Tag Archive: Business

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

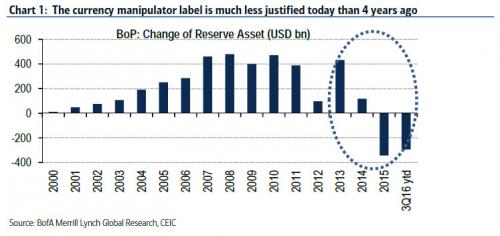

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

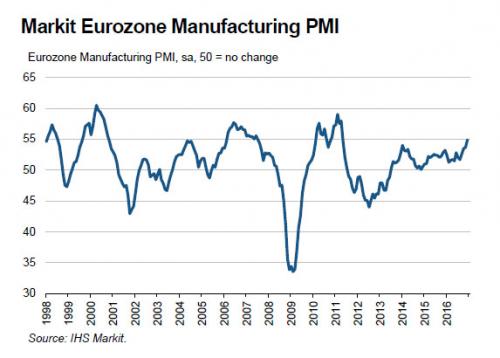

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

ECB Assets Hit 35 percent Of Eurozone GDP; Draghi Owns 9.2 percent Of European Corporate Bond Market

As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global "helicopter money", by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

Read More »

Read More »

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Canadian Bank Starts Charging Negative 0.75percent Rate On Most Foreign Cash Balances

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

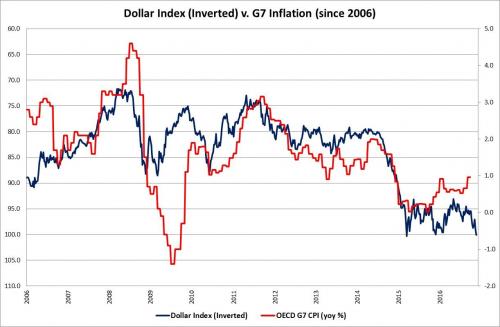

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

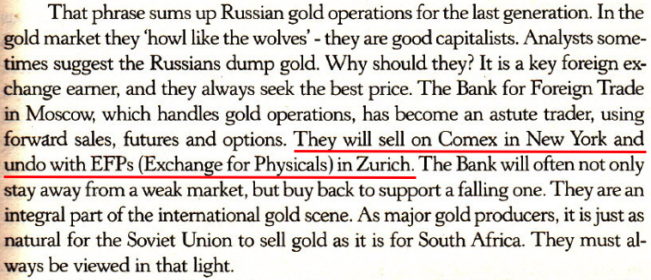

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

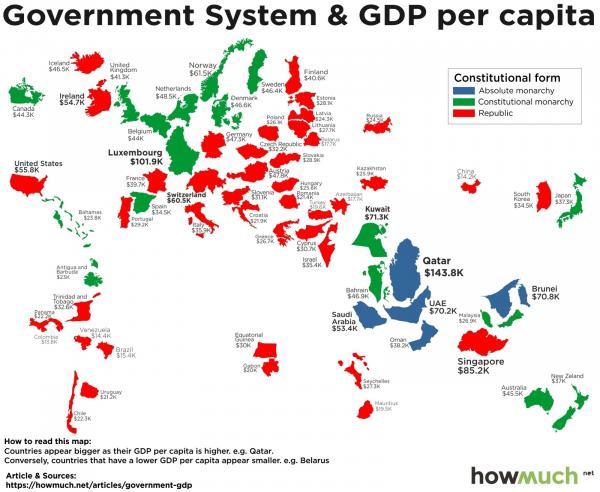

Which Government System Is The Best For People’s Wealth?

We have created a map which shows the per-capita GDP based upon the type of government in a country. The larger the country appears on the map, the higher the GDP per capita.

Read More »

Read More »

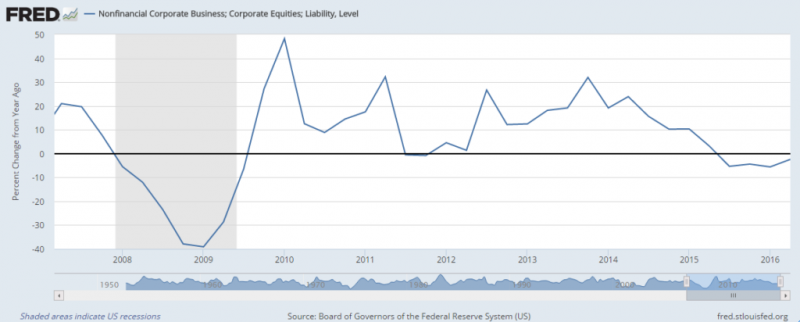

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Swiss Sovereign money initiative: war on bankers but not on central banksters

Iceland has gained the admiration of populists in recent years by doing that which no other nation in the world seems to be willing or capable of doing: prosecuting criminal bankers for engineering financial collapse for profit.

Read More »

Read More »