Tag Archive: Bank of Japan

FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors' confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears to be the essence of the switch to an average inflation target.

Read More »

Read More »

FX Daily, July 15: The Dollar Slumps and EU Court Rules in Favor of Apple

A recovery in US stocks yesterday, coupled with optimism over Moderna's vaccine, is providing new fodder for risk appetites today. Equities are being driven higher, and the dollar is under pressure. Most equity markets in Asia advanced. China and Taiwan were exceptions, and, in fact, the Shanghai Composite fell for the second consecutive session for the first time in a month.

Read More »

Read More »

Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China.

Read More »

Read More »

FX Daily, June 16: Correction Scenario Tested

Overview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it's Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now, it had been buying representative ETFs. Stocks rallied further on the news before pulling back into the close. The rally in risk assets carried into Asia.

Read More »

Read More »

FX Daily, June 15: Unwind Continues

Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today's activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei's 3.5% drop, and South Korea's 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions.

Read More »

Read More »

FX Daily, June 12: Licking Yesterday’s Wounds Today

Overview: The nearly three-month rally in risk assets ended with high drama with a stomach-churning almost 6% slide in the S&P 500 yesterday. Follow-through selling was seen in the Asia Pacific region, but most markets recovered from their lows, and although losses were still recorded, the downside momentum seemed broken. The same holds true for Europe. Bourses opened lower but by mid-morning had moved higher (~1.4%) and US shares are trading...

Read More »

Read More »

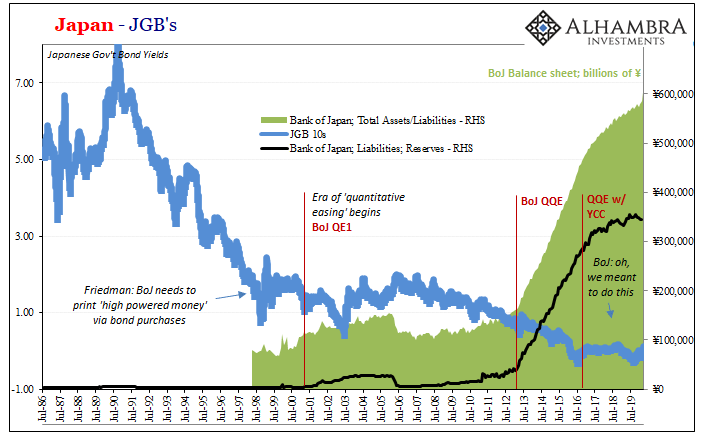

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

FX Daily, May 22: US-China Escalation Sinks Hong Kong and Hits Risk Appetites

Overview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong's 5.5% that led the region lower. Europe's Dow Jones Stoxx 600 is off around 1% in late morning turnover to pare this week's gain to about 2.5%.

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and the Reserve Bank of Australia is preparing for new measures that will be announced Thursday.

Read More »

Read More »

What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

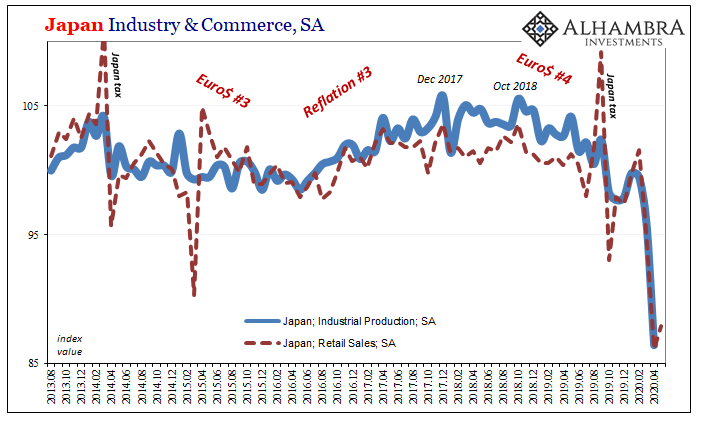

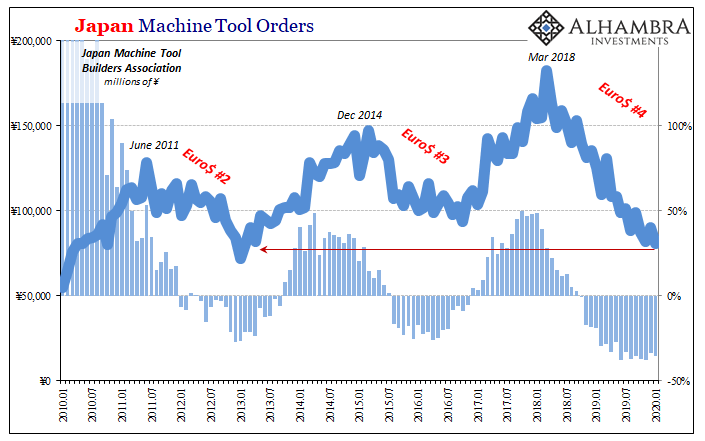

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way.

Read More »

Read More »

FX Daily, March 10: Markets Stabilize after Body Blow

Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump's press conference today is expected to spell out in greater detail relief for households and businesses. Asia Pacific equities rallied, led by a 3% surge in Australia.

Read More »

Read More »

FX Daily, January 20: Stocks Stall while the Dollar Remains Bid

Overview: The new week is off to a quiet start as the US celebrates Martin Luther King's birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a little lower, and the Dow Jones Stoxx 600 is threatening to end a four-session advance. Most benchmark bond yields around half a basis point in one direction or...

Read More »

Read More »

FX Weekly Preview: Central Bank Meetings Featured

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion.

Read More »

Read More »

FX Daily, December 19: Whiff of Inflation in the Air

It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year.

Read More »

Read More »

FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

After last week's flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the...

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

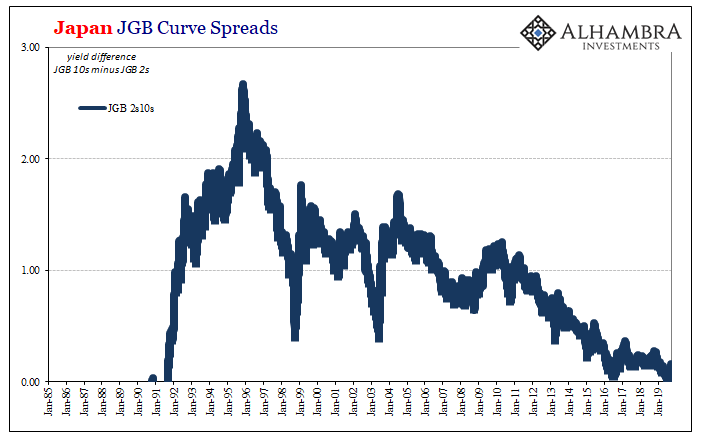

Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more.

Read More »

Read More »

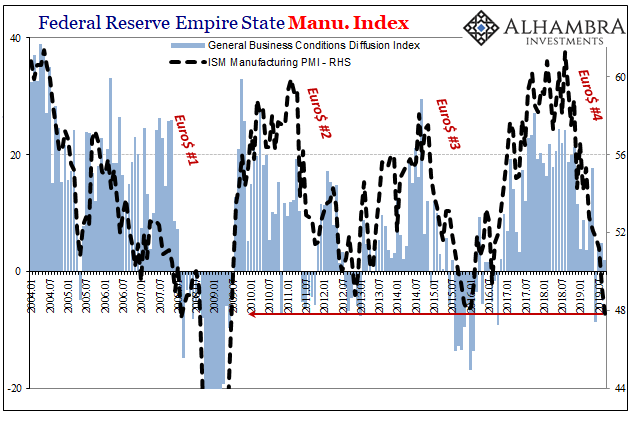

ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

FX Weekly Preview: Six Things to Watch in the Week Ahead

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter.

Read More »

Read More »