Tag Archive: Australia

FX Daily, April 8: Flavor of the Day: Consolidation

Overview: Global equities are struggling after the S&P 500 staged a dramatic reversal yesterday. The early 3.5% gain was completely unwound and closed slightly lower. With few exceptions (e.g., Japan and the Philippines), most equity markets in the Asia Pacific region and Europe are lower.

Read More »

Read More »

FX Daily, February 20: Covid-19 Hits Yen and Korean Won

The increase of Covid-19 cases in South Korea and Japan, coupled with China's changing reverting back to its previous methodology of calculation, dropping clinically-diagnosed cases have again weakened risk appetites and sent the dollar broadly higher. Fears of a Japanese recession are sapping the yen's role as a safe haven, and this helps explain why Japanese equities did react as positively to the weaker yen than is often the case.

Read More »

Read More »

FX Daily, February 18: Apple’s Warning Weighs on Sentiment

Overview: Apple's warning that it will miss Q1 revenue due to the knock-on effects of the coronavirus seemed to be a modest wake-up call to investors, who, judging from the equity market, were looking beyond. Equities have fallen, and bonds have rallied. Japan, Hong Kong, and South Korean stocks fell by more than 1%, and only China and Indonesia were able to post gains.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

FX Daily, January 23: ECB’s Strategic Review and the Coronavirus Command Investors’ Attention

The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China's week-long Lunar New Year celebration when markets will be closed, which may have also spurred today's drama that aw the Shanghai Composite tumbled 2.75%, bringing the week's loss to 3.2%, the most in five months.

Read More »

Read More »

FX Daily, November 20: Dollar Snaps Back

Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1% declines in South Korea and Australia.

Read More »

Read More »

Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains. During the North American session, there will be a fair amount of US data. BOE is expected to keep rates steady; UK reported August retail sales. SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp.

Read More »

Read More »

FX Daily, May 30: Kill Bull: Intermission

Overview: After significant moves in equities and interest rates, investors are taking a collective breath, waiting for fresh developments. A nervous calm has settled over the capital market. China, Japan, and Australian equities leaked lower, but other bourses in the region, including Korea and Taiwan posted modest gains, while Indonesian equities are still responding positively to the recent election.

Read More »

Read More »

FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world's third-largest economy expanded in Q1. Most other equity markets in Asia fell, and European stocks have the week with small losses.

Read More »

Read More »

FX Daily, May 17: China Questions US Sincerity

Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and...

Read More »

Read More »

FX Daily, May 13: Investors Still Looking for New Balance

The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the agreement. Now China was given around a month to capitulate to US demands or face a 25% tariff on their remaining exports to the US.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

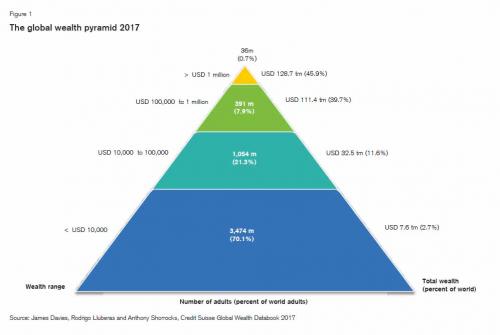

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome...

Read More »

Read More »

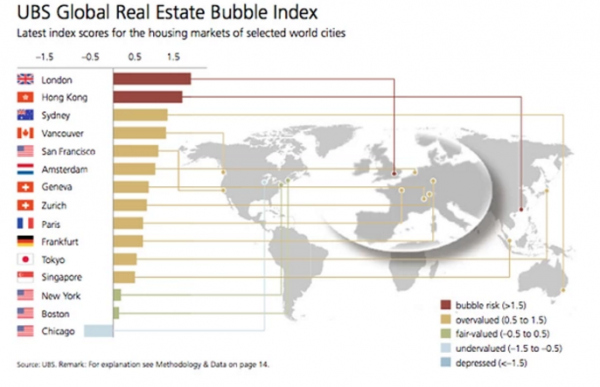

The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk.What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble.

Read More »

Read More »

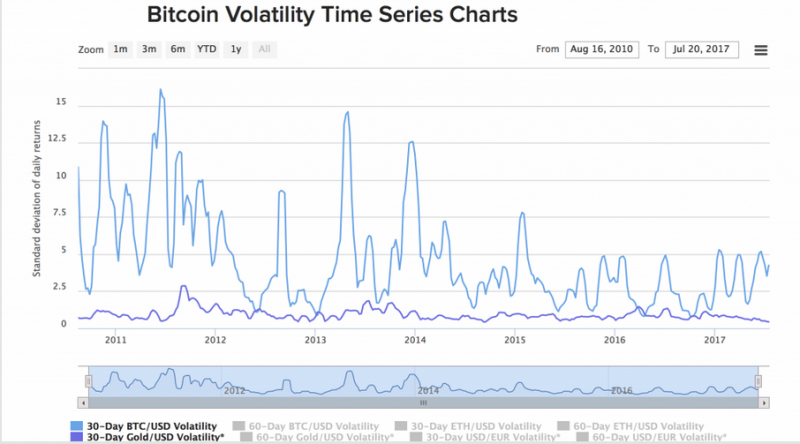

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »