Tag Archive: debt

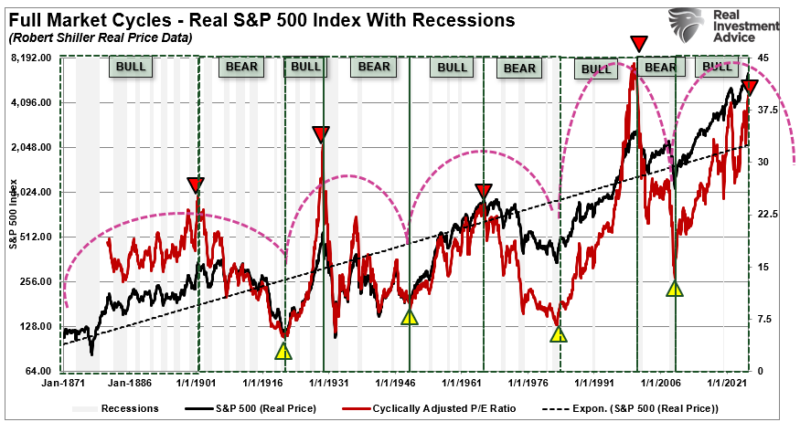

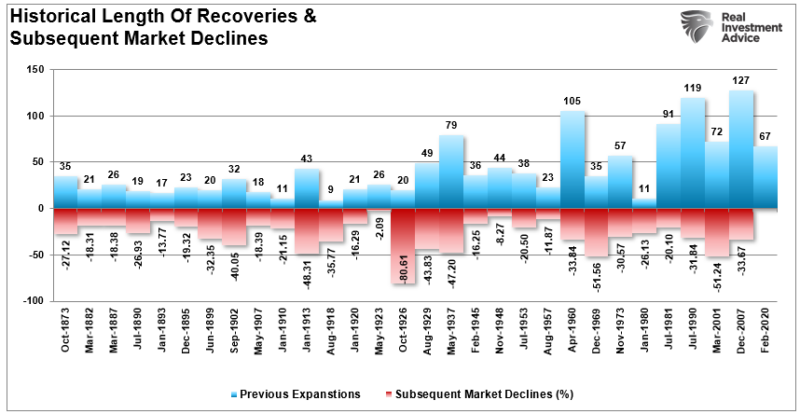

Full Market Cycles: Half Bull and Half Bear

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

Forward Return And The Importance Of Math

During strongly trending bull markets, investors often overlook the importance of math in predicting forward returns. Such is easy to do when the market just seemingly continues to rise without regard to fundamentals. The current environment is also heavily influenced by the impact of "passive indexing," which has distorted market dynamics as well. However, none …

Read More »

Read More »

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

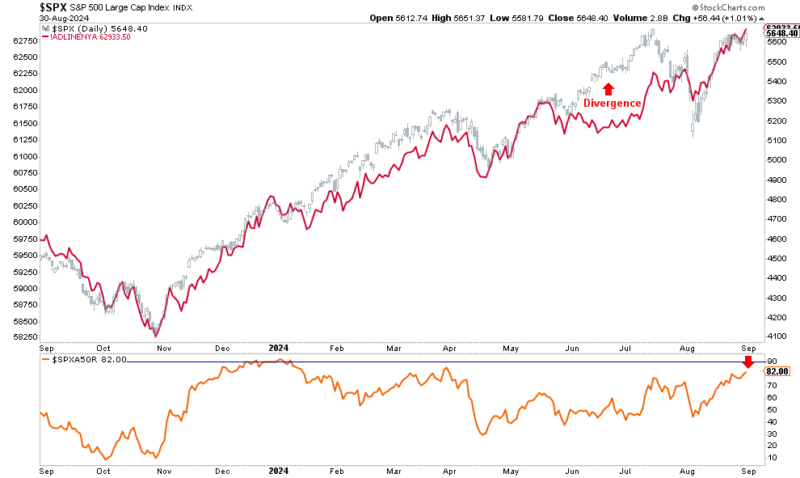

S&P 500 – A Bullish And Bearish Analysis

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

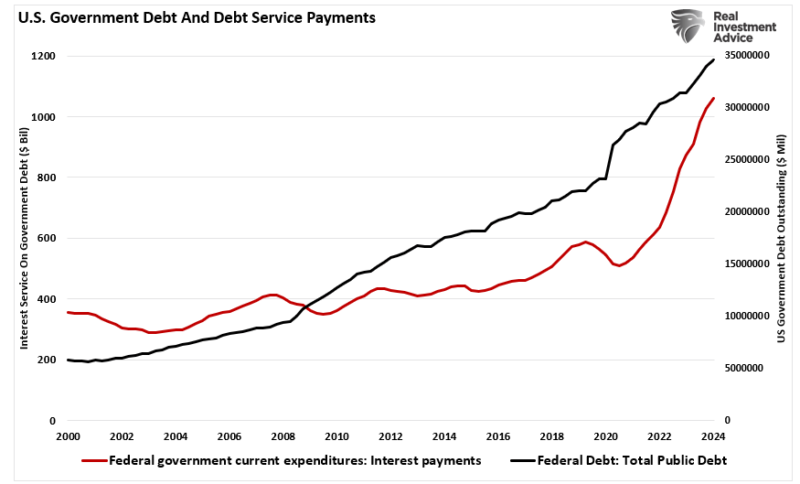

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

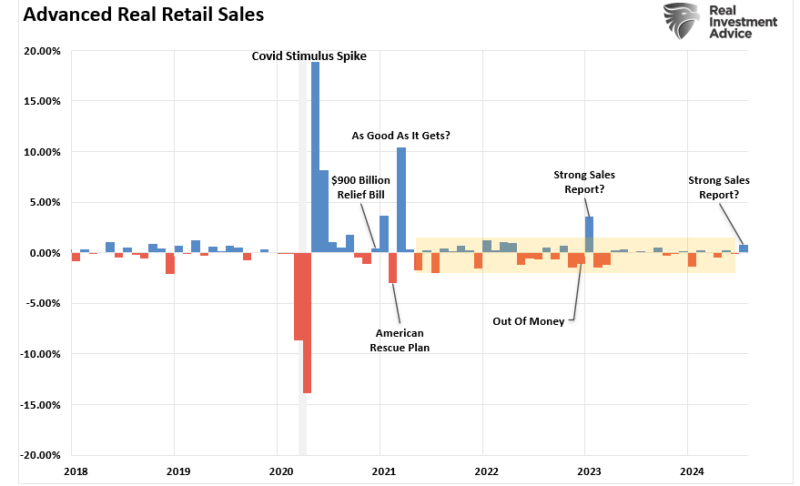

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Inflation

(Traveling and unable to provide a technical overview this week.) Rising price pressures,

stronger and more persistent than generally expected, has been the main

challenge for consumers, businesses, and policymakers. It will stay top of mind in the week

ahead as both the world's two largest economies, the US and China, report July

consumer and producer prices. During the Great Depression, the

central governments discovered their balance sheets,...

Read More »

Read More »

The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

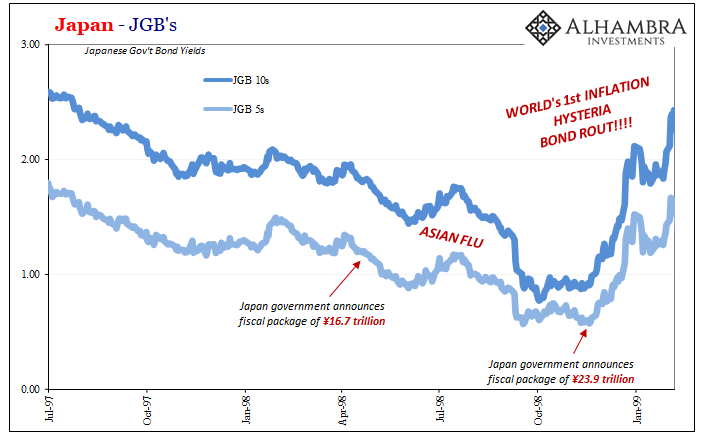

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns.

Read More »

Read More »

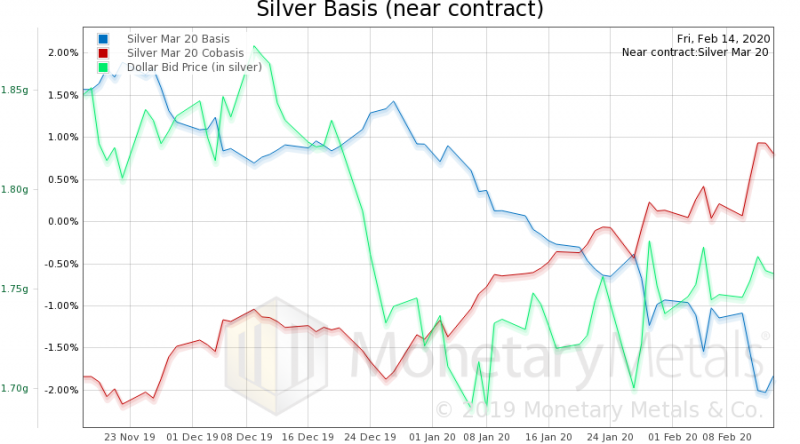

FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

The US dollar's surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven

yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some...

Read More »

Read More »

What happens if the debt ceiling raises

2023-01-20

by Stephen Flood

2023-01-20

Read More »