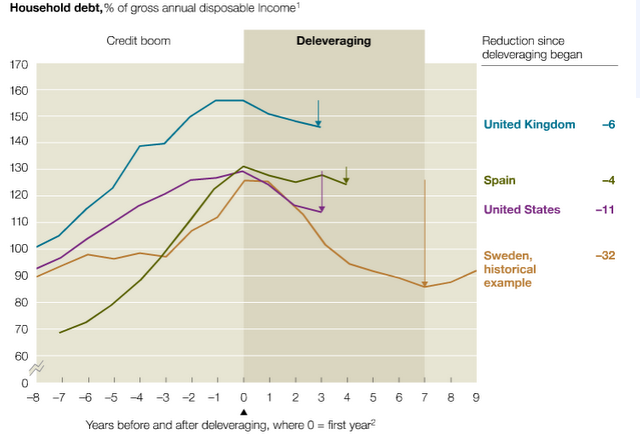

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Tag Archive: Asset Market Model

(7) FX Theory: The Asset Market Model

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

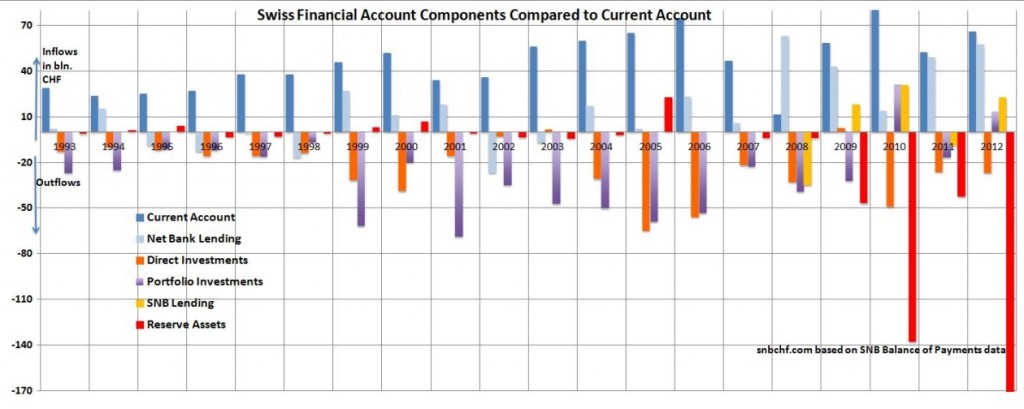

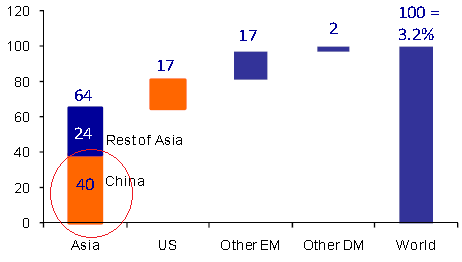

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

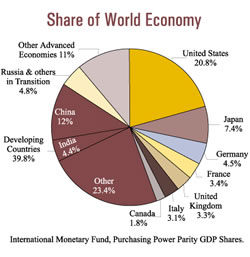

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

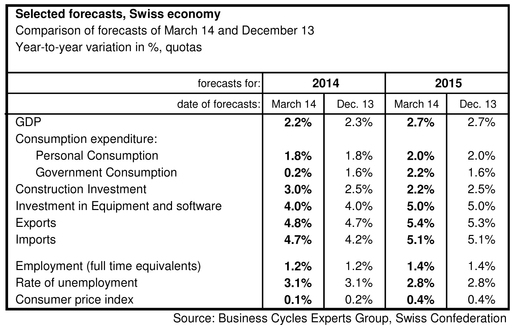

Danthine: SNB would end franc cap once it raises interest rates

It was obvious already at the latest SNB Monetary Policy Assessment, the SNB is becoming more and more hawkish. At the forefront is its ueber-hawk Jean-Pierre Danthine, the person responsible for the overheating Swiss housing market. He has now announced: SNB would end franc limit once it raises interest rates The Swiss National Bank will …

Read More »

Read More »

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

How Currency Speculators Help the SNB to Fight against Ordinary Investors

A discussion in the investor forum made clear how currency speculators currently help the SNB to maintain the floor against normal investors. A situation that was different in August/September 2011, when the SNB had to fight against these speculators. A discussion in the investor forum Seeking Alpha: part one Based on our analysis of …

Read More »

Read More »

The Three Main Forex strategies: Trend Following, Mean Reversion and the Carry trade. Is the Carry Trade Dead ?

Submitted by Mark Chandler, from marctomarkets.com Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 15 Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 8

Submitted by Mark Chandler, from marctomarkets.com The Price of Protection We have been tracking the deterioration in the technical condition of the major foreign currencies in this weekly note for the past three weeks. The euro’s recovery, off the support we identified here last week near $1.2800, should not overshadow the fact that the dollar’s …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week of October 1

Submitted by Mark Chandler, from marctomarkets.com If the third quarter was about the reduction of tail-risk by official actions, then Q4 will be about the limitations of the policy response. It will pose a challenging investment climate after what turned out to be a favorable performance in Q3. Equities generally did well. The US …

Read More »

Read More »

5) FX Theory

Content : What Determines FX Rates? Purchasing Power Parity, Real Effective Exchange Rate, Balance of Payments Model, (Reverse) Carry Trade, Asset Market Model, Real Mean Reversion, lots more

Read More »

Read More »