The sight deposits at the SNB increased by 5.2 billion francs compared to the previous week.

Read More »

Tag Archive: currency reserves

Where does SNB intervene against overvalued CHF, do they sell EUR & USD? (April Update)

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell Euros and dollars.

Read More »

Read More »

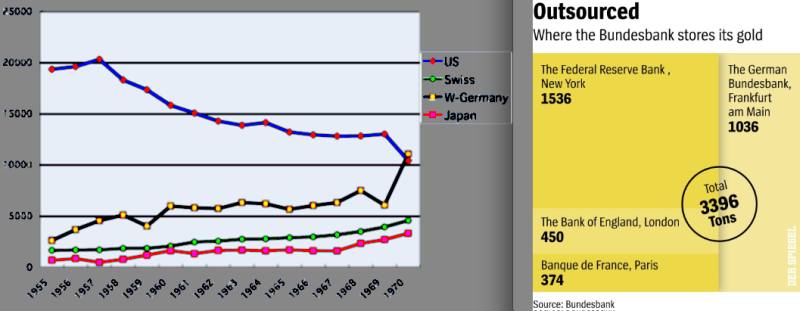

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

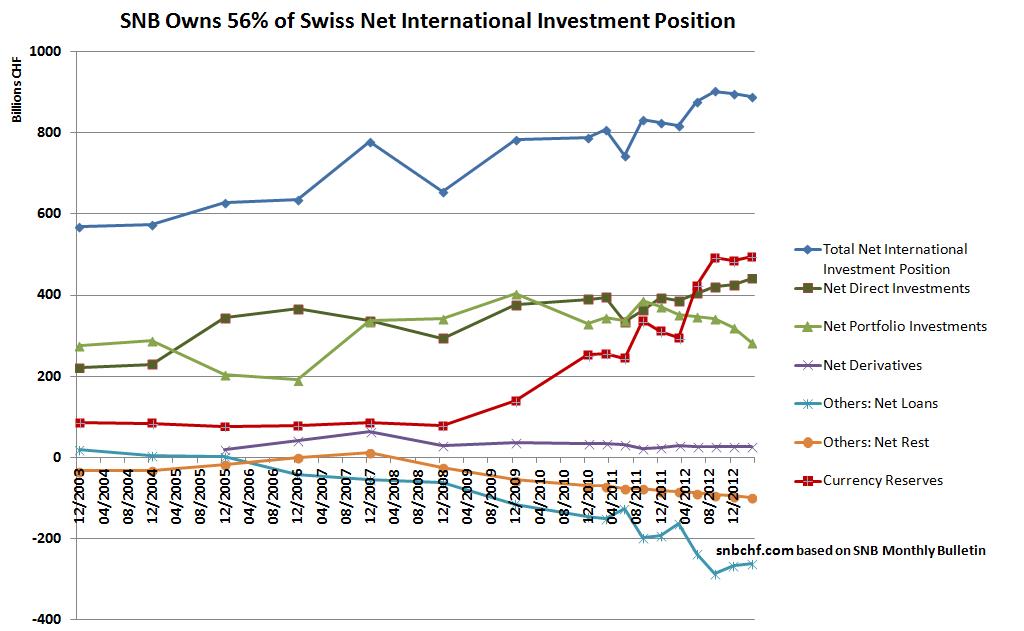

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

SNB Monetary Assessment June 2013: Very risk-averse, nearly hawkish tone

The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. …

Read More »

Read More »

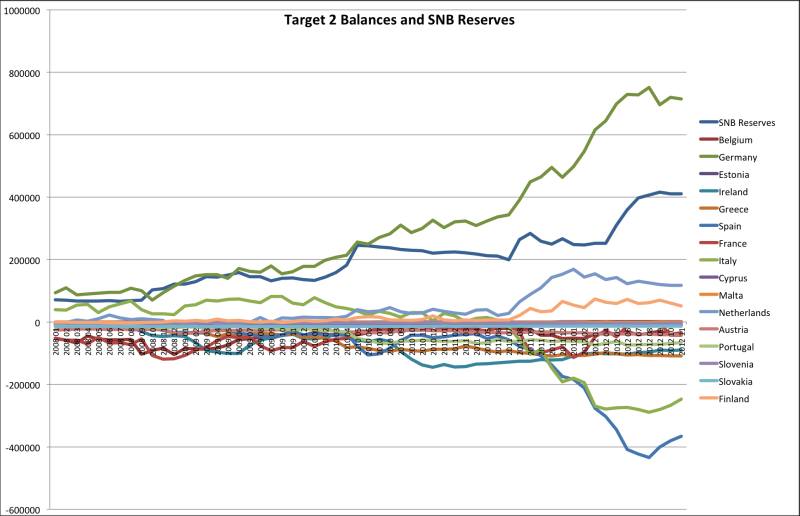

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »

FX Theory: The Balance of Payments Model Explained in 400 Words

The balance of payments leads to many confusions because definitions vary. For example, the IMF’s definition is different from the usual or historical definition. Secondly, the relationship between the balance of payments and reserve assets is difficult to grasp, especially in the IMF definition. Thirdly the origin of “errors and omissions” is often unclear. Therefore …

Read More »

Read More »

Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

Similarly as European leaders knew what they were doing with the euro, namely introducing a not feasible currency, Swiss National Bank did between 2005 and 2008, namely the absolutely wrong thing.

Read More »

Read More »

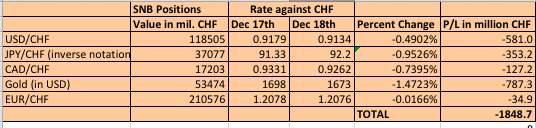

SNB Losses: 1.85 Billion Francs in Just One Day, 231 Francs, 250$ per Inhabitant

After the disappointing US current account data, traders have realized which countries have strong trade balances, namely Germany and Switzerland (see here for our details on the ever rising Swiss trade surplus), additionally fueled the good German IFO data. Both the euro and the Swissie strongly rose against the dollar. Due to Abe’s pressure on the …

Read More »

Read More »