Tag Archive: China

FX Weekly Preview: Sources of Movement

Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins.

Read More »

Read More »

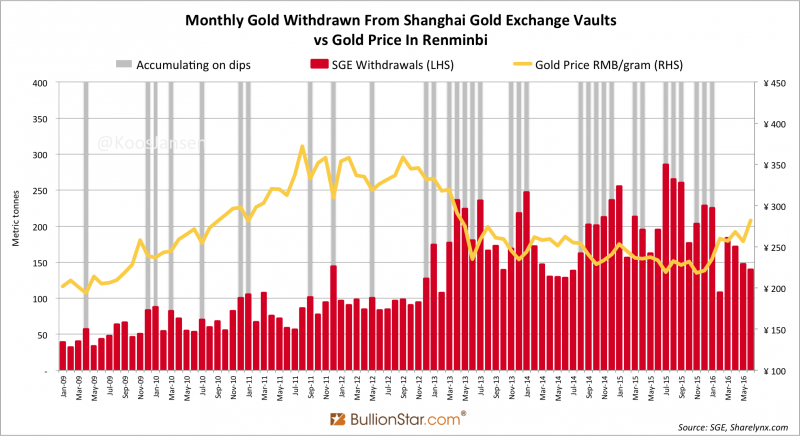

Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year.

Read More »

Read More »

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »

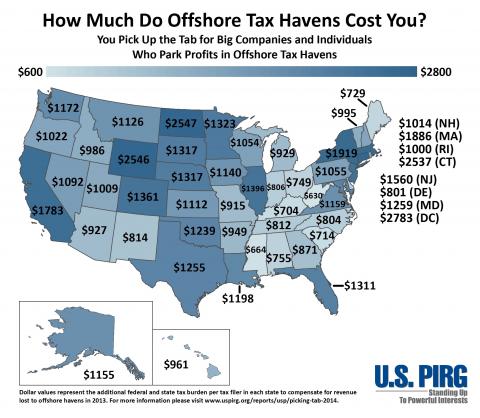

Panama Tax Haven Scandal: The Bigger Picture

The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Ass...

Read More »

Read More »

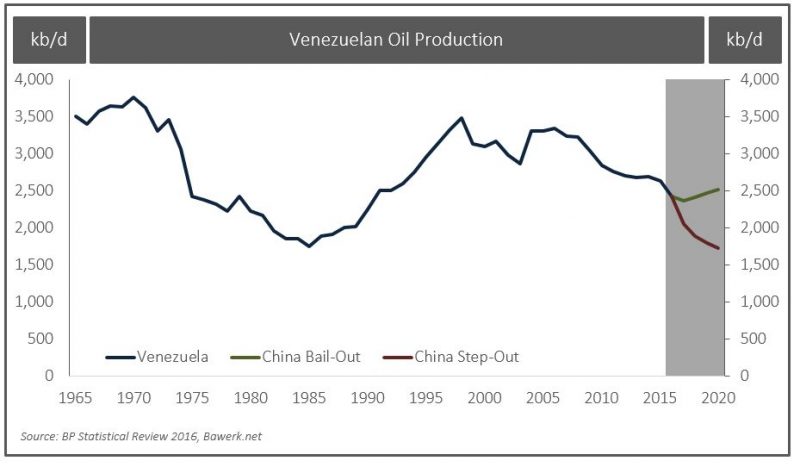

China the lender of last resort for many oil producers

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »

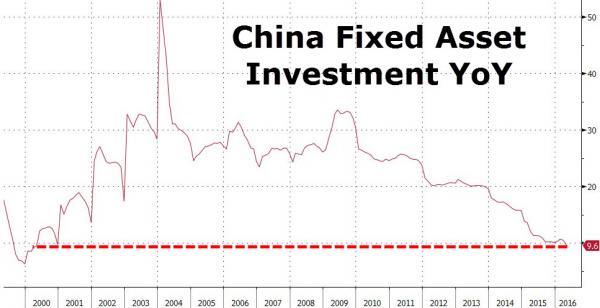

China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better.

Read More »

Read More »

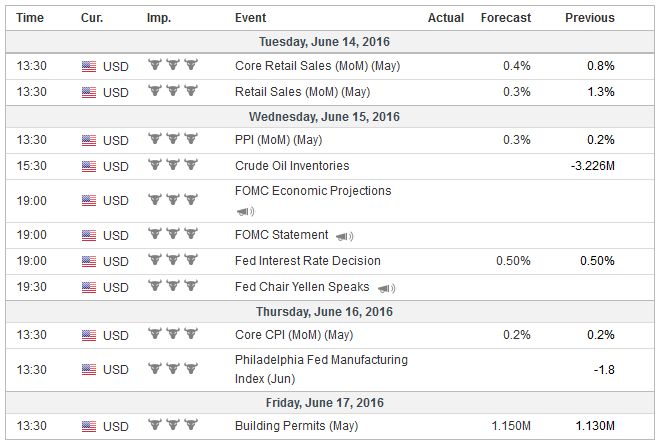

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

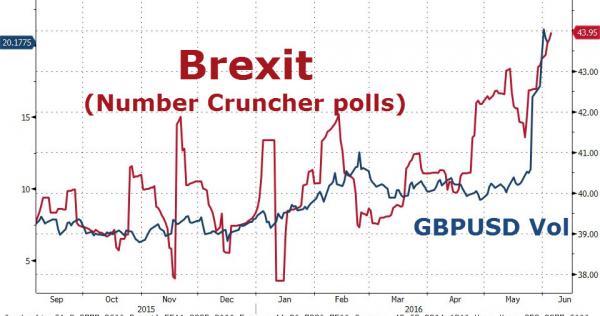

Faber: “Switzerland doing much better than any other country in Europe. So Britain should do the same?”

The European Union is an "empire that is hugely bureaucratic," warns Marc Faber, telling CNBC that he thinks that "a Brexit would be bullish for global economic growth," because "it would give other countries incentive to leave the badly organized EU...

Read More »

Read More »

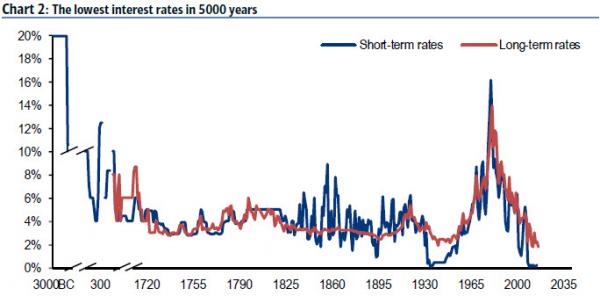

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

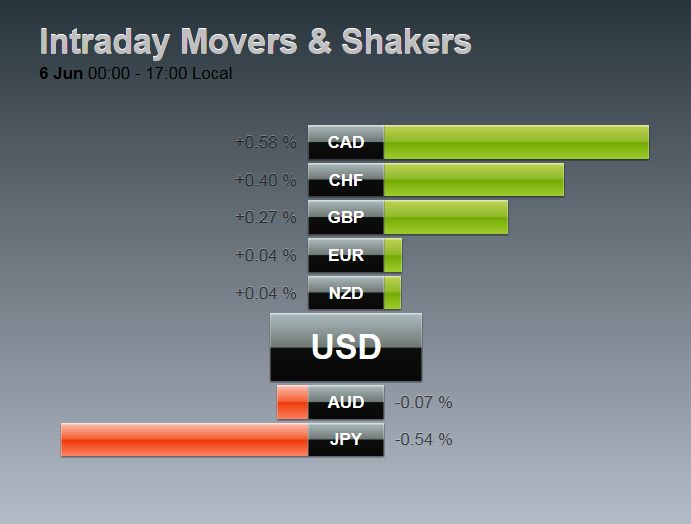

FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the …

Read More »

Read More »

Venezuela’s Gold Reserves Plunge To Lowest Ever As Maduro Repays Debt With Gold

Several months ago, as Venezuela's hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in "Scenes From The Venezuela Apocalypse: "Countless Wounded" After 5,000 ...

Read More »

Read More »

G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the … Continue...

Read More »

Read More »

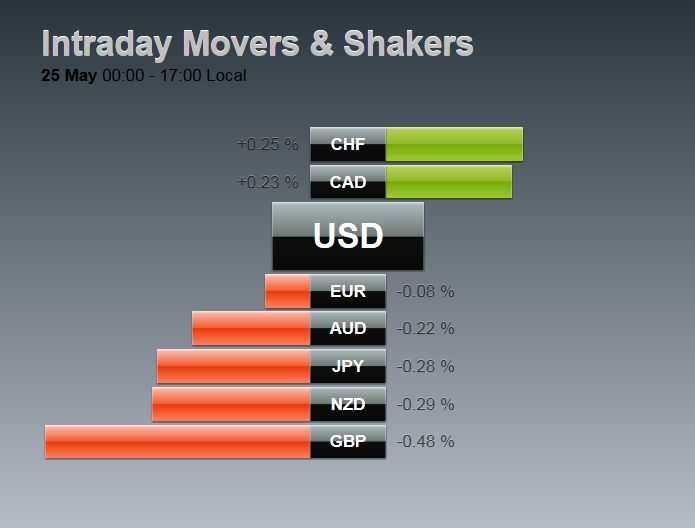

FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds …

Read More »

Read More »

The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that …

Read More »

Read More »

Brief Look at the Start of the New Week’s Activity

The most notable thing is not what has happened, but what has not happened. The market has not responded to the soft Chinese data over the weekend. Chinese equities began softer but recovered fully and the Shanghai Composite closed on its highs. The MSCI Asia Pacific Index is snapping a two-day losing streak with a … Continue reading...

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the …

Read More »

Read More »