Tag Archive: economy

A High Price is a Good Price – Under the Right Conditions

Overpaying for something that could be found in a different store (or online), under the right circumstances, makes both parties happier. After looking around a bit, I asked the cashier at a nearby convenience store if he had any nine-volt batteries because I didn’t see any on the shelf. To my good fortune, he did. I asked for two of them and pulled a $5 bill out of my wallet as he rang them up.

Read More »

Read More »

Forex Trading to Beat Inflation? The Key Considerations

Inflation rates are continuing to rise across the globe, with the UK arguably leading this trend. More specifically, the UK inflation rate hit 10.7% in November, and while it dipped slightly from a peak of 11.1% in October, it remained considerably higher than the Bank of England’s target of 2%.

Read More »

Read More »

How To Design Corporate Budget For A Growing Company

The success of a business organization depends, to quite an extent, on the planning of resources. This planning keeps the business way above others. Budgeting, therefore, becomes a critical aspect of accounting. However, please keep in mind that financial planning in business is steeped in challenges because of the economic turmoil.

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: Happy Holidays

We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%.

Read More »

Read More »

Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed.

Read More »

Read More »

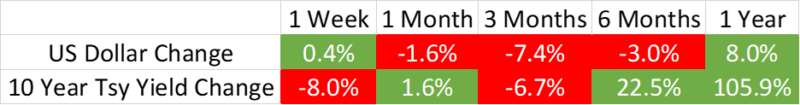

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

The Cleanest Dirty Shirt

It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy.

Read More »

Read More »

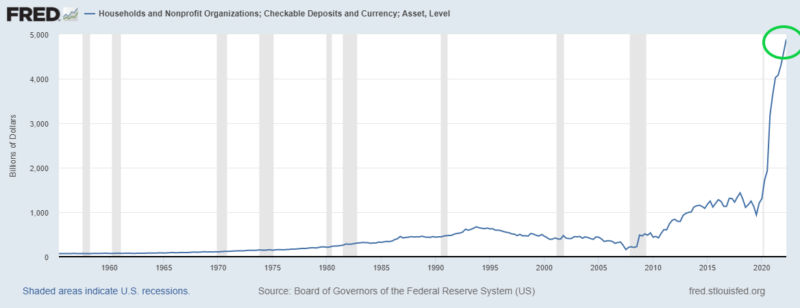

Powell’s Epiphany: There is No Free Lunch p2 Neutralizing the Money is Inflationary

Pandemic Wealth Effect. The top 1% of the US made about $14T or $4.2M per person. The next 19% made about $20T or $318,000 per person. The next 30% made about $5T or $50,000 per person. The bottom 50% made about $1T or $6,000 per person. The resulting inflation is at a 40yr high and Powell wants the money back.

Read More »

Read More »

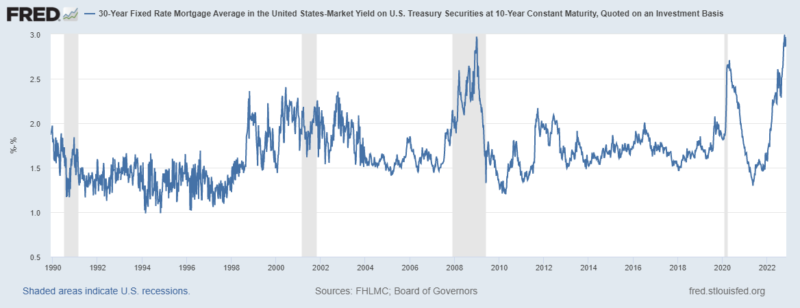

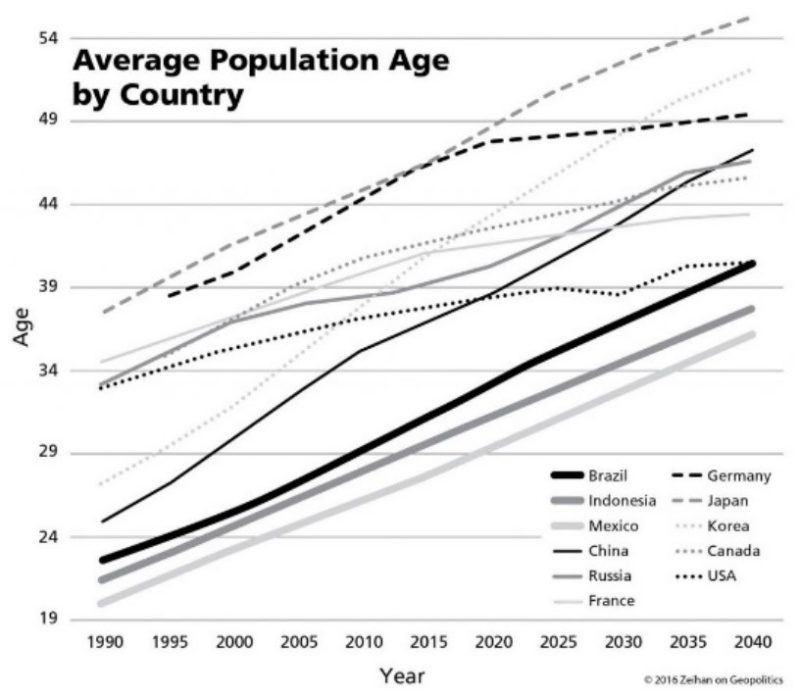

SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates.

Read More »

Read More »

Weekly Market Pulse: Did Powell Just Blink?

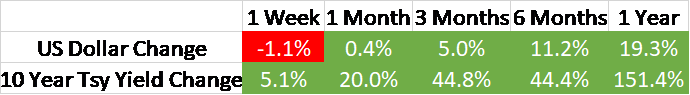

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close.

Read More »

Read More »

Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

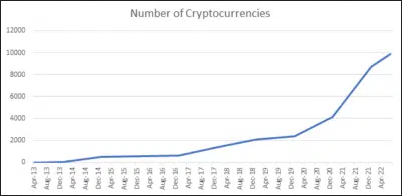

Crypto and the Environment

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result.

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Market Currents: Don’t Listen to Buy and Hold Investing Advice

For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now.

Read More »

Read More »

Market Currents: Impact of Fed Tightening on Home Prices

What impact does Fed tightening really have on home prices? Doug Terry, Alhambra’s Head of Investment Research, explains.

Read More »

Read More »

What happens if the debt ceiling raises

2023-01-20

by Stephen Flood

2023-01-20

Read More »