Tag Archive: economy

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »

Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter.

Read More »

Read More »

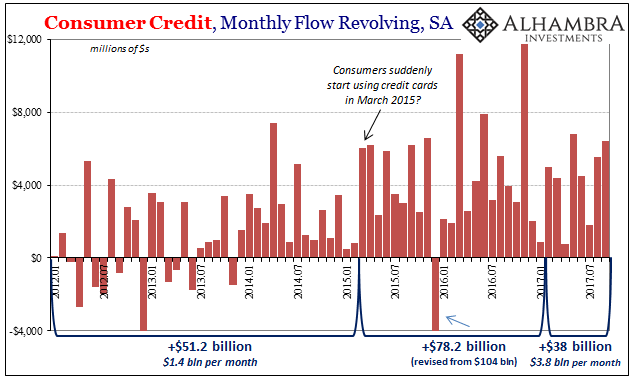

Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month.

Read More »

Read More »

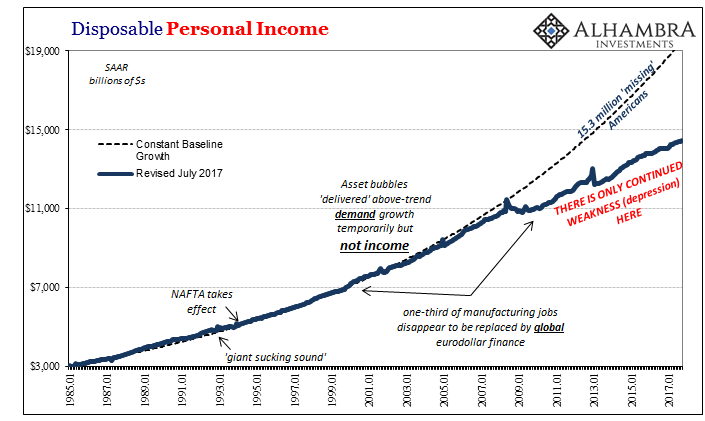

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »

Synchronized Global Not Quite Growth

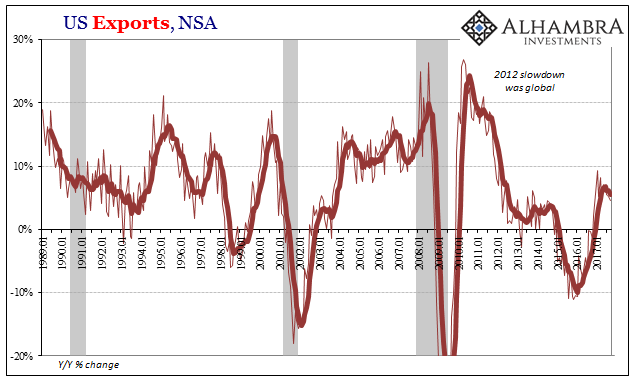

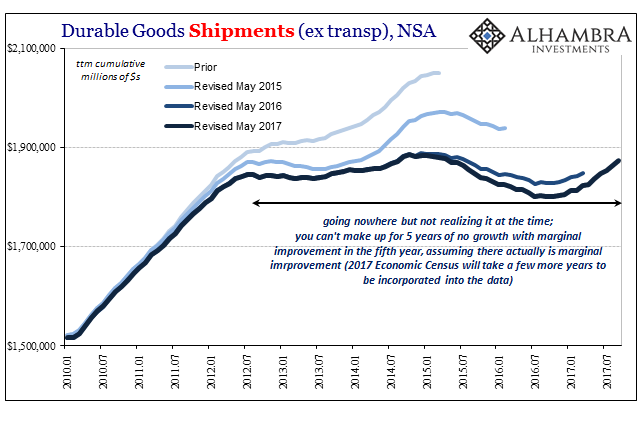

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

Four Point One

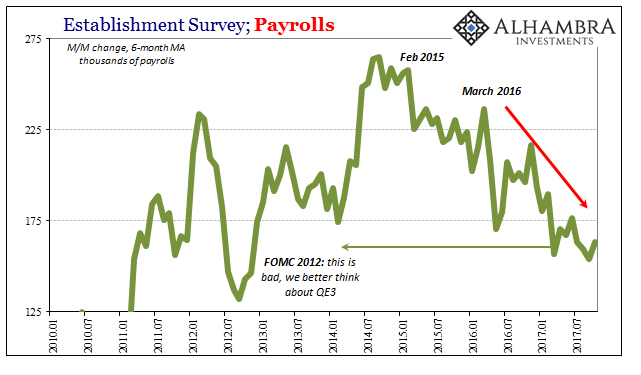

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

Bi-Weekly Economic Review: Gridlock & The Status Quo

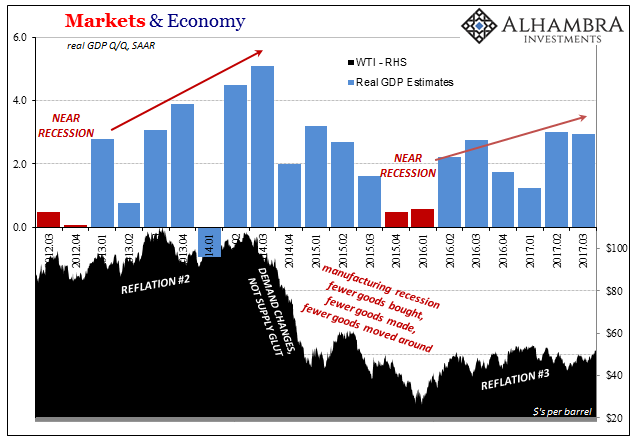

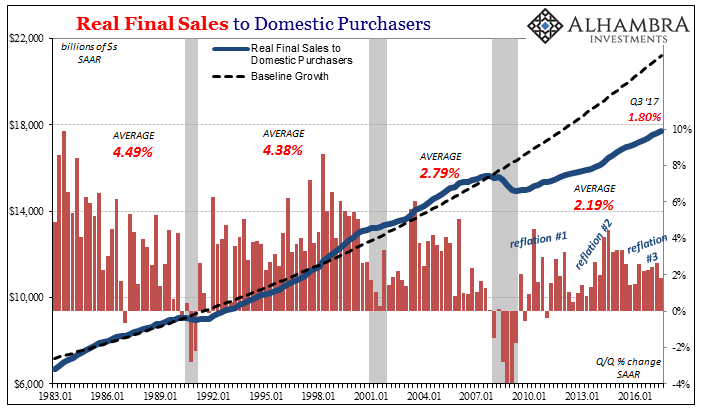

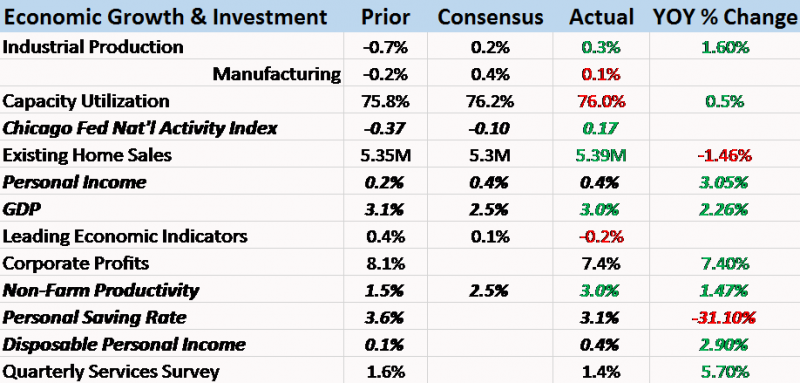

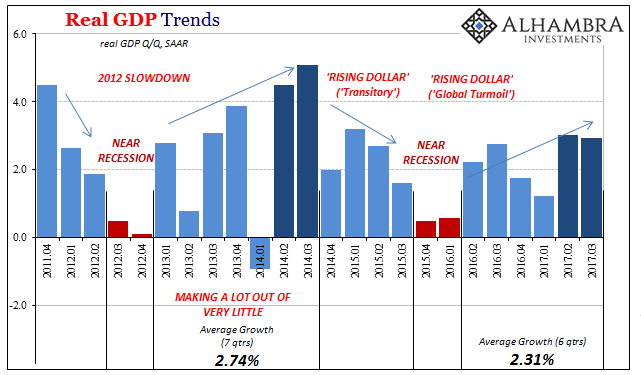

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »

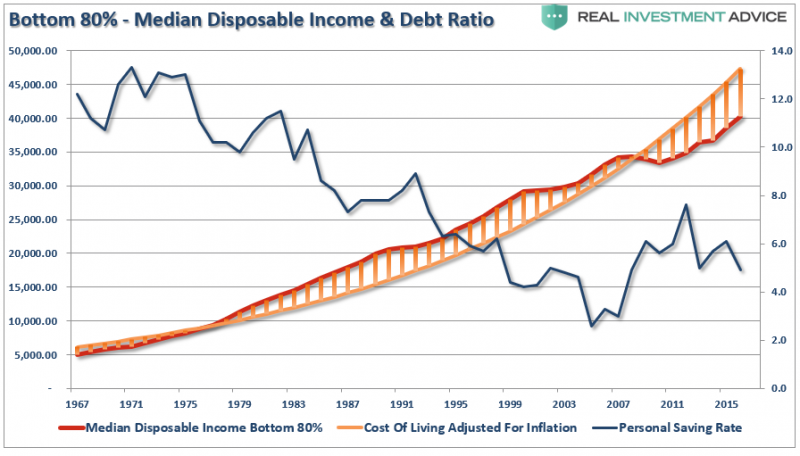

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

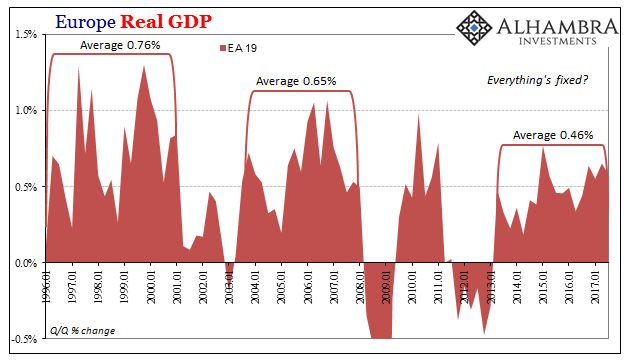

Europe Is Booming, Except It’s Not

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »

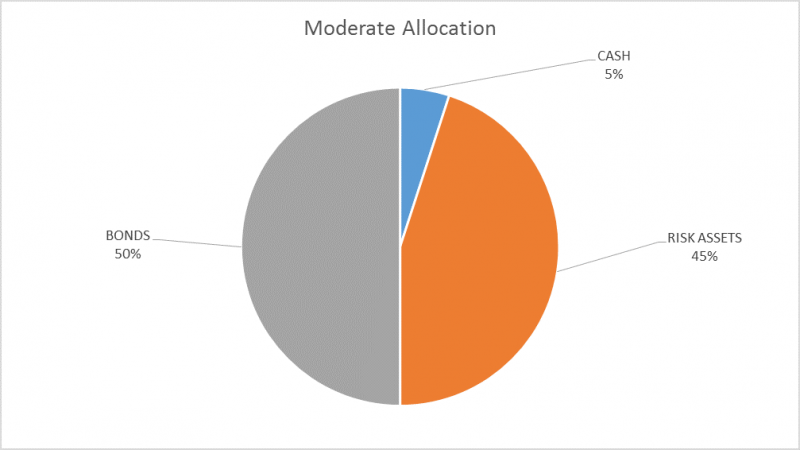

Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

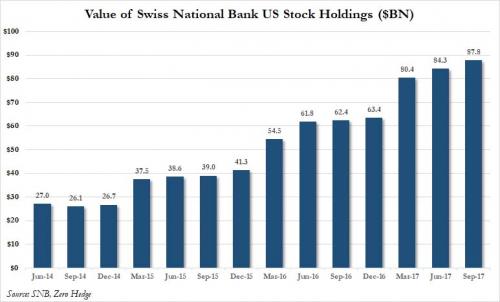

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

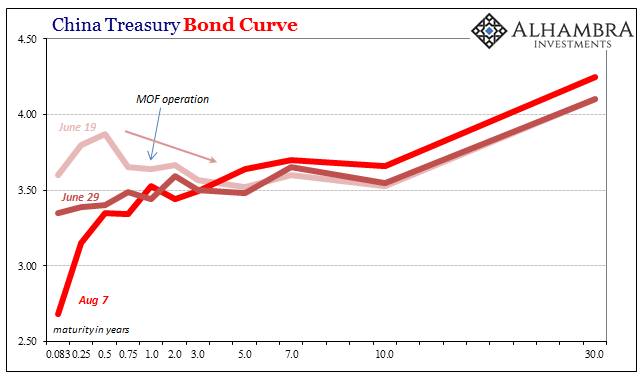

Bonds And Soft Chinese Data

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year.

Read More »

Read More »

The (Economic) Difference Between Stocks and Bonds

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average.

Read More »

Read More »

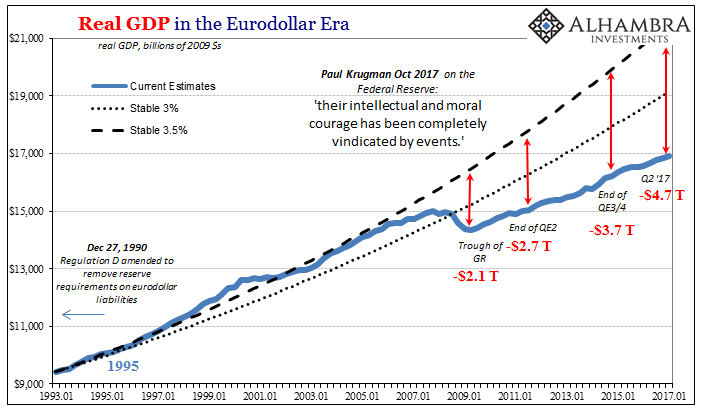

Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate.

Read More »

Read More »

Subject To Gradation

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

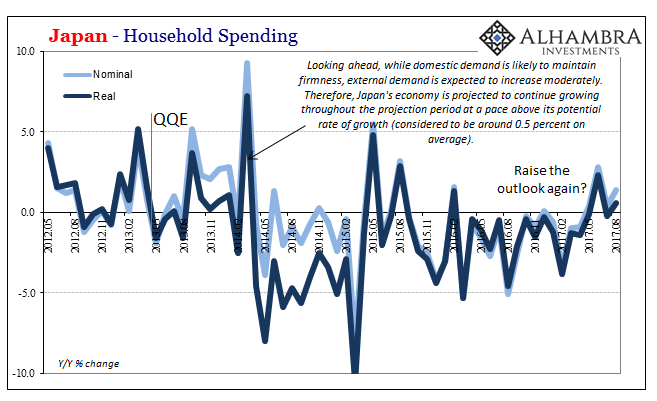

Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of investment research at SMBC Nikko...

Read More »

Read More »

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs....

Read More »

Read More »

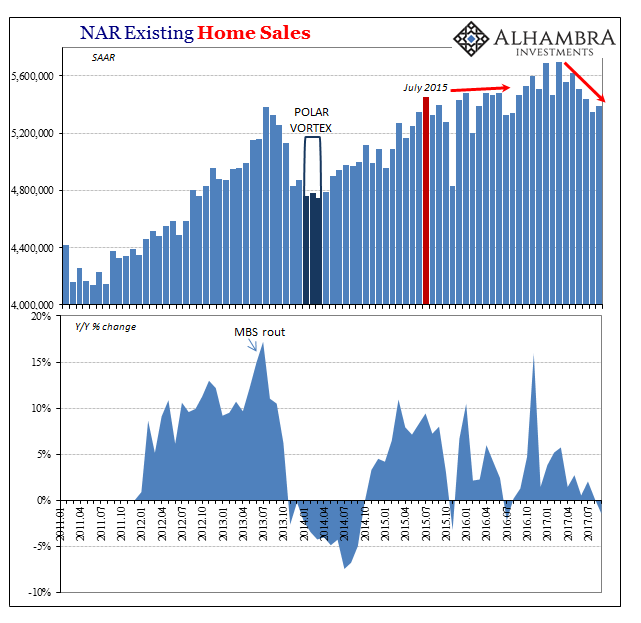

Housing Isn’t Just About Real Estate

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »