Swiss balance of payments Updates Q1-Q3 2013

Update Q3/2013

From the official press release:

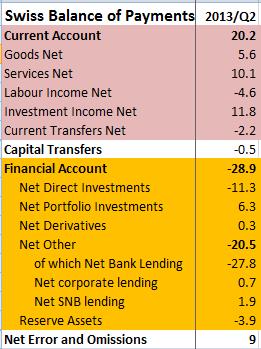

“Compared to the same quarter one year earlier, Switzerland’s current account surplus advanced by CHF 6 billion to CHF 20 billion. …The financial account posted net capital outflows of CHF 39 billion, compared with CHF 30 billion in the same quarter one year earlier, and the composition of the net outflows changed considerably.”

The outflows in Net Bank Lending continued, while as for portfolio investment slight outflows were visible.

source SNB

Update Q2/2013

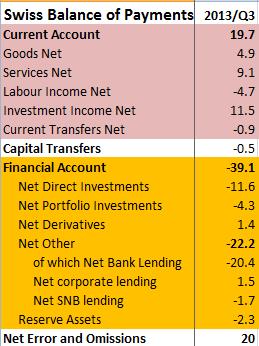

The second quarter showed one movement: Investors were piling more into Swiss equities than Swiss into foreign stocks again. The red line below crossed the blue again (see above). The SNB losses in Q2/2013 represent an additional outflow; this time in reserve assets. The losses, however, are only a valuation effect and do not weaken the currency.

The second quarter showed one movement: Investors were piling more into Swiss equities than Swiss into foreign stocks again. The red line below crossed the blue again (see above). The SNB losses in Q2/2013 represent an additional outflow; this time in reserve assets. The losses, however, are only a valuation effect and do not weaken the currency.

The main important development, however was that Net Bank Lending has inverted path, strong net outflows of 28 bln. CHF. Banks seem to start lending in foreign currency, more than foreigners lend or pay back to Switzerland.

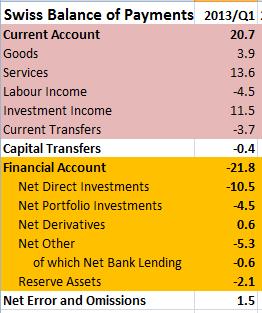

The Balance of Payments for Q1/2013

In the first quarter of 2013, the Swiss franc weakened: one major reason behind this was that outflows in the financial account, excluding reserve assets, were able to counter the strong current account surplus. Direct investment outflows intensified, net portfolio investments were slightly negative. Most importantly net lending was slightly negative for the first time since 2003, the Swiss were lending more to foreigners than the opposite.

The quickly available proxy for the balance of payments (= sum of current account and financial account excl. reserve assets) are SNB sight deposits. They are not rising any more; this implies that the SNB is not intervening, and implicitly that the Financial Account (excl. SNB reserves) is able to neutralize the continuously positive current account surplus.

The next page contains the balance of payments from 1983 to 2008 and some history in German.

2 comments

wiesenda

2013-08-19 at 03:48 (UTC 2) Link to this comment

The position “net bank lending” merits deeper inspection. I suspect it is an aggregate made up of several, possibly quite large, positive and negative terms whose importance is on top of that changing over time. Therefore it is difficult to draw conclusions from the aggregate value alone. For example, the idea that foreign bank clients are the source of positive net bank lending in the years after 2007 is possible albeit an outflow of deposits due to tax regularization may also be taking place.

Be that as it may, these flows surely have to be orders of magnitude smaller than the deleveraging going on in the Swiss banking sector? Were the two big banks not major conduits for exporting capital? Their shrinking exercise must be bringing capital home. The effect of this would be very similar to what has happened in Germany. Its current account surpluses post 2000 had been reinvested in the Euro periphery through the banking conduit (German banks lending to periphery banks).

When trust among banks evaporated post 2007 – they had realized that, oops, mortgage loans can go sour in the US (where they were exposed through securities), therefore also in Europe (where they were exposed through interbank loans) – the ECB stepped in as an intermediary for short term lending, later joined by various other facilities for longer-term lending.

The result of all this assisted de-leveraging and these bailouts was that the cumulative current account surpluses landed on the balance sheet of the Bundesbank as a TARGET2 credit. It is easier to think of this as a stock phenomenon (the transfer of a foreign loan portfolio from the banking system to the Bundesbank) than as a flow phenomenon.

I believe a similar thing is happening in Switzerland for slightly different reasons in a different setting – but basically it’s a central-bank-assisted deleveraging of the banking sector. Now that the money is parked at the SNB what do we do with it? Leave it in the custody account at the SNB? Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF? The latter by the way is the reason that Bali is full of Swiss supermarket checkout personnel as one English writer once remarked with a mixture of envy and admiration.

DorganG

2013-08-23 at 07:11 (UTC 2) Link to this comment

Sorry for the late response due to time constraints during the working week:

I added the details for net bank lending in the text. https://snbchf.com/wp-content/uploads/2013/07/Foreign-Clients-Lending-to-Swiss.jpg

This number shows the gross lending of foreign bank clients to Switzerland. Both gross lending and net lending of foreigners to Switzerland is increasing.

You are right saying that Swiss lending to US and EU has excessively decreased.

Thanks for impressive

“Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF?”