Tag Archive: China

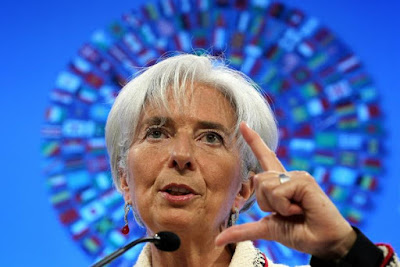

FX Daily, July 22: Enguard Lagarde

Overview: The rally in US shares yesterday, ostensibly fueled by strong earnings reports, is helping to encourage risk appetites today. The MSCI Asia Pacific Index is posting its biggest gain in around two weeks, though Japan's markets are closed today and tomorrow. The Dow Jones Stoxx 600 is building on yesterday's rally, and with today's ~0.8% gain, it is up on the week.

Read More »

Read More »

FX Daily, July 21: Did Japan Deliver a Fait Accompli to the US?

Overview: The biggest rally in US equities in four months has helped stabilize global shares today. In the Asia Pacific region, Japan, China, and Australian markets advanced. Led by information technology and consumer discretionary sectors, Europe's Dow Jones Stoxx 600 is up around 1.35% near the middle of the session.

Read More »

Read More »

FX Daily, July 15: Strong Gains in US CPI and PPI Don’t Stop the Bond Market Rally

Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

FX Daily, July 13: Headline US CPI may Decline for the First Time in a Year

New record highs in the US S&P 500 and NASDAQ coupled with China allowing Tencent to acquire a search engine helped lift Asia Pacific equities. It is the first back-to-back by MSCI's regional index for more than two weeks. Australia's market was a notable exception.

Read More »

Read More »

FX Daily, July 12: Markets Adrift ahead of Key Events

The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc's resilience seen last week is carrying over.

Read More »

Read More »

Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week's economic events, which include June US CPI, retail sales, and industrial production, along with China's Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan.

Read More »

Read More »

FX Daily, July 09: PBOC Cuts Reserve Requirements after Inflation Measures Ease

The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the stage for a better performance next week.

Read More »

Read More »

FX Daily, July 08: Capital Markets Remain Unhinged

The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today.

Read More »

Read More »

FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

The dollar has steadied after surging yesterday and has so far retained the lion's share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming.

Read More »

Read More »

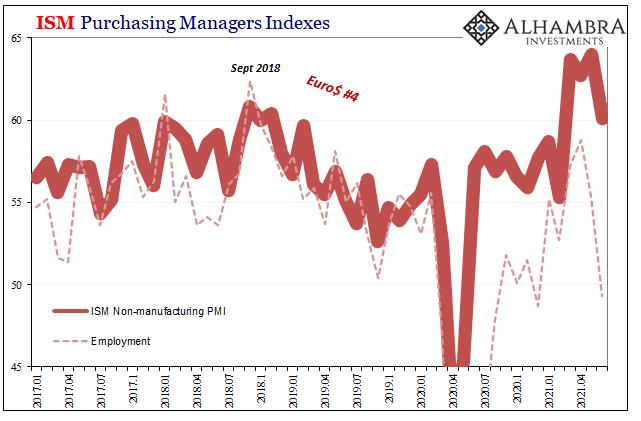

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

FX Daily, June 25: Tokyo Escapes Deflation, Leaving the Greenback Trapped between Two Expiring Options against the Yen

New record highs in the S&P 500 and NASDAQ yesterday helped lift most Asia Pacific markets today. China and Hong Kong led the regional gains and were sufficient to lift the MSCI regional benchmark to halt a two-week drop.

Read More »

Read More »

FX Daily, June 24: Did the PBOC Signal it is Content with the Yuan’s Pullback?

The US dollar is trading slightly lower against most of the major and emerging market currencies. The Scandis are leading the major currencies, while the Russian ruble leads the central and eastern European currencies higher. Emerging market currencies mostly firmer, though the Turkish lira and South African rand are notable exceptions.

Read More »

Read More »

FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week's FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down.

Read More »

Read More »

FX Daily, June 21: Dollar Surge Stalls

Pressure on equities seen last week carried over into Asia and Europe today. The MSCI Asia Pacific Index fell for the fourth consecutive session, led by more than a 3% decline in the Nikkei. Australia, Taiwan, and Hong Kong bourses fell by more than 1%. European equities opened lower, but have turned higher.

Read More »

Read More »

FX Daily, June 17: Fed Rocks the World

A more hawkish than expected Federal Reserve sent the US dollar and interest rates higher and spurred an equity sell-off. The knock-on effect sent ripples through the capital markets today. Most equity markets in the Asia Pacific region fell. China, Hong Kong, and Taiwan were notable exceptions.

Read More »

Read More »

FX Daily, June 16: Will the Fed Talk the Talk?

With the outcome of the FOMC meeting awaited, the dollar is narrowly mixed in quiet turnover. The Scandis are the weakest (~-0.3%) among the majors, while the Antipodeans are the strongest (~+0.25%). JP Morgan's Emerging Market Currency Index is snapping a three-day decline

Read More »

Read More »

FX Daily, June 15: Commodities Ease though Oil remains Firm

The new record high in the S&P 500 and the NASDAQ's sixth gain in seven sessions may have helped lift Asia Pacific markets today. Only China and Hong Kong did not participate. MSCI's regional index rose for its fourth consecutive session. Europe's Dow Jones Stoxx 600 is moving higher for the eighth session in a row.

Read More »

Read More »

FX Daily, June 14: Dollar Becalmed as Markets Wait for US Leadership

The short squeeze that lifted the US dollar ahead of the weekend has seen limited follow-through buying, and instead a consolidative tone emerged. Europe is searching for direction and perhaps waiting for US leadership after a quiet Asia Pacific session, with several centers closed for holiday today (China, Hong Kong, Taiwan, and Australia).

Read More »

Read More »

FX Daily, June 11: US Yields Stabilize After Falling to Three-Month Lows

The 10-year US Treasury yield steadied after reaching a three-month low near 1.43%, despite the US CPI rising more than expected to 5% year-over-year. On the week, the decline of around a dozen basis points would be the largest in a year. Australia, New Zealand, and Italy benchmark yields have seen a bigger decline this week.

Read More »

Read More »