Tag Archive: ECB

FX Daily, July 12: Markets Adrift ahead of Key Events

The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc's resilience seen last week is carrying over.

Read More »

Read More »

Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week's economic events, which include June US CPI, retail sales, and industrial production, along with China's Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan.

Read More »

Read More »

FX Daily, June 16: Will the Fed Talk the Talk?

With the outcome of the FOMC meeting awaited, the dollar is narrowly mixed in quiet turnover. The Scandis are the weakest (~-0.3%) among the majors, while the Antipodeans are the strongest (~+0.25%). JP Morgan's Emerging Market Currency Index is snapping a three-day decline

Read More »

Read More »

FX Daily, June 10: ECB Meeting and US CPI: Transitory Impact

The ECB meeting and the US May CPI report is at hand. The US dollar is consolidating at a higher level against most of the major currencies. Softer than expected, inflation readings are weighing on the Scandis, which are bearing the brunt. The US 10-year yield closed below 1.50% for the first time in three months yesterday, and this may have helped underpin the Japanese yen.

Read More »

Read More »

FX Daily, May 28: The Yuan Extends Gains, While Sterling’s First Close above $1.42 in Three Years Goes for Nought

The recovery of the US 10-year yield, so it is flat on the week near 1.61% coupled with month-end demand, is helping the US dollar firm. While the yen is bearing the burden on the week, with a 0.8% loss, the Antipodeans are leading the downside on the day.

Read More »

Read More »

FX Daily, May 27: Narrow Ranges in FX Prevail Amid Month-End Considerations

Dollar demand linked to the month-end gave the greenback a bit of a reprieve, helped by firmer bond yields. Some momentum players may have been forced out of the euro and yen when the $1.22 and JPY109 levels yielded. However, follow-through dollar buying has been limited, and it has come back a little softer but broadly so.

Read More »

Read More »

FX Daily, May 13: Long Lost Bond Vigilantes Sighted, Gives Dollar Fillip

It is as if the bond vigilantes were pushed too far. US inflation is accelerating more than expected, and it cannot all be attributed to the base effect, and the Federal Reserve, to many investors, is tone-deaf. With powerful fiscal stimulus, nominal growth above 10%, and the economy re-opening, albeit unevenly, does the monetary accelerator need to be fully engaged?

Read More »

Read More »

FX Daily, April 28: Biden and Powell are Center Stage

Overview: It appears that the backing up of US yields is giving the dollar a better tone and challenging the Eurosystem, which has stepped up its bond purchases. The US 10-year yield is around 1.65%, roughly a two-week high and back above the 20-day moving average.

Read More »

Read More »

FX Daily, April 23: Greenback Slips into the Weekend

Overview: Many narratives link the prospect of higher capital gains tax on about a third of 1% of Americans as the catalyst for losses in US equities yesterday (and Bitcoin) and weakness in some global shares today. Of the large markets in the Asia Pacific region, only Japan, which is reimposing a formal emergency in Tokyo, Osaka, and two other prefectures, fell.

Read More »

Read More »

FX Daily, March 11: Risk Extends Gains Ahead of the ECB

Overview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite's 2.35% gain not only snaps a five-session slide but is the largest rally since last October.

Read More »

Read More »

FX Daily, March 10: Markets are not Yet Convinced that Yesterday’s Move Signaled a Trend Change

Fear that yesterday's reversals represent little more than one-day wonders is contributing to the overall consolidative tone today. Most equity markets in the Asia Pacific region and Europe edged higher. China's stocks tumbled yesterday, despite reports of official assistance, were mixed with the Shanghai Composite posting small gain and Shenzhen a small loss.

Read More »

Read More »

FX Daily, March 2: The Dollar Finds Better Footing

Overview: A warning from China's top banking regulator about the frothiness of foreign markets appeared to blunt the knock-on effect of yesterday's largest rise in the S&P 500 since last June (~2.4%) and weighed on global equities. The large markets in the Asia Pacific region but India and South Korea fell.

Read More »

Read More »

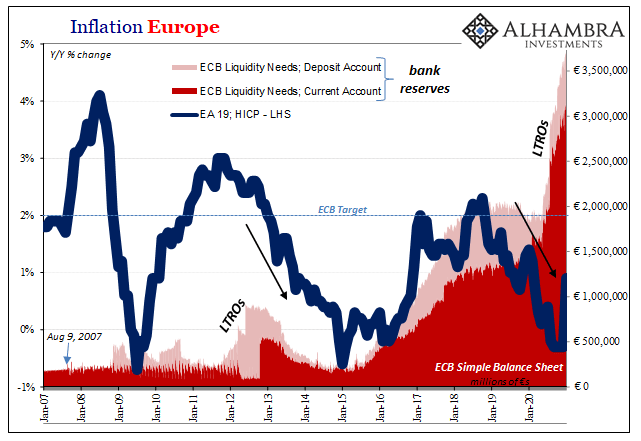

Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona.Whereas Draghi spent those years howling for inflationary conditions...

Read More »

Read More »

FX Daily, January 29: Please Stay Seated, the Ride is not Over

Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week's loss to 2.5% to 5.5% throughout the region. Europe's Dow Jones Stoxx 600 is a little more than 1% lower on the day.

Read More »

Read More »

FX Daily, January 22: Faltering Friday

Fear that social restrictions may have to be broadened and extended is helping spur a wave of profit-taking and de-risking, which has also been encouraged by disappointingly high-frequency data. The equity rally seemed to falter a bit in the US, as the S&P 500 eked out a minor 0.03% gain yesterday.

Read More »

Read More »

FX Daily, January 21: It is the ECB’s Turn but Little New to be Said or Done

Overview: The S&P 500 and NASDAQ gapped higher yesterday to record-levels, and the reflation theme lifted Asia Pacific shares for the third session today. South Korea, Taiwan, and China led the advance.

Read More »

Read More »

FX Daily, January 11: Greenback Extends Recovery

Julius Ceasar is said to have "crossed the Rubicon" on January 10, 49 BCE, taking the 13th Legion into Rome, defying orders from the Senate, and precipitating the Roman Civil Wat that marked the end of the republic and the birth of the empire.

Read More »

Read More »

FX Daily, December 11: Brexit Fears Weigh on Sterling

Overview: The odds of a UK-EU agreement and new stimulus before year-end in the US have faded and are sapping risk appetites ahead of the weekend. Although most Asia Pacific equity markets gained, China and Australia were notable exceptions, European shares are heavy, and the Dow Jones Stoxx 600 is near three-week lows.

Read More »

Read More »

FX Daily, December 10: Brexit and US Stimulus are Unresolved as Attention Turns to the ECB

Overview: US threats to break-up Facebook and the stalled stimulus talks spurred profit-taking in US shares yesterday and is dampening enthusiasm today. The MSCI Asia Pacific Index fell for the third time this week, and Europe's Dow Jones Stoxx 600 is little changed.

Read More »

Read More »

FX Daily, November 30: Equities are Heavy and the Dollar Softer to Start New Week

Overview: Month-end profit-taking saw Asia Pacific shares tumble earlier today. Most markets are off 1-2.5% today after the MSCI Asia Pacific Index rose 2.25% last week. European shares are mixed, but little changed. US shares are also trading lower.

Read More »

Read More »