Tag Archive: Credit Suisse

Swiss firms face greater shareholder opposition

Shareholder rebellion over executive pay at Credit Suisse earlier this year is just one example of growing dissent by Swiss company owners. While annual general meetings are hardly a hotbed of revolutionary unrest, shareholders are slowly - but perceptibly - demanding more accountability.

Read More »

Read More »

Swiss Asset Manager Settles US Tax Evasion Charges

The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

Swiss banks defy Brexit to recruit in London

At the same time as big global banks are considering alternatives to London in the wake of the Brexit vote, Swiss newspaper Le Matin Dimanche reports, financial institutions are also recruiting new staff in the City. Rather than in commercial banking, however, these employees specialise in private wealth management.

Read More »

Read More »

Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

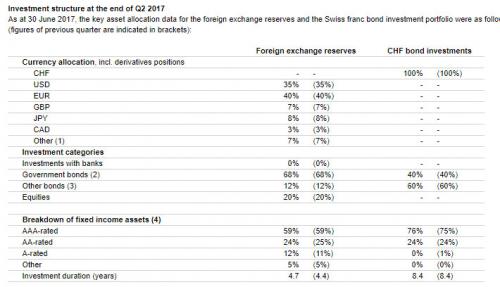

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below.

Read More »

Read More »

The Internet Helped Kill Inflation In America, Says Credit Suisse

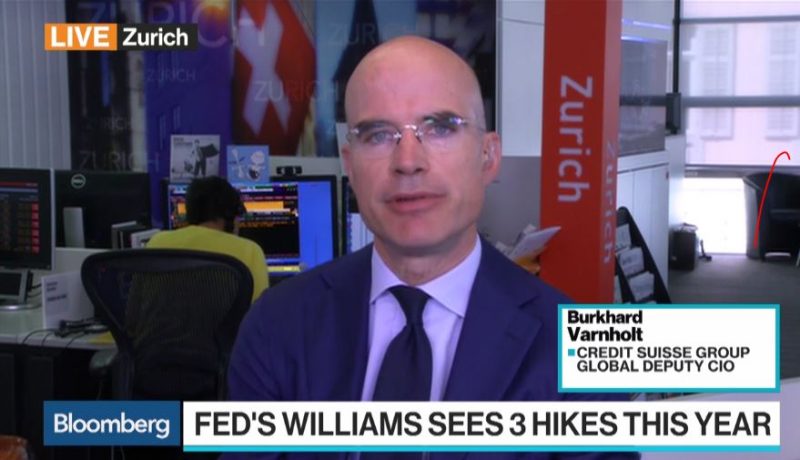

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen - as he told CNBC two days ago - is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt.

Read More »

Read More »

Credit Suisse Offices Raided In Multiple Tax Probes: Gold Bars, Paintings, Jewelry Seized

Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders.

Read More »

Read More »

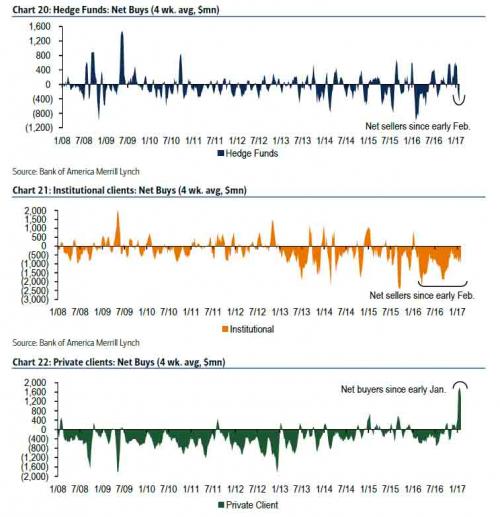

CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

Read More »

Read More »

Switzerland: Chocolate, Watches, And Jihad

Swiss authorities are currently investigating 480 suspected jihadists in the country. "Radical imams always preached in the An-Nur Mosque... Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad." — Saïda Keller-Messahli, president of Forum for a Progressive Islam.

Read More »

Read More »

SMI set to end 2016 in negative territory

In the last week of the year, the Swiss Market Index deepened its loss for the year as banks continued lower on low trading volumes. The SMI is set to end 2016 with an annual loss of 6.8% as banking and pharmaceutical giants pulled the index down in a year of turbulent trading. A volatile 2016 started with a brutal equity sell off as investors dumped global stocks on fears of an accelerating economic slowdown in China. The Brexit vote in June...

Read More »

Read More »

Sentiment appears positive as investors close their books for the year

Ahead of the Christmas break, trading volumes were thin this week amid a lack of new market catalysts. Swiss and European equities were generally unchanged through the week, tracking global stock markets. Overall, sentiment appears to be positive as investors close their books for the year.

Read More »

Read More »

Credit Suisse planning more Swiss job cuts

Credit Suisse Group AG is preparing a new cost-savings program that puts as many as 1,300 jobs in Switzerland on the line, according to Schweiz am Sonntag. The plan will be announced Wednesday, when the lender holds its investor day in London, the newspaper said, without saying where it got the information. Credit Suisse’s Swiss unit may slash an additional 1,000 to 1,300 positions, or about eight to 10 percent of the unit’s workforce, it said.

Read More »

Read More »

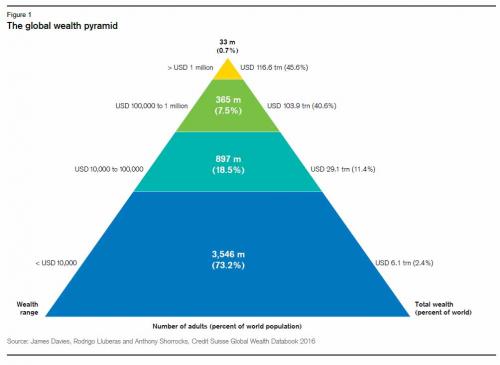

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

The Swiss Begin To Hoard Cash

While subtle, the general public loss of faith in central banking has been obvious to anyone who has simply kept their eyes open: it started in Japan where in February hardware stores were reported that consumers were hoarding cash, as confirmed by t...

Read More »

Read More »

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »