Tag Archive: Daily News

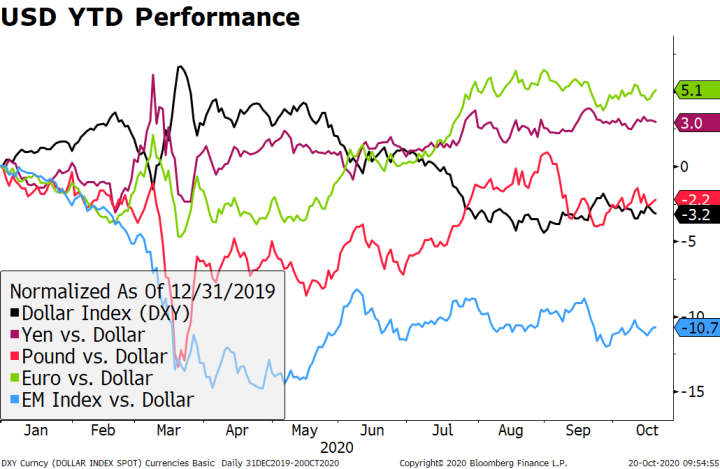

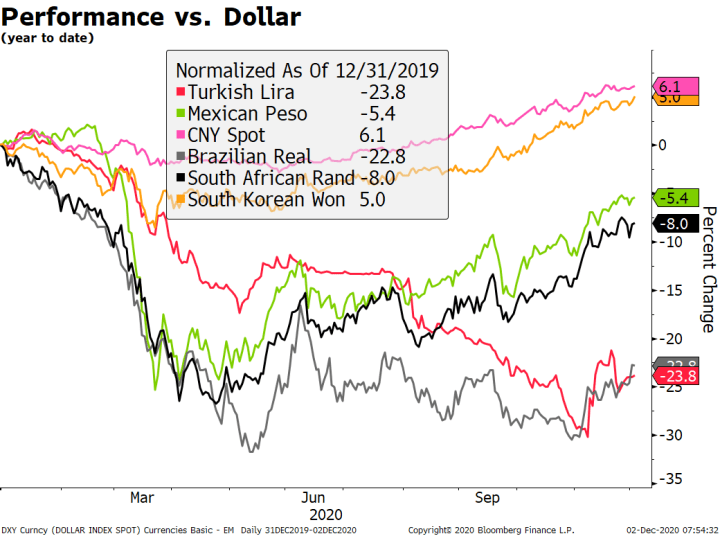

Dollar Consolidates, Weakness to Resume

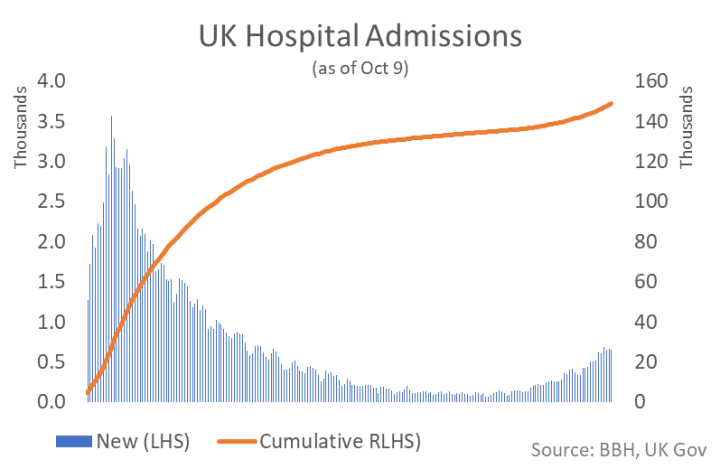

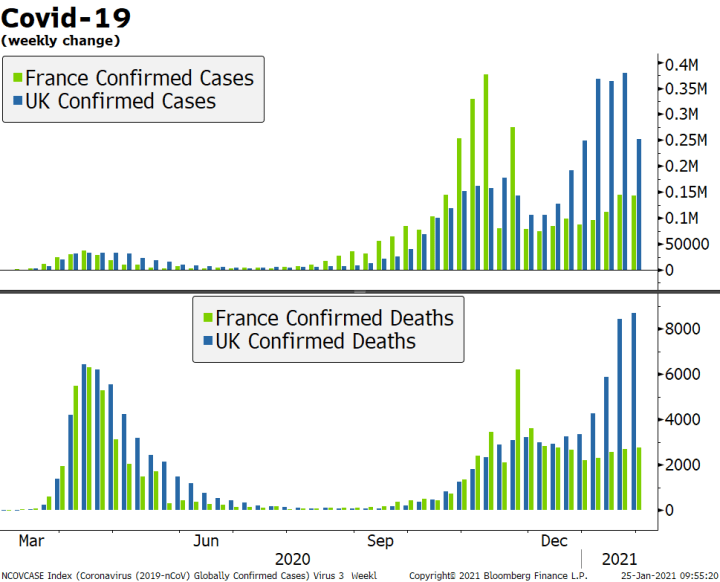

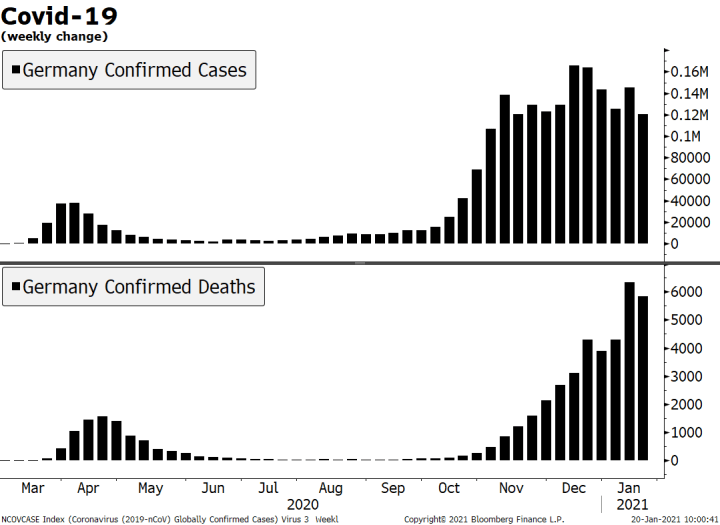

Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today. With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today.

Read More »

Read More »

Dollar Soft as Risk On Sentiment Dominates Ahead of FOMC Decision

Dollar weakness has resumed as risk on sentiment dominates; the US election outcome is starting to take shape. Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session; the two day FOMC meeting concludes today with a likely dovish hold; weekly jobless claims will be reported.

Read More »

Read More »

Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs. Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities.

Read More »

Read More »

Dollar Firm at Start of Very Eventful Week

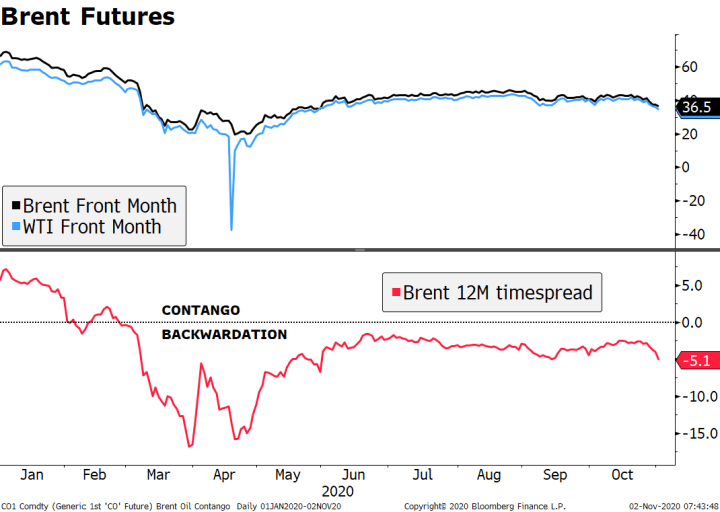

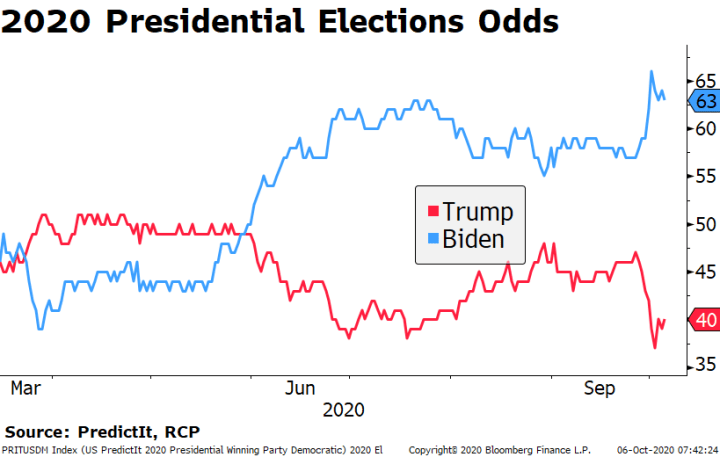

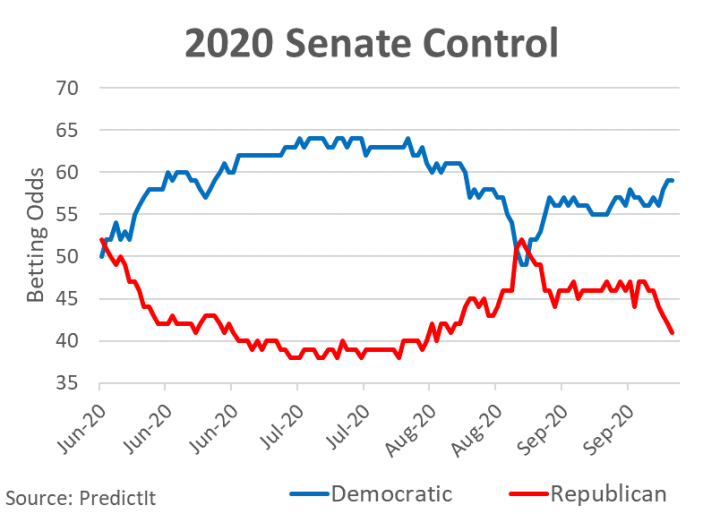

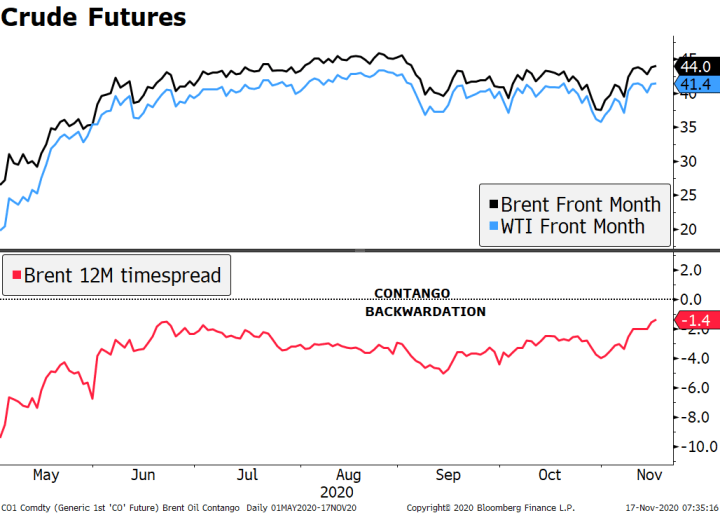

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges. This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week.

Read More »

Read More »

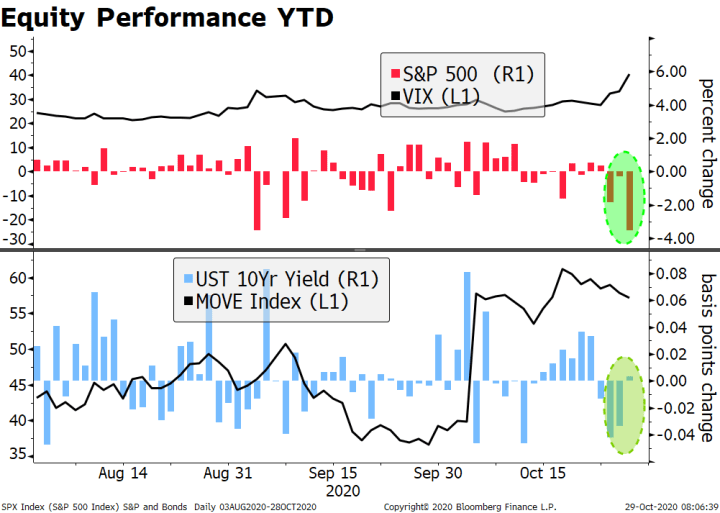

Dollar Bid as Markets Steady Ahead of ECB Decision

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors. The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported.

Read More »

Read More »

Dollar Bid as Markets Start the Week in Risk-Off Mode

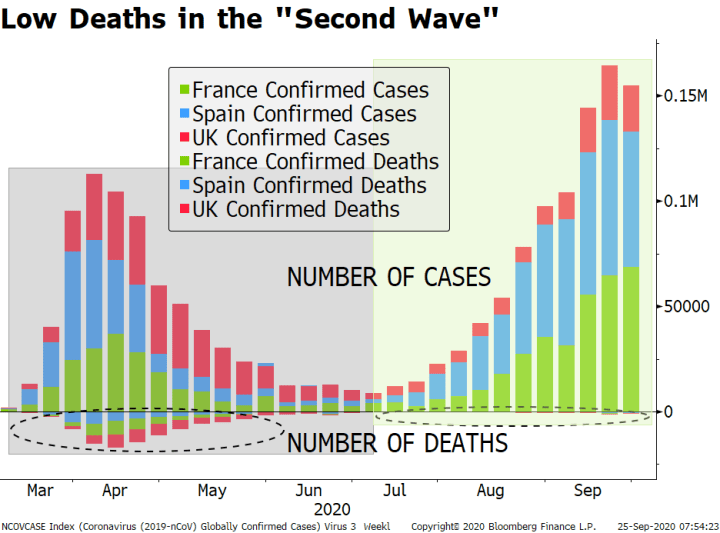

Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note. Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in.

Read More »

Read More »

Dollar Catches Modest Bid but Weakness to Resume

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today. Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome.

Read More »

Read More »

Dollar Soft as Markets Await Fresh News and Rumours

The dollar is coming under pressure again; markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely; 10-year Treasury yields have been trading in a narrow range for months.

Read More »

Read More »

Dollar Gains as Market Sentiment Goes South

Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop. The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5%.

Read More »

Read More »

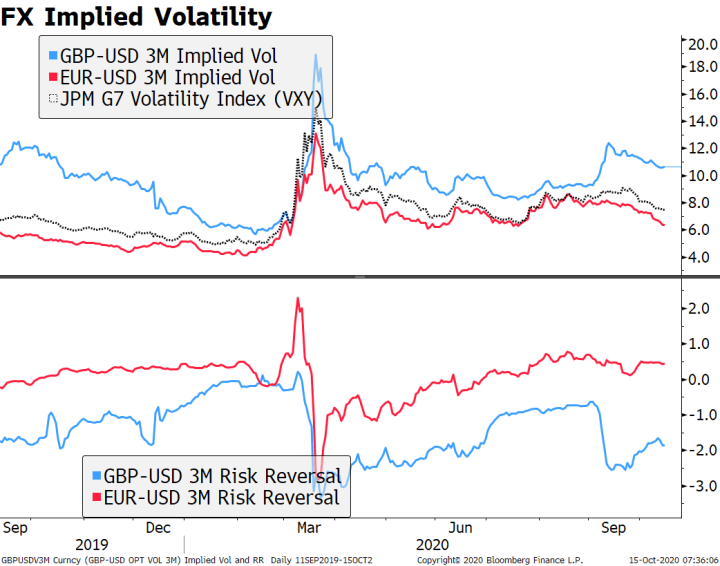

Dollar Bounce Remains Modest as Headwinds Build

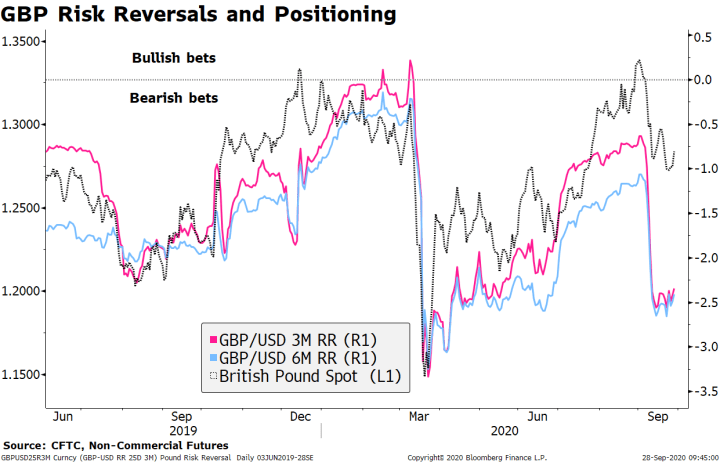

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September. Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country.

Read More »

Read More »

Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook. A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today.

Read More »

Read More »

Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

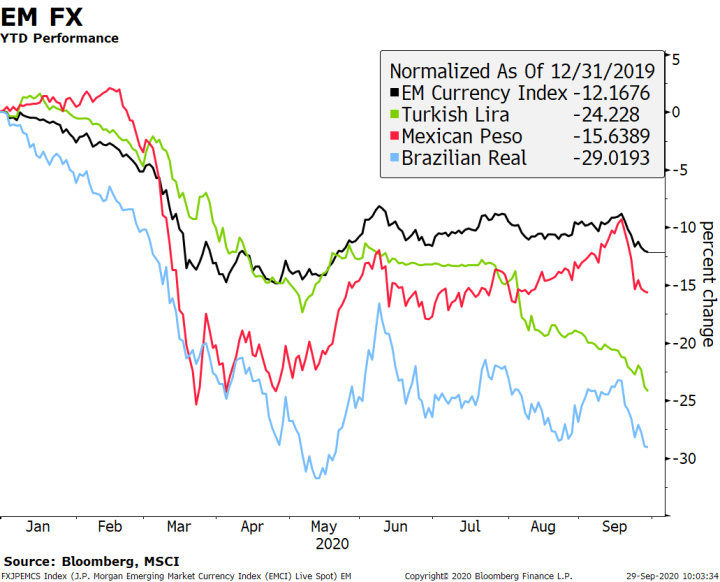

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals. This is another quiet day in terms of US data; Canada reports September jobs data. We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield.

Read More »

Read More »

Dollar Remains Heavy as Markets Await Fresh Drivers

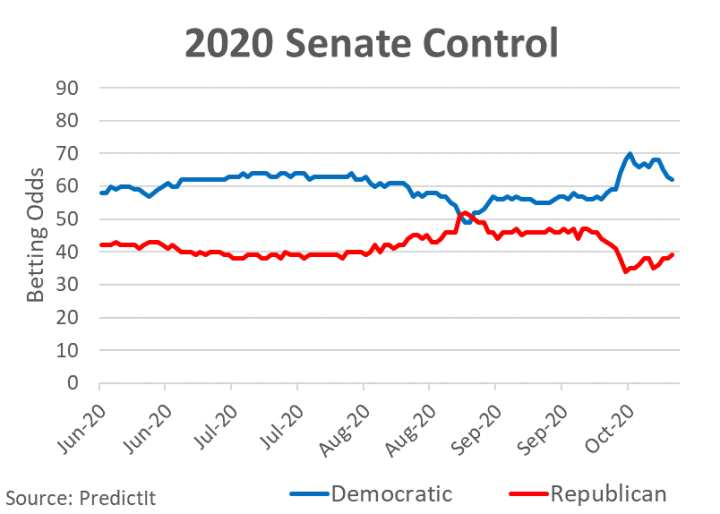

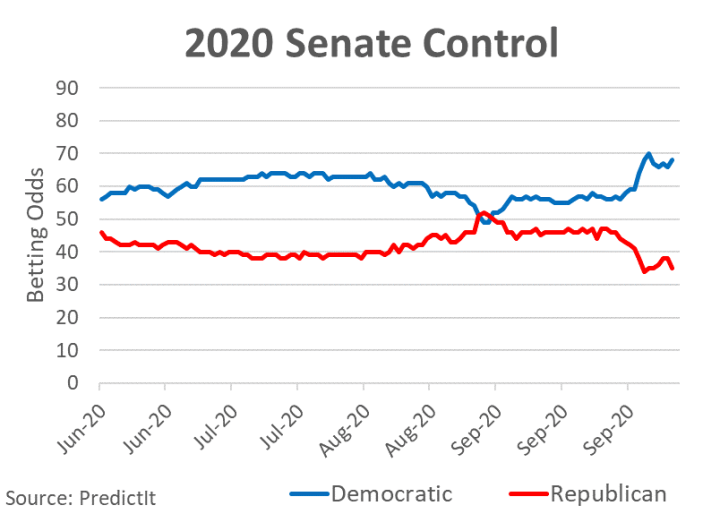

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states. The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises.

Read More »

Read More »

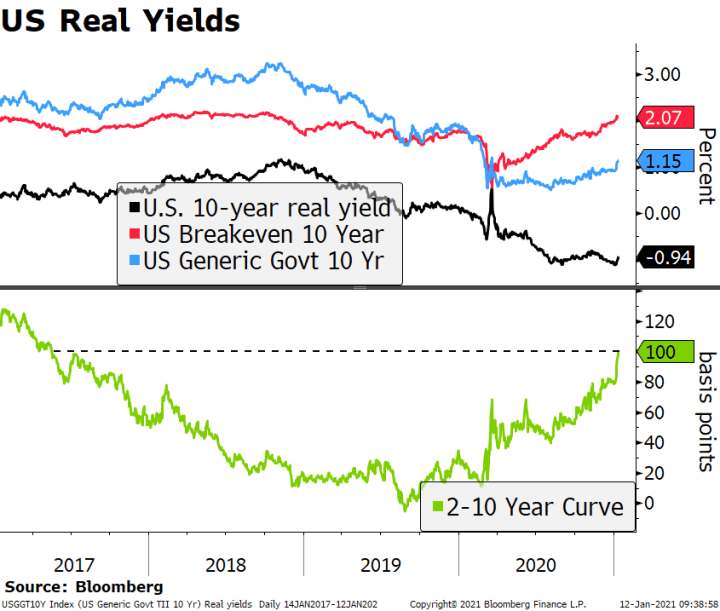

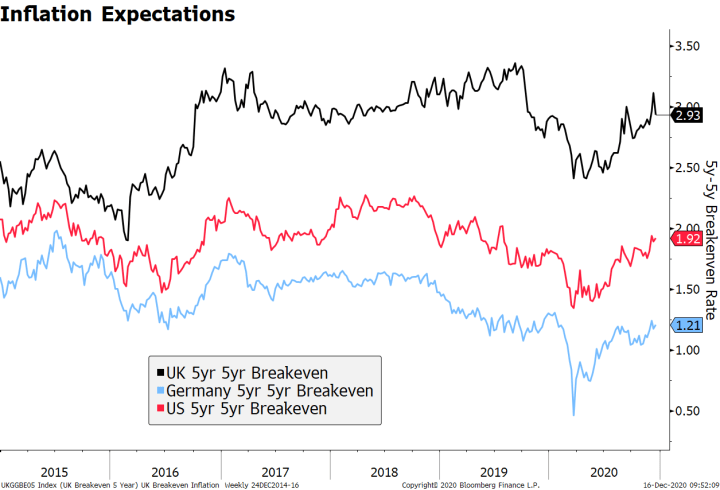

Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data. President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4.

Read More »

Read More »

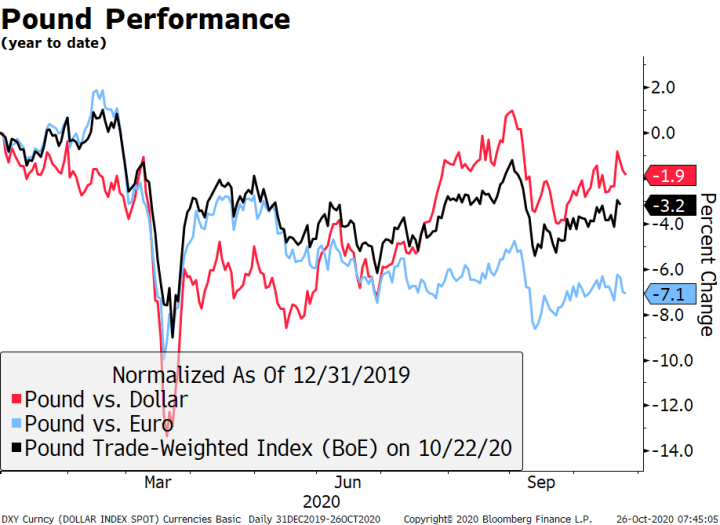

Dollar Remains Soft but Sterling Pounded by Brexit Risks

The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended. Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported.

Read More »

Read More »

Dollar Softens as Risk-Off Sentiment Ebbs

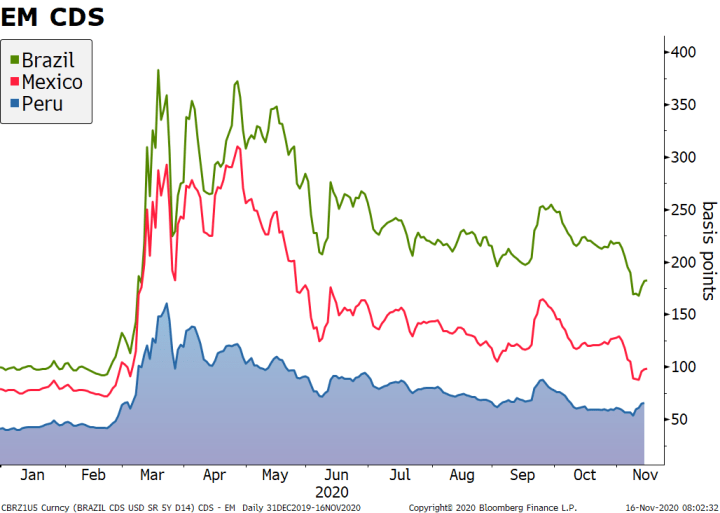

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight. House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns.

Read More »

Read More »

Dollar Soft as Markets Ignore Virus Numbers and Switch to Risk-On Mode

Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs. It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed.

Read More »

Read More »

Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside. Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations.

Read More »

Read More »

Dollar Remains Firm Ahead of Powell Testimony

The dollar remains firm on continued safe haven flows but we still view this situation as temporary. Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already.

Read More »

Read More »

Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary. US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done.

Read More »

Read More »