Tag Archive: ECB

FX Weekly Preview: The Week Ahead

The combination of the dovish hold by the Federal Reserve and the eurozone's miserable flash Purchasing Managers Index casts a pall over the economic outlook. Japan's flash PMI remained stuck at February's 48.9, while core inflation unexpectedly eased. Three months after the European Central Bank stopped buying bonds, the German 10-year Bund yield fell below zero for the first time since 2016.

Read More »

Read More »

FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident.

Read More »

Read More »

Not Buying The New Stimulus

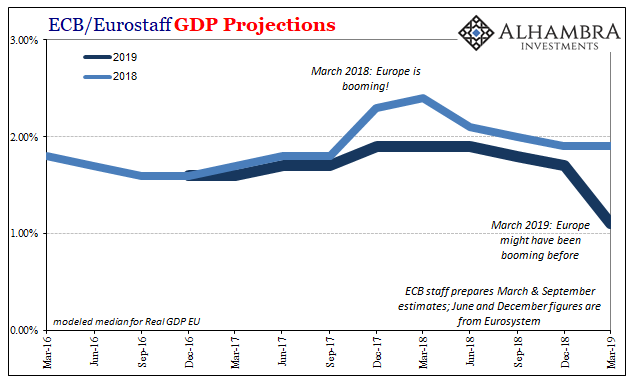

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates.

Read More »

Read More »

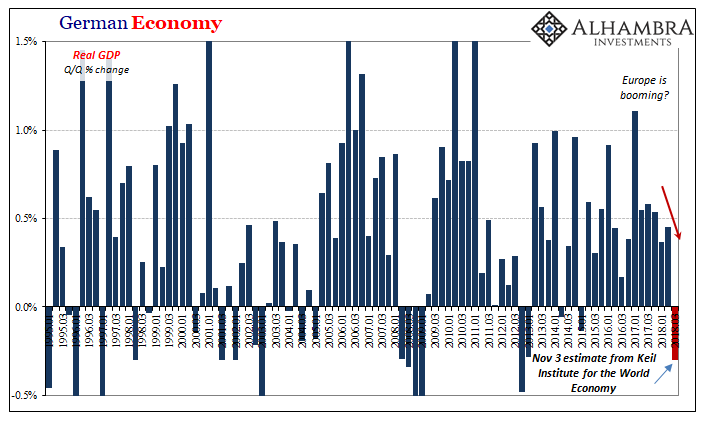

Thoughts about the ECB and Euro

Mario Draghi's term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered.

Read More »

Read More »

FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive.

Read More »

Read More »

It’s Not That There Might Be One, It’s That There Might Be Another One

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality.

Read More »

Read More »

FX Weekly Preview: Divergence Reinvigorated

Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling's gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December.

Read More »

Read More »

ECB Preview: Worries Increase but Not Quite Ready to Act

The ECB meets Thursday, and it may be best conceived as a transition meeting. It will lay the rhetorical groundwork for two things: a likely downgrade to the staff's growth forecasts and moving toward a new round of long-term loans (targeted long-term refinance operations).

Read More »

Read More »

European Central Bank likely to stick to script

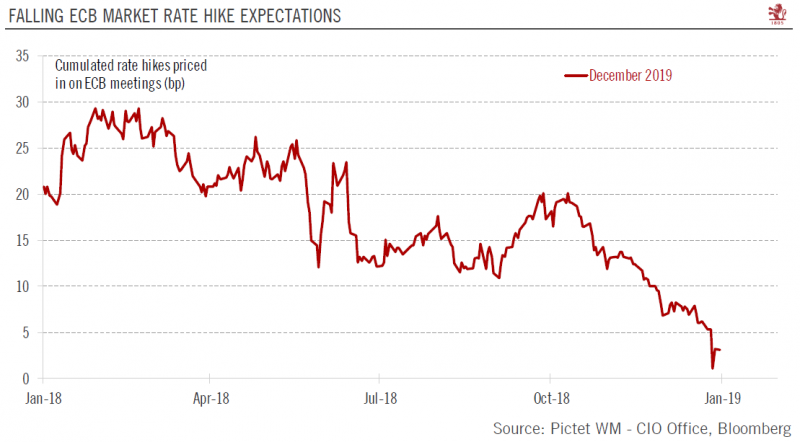

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside.

Read More »

Read More »

That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention.

Read More »

Read More »

Two Takeaways from ECB Record

The record of the ECB's December meeting was released, and there are two takeaways. The first is that officials may have been more concerned with the deteriorating situation than they let on at the time. Apparently, paring near-term growth forecasts was seen as a sufficient signal that risks were increasing. This allowed Draghi to maintain the "broadly balanced" risk assessment.

Read More »

Read More »

Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January 2017-February 2018 rally.

Read More »

Read More »

Core Euro Sovereign Bonds 2019 Outlook

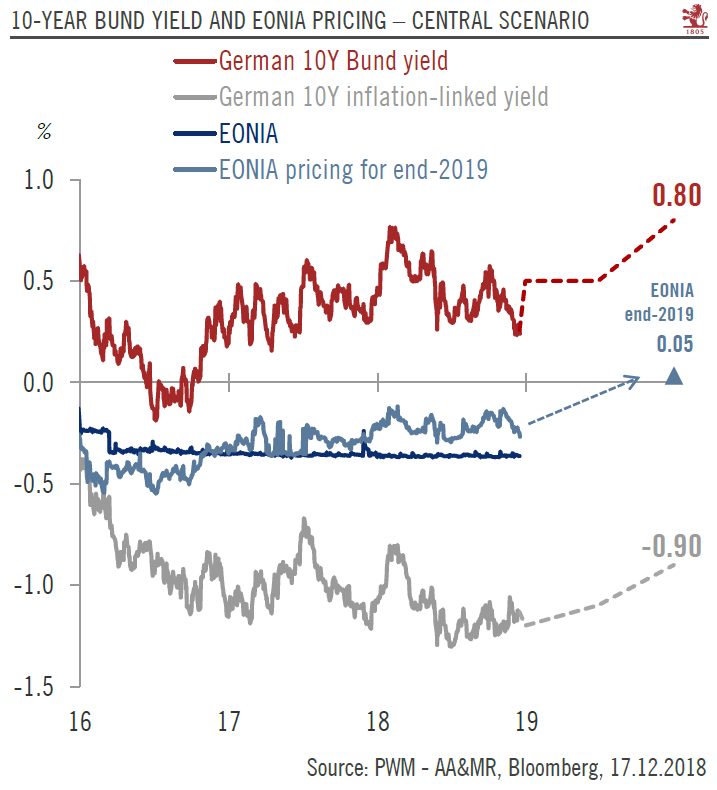

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

Read More »

Read More »

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced.

Read More »

Read More »

FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi's testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and the steel and aluminum...

Read More »

Read More »

Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death.

Read More »

Read More »

FX Daily, October 25: ECB Overshadowed by Equity Market Drama

The Dollar Index broke above 96.00 yesterday and is consolidating today. Provided the 96.00 area holds, the next target is the year's high near 97.00. The euro has been confined to a little more than a quarter of a cent. Players seem reluctant to sell it below $1.14 and note there is a 570 mln euro option at $1.1420 that expires today.

Read More »

Read More »

FX Weekly Preview: What Can Bite You This Week?

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets.

Read More »

Read More »

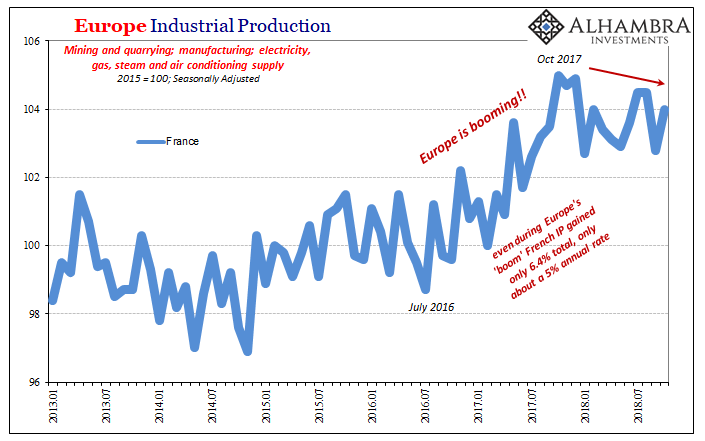

Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

Read More »

Read More »