Shelter inflation in the U.S. is at 3.2% per year, but only 1% in Europe. It is 33% of the US CPI basket, but only 6.4% of the euro zone. This leads to massive distortions in CPI inflation, and to wrong bets of investors and FX traders.

Read More »

Tag Archive: CPI basket

(2) FX Theory: Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

Read More »

Read More »

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »

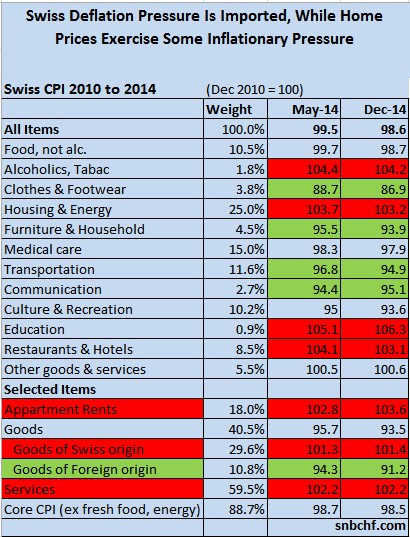

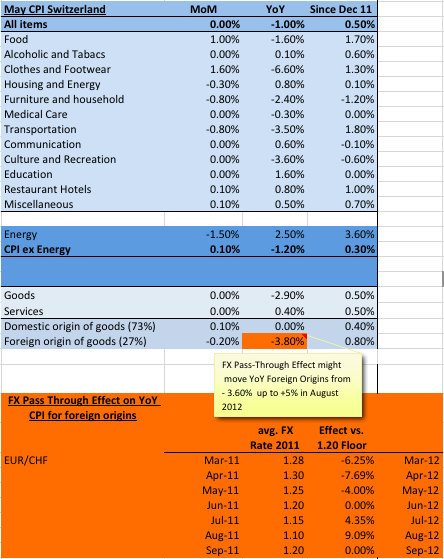

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

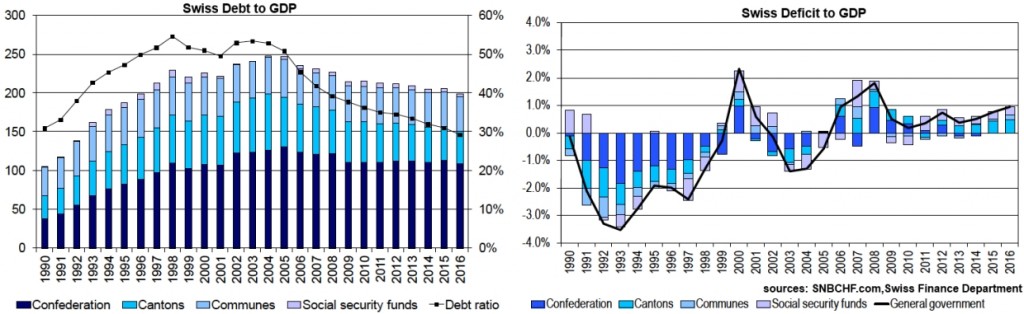

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

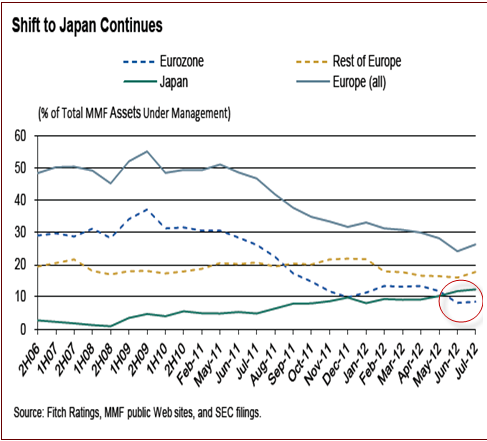

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

Switzerland in MoM deflation due to cheaper energy and clothes

Slowing energy prices (MoM -4.2%) and seasonal effects for clothes and footwear (MoM -2.8%) drove Switzerland in a slight deflation on monthly basis again.

Read More »

Read More »