Tag Archive: $CNY

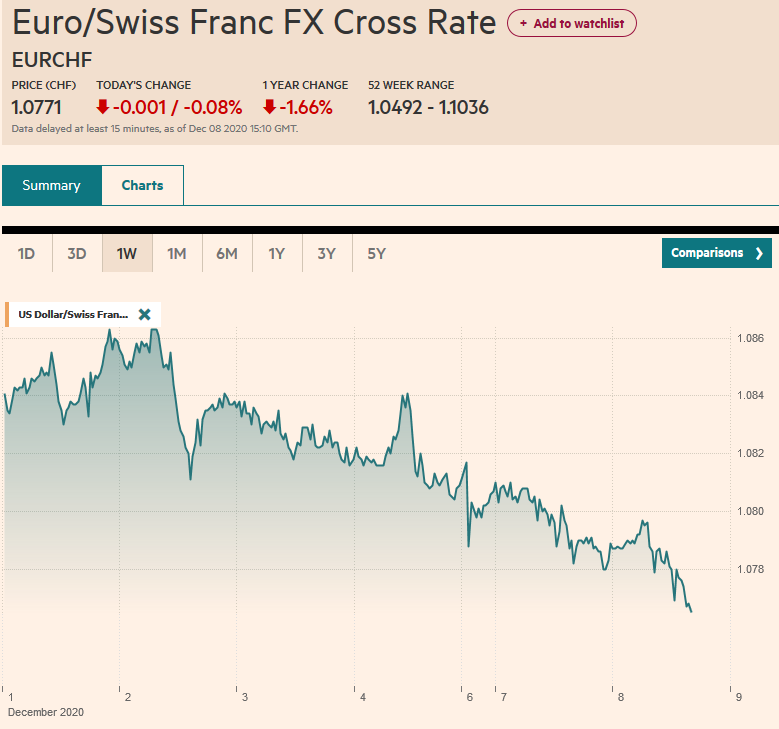

FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders' summit that begins Thursday. The US federal spending authorization is exhausted at the end of the week.

Read More »

Read More »

FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents.

Read More »

Read More »

FX Daily, December 4: The Employment Report may not Give Greenback much of a Reprieve

After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine's supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea's Kospi and Taiwan's Taiex, the MSCI Asia Pacific benchmark secured its fifth consecutive weekly gain.

Read More »

Read More »

FX Daily, November 30: Equities are Heavy and the Dollar Softer to Start New Week

Overview: Month-end profit-taking saw Asia Pacific shares tumble earlier today. Most markets are off 1-2.5% today after the MSCI Asia Pacific Index rose 2.25% last week. European shares are mixed, but little changed. US shares are also trading lower.

Read More »

Read More »

FX Daily, November 23: Markets Look Past Near-Term Challenges

Overview: News that the AstraZeneca vaccine was 70% effective but could be enhanced by changing dosage is lifting spirits and boosting equities. Japan's markets were closed for a national holiday, but all the equity markets in the region advanced and many by more than 1%.

Read More »

Read More »

FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday's range.

Read More »

Read More »

FX Daily, November 17: Greenback Remains Under Pressure

Overview: Moderna's announcement did not spur nearly the magnitude of the disruption caused by Pfizer's similar announcement a week ago. Still, in the US, the NASDAQ underperformed the other indices, and the US Dow Industrials saw record highs.

Read More »

Read More »

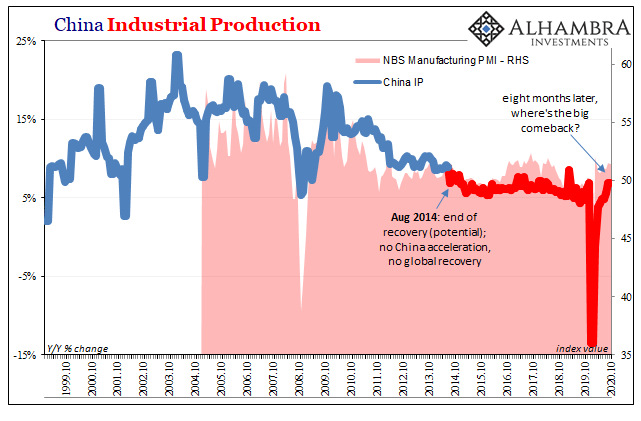

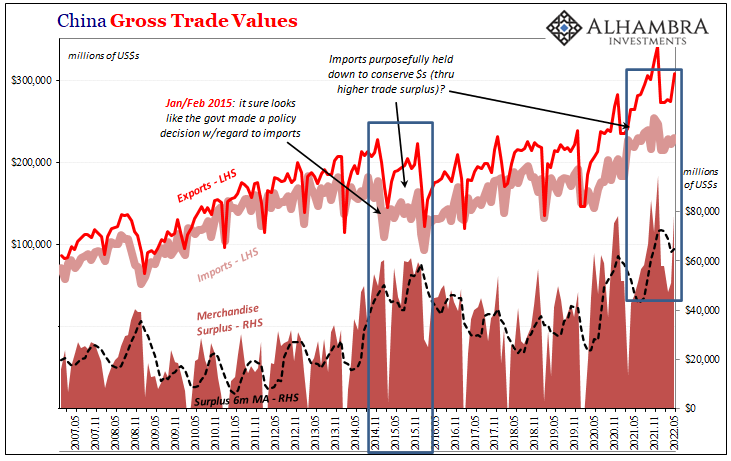

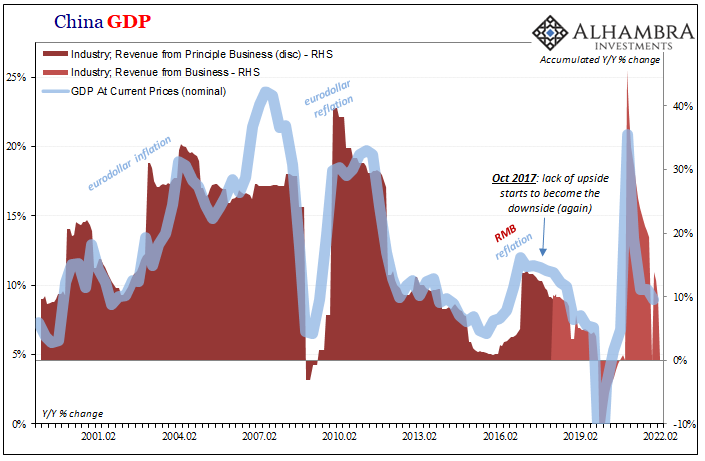

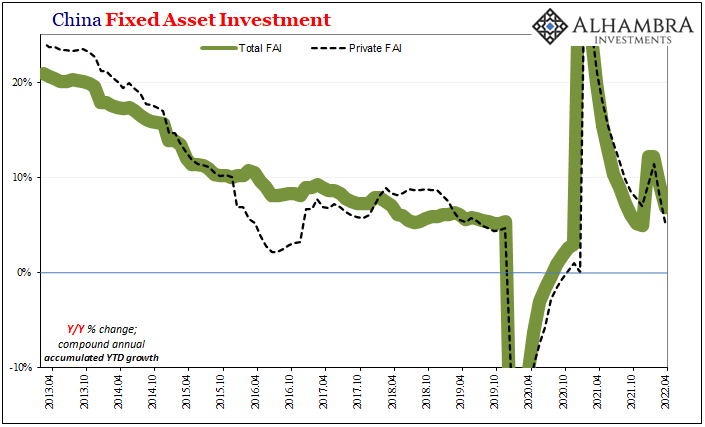

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

FX Daily, November 9: Markets are not Waiting for Official Closure in the US

The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia.

Read More »

Read More »

FX Daily, November 6: A Pause that Refreshens?

Investors have piled into risk assets this week, seemingly undeterred by the US elections' lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April.

Read More »

Read More »

FX Daily, November 4: Indecision Keeps Investors on Edge, but the Dollar Rides High

Initially, the markets built on Tuesday's price action, but as soon as a few counties in Florida indicated that it was not going to be the "blue wave," risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced.

Read More »

Read More »

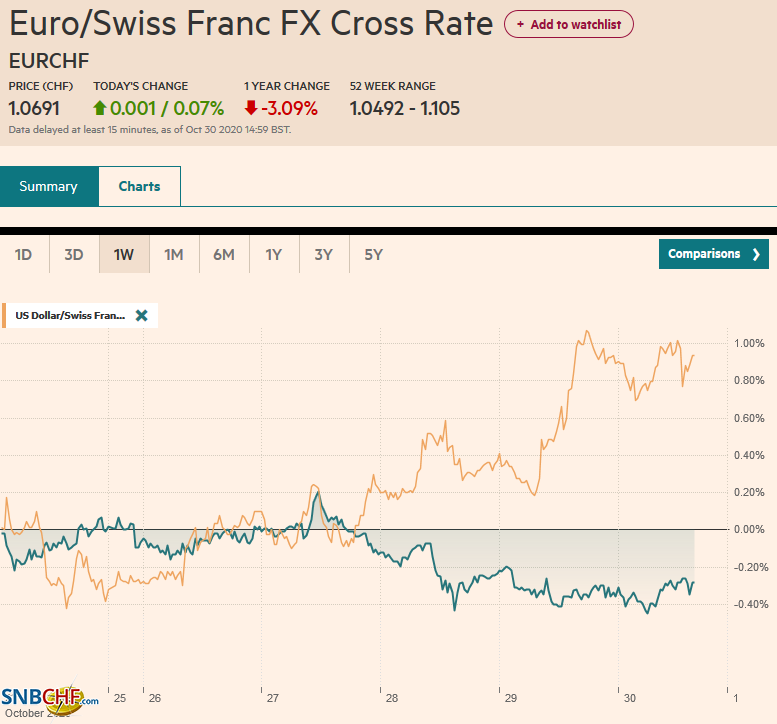

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

FX Daily, October 28: Animal Spirits Called in Sick

Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 26: Troubling Start of the Important Week

The surging virus ravaging large parts of Europe and the United States is fanning concerns over the economic implications as new social restrictions and curfews are announced in several countries. US additional fiscal support remains elusive as aid for states and local governments remains a bone of contention.

Read More »

Read More »

FX Daily, October 22: Greenback Stabilizes

Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks.

Read More »

Read More »

FX Daily, October 21: Dollar Slumps as Yields Rise

Overview: The dollar is falling against most of the world's currencies today, even as long-term yields rise to the most in four months and drags global yields higher. The US 10-year yield is pushing above 0.80%, and the 30-year is above 1.60%.

Read More »

Read More »

FX Daily, October 20: Narrowly Mixed Markets as Clearer Direction Sought

The capital markets lack a clear direction today. This is reflected in narrowly mixed equities, bonds, and currencies. The spreading contagion is giving rise to new economic concerns, among other things, and the UK-EU talks are struggling to resume, while Pelosi-Mnuchin talks in the US continue to drag.

Read More »

Read More »

FX Daily, October 19: Sterling Sparkles in Dollar Setback

Investors have not let the surge of the virus or uncertainty over the UK-EU talks or US fiscal stimulus to stand in their way. Sterling is leading the major currencies higher, returning to the $1.30 area, while global equities are trading higher.

Read More »

Read More »