Tag Archive: ECB

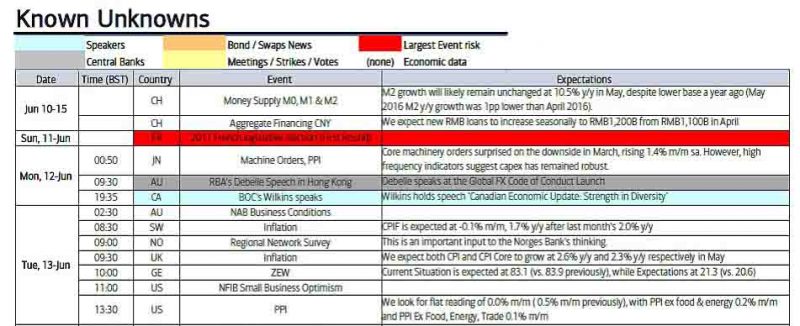

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Merkel Sends Euro Higher

Markel said the euro was too weak, so it rallied. This is not a new position for Germany. Merkel may now tack to the left since the AfD appears to have been dispatched. Look for Weidmann to begin moderating views or becoming less antagonistic.

Read More »

Read More »

Euro Drivers

Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »

Draghi Does Nothing and Talks about It

Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path.

Read More »

Read More »

FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

The US dollar was marked down in response to the French election and saw some follow through selling yesterday, but the momentum had slowed, and now it is stalled. The greenback is posting upticks against nearly all the major currencies. There is a good reason to be cautious.

Read More »

Read More »

Ultra-Loose Terminology, Not Policy

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction.

Read More »

Read More »

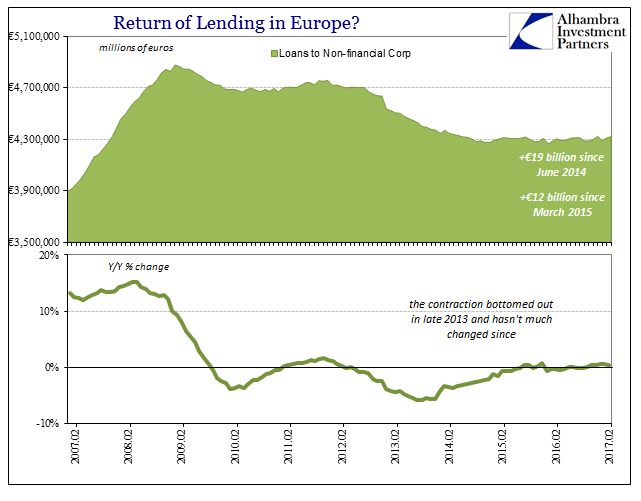

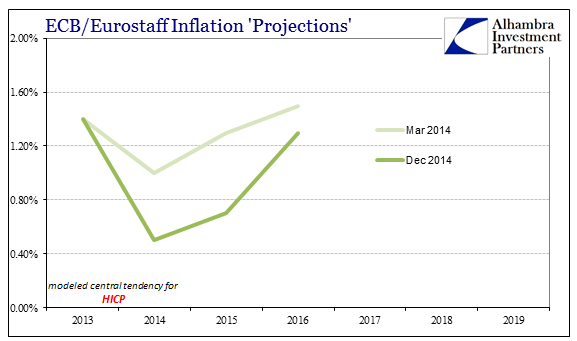

Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

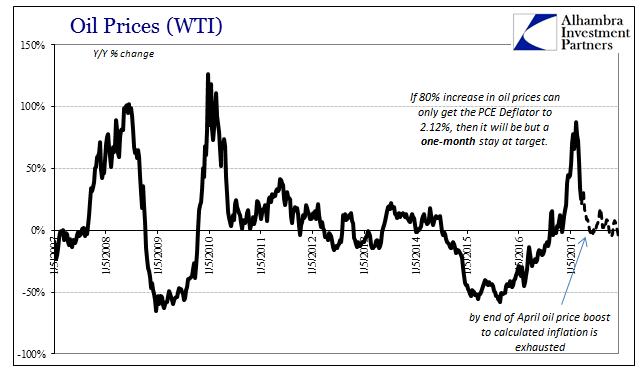

The Power of Oil

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once.

Read More »

Read More »

FX Daily, March 17: Dollar Remains Heavy

The dollar is softer against most of the major currencies to cap a poor weekly performance. The Dollar Index is posting what may be its biggest weekly loss since last November. The combination of the Federal Reserve not signaling an acceleration of normalization, while the market remains profoundly skeptical of even its current indications, and perceptions that the ECB and BOE can raise earlier than anticipated weighed on the dollar. The PBOC...

Read More »

Read More »

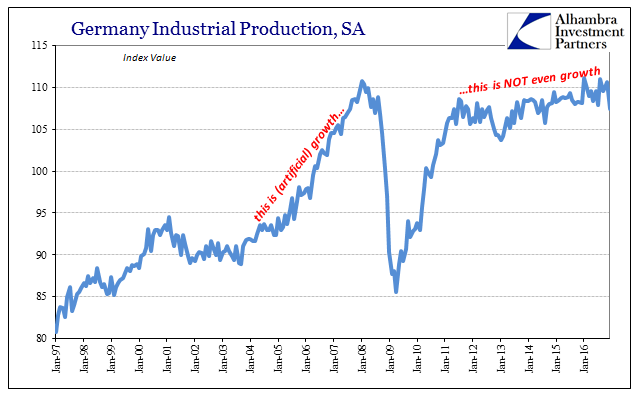

Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

Draghi Lets Steam out of Euro

US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration.

Read More »

Read More »

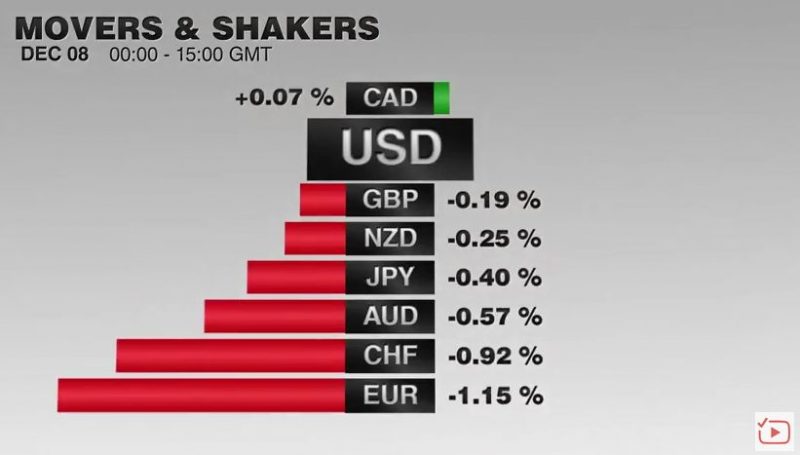

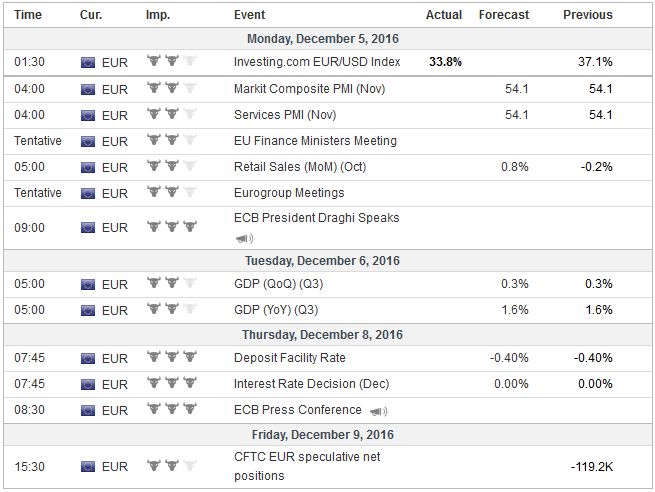

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

ECB: Dovish Taper or Hawkish Ease?

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

Cool Video: Discussing the ECB on Bloomberg TV

Tired of reading what analysts are saying? Here is a 4.3 minute video clip of my discussion earlier today on Bloomberg TV about the outlook for tomorrow's ECB meeting. The discussion covers various aspects of the ECB's decision.

Read More »

Read More »

ECB and the Future of QE

ECB will likely extend asset purchases in full. It may modify the rules by which it buys securities. It may adjust the rules of engagement for its securities lending program.

Read More »

Read More »

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »