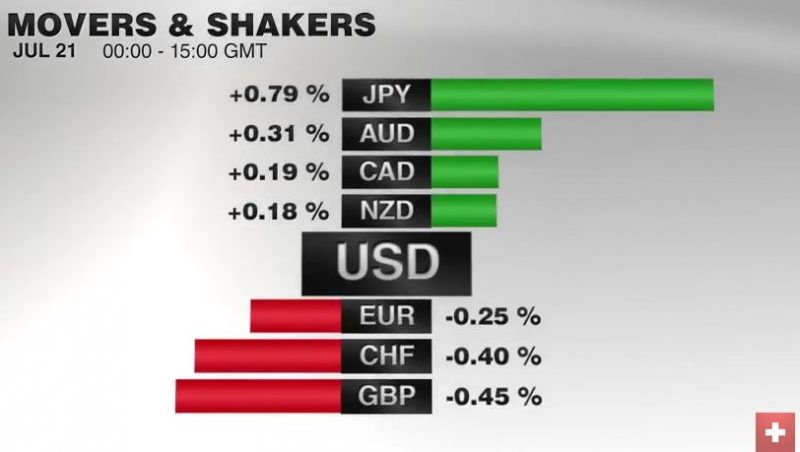

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »