Tag Archive: China

Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan's sell-off accelerated and slide to its lowest level since last October.

Read More »

Read More »

Yen Blues

Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc.

Read More »

Read More »

Greenback Starts New Week on Firm Note

Overview: With many financial centers, especially in Europe, closed for the long holiday weekend, risk-appetites remain in check. Most Asia Pacific markets fell, and poor earnings from Infosys and Tata Consultancy, saw India pace the decline with a 2% drop. US futures are also trading with a heavier bias.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

Central Banks on a Preset Course Reduces Significance of High-Frequency Data

Arguably the most important data next week is the flash PMI. It is not available for all countries, but for those generally large G10 economies, the preliminary estimate is often sufficiently close to the final reading to steal its thunder.

Read More »

Read More »

China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics.

Read More »

Read More »

PBOC Trim Reserve Requirements: Delilvers Wet Noodle after Earlier Disappointment

After posting the daily analysis, the PBOC announced a 25 bp cut in required reserves. This is said to free up around CNY530 bln or around $83 bln. It may help explain the failure to cut the benchmark Medium-Term Lending Facility. Some rural banks may see a 50 bp cut in reserve requirements.

Read More »

Read More »

Good Friday

Overview: Most centers are closed for the holidays today. The Asia Pacific equity markets were open and moved lower following the losses on Wall Street yesterday. The weakness of the yen failed to underpin Japanese shares.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools.

Read More »

Read More »

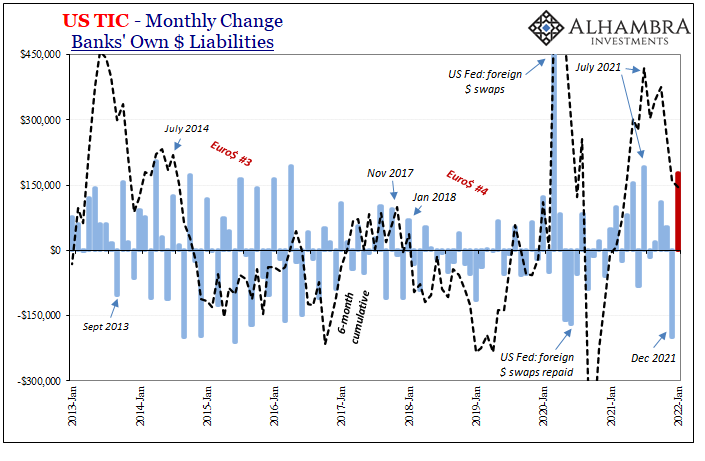

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

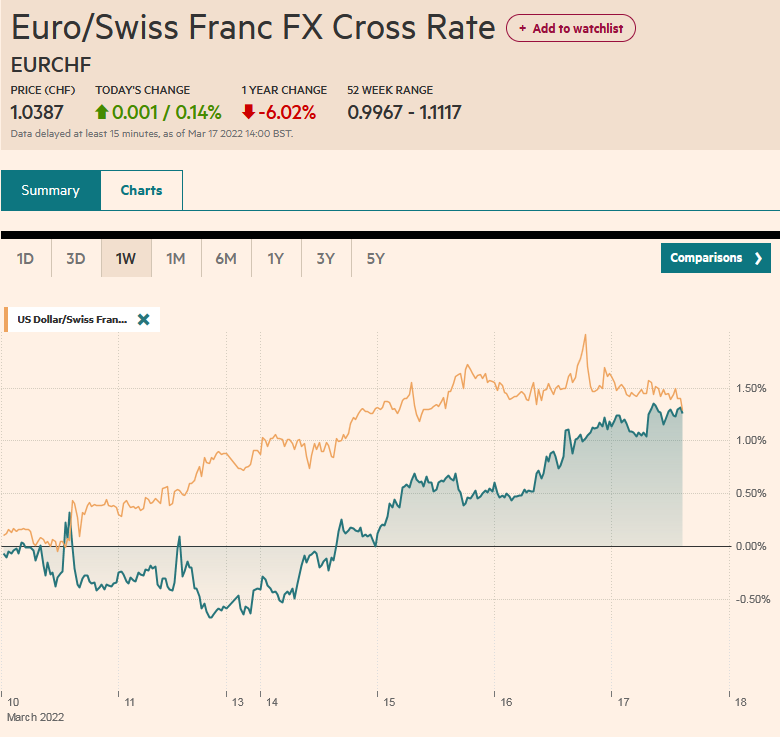

FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Overview: The markets continue to digest the implications of yesterday's Fed move and Beijing's signals of more economic supportive efforts as the Bank of England's move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday's surge. The Hang Seng led the...

Read More »

Read More »

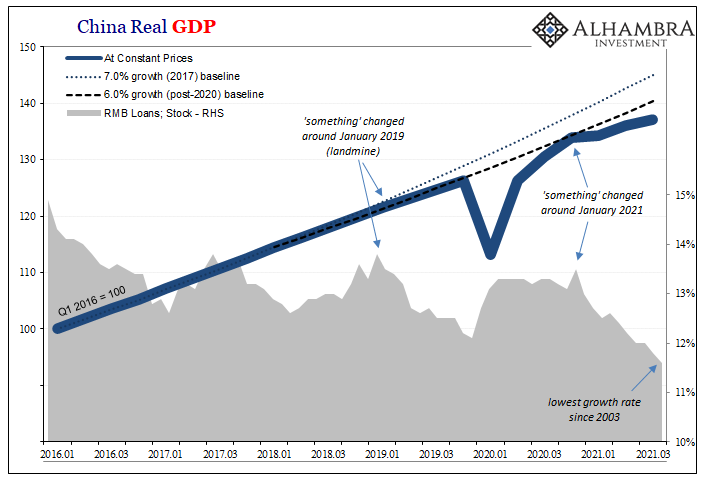

China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated.

Read More »

Read More »