Tag Archive: EUR/CHF

FX Weekly Review, August 15 – August 19: Swiss Franc index improves 5% compared to dollar index

The US dollar lost ground against nearly all the major currencies last week. The sole exceptions were the Australian dollar, where Moody's decision to cut the outlook for five Australian banks wiped out the previous small gain. The Swiss Franc index gained nearly 5% compared to the dollar index.

Read More »

Read More »

FX Weekly Review, August 08 – August 12: Finally an Improvement of the CHF Index

The CHF index experienced its first good week since many weeks, when we compare it against the dollar index. On a three years interval, the Swiss Franc had a weak performance.

Read More »

Read More »

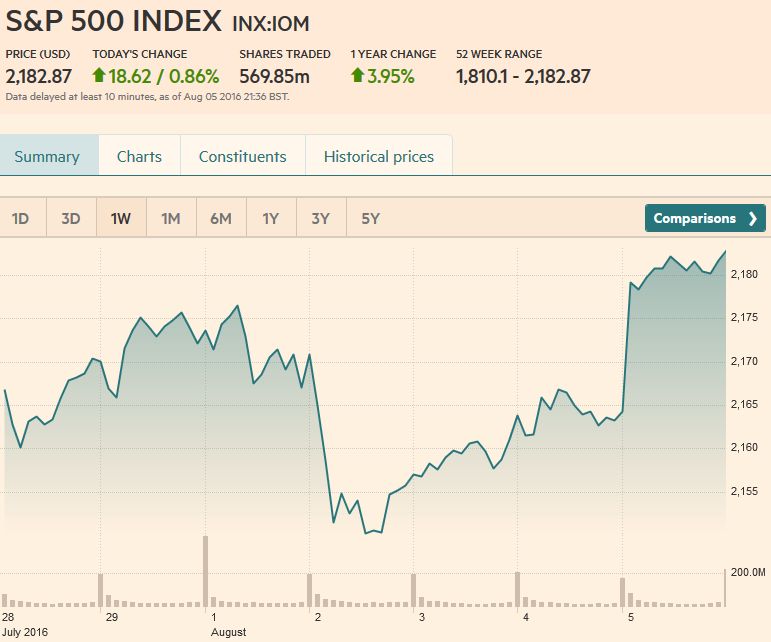

FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the

week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for the

week.

Read More »

Read More »

FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

The US dollar advance was stopped in its tracks by the

disappointingly weak Q2 GDP figures. The 1.2% annualized growth rate was

roughly half of the pace expected. The FOMC statement earlier in the week did not leave the impression that a September hike was likely, and with the poor growth numbers, the odds were downgraded

further.

Read More »

Read More »

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

FX Weekly Review, July 11 – July 15: It is not About the Dollar, but About Other Currencies

Our weekly review of currency movements, with focus on the Swiss franc. This week: The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much driven by the dollar as it is by other currencies.

Read More »

Read More »

FX Weekly Review, July 04 – July 08: Further SNB Interventions, Good Dollar Week

In the Brexit month, the Swiss franc index clearly underperformed the dollar index. The major reason is that the dollar is seen as a better safe-haven than the Swiss Franc, possibly because Swiss sales are affected more when British demand falls.

Read More »

Read More »

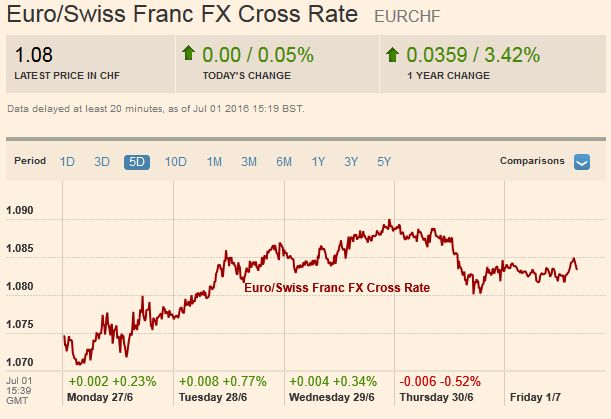

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

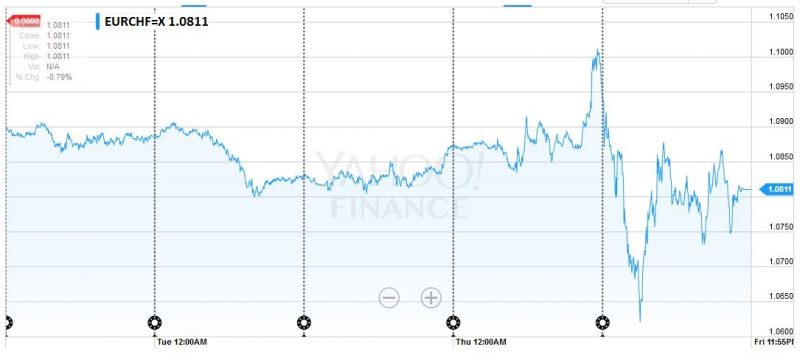

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »

Exchange-rate targets: Francly wrong

WHEN the going gets tough, the tough buy Swiss francs. That was true in the 1970s, when the Swiss were forced to impose negative interest rates on foreign depositors. And it has been true in recent years, with Switzerland's currency rising by 43% against the euro between the start of 2010 and mid-August this year.

Read More »

Read More »

Currency interventions: Francs for nothing

CENTRAL banks have historically been regarded as the guardians of a currency's value, but occasionally they want to drive their exchange rates down. Rarely have they acted as aggressively as the Swiss National Bank (SNB) did on September 6th.

Read More »

Read More »