Tag Archive: economy

Peak Policy Error

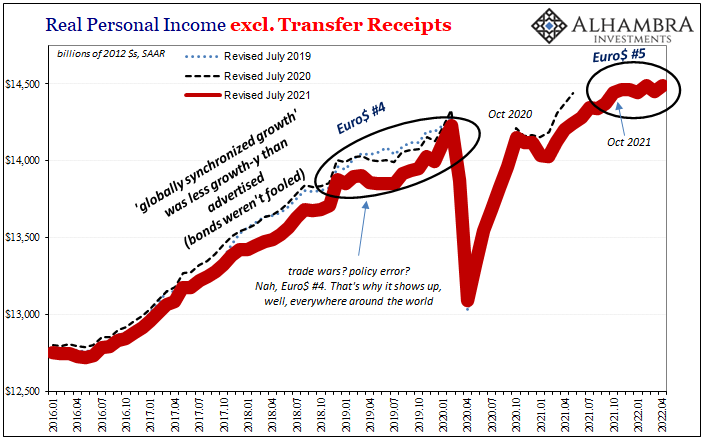

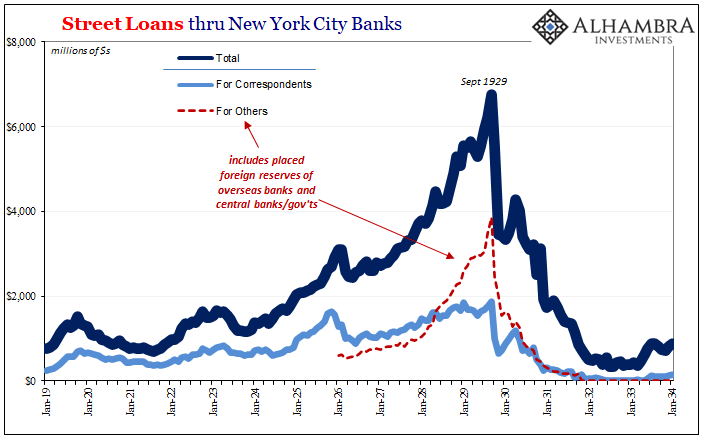

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US.

Read More »

Read More »

Weekly Market Pulse: Is The Bear Market Over?

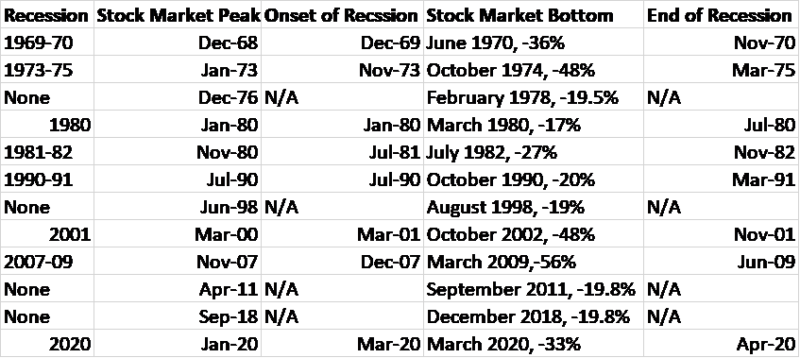

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days.

Read More »

Read More »

Inventory Flood Continues Just As Consumers Tap Out

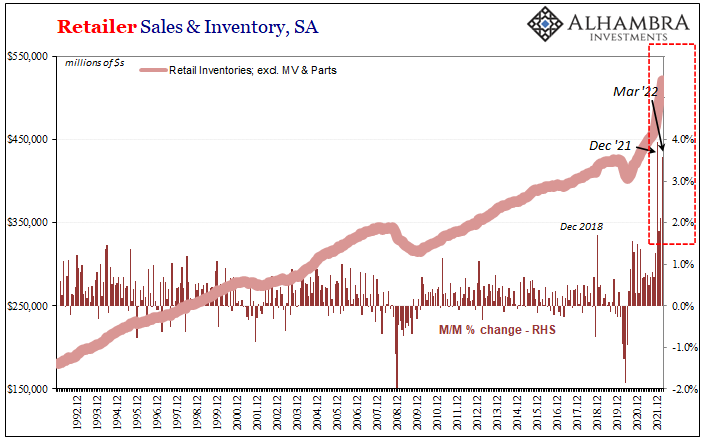

If it continues to play out the same way, it would be all the worst scenarios lumped together all at the same time. A real unfortunate convergence, yet one that has been entirely predictable. Consumers reaching their absolute spending limits.

Read More »

Read More »

‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?”

Read More »

Read More »

Is It Being Demanded?

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing.

Read More »

Read More »

Hong Kong Stocks Pivot Euro$ #5

The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices.

Read More »

Read More »

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

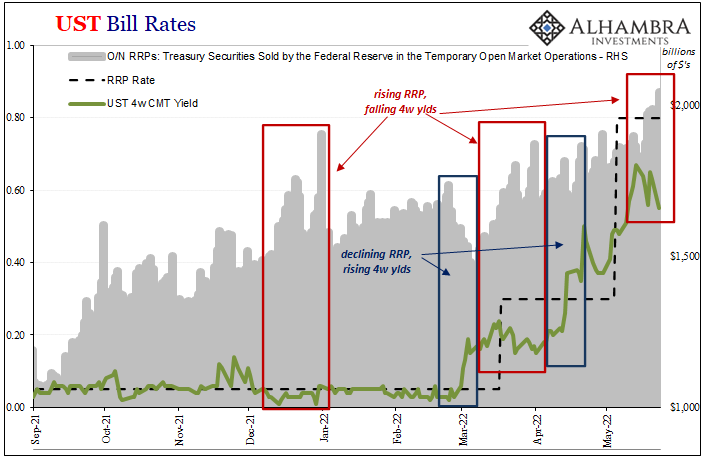

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

Another Month Closer To Global Recession

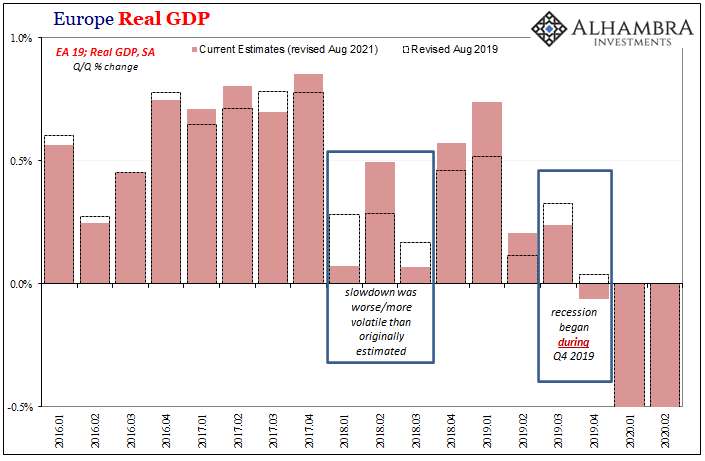

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

UST 2s & Euro$ Futures *Whites* Both Ask, Landmine At Last?

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Read More »

Read More »

Shipping Around Retail ‘Inflation’

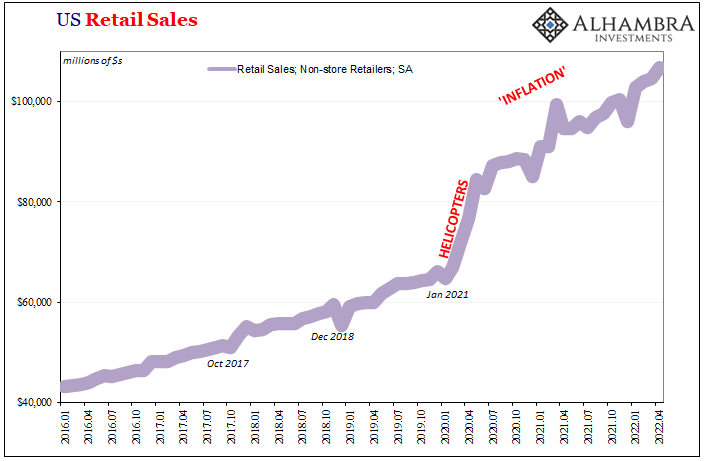

This whole “inflation” scenario isn’t really that difficult to piece together, effect from cause. Sure, Jay Powell’s trying to nuke it by hiking the federal funds rate, but no one really uses fed funds and the problem isn’t the unsecured cost of borrowing bank reserves (not money) that are literally overflowing.

Read More »

Read More »

Looking Back At Chaotic March Through TIC

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

Synchronized Not Coronavirus

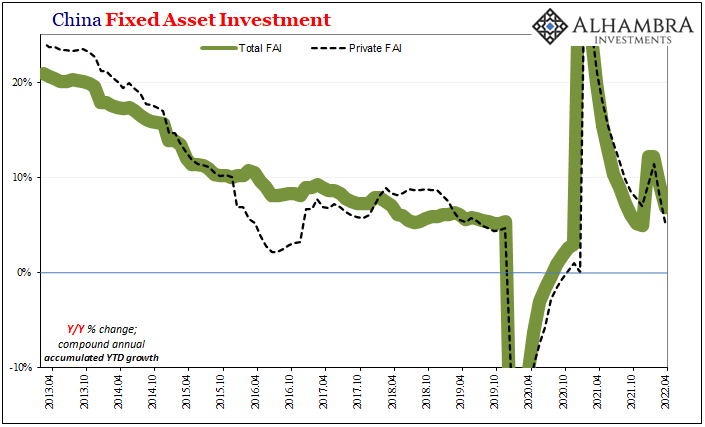

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

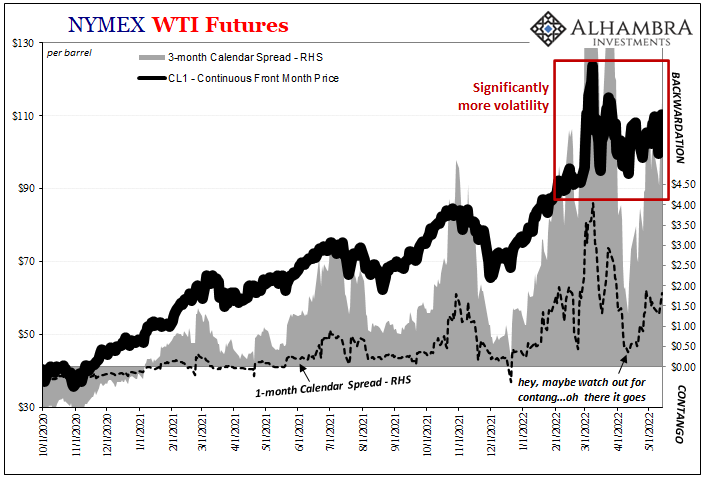

Crude Contradictions Therefore Uncertainty And Big Volatility

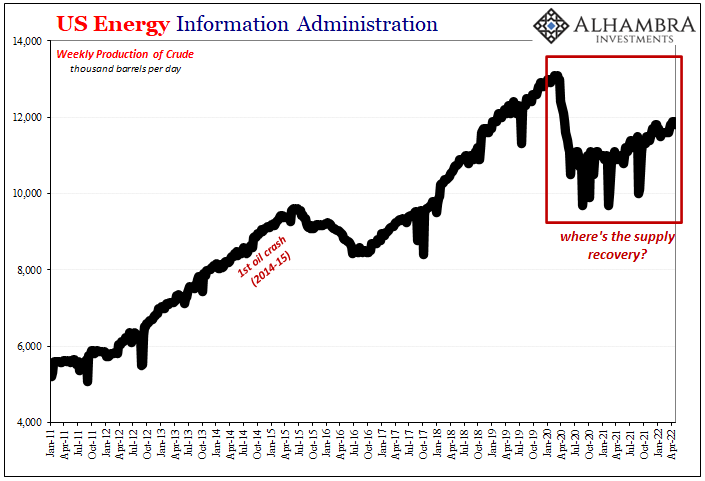

This one took some real, well, talent. It was late morning on April 11, the crude oil market was in some distress. The price was falling faster, already down sharply over just the preceding two weeks. Going from $115 per barrel to suddenly less than $95, there was some real fear there.But what really caught my attention was the flattening WTI futures curve.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

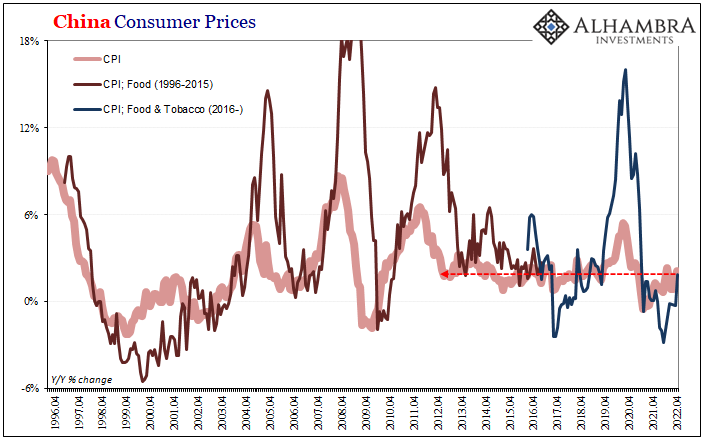

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

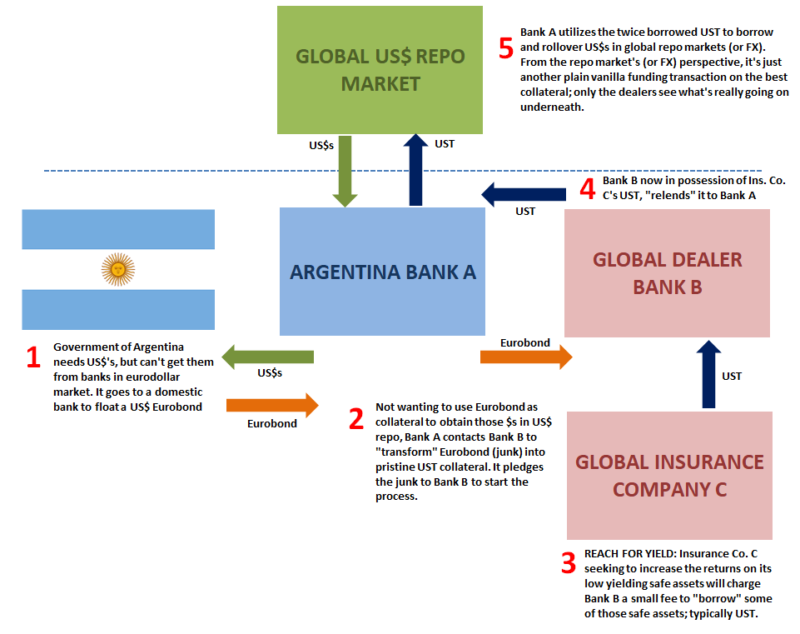

Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat.

Read More »

Read More »

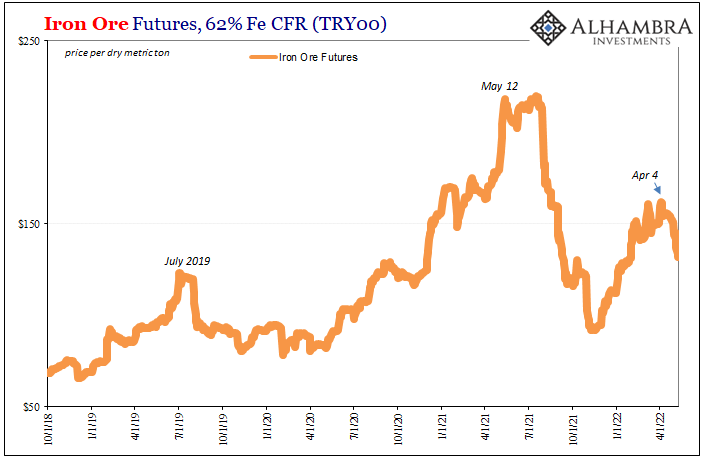

Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

Is Gold Starting to Behave Itself?

2022-05-14

by Stephen Flood

2022-05-14

Read More »