Tag Archive: Daily Market Update

Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

Gold in USD – 3 Days Gold prices are 0.7% higher today after falling just 0.3% yesterday as traders sought refuge in safe haven gold as oil prices collapsed lower again. Oil slumped to nearly $15 a barrel, its lowest since 1999 as the economic fallout from government lockdowns and the shutting down of entire economies impacts risk assets and commodities dependent on economic growth.

Read More »

Read More »

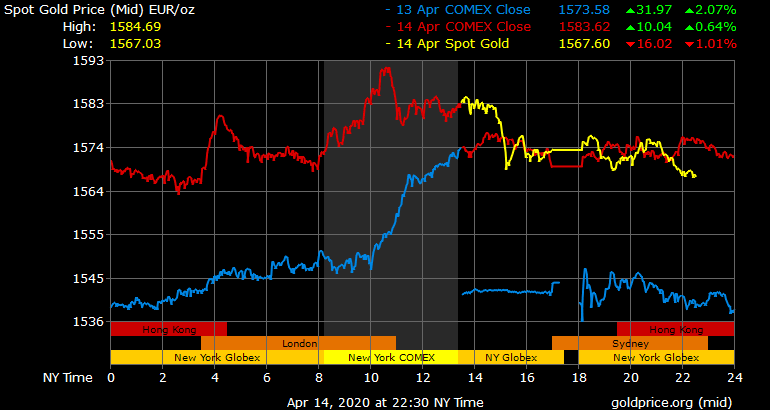

Gold Surges To New Record Highs in Euros at €1,581/oz and $1,726/oz in Dollars

Gold prices surged to new all time record highs in euros and other digital fiat currencies today due to concerns about the outlook for risk assets and currencies in an era of unprecedented economic and monetary risk.

Read More »

Read More »

Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have...

Read More »

Read More »

Don’t Panic – Prepare

◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely

Read More »

Read More »

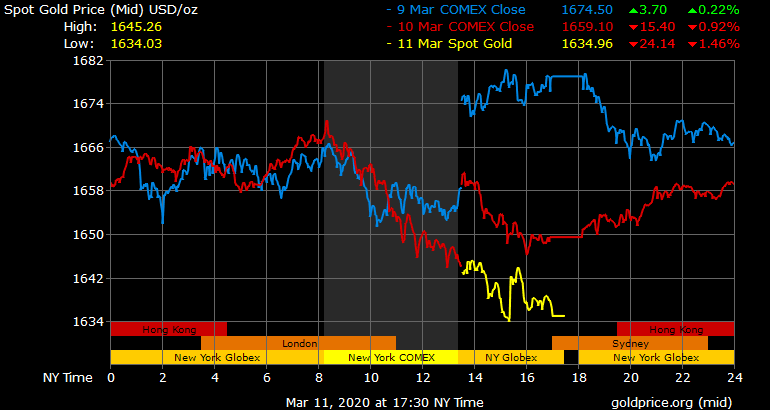

Gold Hedging Stock Market Crash: Euro Stoxx -6 percent, FTSE -5.7 percent and DAX -5.6 percent

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised.◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground.

Read More »

Read More »

Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy.

Read More »

Read More »

Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

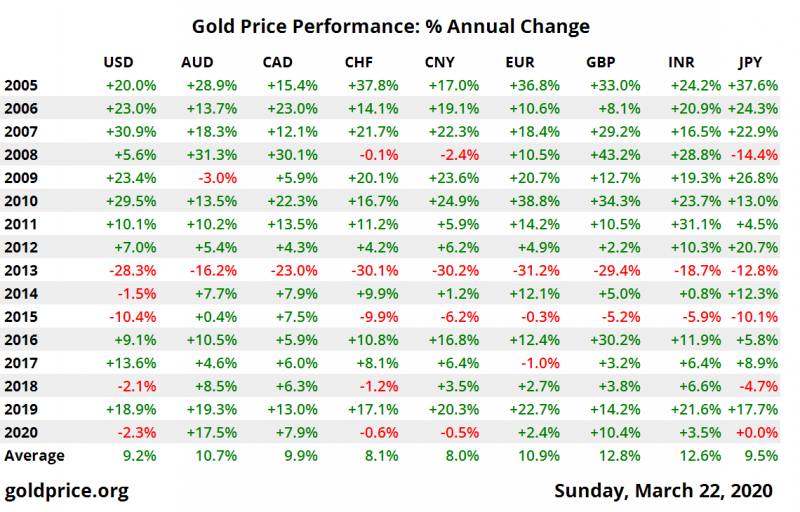

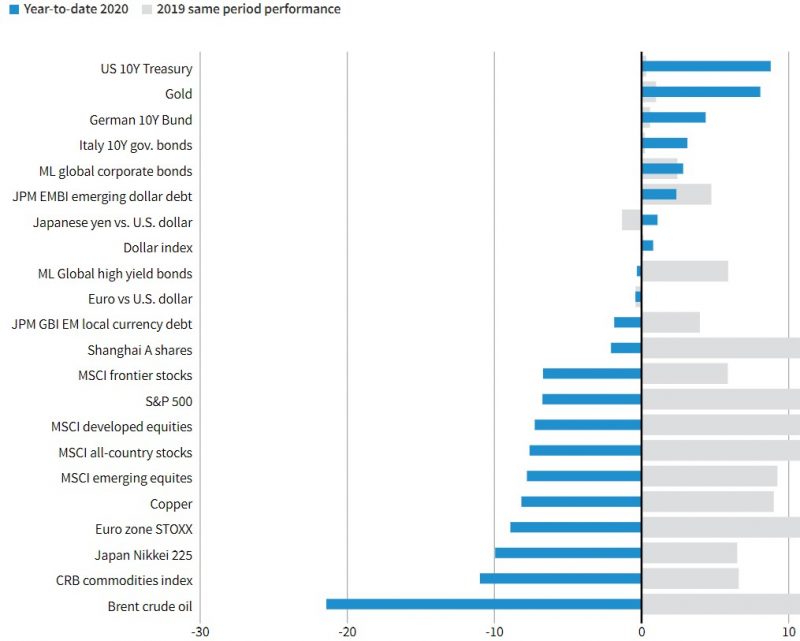

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table)

Read More »

Read More »

Goldman: 3 Key Reasons Why We Are Bullish On Gold

On “Bloomberg Commodities Edge”, Bloomberg’s Alix Steel and Naureen Malik talk with Jeff Currie, global head of commodities research at Goldman Sachs. They discuss Goldman’s bullish stance on gold.

Read More »

Read More »

Gold May Rise To $2,000/oz This Year Due To Strong Coin and Bar, ETF and Central Bank Demand

IGTV interviewed Mark O’Byrne, Research Director at GoldCore about the outlook for gold and silver bullion. He is bullish on both precious metals in the medium and long term. The fundamentals are very strong with strong central bank demand and ETF gold holdings reaching an all time record high due to deepening political and economic risks.

Read More »

Read More »

Gold Coins Worth £80,000 Found In Retiree’s Drawers In Cottage: “It Was Mind-Blowing. I Felt Like a Pirate in a Grotto”

Gold coins including gold sovereigns found in drawers of deceased retiree’s cottage sell at auction for £80,000. ◆ British gold coins including gold sovereigns from the Royal Mint found in drawers and cupboards of cottage fetch £80,000; one British gold sovereign found in a sugar bowl. ◆ Auctioneer John Rolfe expected little before he entered damp, rat-infested property near Stroud.

Read More »

Read More »

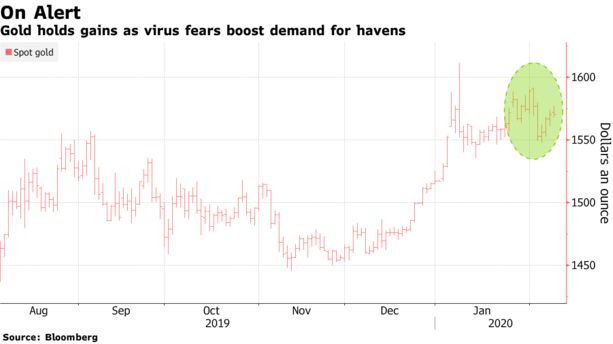

Gold Consolidates Near Six Year Record Highs At $1574/oz; WHO’s ‘Tip of the Iceberg’ Virus Warning

Gold climbed for a fourth day as investors weighed the unfolding coronavirus crisis, including a stark warning from the head of the World Health Organization about the potential for more cases beyond China and signs the disease is spreading in the key Asian trading hub of Singapore.

Read More »

Read More »

“Smart Move” By Prudent Investors Is To Diversify Into Gold

With no opportunity cost to holding a zero-yield asset such as gold, investors increasingly are adding it to their portfolios as a hedge. ◆ Gold retains its intrinsic value, something no paper currency has managed to do over history. ◆ Gold is insurance. Insurance isn’t supposed to make you rich; it’s supposed to keep you from being poor.

Read More »

Read More »

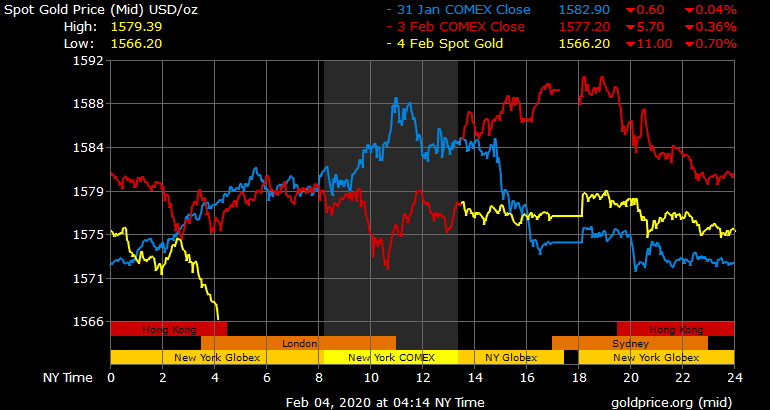

Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close ◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb.

Read More »

Read More »

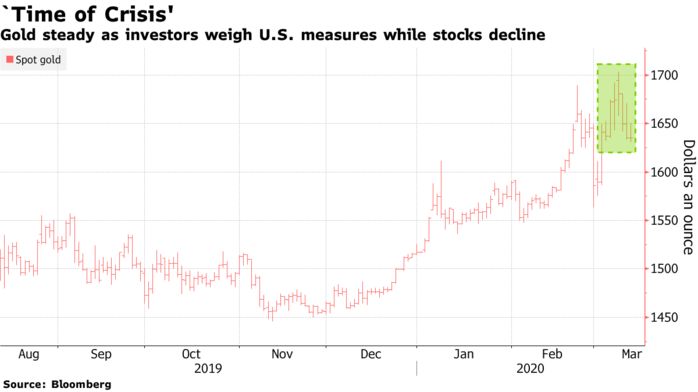

Gold May Top $2,000 As “Prices Surge On Global Fear”

Gold was one of the few investments heading higher Monday as worries about the coronavirus outbreak led to a steep market slide. Gold is now up more than 20% in the past year, and trading near $1,600 an ounce, its highest level since 2013. Other precious metals, such as silver and platinum, have rallied too. Meanwhile, the Dow was down nearly 350 points in midday trading.

Read More »

Read More »

“All You Need To Do Is Own Gold and Silver” To Make Money In 2020

If you want to make money from investing, it’s simple: find a bull market and go long. And in 2020 gold and silver are in a bull market. by Dominic Frisby via the UK’s best-selling financial magazine Money Week

I ran into Jim Mellon at a party at the weekend, and we soon got talking about markets. One of his comments – stated with surety and simplicity – has stuck in my mind.

Read More »

Read More »

Why Do Prudent Indians Diversify Into Gold?

◆ Indians diversify into gold coins, bars and jewellery because it never fails them in an emergency◆ Indians are simply very prudent and practical and believe in channeling some of their wealth and saving into physical gold ◆ “A woman’s gold is both her personal treasure and plays a functional role as the family’s financial buffer” – Richard Davies

Read More »

Read More »

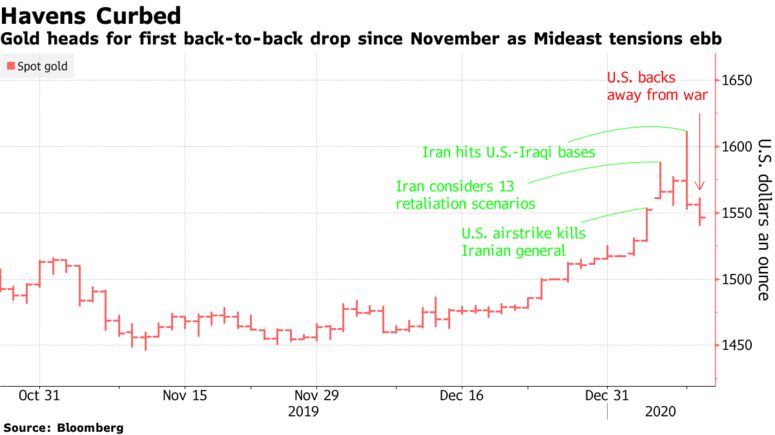

Gold Steadies After Falls As U.S., Iran Stepping Back From the Brink

◆ Haven demand ebbs as stocks climb with easing Mideast tensions◆ Palladium retreats from fresh record but holds near $2,100. ◆ There’s still very strong demand for gold “due to a host of financial, geopolitical and monetary risks,” said Mark O’Byrne, research director at GoldCore

Read More »

Read More »

Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

◆ Gold could rise to more than $7,000 an ounce according to respected MoneyWeek contributor and fund manager Charlie Morris (Part I today and Part II tomorrow). A year ago, in my occasional free newsletter, Atlas Pulse, I upgraded gold – which was trading at $1,239 an ounce at that point – to “bull market” status for the first time since 2012.

Read More »

Read More »

Gold Surges To Test $1,600/oz, Oil Over $70, Stocks Fall on Risks of World War In Middle East

◆ Gold has surged to test $1,600 per ounce, up 4% so far in 2020 and building on the stellar near 18.9% gain in 2019 ◆ Gold is testing it’s highest levels since 2013 as investors diversify into gold; Goldman, Citi and other gold analysts are advocating gold bullion as important hedge in crisis ◆ Oil prices have surged with Brent crude reaching $70 per barrel; concern over oil supplies from Iran, Iraq and other nations as U.S. State Department warns...

Read More »

Read More »