Tag Archive: economy

Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule.

Read More »

Read More »

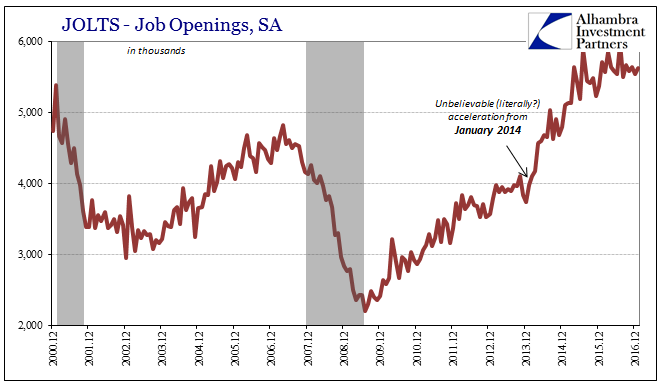

Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Read More »

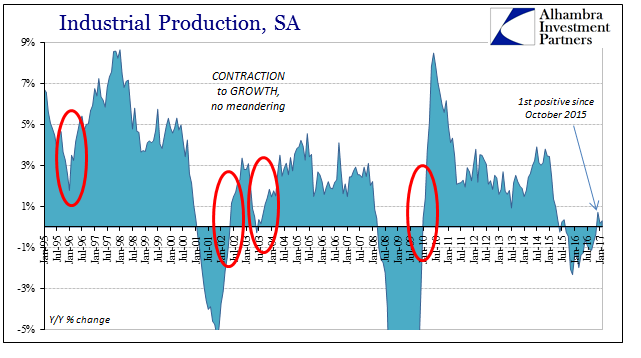

Industrial Symmetry

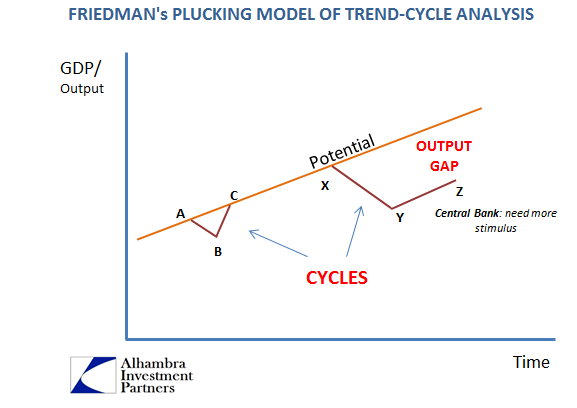

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking model theory he had first...

Read More »

Read More »

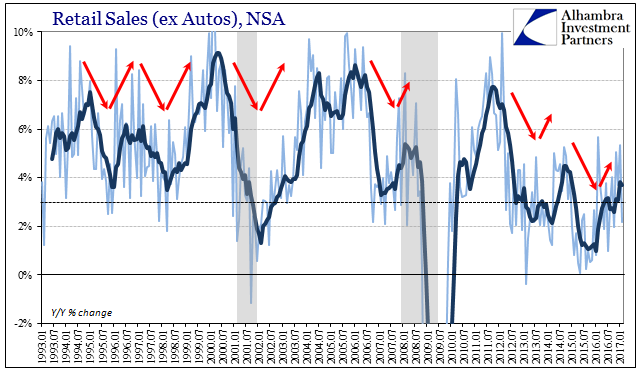

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

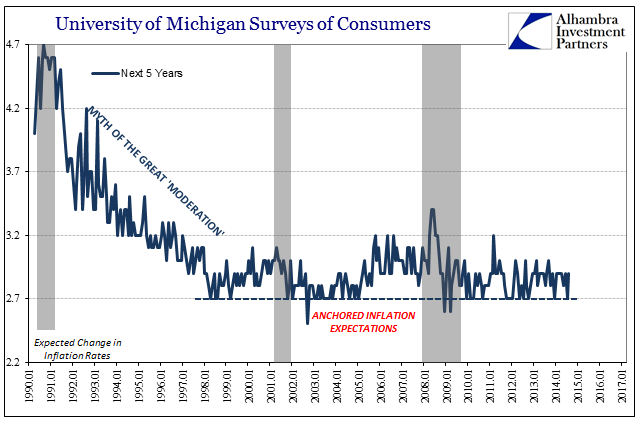

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

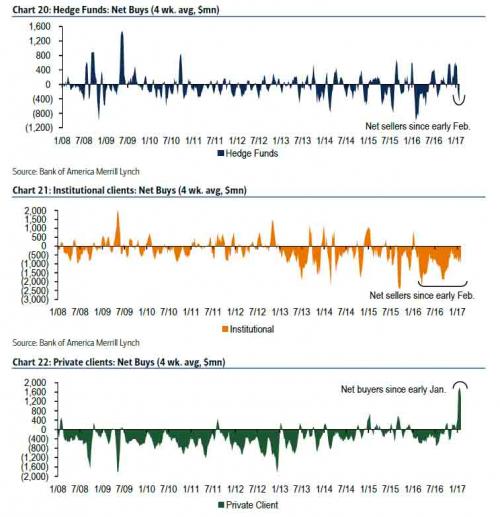

CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

Read More »

Read More »

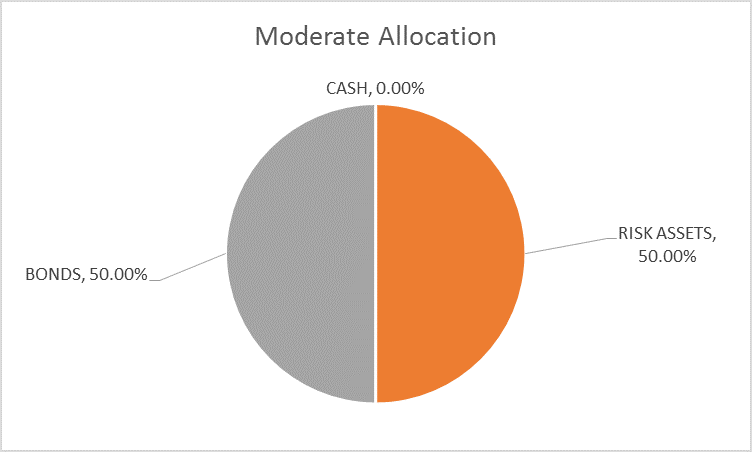

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

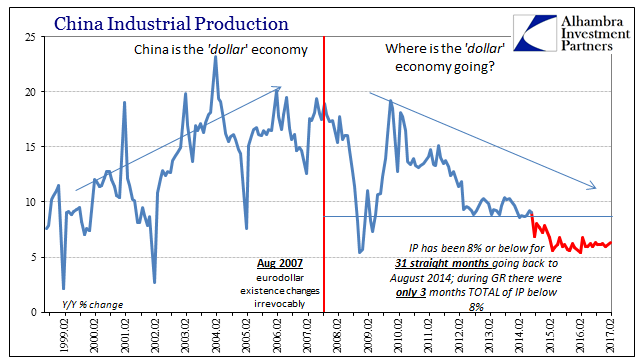

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »

Bi-Weekly Economic Review

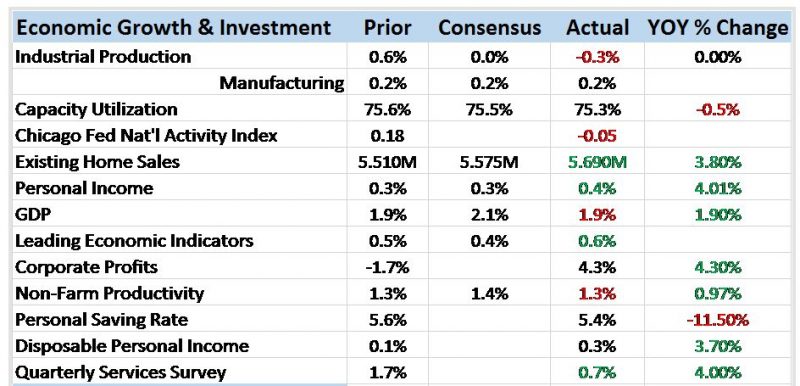

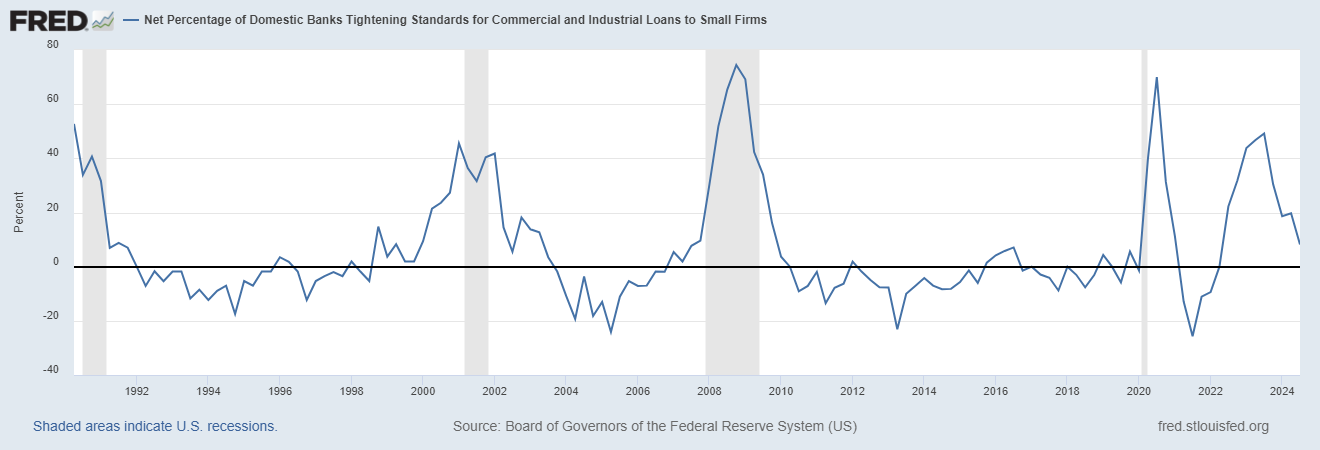

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Read More »

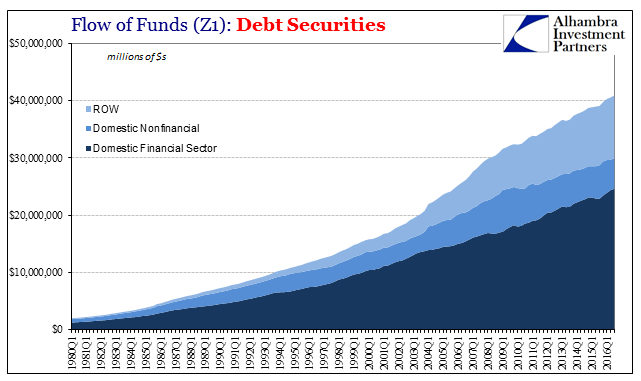

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

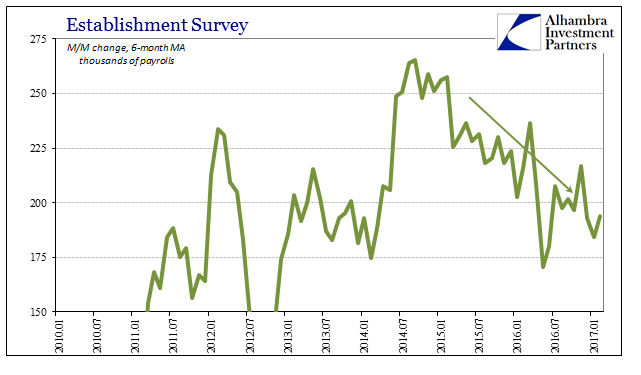

Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down...

Read More »

Read More »

Time, The Biggest Risk

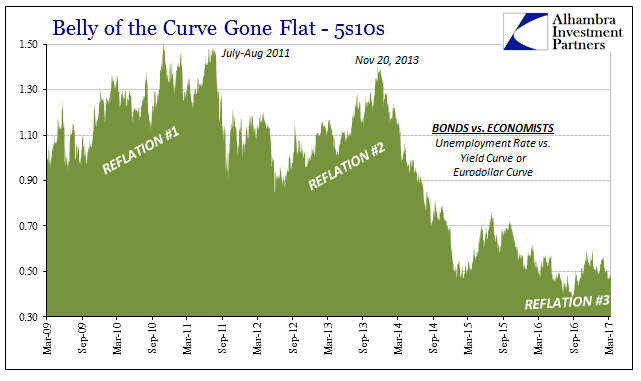

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the failures of QE’s 1 and 2. This...

Read More »

Read More »

No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression.

Read More »

Read More »

Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to some far off location nowhere...

Read More »

Read More »

US Trade Skews

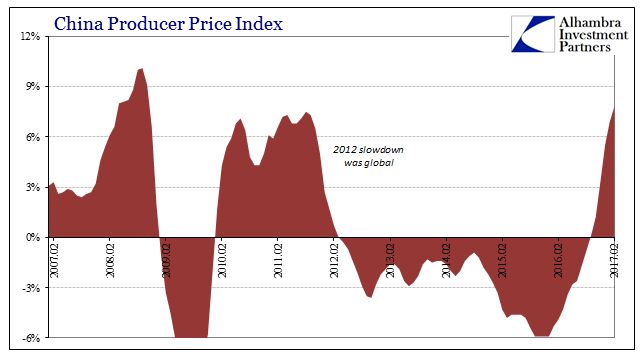

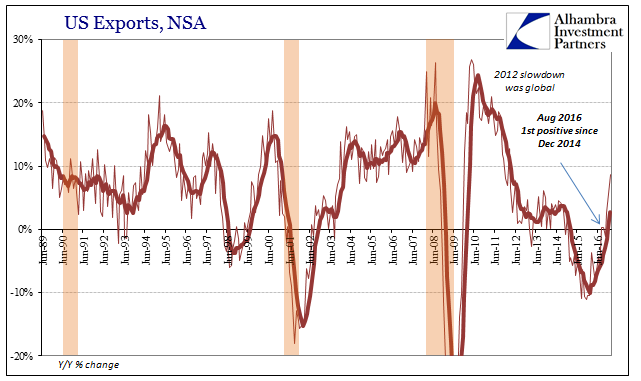

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it.

Read More »

Read More »

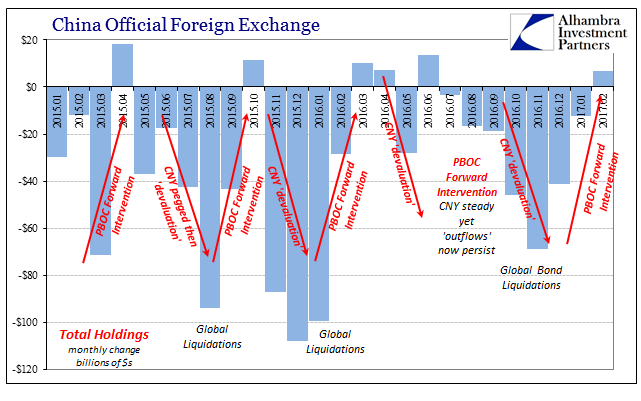

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

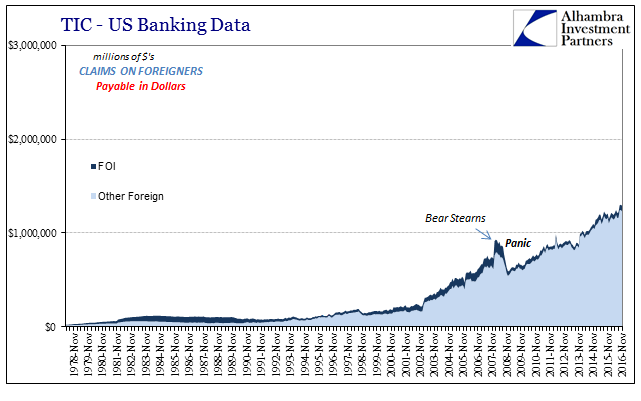

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

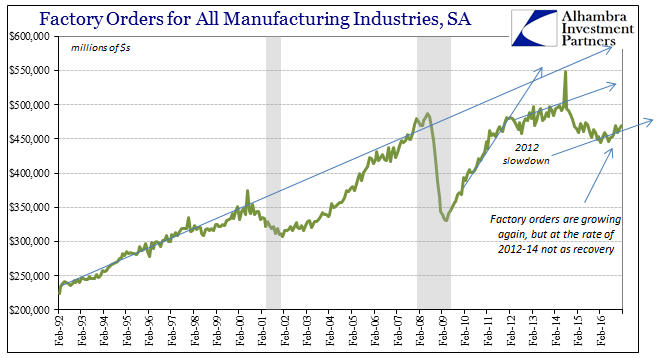

Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but.

Read More »

Read More »