Tag Archive: ECB

Merkel, European Autonomy, and the ECB

Merkel has again shown herself to be more wily than most. While pundits, investors, and politicians anticipated she would push hard for a German to replace Draghi as ECB President when his term ends next October. After all, it is German's turn at the helm, and its interests were ridden roughshod over by the extraordinary and prolonged monetary policy.

Read More »

Read More »

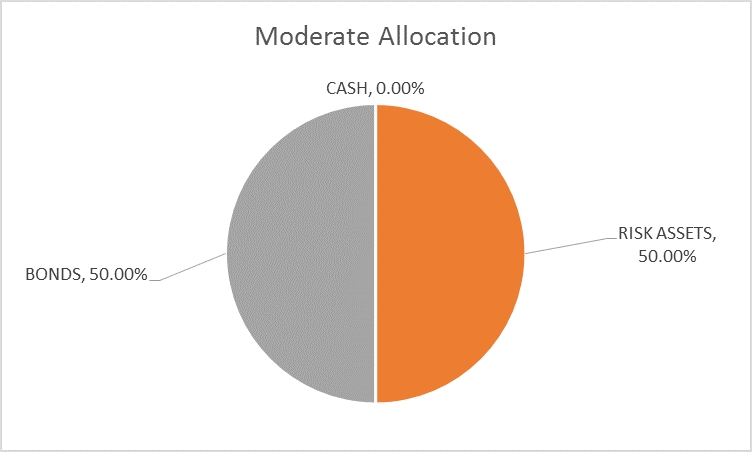

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

The markets generated a collective sigh when Juncker and Trump announced that there would be no new tariffs while new trade negotiations took place. This was particularly important because Trump reportedly wanted to press ahead with a 25% tariff on car imports. It was also announced that the EU would buy more soy and liquid natural gas from the US.

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

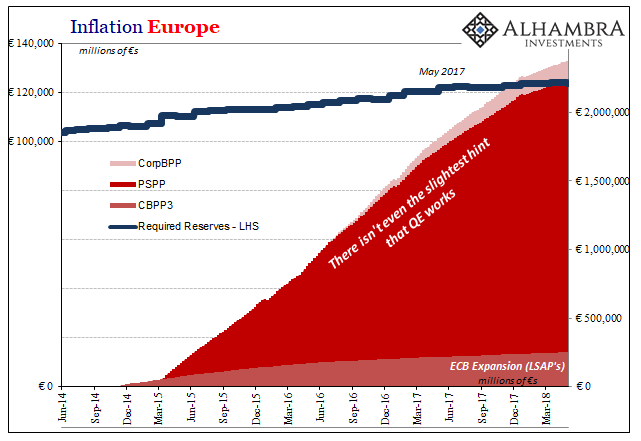

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

FX Weekly Preview: Next Week in Context

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back.

Read More »

Read More »

Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year's election, the central bank's mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat.

Read More »

Read More »

FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the...

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September's election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD public support has waned,...

Read More »

Read More »

FX Weekly Preview: Four Key Numbers in the Week Ahead

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four "numbers" that can illuminate the path ahead.

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

Initial Thoughts on Draghi

ECB President Draghi was unable to arrest the US dollar's slide and euro's surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar's slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy.

Read More »

Read More »

FX Daily, January 25: And Now, a Word from Draghi

With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events for Mr. Draghi, the President of the European Central Bank.

Read More »

Read More »

FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

Cool Video: Bloomberg TV Clip on Central Banks

I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%.

Read More »

Read More »

FX Weekly Preview: FOMC and ECB Highlight Central Banks’ Last Meetings of the Year

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan's latest Tankan business survey will be released.

Read More »

Read More »

FX Weekly Preview: Another Week that is Not about the Data

The contours of the investment climate are unlikely to change based on next week's economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors. Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down.

Read More »

Read More »

Europe Is Booming, Except It’s Not

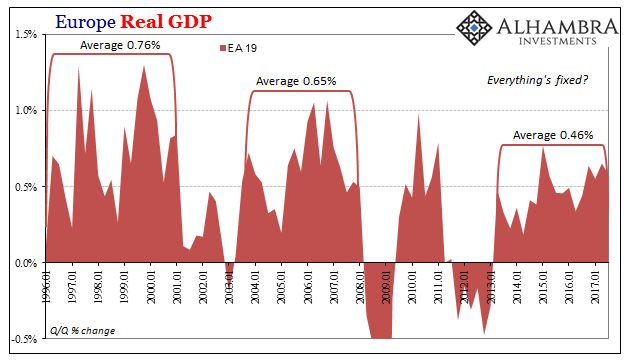

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »

FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are diverging the most since the late 1990s and...

Read More »

Read More »