Tag Archive: developed markets

Drivers for the Week Ahead

President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate.

Read More »

Read More »

Drivers for the Week Ahead

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday.

Read More »

Read More »

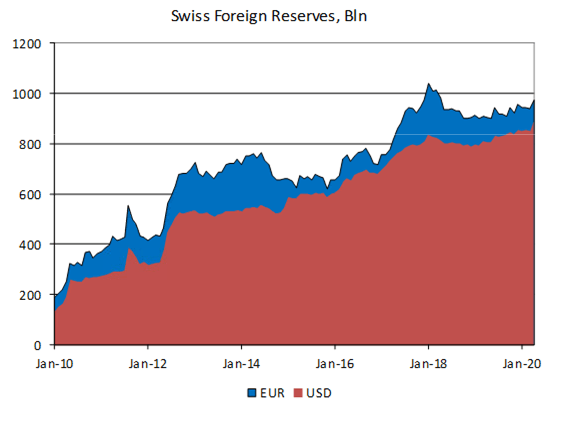

Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report named Switzerland and Vietnam as currency manipulators. Both countries came under scrutiny in the last report and so this week’s announcement was only surprising in that it was made by a lame duck administration that will be gone in a month.

Read More »

Read More »

FOMC Preview

The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months.

Read More »

Read More »

Drivers for the Week Ahead

The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important.

Read More »

Read More »

Drivers for the Week Ahead

Dollar weakness has resumed. This will be a very important data week for the US and the highlight will be November jobs data Friday; we will also get some important manufacturing readings for November; the Fed releases its Beige Book report for the December FOMC meeting Wednesday; Canada also has a busy week.

Read More »

Read More »

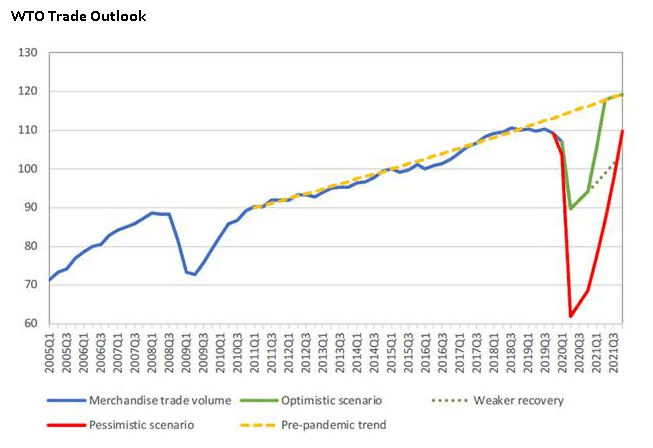

Roadblocks and Opportunities for International Trade in 2021

We see significant upside risk for global trade coming from “top down” forces (such as politics), but at the same time we expect the undercurrent reconfiguring many of the existing relationships to intensify. The “Peak Globalization” narrative (at least regarding trade) is being challenged by hopes of a revival of multilateral cooperation under Biden and the latest Asian trade agreement.

Read More »

Read More »

Drivers for the Week Ahead

The virus numbers in the US show no signs of slowing; the dollar should continue to soften. October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors.

Read More »

Read More »

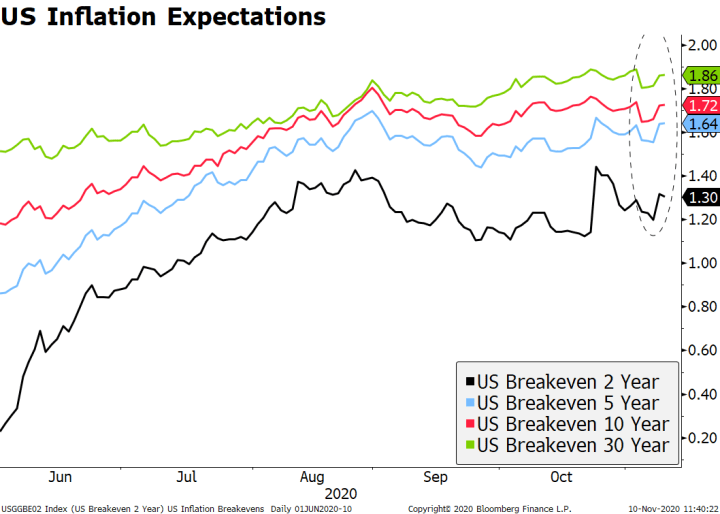

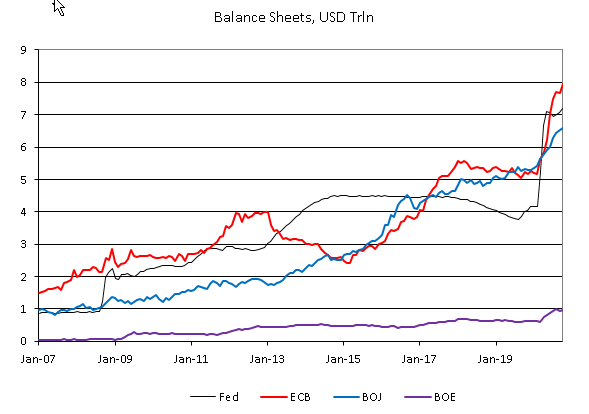

Vaccine and Split Government

The interplay of a vaccine-driven reflation rally and the (likely) split government in the US are emerging as the driving themes for markets in the months ahead. We think reflation will win out in the end, but it could manifest itself differently this time around.

Read More »

Read More »

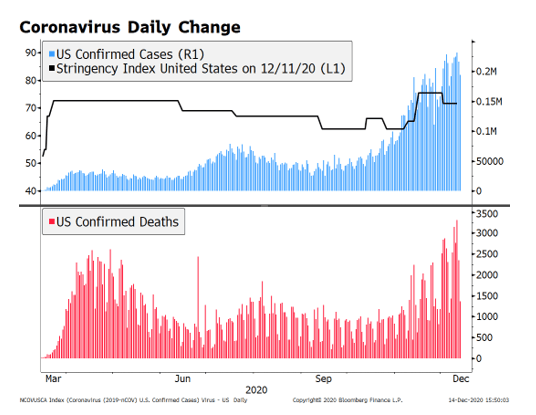

FOMC Preview: Coronavirus Daily Change

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4.

Read More »

Read More »

ECB Preview

The ECB meets Thursday and is widely expected to stand pat until the next meeting. Macro forecasts won’t be updated until the December 10 meeting, but the bank will have to acknowledge the deteriorating outlook now.

Read More »

Read More »

Drivers for the Week Ahead

Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week. Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday.

Read More »

Read More »

Drivers for the Week Ahead

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday. A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week.

Read More »

Read More »

Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling. This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers.

Read More »

Read More »

ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions.

Read More »

Read More »

Drivers for the Week Ahead

The dollar is likely to remain under pressure after Powell’s dovish message at Jackson Hole. August jobs data Friday will be the data highlight of the week. The Fed releases its Beige Book report Wednesday; Powell will face many questions about the Framework Review that he unveiled at Jackson Hole.

Read More »

Read More »

Where Has All the Carry Gone?

Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover.

Read More »

Read More »

Recent Trade Developments Suggest Some Caution Ahead Warranted

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities.

Read More »

Read More »

Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday. The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week.

Read More »

Read More »

SNB Preview

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB.

Read More »

Read More »